by Calculated Risk on 1/19/2012 10:10:00 AM

Thursday, January 19, 2012

Philly Fed: "Regional manufacturing activity continued to expand at a moderate pace in January"

From the Philly Fed: January 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged up slightly from a revised reading of 6.8 in December to 7.3 in January. ... The new orders index remained positive for the fourth consecutive month but declined from a revised reading of 10.7 in December to 6.9 this month.This indicates expansion in January, at a slower pace than in December, but below the consensus forecast of +11.0.

...

The current employment index has now been positive for five consecutive months

but was virtually unchanged from last month’s reading. The percentage of firms

reporting an increase in employment (21 percent) was higher than the percentage

reporting a decline (10 percent). Firms reporting a longer workweek (23 percent) only narrowly outnumbered those reporting a shorter one (18 percent).

...

The future general activity index increased from a revised reading of 40 in December to 49 this month. The index has increased for five consecutive months and is now at its highest reading in 10 months.

The six month outlook improved again, and employment increased (number of employees was at 11.6, up slightly from 11.5 last month, and the average workweek was at 5.0, up from 2.8).

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys increased again in January, and is at the highest level since early 2011.

Earlier:

• Weekly Initial Unemployment Claims decline to 352,000

• Housing Starts decline in December

Housing Starts decline in December

by Calculated Risk on 1/19/2012 08:55:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 657,000. This is 4.1 percent below the revised November estimate of 685,000, but is 24.9 percent (±18.3%) above the December 2010 rate of 526,000.

Single-family housing starts in December were at a rate of 470,000; this is 4.4 percent above the revised November figure of 450,000. The December rate for units in buildings with five units or more was 164,000.

An estimated 606,900 housing units were started in 2011. This is 3.4 percent above the 2010 figure of 586,900.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 679,000. This is 0.1 percent below the revised November rate of 680,000, but is 7.8 percent above the December 2010 estimate of 630,000.

Single-family authorizations in December were at a rate of 444,000; this is 1.8 percent above the revised November figure of 436,000. Authorizations of units in buildings with five units or more were at a rate of 209,000 in December.

Click on graph for larger image.

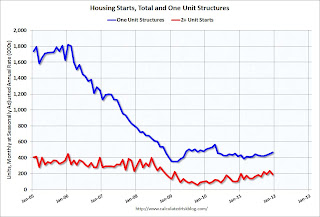

Click on graph for larger image.Total housing starts were at 657 thousand (SAAR) in December, down 4.1% from the November rate of 685 thousand (SAAR). The decline in December was related to the volatile multifamily sector. Most of the increase this year has been for multi-family starts, but single family starts have been increasing recently too.

Single-family starts increased 4.4% to 470 thousand in December - the highest level in 2011, and the highest since the expiration of the tax credit.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing a little lately, but have mostly moved sideways for about two years and a half years..Multi-family starts increased in 2011 - although from a very low level. Single family starts appear to be increasing lately, but are still mostly "moving sideways".

This was below expectations of 680 thousand starts in December. I'll have more on housing starts and completions later.

Weekly Initial Unemployment Claims decline to 352,000

by Calculated Risk on 1/19/2012 08:30:00 AM

The DOL reports:

In the week ending January 14, the advance figure for seasonally adjusted initial claims was 352,000, a decrease of 50,000 from the previous week's revised figure of 402,000. The 4-week moving average was 379,000, a decrease of 3,500 from the previous week's revised average of 382,500.The previous week was revised up to 402,000 from 399,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 379,000.

The 4-week moving average is well below 400,000.

And here is a long term graph of weekly claims:

This is the lowest level for weekly claims since April 2008.

Summary of Busy Day

by Calculated Risk on 1/19/2012 12:01:00 AM

• From the LA Times: SOPA blackout: Bills lose three co-sponsors amid protests

Three co-sponsors of the SOPA and PIPA antipiracy bills have publicly withdrawn their support as Wikipedia [,hoocoodanode.org] and thousands of other websites blacked out their pages Wednesday to protest the legislation.• NAHB Builder Confidence index increases in January

Sen. Marco Rubio (R-Fla.) withdrew as a co-sponsor of the Protect IP Act in the Senate, while Reps. Lee Terry (R-Neb.) and Ben Quayle (R-Ariz.) said they were pulling their names from the companion House bill, the Stop Online Piracy Act.

• Industrial Production increased 0.4% in December, Capacity Utilization increased

• AIA: Architecture Billings Index indicated expansion in December

• MBA: Mortgage Refinance Applications increase sharply

• Residential Remodeling Index declines seasonally in November

Wednesday, January 18, 2012

FNC and Zillow House Price Indexes for November

by Calculated Risk on 1/18/2012 06:15:00 PM

Note: The Case-Shiller House Price index for November will be released Tuesday, Jan 31st. CoreLogic has already reported that prices declined 1.4% in November (NSA, including foreclosures).

• Today from FNC: November Home Prices Decline 0.4%

Based on the latest data on non-distressed home sales (existing and new homes) through November, FNC’s national RPI shows that single-family home prices fell in November to a seasonally unadjusted rate of 0.4%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts reflecting poor property conditions.The FNC index tables for three composite indexes and 30 cities are here.

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show month-to-month declines in November, ranging from -0.4% at the national level to -0.9% across the nation’s top 10 housing markets. ... The two broader indices indicate a nearly 5.0% decline in the 12-month period between November 2010 and November 2011, or -0.4% per month on an annualized basis. The 10-MSA composite index lost about 4.0% during the period, or -0.3% per month annualized.

