by Calculated Risk on 12/30/2011 08:54:00 AM

Friday, December 30, 2011

Fannie Mae and Freddie Mac Serious Delinquency Rates: Slight increase for Freddie in November

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.00% in November. This is down from 4.50% in November of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.57% in November, up from 3.54% in October. This is down from 3.85% in November 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The increase in November (unchanged for Fannie) is probably seasonal. The serious delinquency rates have been declining, but declining very slowly. The reason for the slow decline is most likely the backlog of homes in the foreclosure process.

The "normal" serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a long time.

Early in 2012, a mortgage settlement agreement with the servicers might be reached, and that might lead to more modifications and foreclosures - so the delinquency rate might decline faster. Also Fannie and Freddie are expected to announce a bulk sale of REO to investors (and possible rental program) early next year - and that might also lead to more foreclosures.

Thursday, December 29, 2011

Gasoline Prices and Brent WTI Spread

by Calculated Risk on 12/29/2011 07:53:00 PM

The year is almost over and once again a key downside risk for the economy is high gasoline prices. According to Bloomberg, Brent Crude is up to $108.10 per barrel, while WTI is up to $99.76. These prices have kept gasoline prices high, and pushed down vehicle miles driven in the US.

Although prices were higher in the first half of 2008, it is possible that the average annual price for oil and gasoline in 2012 will see a new record high.

If the global economy really slows, oil and gasoline prices will probably fall - and probably offset some of the impact from lower exports. Unfortunately turmoil in the Middle East (this time with Iran) might be pushing up oil prices.

This following graph shows the prices for Brent and WTI over the last few years. Usually the prices track pretty closely, but the "glut" of oil at Cushing pushed down WTI prices relative to Brent.

Click on graph for larger image.

Click on graph for larger image.

The spread has narrowed over the last couple of months following the announcement of a partial reversal of the Seaway pipeline to transport crude oil from Cushing, Oklahoma, to the Gulf Coast (the pipeline is scheduled to be reversed in Q2 2012).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early May. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Labor Force Participation: The Kids are Alright Part 2

by Calculated Risk on 12/29/2011 04:13:00 PM

A few weeks ago, I posted: Labor Force Participation Rate: The Kids are Alright

Catherine Rampell at the NY Times adds some more data: Instead of Work, Younger Women Head to School

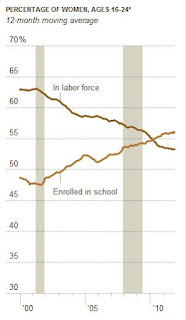

Workers are dropping out of the labor force in droves, and they are mostly women. In fact, many are young women. But they are not dropping out forever; instead, these young women seem to be postponing their working lives to get more education.

[M]any of the workers on the sidelines are young people upgrading their skills, which could portend something like the postwar economic boom, when millions of World War II veterans went to college through the G.I. Bill instead of immediately entering, and overwhelming, the job market.The flip side is that many older workers are also going back to school and getting student loans, see: Middle-aged borrowers piling on student debt (ht Ann)

Both men and women are going back to school, but the growth in enrollment is significantly larger for women (who dominated college campuses even before the financial crisis). In the last two years, the number of women ages 18 to 24 in school rose by 130,000, compared with a gain of 53,000 for young men.

...

The main risk in going back to school is the accompanying student loan debt.

Middle-aged borrowers are piling up student debt faster than any other age group, according to a new analysis obtained by Reuters.That is deeply concerning.

But in the long run, more education is a positive for the economy - and Rampell's article suggests the kids (well, young adults) are alright!

Kansas City Fed manufacturing index "eased slightly" in December

by Calculated Risk on 12/29/2011 11:45:00 AM

This is the last of the regional Fed surveys for December. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed in December although they showed some improvement in the aggregate.

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Slightly

According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased slightly, but expectations for future months improved somewhat.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“We saw a slight moderation in factory activity in our region in December,” said Wilkerson. “But plant managers continue to expect solid growth in the months ahead and are planning to increase employment and capital spending accordingly.”

...

The month-over-month composite index was -4 in December, down from 4 in November and 8 in October, and the first negative reading since December 2009 ... Most other month-over-month indexes also fell somewhat in December. The production and shipments indexes moved into negative territory, and the new orders and order backlog indexes fell further. The employment index dropped to its lowest level since mid-2009, and the new orders for exports index edged down.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM index for December will be released Tuesday, Jan 3rd and the regional surveys suggest another reading in the low to mid 50s. for December.

