by Calculated Risk on 1/19/2012 05:26:00 PM

Thursday, January 19, 2012

Lawler: Housing Forecast for 2012

From economist Tom Lawler:

At the beginning of 2011, the “consensus” forecast for total housing starts was in the 690,000 to 700,000 range, with most analysts looking for an increase in both Single Family (SF) and Multifamily (MF) starts. Early last year one well-respected analysts who regularly surveys SF builders said that on average builders planned to increase SF starts by 15-20% in 2011. As I noted at the time, however, such an increase seemed highly unlikely given new and existing inventories, distressed sales, and pricing relative to where builders were willing to sell homes. It turned out, of course, that new home sales in the early months of last year were “quite disappointing” in aggregate, and builders in aggregate quickly changed their “plans.”

MF starts, in contrast, exceeded “consensus” forecasts, as the combination of very low completion rates (completions lag starts considerably), a moderate rebound in household growth, and a shift toward more renters than buyers (both voluntary and involuntary) resulted in a sharp reduction in apartment rental vacancy rates, as well as rising rents.

While the labor market has shown some signs of improving, household growth is highly likely to be faster in 2012 than 2011, active government intervention has pushed mortgage rates to yet new lows (AND with a record low “handle”), new and existing home inventories are down significantly from a year ago, last year’s subdued housing production helped further reduce the “excess” supply of housing, and last year’s SF activity was still depressed by the earlier and ill-conceived home buyer tax credits, this year’s “consensus” forecast for housing starts in 2012 appears to be lower than last year’s forecast for 2011 – especially on the SF side!

Quite frankly, that doesn’t seem to make a lot of sense to me.

So ... just like a year ago I thought the consensus forecast for housing starts was too high, this year I believe it is too low.

Right now, my “best guess” for housing starts, new SF home sales, existing home sales, and housing completions, would be as follows.

| Housing Starts and Home Sales (000s) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Housing Starts | Single Family | Multifamily (2+) | ||||||

| Total | Built for Sale | SF | Built for Sale | MF | Built for Sale | New SF Home Sales | Existing Home Sales | |

| 2010 | 587 | 321 | 471 | 306 | 116 | 15 | 323 | 4,182 |

| 2011 | 607 | 315 | 429 | 295 | 178 | 20 | 305 | 4,272 |

| 2012(F) | 740 | 385 | 515 | 360 | 225 | 25 | 365 | 4,550 |

Note: My 2010 existing home sales numbers is the sum of the NAR’s NOT SEASONALLY ADJUSTED sales figures from its re-benchmarking release. In the past the NAR’s annual number always “footed” to the sum of the NSA numbers, but that was not the case when it released its benchmark revisions.

And for completions in 2012:

| Housing Completions (000s) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Housing Completions | Single Family | Multifamily (2+) | ||||||

| Total | Built for Sale | SF | Built for Sale | MF | Built for Sale | Mfg. Housing Placements | Total | |

| 2010 | 652 | 362 | 496 | 331 | 155 | 31 | 50 | 702 |

| 2011 | 584 | 309 | 445 | 294 | 139 | 15 | 46 | 630 |

| 2012(F) | 635 | 359 | 470 | 340 | 165 | 19 | 60 | 695 |

CR Note: The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 302 | 431 | 609 |

CR Note: table updated on Feb 16, 2012 (Merrill's actual forecast added)

Key Measures of Inflation moderate in December

by Calculated Risk on 1/19/2012 03:08:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in December on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in December after rising 0.2 percent in November.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.5% annualized rate) during the month.Note: The Cleveland Fed has the median CPI details for December here.

...

The CPI less food and energy increased 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.0%, and the CPI less food and energy rose 2.2%.

On a monthly basis, the rate of increase is mostly below the Fed's target (Median is above, trimmed-mean and core are below).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. Core PCE is for November and increased 1.7% year-over-year. On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.5% annualized, and core CPI increased 1.8% annualized.

These measures show inflation has moderated.

Housing: Record Low Total Completions in 2011

by Calculated Risk on 1/19/2012 12:22:00 PM

A few key points for 2011:

• There were a record low number of total completions.

• There were a record low number of single family completions.

• There were a record low number of housing units added to the housing stock, and this suggests the excess vacant inventory declined significantly.

• Multifamily starts were up 60%. This will probably increase further in 2012.

• Single family starts were down 9% to a new record low. This looks to rebound in 2012.

