by Calculated Risk on 12/16/2011 04:11:00 PM

Friday, December 16, 2011

Lawler: Early Read on Existing Home Sales: Given the Benchmark Revision, a “Challenge”

CR Note: The NAR is scheduled to release November existing home sales on Wednesday, December 21st at 10:00 AM ET. The NAR will also release the benchmark downward revisions for 2007 through 2011 next Wednesday.

From economist Tom Lawler:

Based on my tracking of regional realtor/MLS reports, I estimate that existing home sales in November as measured by the National Association of Realtors ran at a seasonally adjusted annual rate that was about 1.8% higher than October’s pace, and about 9% higher than last November’s pace.

What that will mean for the NAR’s estimated sales number, however, is not clear, as the NAR announced that it is releasing updated (and lower) existing home sales estimates from 2007 to 2011. While I do NOT know what the revised sales estimates will be, based on various data sources I estimate that the NAR’s estimate of existing home sales for 2010 will be revised down by about 13% or so. As best as I can tell, 2011 sales data will be revised down by about the same amount as 2010 sales data.

As a result, I estimate that the NAR’s estimate for existing home sales for November will be a seasonally adjusted annual rate of around 4.40 million. If no benchmarking were done, I estimate the NAR’s existing home sales estimate would be a SAAR of around 5.06 million for November.

On the inventory side, the NAR said that its “months’ supply” measure will not be revised, implying that inventories will be revised down by the same percentage as sales. Various sources indicate that aggregate active listings fell considerably from October to November, with my tracking suggesting a monthly drop of about 5% -- though NAR inventory numbers don’t always “track” listings data. But if that drop were to happen, I’d estimate that the NAR will report an existing home inventory of about 2.753 million, down about 14.9% from last November.

The NAR has also said that it would not revise its median sales price data. Based on my tracking – which has an at best “so-so” track record in predicting the NAR number – I estimate that the median existing home sales price for November will be down about 4.2% from last November.

CR Note: Tom's estimate for inventory includes adjusting for the benchmark downward revision. This would put months-of-supply at around 7.5 months, and would put listed inventory at the lowest level since mid-2005.

Europe Update

by Calculated Risk on 12/16/2011 02:36:00 PM

European bond yields have fallen recently ...

The Italian 2 year yield is down to 5.29% - the lowest level since October, and the 10 year yield is at 6.59%.

The Spanish 2 year yield is down sharply to 3.46%, and the 10 year yield is down to 5.31%.

But there are plenty of negative headlines:

From the Financial Times: EFSF considers euro warning clause (ht Brian)

In the latest draft of the prospectus, seen by the Financial Times, a summary of the dangers to investors includes: “[R]isks arising from a Reference Sovereign ceasing to use the euro as its lawful currency . . . or the cessation of the euro as a lawful currency”.That would be quite a warning clause.

excerpt with permission

And here is some downbeat testimony from Deputy Assistant Treasury Secretary Mark Sobel today: What the Euro Crisis Means for Taxpayers and the U.S. Economy

The European Economic Outlook is WeakeningAnd there is some evidence of tightening. The TED spread is increasing and is now up to 56.8 (This hit 463 on Oct 10, 2008), and the two year swap spread is up to 49.5 (This spread peaked at near 165 in early October 2008). Still not too bad.

Over the past year, economic and financial stresses in Europe have spread to some of Europe’s largest economies, and the crisis now facing Europe is deeper and more entrenched. Sovereign bond yields have risen sharply in many countries. Many European financial institutions have faced difficulties in obtaining funding from markets and are de-leveraging in order to strengthen their capital adequacy. European equities have fallen by a quarter since April.

These developments have resulted in a sharp weakening in Europe’s current growth performance and significant markdowns in growth projections for 2012. Growth in the euro area is projected by most analysts to be negative this quarter and into early 2012, with weak growth persisting in 2012. For example, the OECD, which earlier this year had projected annual average European growth in 2012 of 2.0 percent, just revised its estimate to 0.2 percent. Many private forecasters are more pessimistic.

Europe’s problems are a serious risk for the U.S. outlook

In the United States, the pace of recovery has strengthened recently and most analysts expect continued moderate growth next year. But given Europe’s strong trade and financial linkages with the rest of the world, other regions could feel the impact as well. Indeed, Europe’s problems are a serious risk for the U.S. economic outlook.

• The European Union buys nearly 20 percent of U.S. goods exports ($242.6 billion in 2010) and over 30 percent of U.S. service exports ($170.2 billion). The European Union accounts for 63 percent of the stock of foreign direct investment (FDI) into the United States, at $1.5 trillion, and 56 percent of new investment in 2010. Therefore, when European growth slows, U.S. jobs, exports, and FDI inflows decline.