Misc: Chicago PMI at 62.5, Pending Home Sales increase

by Calculated Risk on 12/29/2011 10:10:00 AM

• Chicago PMI: The overall index declined slightly to 62.5 in December from 62.6 in November. This was above consensus expectations of 60.1. Note: any number above 50 shows expansion.

• From the NAR: Pending Home Sales Highest in a Year-and-a-Half

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 7.3 percent to 100.1 in November from an upwardly revised 93.3 in October and is 5.9 percent above November 2010 when it stood at 94.5. The October upward revision resulted in a 10.4 percent monthly gain.

The last time the index was higher was in April 2010 when it reached 111.5 as buyers rushed to beat the deadline for the home buyer tax credit.

...

The PHSI in the Northeast rose 8.1 percent to 77.1 in November but is 0.3 percent below November 2010. In the Midwest the index increased 3.3 percent to 91.6 in November and is 9.5 percent above a year ago. Pending home sales in the South rose 4.3 percent in November to an index of 103.8 and remain 8.7 percent above November 2010. In the West the index surged 14.9 percent to 121.2 in November and is 2.9 percent higher than a year ago.

Weekly Initial Unemployment Claims increase to 381,000

by Calculated Risk on 12/29/2011 08:39:00 AM

The DOL reports:

In the week ending December 24, the advance figure for seasonally adjusted initial claims was 381,000, an increase of 15,000 from the previous week's revised figure of 366,000. The 4-week moving average was 375,000, a decrease of 5,750 from the previous week's revised average of 380,750.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 375,000.

This is the lowest level for the 4-week average since June 2008.

And here is a long term graph of weekly claims:

Although initial claims increased this week, the 4-week moving average is still falling and is now well below 400,000.

Although initial claims increased this week, the 4-week moving average is still falling and is now well below 400,000.Wednesday, December 28, 2011

A Pickup for Housing in 2012?

by Calculated Risk on 12/28/2011 06:16:00 PM

Residential investment made a small positive contribution to GDP in 2011, for the first time since 2005. And construction employment turned slightly positive in 2011.

Now the question is what will happen in 2012? I think some pickup is likely, but I'm not as optimistic as some other people ...

From the WSJ: Hedge Funds See Rebirth for U.S. Housing

Hedge funds run by Caxton Associates LP, SAC Capital Advisors LP, Avenue Capital and Blackstone Group LP have been buying housing-related investments, betting on a rebound. And formerly bearish research firm Zelman & Associates now predicts a housing pickup, as does Goldman Sachs Group Inc.Of course there are still housing bears:

...

Even some housing skeptics acknowledge that real estate may no longer be the drag it has been on the economy. ... "I'm sold that it's a bottom," says James Bianco, who runs Bianco Research, in Chicago. "It's gone from a negative to a nothing for the economy," ...

Ivy Zelman [predicts] that rising rents will push would-be buyers to purchase homes. A housing recovery isn't "happening as fast as everyone would like," she says. But there are "a lot of pillars in place to give us some optimism."

"The smartest money in the world has been carried out on stretchers betting on a true recovery for housing," says Mark HansonI think we will probably see some increase in new home sales in 2012, but it will be from a very low level (around 300 thousand new homes will be sold in 2011, a record low since the Census Bureau started tracking new home sales in 1963). I'll have more on housing and residential investment soon.

Existing Home Inventory declines 18% year-over-year in December

by Calculated Risk on 12/28/2011 01:45:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June.

According to the deptofnumbers.com for monthly inventory (54 metro areas), listed inventory is probably back to early 2005 levels. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through November (left axis) and the HousingTracker data for the 54 metro areas through December.

Click on graph for larger image.

Click on graph for larger image.

This is the first update since the NAR released their revisions for sales and inventory. Now the NAR and HousingTracker are pretty close.

There is a seasonal pattern for inventory, bottoming in December and January and peaking during the summer months. So inventory will probably decline again next month and then start increasing in February.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the December listings - for the 54 metro areas - declined 17.6% from the same month last year. For the final week in December, inventory is down 18.4% from a year ago.