Multifamily starts were up 60% in 2011 over 2010 - from 104,300 in 2010 to 167,400 in 2011. This will probably increase further in 2012 since 167 thousand is still a fairly low level of starts. Single family starts were down 9% in 2011 to 428,600. This is the lowest level of single family starts since the Census Bureau started tracking starts in 1959!

Since it typically takes over a year to complete a multifamily building, and since multifamily starts were are record lows in 2009 (and close in 2010), there were a near record low number of multifamily completions in 2011.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total. The blue line is for multifamily starts and the red line is for multifamily completions.

Click on graph for larger image.

Click on graph for larger image.

The rolling 12 month total for starts (blue line) increased all year. Multifamily starts were at 167.4 thousand units in 2011.

Completions (red line) appear to have bottomed. This is probably because builders rushed some projects to completion because of the strong demand for rental units. Multifamily completions were at 130.5 thousand in 2011, just above the record low of 127.1 thousand in 1993.

Total completions were at a record low in 2011 (as were single family completions), and the U.S. added the fewest net housing units to the housing stock since the Census Bureau started tracking completions in the '60s.

Below is a table of net housing units added to the housing stock since 1990. Note: Demolitions / scrappage estimated.

This means that the overhang of excess inventory probably declined significantly in 2011.

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 | 453.5 | 130.5 | 46 | 630 | 150 | 480 |

Philly Fed: "Regional manufacturing activity continued to expand at a moderate pace in January"

by Calculated Risk on 1/19/2012 10:10:00 AM

From the Philly Fed: January 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged up slightly from a revised reading of 6.8 in December to 7.3 in January. ... The new orders index remained positive for the fourth consecutive month but declined from a revised reading of 10.7 in December to 6.9 this month.This indicates expansion in January, at a slower pace than in December, but below the consensus forecast of +11.0.

...

The current employment index has now been positive for five consecutive months

but was virtually unchanged from last month’s reading. The percentage of firms

reporting an increase in employment (21 percent) was higher than the percentage

reporting a decline (10 percent). Firms reporting a longer workweek (23 percent) only narrowly outnumbered those reporting a shorter one (18 percent).

...

The future general activity index increased from a revised reading of 40 in December to 49 this month. The index has increased for five consecutive months and is now at its highest reading in 10 months.

The six month outlook improved again, and employment increased (number of employees was at 11.6, up slightly from 11.5 last month, and the average workweek was at 5.0, up from 2.8).

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys increased again in January, and is at the highest level since early 2011.

Earlier:

• Weekly Initial Unemployment Claims decline to 352,000

• Housing Starts decline in December

Housing Starts decline in December

by Calculated Risk on 1/19/2012 08:55:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 657,000. This is 4.1 percent below the revised November estimate of 685,000, but is 24.9 percent (±18.3%) above the December 2010 rate of 526,000.

Single-family housing starts in December were at a rate of 470,000; this is 4.4 percent above the revised November figure of 450,000. The December rate for units in buildings with five units or more was 164,000.

An estimated 606,900 housing units were started in 2011. This is 3.4 percent above the 2010 figure of 586,900.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 679,000. This is 0.1 percent below the revised November rate of 680,000, but is 7.8 percent above the December 2010 estimate of 630,000.

Single-family authorizations in December were at a rate of 444,000; this is 1.8 percent above the revised November figure of 436,000. Authorizations of units in buildings with five units or more were at a rate of 209,000 in December.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 657 thousand (SAAR) in December, down 4.1% from the November rate of 685 thousand (SAAR). The decline in December was related to the volatile multifamily sector. Most of the increase this year has been for multi-family starts, but single family starts have been increasing recently too.

Single-family starts increased 4.4% to 470 thousand in December - the highest level in 2011, and the highest since the expiration of the tax credit.

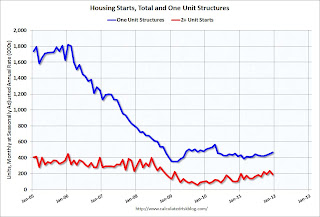

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..Multi-family starts increased in 2011 - although from a very low level. Single family starts appear to be increasing lately, but are still mostly "moving sideways".

This was below expectations of 680 thousand starts in December. I'll have more on housing starts and completions later.

Weekly Initial Unemployment Claims decline to 352,000

by Calculated Risk on 1/19/2012 08:30:00 AM

The DOL reports:

In the week ending January 14, the advance figure for seasonally adjusted initial claims was 352,000, a decrease of 50,000 from the previous week's revised figure of 402,000. The 4-week moving average was 379,000, a decrease of 3,500 from the previous week's revised average of 382,500.The previous week was revised up to 402,000 from 399,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.