• Global financial markets are strongly interconnected. When European financial markets tighten, it can adversely impact U.S. banks’ confidence and their willingness to lend and invest. That, in turn, can hurt American businesses and jobs, particularly in smaller firms that depend on credit from their banks to grow and innovate.

• When EU stocks decline, U.S. equity markets often do as well, hitting the savings and wealth of Americans.

To make these linkages more concrete, for instance, exports to the European Union represent over 24, 20 and 18 percent, respectively, of merchandise exports from New York, North Carolina, and Illinois. In each of these states, over 150,000 jobs – and over 250,000 in Illinois – are export-related. A decline in exports to Europe will inevitably adversely impact America.

From the WSJ: Fitch Affirms France as AAA, Warns on Six Others

Fitch Ratings lowered its outlook on France's triple-A rating to "negative" from "stable," indicating there is a 50-50 chance the nation could lose its top investment-grade rating over the next two years.And there is a rumor of an S&P downgrade of France after the market today.

...

The ratings firm also put on downgrade watch several investment-grade-rated euro-zone nations that already had a negative outlook. In addition to Italy and Spain, that action snared Belgium, Slovenia, Ireland and Cyprus. Fitch said it expects to complete the review by the end of January. It said it would likely downgrade the ratings by one or two notches.

Key Measures of Inflation mostly slow in November

by Calculated Risk on 12/16/2011 11:55:00 AM

Earlier today the BLS reported:

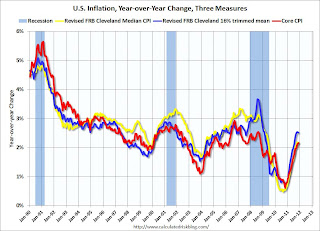

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in November on a seasonally adjusted basis ... The index for all items less food and energy increased 0.2 percent in November following increases of 0.1 percent in each of the prior two months.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.1% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.0% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for November here.

...

The CPI less food and energy increased 0.2% (2.1% annualized rate) on a seasonally adjusted basis. ... Over the last 12 months, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.4%, and the CPI less food and energy rose 2.2%.

On a year-over-year basis, these measures of inflation have stopped increasing, and are slightly above the Fed's target. On a monthly basis, the rate of increase is mostly below the Fed's target (Core is above, median and trimmed-mean are below).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these three key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%.

On a monthly basis, the median Consumer Price Index increased 1.1% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.0% annualized, and core CPI increased 2.1% annualized.

Both the median CPI and trimmed-mean CPI increased at a slower rate in November than in October.

LA area Port Traffic declines year-over-year in November

by Calculated Risk on 12/16/2011 09:41:00 AM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for November. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down 0.3% from October, and outbound traffic is down 0.2%.

Inbound traffic is "rolling over" and outbound traffic has stopped increasing.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of November, loaded inbound traffic was down 4% compared to November 2010, and loaded outbound traffic was down 2% compared to November 2010.

For the month of November, loaded inbound traffic was down 4% compared to November 2010, and loaded outbound traffic was down 2% compared to November 2010.

Exports have been increasing, although bouncing around month-to-month. This is only the 2nd month with a year-over-year decline in exports since Sept 2009.

Imports have been soft - this is the sixth month in a row with a year-over-year decline in imports.

BLS: CPI Unchanged in November

by Calculated Risk on 12/16/2011 08:30:00 AM

From the BLS: CPI unchanged in November as energy declines offset increases in other categories

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.Later today I'll post a graph of several core measures of inflation.

The energy index declined for the second month in a row and offset increases in the indexes for food and all items less food and energy. ... The index for all items less food and energy increased 0.2 percent in November following increases of 0.1 percent in each of the prior two months.

Thursday, December 15, 2011

Report: Deal near on spending bill, payroll tax cut extension

by Calculated Risk on 12/15/2011 07:43:00 PM

Just more brinkmanship, but I'm pretty sure there will no significant government shutdown and the payroll tax cut will be extended.

From the WSJ: Congress Blinks on Shutdown

Congressional leaders—fearful of voters' wrath over Washington's bickering and brinkmanship—stepped back Thursday from a possible government shutdown, clearing the way for extending a payroll tax cut that is set to expire at year's end.Earlier:

...

The spending bill compromise was expected to come to a final vote Friday, in time to avert a shutdown. ... A deal on the payroll tax compromise is expected to follow, although negotiators were still struggling to decide how to offset the cost ...