• Last week From Zillow: U.S. Home Values Unchanged in November

TThe Zillow Real Estate Market Reports, released today, show home values remained essentially flat from October to November falling only 0.1 percent to $147,800, representing a 4.6 percent decline on a year-over-year basis. ... Home values are back to late 2003 levels and mortgage rates are still below 4 percent for a 30-year fixed rate mortgage.In nominal terms, Case-Shiller and CoreLogic show prices are back to 2003 levels too. In real terms (and as a price-to-rent ratio), prices are back to 2000 levels.

Even though there are some differences between the indexes, on a year-over-year basis they are fairly close with CoreLogic down 4.3%, FNC down 4.9%, and Zillow down 4.6%.

HUD Secretary Donovan : Mortgage Settlement "Very Close"

by Calculated Risk on 1/18/2012 03:21:00 PM

From the WSJ: U.S., Banks Near 'Robo-Signing' Settlement

Administration officials and attorneys general are "very close" to a settlement with major banks of the so-called robo-signing issues after about a year of negotiations, [Housing and Urban Development Secretary Shaun Donovan] said at a conference of U.S. mayors meeting in Washington.The settlement was "close" last year, and now it is "very close". The story mentions some regional banks taking charges that appear related to the settlement - and that suggests "very close" is probably means the next month or two.

The reductions in borrowers' principal balances contained in the settlement, Mr. Donovan said, will be "far and away the largest principal reduction of the [housing] crisis" ...

For months, officials have said that a settlement is close, only to be frustrated by new hurdles. ... Meanwhile, regional banks are also preparing for an agreement. U.S. Bancorp Inc. said Wednesday that it took a $130 million fourth-quarter charge tied to matters that involve collecting mortgage payments and foreclosing on delinquent home owners.

AIA: Architecture Billings Index indicated expansion in December

by Calculated Risk on 1/18/2012 12:11:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Second Straight Month

After showing struggling business conditions for most of 2011, the Architecture Billings Index (ABI) has now reached positive terrain in consecutive months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 52.0, following the exact same mark in November. This score reflects an overall increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.0, down just a point from a reading of 65.0 the previous month.

“We saw nearly identical conditions in November and December of 2010 only to see momentum sputter and billings fall into negative territory as we moved through 2011, so it’s too early to be sure that we are in a full recovery mode,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Nevertheless, this is very good news for the design and construction industry and it’s entirely possible conditions will slowly continue to improve as the year progresses.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was unchanged at 52.0 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

NAHB Builder Confidence index increases in January

by Calculated Risk on 1/18/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in January to 25 from 21 in December. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Fourth Consecutive Time in January

Builder confidence in the market for newly built, single-family homes continued to climb for a fourth consecutive month in January, rising four points to 25 on the NAHB/Wells Fargo Housing Market Index (HMI), released today. This is the highest level the index has attained since June of 2007.

...

“Builders are seeing greater interest among potential buyers as employment and consumer confidence slowly improve in a growing number of markets, and this has helped to move the confidence gauge up from near-historic lows in the first half of 2011,” noted NAHB Chief Economist David Crowe. “That said, caution remains the word of the day as many builders continue to voice concerns about potential clients being unable to qualify for an affordable mortgage, appraisals coming through below construction cost, and the continuing flow of foreclosed properties hitting the market.”

...

Each of the HMI’s three component indexes registered a fourth consecutive month of improvement in January. The component gauging current sales conditions rose three points to 25, which was its highest point since June of 2007. The component gauging sales expectations in the next six months also rose three points, to 29 -- its highest point since September 2009. And the component gauging traffic of prospective buyers rose three points to 21, its highest point since June of 2007.

The HMI also posted gains in all four regions in January, including a nine-point gain to 23 in the Northeast, a one-point gain to 24 in the Midwest, a two-point gain to 27 in the South and a five-point gain to 21 in the West.

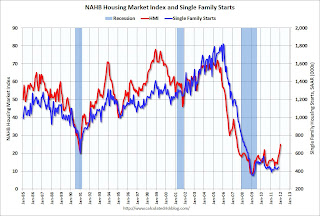

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up.

This is still very low, but this is the highest level since June 2007.

Industrial Production increased 0.4% in December, Capacity Utilization increased

by Calculated Risk on 1/18/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in December after having fallen 0.3 percent in November. For the fourth quarter as a whole, industrial production rose at an annual rate of 3.1 percent, its 10th consecutive quarterly gain. In the manufacturing sector, output advanced 0.9 percent in December with similarly sized gains for both durables and nondurables. The output of utilities fell 2.7 percent, as unseasonably warm weather reduced the demand for heating; the output of mines moved up 0.3 percent. At 95.3 percent of its 2007 average, total industrial production in December was 2.9 percent above its level of a year earlier. The capacity utilization rate for total industry rose to 78.1 percent, a rate 2.3 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is still 2.3 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 95.3, and previous months were revised up slightly.

The consensus was for a 0.5% increase in Industrial Production in December, and for an increase to 78.1% for Capacity Utilization. This was close to consensus.

MBA: Mortgage Refinance Applications increase sharply

by Calculated Risk on 1/18/2012 08:33:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 26.4 percent from the previous week to its highest level since August 8, 2011. The seasonally adjusted Purchase Index increased 10.3 percent from one week earlier to its highest level since December 12, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

"Interest rates dropped last week due to continuing anxieties regarding the fragile economic situation in Europe," said Michael Fratantoni, MBA's Vice President of Research and Economics. Fratantoni continued, "With mortgage rates reaching new lows, refinance volume jumped and MBA's refinance index reached its highest level in the last six months. Purchase activity also increased as buyers returned to the market after the holiday season."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.06 percent from 4.11 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.40 percent from 4.34 percent

...

Click on graph for larger image.

Click on graph for larger image.The purchase index increased last week, and the 4-week average also increased. This index has mostly been sideways for the last 2 years - and even with the recent increase, this is at about the same level as in 1997.