The 4-week moving average is well below 400,000.

And here is a long term graph of weekly claims:

This is the lowest level for weekly claims since April 2008.

Summary of Busy Day

by Calculated Risk on 1/19/2012 12:01:00 AM

• From the LA Times: SOPA blackout: Bills lose three co-sponsors amid protests

Three co-sponsors of the SOPA and PIPA antipiracy bills have publicly withdrawn their support as Wikipedia [,hoocoodanode.org] and thousands of other websites blacked out their pages Wednesday to protest the legislation.• NAHB Builder Confidence index increases in January

Sen. Marco Rubio (R-Fla.) withdrew as a co-sponsor of the Protect IP Act in the Senate, while Reps. Lee Terry (R-Neb.) and Ben Quayle (R-Ariz.) said they were pulling their names from the companion House bill, the Stop Online Piracy Act.

• Industrial Production increased 0.4% in December, Capacity Utilization increased

• AIA: Architecture Billings Index indicated expansion in December

• MBA: Mortgage Refinance Applications increase sharply

• Residential Remodeling Index declines seasonally in November

Wednesday, January 18, 2012

FNC and Zillow House Price Indexes for November

by Calculated Risk on 1/18/2012 06:15:00 PM

Note: The Case-Shiller House Price index for November will be released Tuesday, Jan 31st. CoreLogic has already reported that prices declined 1.4% in November (NSA, including foreclosures).

• Today from FNC: November Home Prices Decline 0.4%

Based on the latest data on non-distressed home sales (existing and new homes) through November, FNC’s national RPI shows that single-family home prices fell in November to a seasonally unadjusted rate of 0.4%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts reflecting poor property conditions.The FNC index tables for three composite indexes and 30 cities are here.

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show month-to-month declines in November, ranging from -0.4% at the national level to -0.9% across the nation’s top 10 housing markets. ... The two broader indices indicate a nearly 5.0% decline in the 12-month period between November 2010 and November 2011, or -0.4% per month on an annualized basis. The 10-MSA composite index lost about 4.0% during the period, or -0.3% per month annualized.

• Last week From Zillow: U.S. Home Values Unchanged in November

TThe Zillow Real Estate Market Reports, released today, show home values remained essentially flat from October to November falling only 0.1 percent to $147,800, representing a 4.6 percent decline on a year-over-year basis. ... Home values are back to late 2003 levels and mortgage rates are still below 4 percent for a 30-year fixed rate mortgage.In nominal terms, Case-Shiller and CoreLogic show prices are back to 2003 levels too. In real terms (and as a price-to-rent ratio), prices are back to 2000 levels.

Even though there are some differences between the indexes, on a year-over-year basis they are fairly close with CoreLogic down 4.3%, FNC down 4.9%, and Zillow down 4.6%.

HUD Secretary Donovan : Mortgage Settlement "Very Close"

by Calculated Risk on 1/18/2012 03:21:00 PM

From the WSJ: U.S., Banks Near 'Robo-Signing' Settlement

Administration officials and attorneys general are "very close" to a settlement with major banks of the so-called robo-signing issues after about a year of negotiations, [Housing and Urban Development Secretary Shaun Donovan] said at a conference of U.S. mayors meeting in Washington.The settlement was "close" last year, and now it is "very close". The story mentions some regional banks taking charges that appear related to the settlement - and that suggests "very close" is probably means the next month or two.

The reductions in borrowers' principal balances contained in the settlement, Mr. Donovan said, will be "far and away the largest principal reduction of the [housing] crisis" ...

For months, officials have said that a settlement is close, only to be frustrated by new hurdles. ... Meanwhile, regional banks are also preparing for an agreement. U.S. Bancorp Inc. said Wednesday that it took a $130 million fourth-quarter charge tied to matters that involve collecting mortgage payments and foreclosing on delinquent home owners.

AIA: Architecture Billings Index indicated expansion in December

by Calculated Risk on 1/18/2012 12:11:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Second Straight Month

After showing struggling business conditions for most of 2011, the Architecture Billings Index (ABI) has now reached positive terrain in consecutive months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 52.0, following the exact same mark in November. This score reflects an overall increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.0, down just a point from a reading of 65.0 the previous month.

“We saw nearly identical conditions in November and December of 2010 only to see momentum sputter and billings fall into negative territory as we moved through 2011, so it’s too early to be sure that we are in a full recovery mode,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Nevertheless, this is very good news for the design and construction industry and it’s entirely possible conditions will slowly continue to improve as the year progresses.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.