• Weekly Initial Unemployment Claims decline to 366,000

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

Lawler on FHA: Slow Pace of Conveyances, Solid Sales Pushes SF Inventory to Lowest Level since mid-2008

by Calculated Risk on 12/15/2011 04:24:00 PM

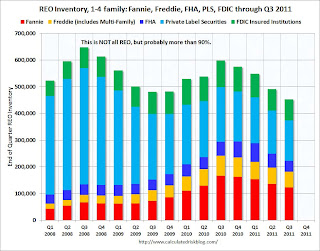

CR Note: The FHA has some "issues" and just released the September (Q3) REO data. I've update the Q3 REO graphs (see bottom of this post).

From economist Tom Lawler:

The FHA finally addressed the “issues” delaying the release of the September Report to the FHA Commissioner, and even released the October report this week.

On the SF REO front, the continued slow pace of property conveyances (partly related to the foreclosure “mess”), combined with a decent pace of sales, pushed the FHA’s SF REO inventory down to an estimated 37,922 at the end of October, the lowest level since mid-2008. I say “estimated” because the numbers in this report don’t always exactly “jive” with other FHA data not regularly released to the public. Here is a table with some history of data from various monthly reports.

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| Jun-10 | 44,850 | 8,487 | 8,893 | 41 |

| Jul-10 | 44,944 | 8,341 | 8,508 | 261 |

| Aug-10 | 47,007 | 9,810 | 7,686 | -61 |

| Sep-10 | 51,487 | 11,411 | 7,439 | 508 |

| Oct-10 | 54,609 | 9,908 | 7,289 | 503 |

| Nov-10 | 55,488 | 6,752 | 5,817 | -56 |

| Dec-10 | 60,739 | 7,728 | 2,749 | 272 |

| Jan-11 | 65,639 | 7,709 | 2,632 | -177 |

| Feb-11 | 68,801 | 7,383 | 4,221 | 0 |

| Mar-11 | 68,997 | 8,647 | 8,728 | 277 |

| Apr-11 | 65,063 | 7,410 | 11,375 | 31 |

| May-11 | 59,465 | 7,032 | 12,659 | 29 |

| Jun-11 | 53,164 | 7,240 | 13,600 | 59 |

| Jul-11 | 48,507 | 6,509 | 11,379 | 213 |

| Aug-11 | 44,749 | 8,005 | 11,701 | -62 |

| Sep-11 | 40,719 | 6,567 | 10,554 | -43 |

| Oct-11 | 37,922 | 6,541 | 9,883 | 545 |

The shockingly slow sales pace in the latter part of 2010 and the early part of 2011 reflected contract changes for managing FHA property sales.

What is especially striking is the extraordinarily low level of property conveyances in September and October, especially given the continued increase in the number of FHA-insured SF loans that are seriously delinquent.

The latest report also showed a substantial slowdown in the number of SF FHA loan modifications over the past few months.

| FHA SF "Home Retention" Activity | |||||

|---|---|---|---|---|---|

| Forbearance Agreements | Loan Modifications | Partial Claims | Total "Loss Mitigation Activity" | SDQ Loans | |

| Dec-09 | 1,840 | 8,514 | 968 | 11,322 | 549,667 |

| Jan-10 | 1,766 | 9,319 | 986 | 12,071 | 576,691 |

| Feb-10 | 1,618 | 11,359 | 846 | 13,823 | 570,799 |

| Mar-10 | 1,686 | 14,604 | 1,158 | 17,448 | 553,650 |

| Apr-10 | 1,228 | 11,525 | 1,603 | 14,356 | 544,464 |

| May-10 | 1,189 | 12,034 | 1,621 | 14,844 | 548,193 |

| Jun-10 | 1,074 | 17,072 | 1,479 | 19,625 | 551,330 |

| Jul-10 | 1,212 | 19,002 | 1,421 | 21,635 | 559,620 |

| Aug-10 | 1,152 | 16,090 | 1,676 | 18,918 | 558,316 |

| Sep-10 | 1,070 | 15,634 | 1,520 | 18,224 | 563,513 |

| Oct-10 | 2,361 | 12,667 | 1,194 | 16,222 | 532,938 |

| Nov-10 | 1,720 | 14,830 | 1,631 | 18,181 | 588,947 |

| Dec-10 | 3,301 | 18,000 | 2,328 | 23,629 | 598,140 |

| Jan-11 | 2,905 | 12,075 | 2,352 | 17,332 | 612,443 |

| Feb-11 | 2,628 | 10,412 | 1,991 | 15,031 | 619,712 |

| Mar-11 | 3,562 | 12,752 | 2,714 | 19,028 | 553,650 |

| Apr-11 | 2,503 | 13,564 | 2,366 | 18,433 | 575,950 |

| May-11 | 2,211 | 11,945 | 3,377 | 17,533 | 578,933 |

| Jun-11 | 2,655 | 13,368 | 3,082 | 19,105 | 584,822 |

| Jul-11 | 2,259 | 8,075 | 1,629 | 11,963 | 598,921 |

| Aug-11 | 2,068 | 9,950 | 1,815 | 13,833 | 611,822 |

| Sep-11 | 1,581 | 7,346 | 1,501 | 10,428 | 635,096 |

| Oct-11 | 2,109 | 7,183 | 1,426 | 10,718 | 661,554 |

Here is a table showing FHA SF insurance claims for the past few fiscal years (October to September), as well as for October 2011.