HousingTracker reported that the December listings - for the 54 metro areas - declined 17.6% from the same month last year. For the final week in December, inventory is down 18.4% from a year ago.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. Shadow inventory could include bank owned properties (REO: Real Estate Owned), properties in the foreclosure process, other properties with delinquent mortgages (both serious delinquencies of over 90+ days, and less serious), condos that were converted to apartments (and will be converted back), investor owned rental properties, and homeowners "waiting for a better market", and a few other categories - as long as the properties are not currently listed for sale. Some of this "shadow inventory" will be forced on the market, such as completed foreclosures, but most of these sellers will probably wait for a "better market".

However listed inventory has clearly declined in many areas. And it is the listed months-of-supply combined with the number of distressed sales that mostly impacts prices. (note: there are still 7 months of supply because both sales and inventory have declined).

Question #10 for 2012: Monetary Policy

by Calculated Risk on 12/28/2011 11:46:00 AM

Over the weekend I posted some questions for next year: Ten Economic Questions for 2012. I'll try to add some thoughts, and maybe some predictions for each question over the next week.

Many of the questions are interrelated. The question on monetary policy depends on inflation (question #9), the unemployment rate (question #6) and what happens in Europe (question #8). And the unemployment rate is related to GDP growth (question #4), and on and on ...

10) Monetary Policy: Will the Fed introduce QE3? Will the Fed change their communication strategy and include the likely future path of the Fed Funds rate?

Last year many analysts were arguing that the Fed would end QE2 early and raise rates before the end of 2011. That seemed very unlikely. Not only didn't the Fed raise rates, but they went a step further at the August meeting and dropped the somewhat ambiguous "extended period" language and replaced it with a time frame: "economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013."

Now it appears the FOMC will drop the time frame from the FOMC statement and replace it with a forecast of the likely future path of the Fed Funds rate. There have been several recent articles suggesting this change (see the WSJ: Federal Reserve Prepares to Make Itself Perfectly Clear and Fed Could Keep Rates Near Zero Into 2014)

When the Fed revises its communications approach, there is a good chance it will cease offering a fixed date for the timing of rate increases. Instead, officials could signal their intentions by publishing a range of their forecasts for rates along with their quarterly economic projections.This change in communication strategy will probably happen at the two day January FOMC meeting on the 24th and 25th.

There is also a good chance the Fed will embark on another round of Large Scale Asset Purchases (LSAP or QE3) in 2012. The Fed will probably take a wait and see approach early in the year, and QE3 would be dependent on the unemployment rate and inflation (the Fed's dual mandate).

If the economy tracks the most recent projections, QE3 would seem likely at either the April or June meetings. Others are arguing that QE3 could happen at the March meeting. If the economy performs better than expected, then the Fed will probably wait longer. QE3 will probably be focused on purchases of agency Mortgage Backed Securities (MBS).

Of course, if the economy performs worse than projected early in the year - or Europe implodes - the Fed would probably move quickly on QE3.

To summarize my views:

• I expect the Fed will change their communication strategy and add a likely future path of the Fed Funds rate to the quarterly economic forecasts.

• I think QE3 is likely, but more towards mid-year - and is data dependent.

Italian bond yields decline

by Calculated Risk on 12/28/2011 08:53:00 AM

From the NY Times: Italy's Borrowing Costs Drop Sharply at Auction

The sale of €9 billion, or $11.8 billion, of six-month Treasury bills was seen as the first post-holiday pointer to condition of the beleaguered euro zone.The Italian 2 year yield is down to 4.95% - the lowest level since October, but the 10 year yield is still at 6.86%.

The bills were sold at a yield of 3.251 percent, sharply down from 6.504 percent at a previous auction in late November. ... In an auction of two-year bonds, which raised €1.7 billion, the yield fell to 4.853 percent from 7.814 percent last month.

The Spanish 2 year yield is down sharply to 3.26%, and the 10 year yield is down to 5.09%.

But the Italian economy is weak:

Italy suffered its biggest decline in Christmas retail sales in 10 years, according to data released this week by the consumer group Codacons, reflecting the impact of the souring economy.

It was a similar picture in Greece, headed for a fourth year of recession in 2012. The country’s near-record unemployment was reflected in a 30 percent drop in pre-Christmas sales, the ESEE retail federation said Tuesday.