| Insurance Claims | 11-Oct | FY 2011 | FY 2010 | FY 2009 |

|---|---|---|---|---|

| Conveyance Foreclosure | 6,649 | 90,340 | 98,868 | 69,009 |

| Pre-Foreclosure Sale | 4,435 | 25,069 | 15,293 | 6,473 |

| Deed-in-Lieu of Foreclosure | 106 | 1,132 | 863 | 835 |

| Other | 48 | 1,646 | 152 | 102 |

| Total | 11,238 | 118,187 | 115,176 | 76,419 |

In its 2011 report to Congress on the financial status of the FHA Mutual Mortgage Insurance fund, HUD noted that the “so-called ‘robo-signing’ crisis” had “created a lengthening of time-in-foreclosure for FHA-insured loans” that produced a drop in conveyance foreclosures and a surge in “open cases,” the final resolution of which was “still to be determined.” Clearly, the pace of conveyance foreclosures continued to be “artificially” depressed in October. FHA pre-foreclosure sales activity surged last year, and October was a record month for pre-foreclosure sales.

CR Note: The above was from Tom Lawler, below are update to REO graphs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks (after the settlement) - however I expect quite a few modifications as part of the settlement too, and probably a bulk REO selling program from Fannie and Freddie.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.As Tom Lawler has noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 500,000 in Q3.

Important: REO inventories have declined over the last year. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post last month Housing: REO and Mortgage Delinquencies.

Hotels: Occupancy Rate increases 3.2% year-over-year

by Calculated Risk on 12/15/2011 01:34:00 PM

This is one of the industry specific metrics I track - from HotelNewsNow.com: New Orleans hotels top weekly performance gains

Overall, the U.S. hotel industry’s occupancy increased 3.2% to 53.5%, its ADR increased 3.6% to US$102.12 and its RevPAR finished the week with an increase of 6.9% to US$54.65.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.This year is almost over! The 4-week average of the occupancy rate will decline until mid-January and then start to increase again (the normal seasonal pattern). February and March are the next key period - that is when business travel usually picks up.

Right now the occupancy rate is running at the median rate for 2000 - 2007. But this is just the occupancy rate, room rates are still lower than before the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier:

• Weekly Initial Unemployment Claims decline to 366,000

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

Empire State and Philly Fed Manufacturing Indexes show improvement in December

by Calculated Risk on 12/15/2011 10:15:00 AM

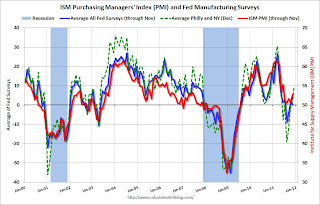

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that manufacturing activity improved in New York State in December. The general business conditions index rose nine points to 9.5, its highest level since May. The new orders index climbed above zero, to 5.1, and the shipments index advanced eleven points to 20.9. ... Employment indexes were mixed, showing a slight increase in employment levels but a slight decrease in the length of the average workweek.From the Philly Fed: December 2011 Business Outlook Survey

The diffusion index of current activity, the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3. ... The current employment index remained positive at 10.7, only 1 point lower than in November. The average workweek index also remained positive but fell nearly 9 points.Both surveys indicate expansion in December, and at a faster pace than in November. Both indexes were above the consensus forecasts.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased again in December and suggests the December ISM index will be in the mid 50s.

Industrial Production decreased 0.2% in November, Capacity Utilization decreased

by Calculated Risk on 12/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in November after having advanced 0.7 percent in October. Factory output moved down 0.4 percent in November; excluding a drop of 3.4 percent in the output of motor vehicles and parts, manufacturing production declined 0.2 percent. Mining production edged up 0.1 percent, while the output of utilities rose 0.2 percent. At 94.8 percent of its 2007 average, total industrial production for November was 3.7 percent above its year-earlier level. Capacity utilization for total industry decreased to 77.8 percent, a rate 2.0 percentage points above its level from a year earlier but 2.6 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in November to 94.8, however October was revised up (this would have been an increase without the upward revisions to previous months).

The consensus was for a 0.2% increase in Industrial Production in October, and for no change (at 77.8%) for Capacity Utilization. Adjusting for the upward revisions to October (and previous months), this was slightly below consensus.