by Calculated Risk on 12/15/2011 07:43:00 PM

Thursday, December 15, 2011

Report: Deal near on spending bill, payroll tax cut extension

Just more brinkmanship, but I'm pretty sure there will no significant government shutdown and the payroll tax cut will be extended.

From the WSJ: Congress Blinks on Shutdown

Congressional leaders—fearful of voters' wrath over Washington's bickering and brinkmanship—stepped back Thursday from a possible government shutdown, clearing the way for extending a payroll tax cut that is set to expire at year's end.Earlier:

...

The spending bill compromise was expected to come to a final vote Friday, in time to avert a shutdown. ... A deal on the payroll tax compromise is expected to follow, although negotiators were still struggling to decide how to offset the cost ...

• Weekly Initial Unemployment Claims decline to 366,000

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

Lawler on FHA: Slow Pace of Conveyances, Solid Sales Pushes SF Inventory to Lowest Level since mid-2008

by Calculated Risk on 12/15/2011 04:24:00 PM

CR Note: The FHA has some "issues" and just released the September (Q3) REO data. I've update the Q3 REO graphs (see bottom of this post).

From economist Tom Lawler:

The FHA finally addressed the “issues” delaying the release of the September Report to the FHA Commissioner, and even released the October report this week.

On the SF REO front, the continued slow pace of property conveyances (partly related to the foreclosure “mess”), combined with a decent pace of sales, pushed the FHA’s SF REO inventory down to an estimated 37,922 at the end of October, the lowest level since mid-2008. I say “estimated” because the numbers in this report don’t always exactly “jive” with other FHA data not regularly released to the public. Here is a table with some history of data from various monthly reports.

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| Jun-10 | 44,850 | 8,487 | 8,893 | 41 |

| Jul-10 | 44,944 | 8,341 | 8,508 | 261 |

| Aug-10 | 47,007 | 9,810 | 7,686 | -61 |

| Sep-10 | 51,487 | 11,411 | 7,439 | 508 |

| Oct-10 | 54,609 | 9,908 | 7,289 | 503 |

| Nov-10 | 55,488 | 6,752 | 5,817 | -56 |

| Dec-10 | 60,739 | 7,728 | 2,749 | 272 |

| Jan-11 | 65,639 | 7,709 | 2,632 | -177 |

| Feb-11 | 68,801 | 7,383 | 4,221 | 0 |

| Mar-11 | 68,997 | 8,647 | 8,728 | 277 |

| Apr-11 | 65,063 | 7,410 | 11,375 | 31 |

| May-11 | 59,465 | 7,032 | 12,659 | 29 |

| Jun-11 | 53,164 | 7,240 | 13,600 | 59 |

| Jul-11 | 48,507 | 6,509 | 11,379 | 213 |

| Aug-11 | 44,749 | 8,005 | 11,701 | -62 |

| Sep-11 | 40,719 | 6,567 | 10,554 | -43 |

| Oct-11 | 37,922 | 6,541 | 9,883 | 545 |

The shockingly slow sales pace in the latter part of 2010 and the early part of 2011 reflected contract changes for managing FHA property sales.

What is especially striking is the extraordinarily low level of property conveyances in September and October, especially given the continued increase in the number of FHA-insured SF loans that are seriously delinquent.

The latest report also showed a substantial slowdown in the number of SF FHA loan modifications over the past few months.

| FHA SF "Home Retention" Activity | |||||

|---|---|---|---|---|---|

| Forbearance Agreements | Loan Modifications | Partial Claims | Total "Loss Mitigation Activity" | SDQ Loans | |

| Dec-09 | 1,840 | 8,514 | 968 | 11,322 | 549,667 |

| Jan-10 | 1,766 | 9,319 | 986 | 12,071 | 576,691 |

| Feb-10 | 1,618 | 11,359 | 846 | 13,823 | 570,799 |

| Mar-10 | 1,686 | 14,604 | 1,158 | 17,448 | 553,650 |

| Apr-10 | 1,228 | 11,525 | 1,603 | 14,356 | 544,464 |

| May-10 | 1,189 | 12,034 | 1,621 | 14,844 | 548,193 |

| Jun-10 | 1,074 | 17,072 | 1,479 | 19,625 | 551,330 |

| Jul-10 | 1,212 | 19,002 | 1,421 | 21,635 | 559,620 |

| Aug-10 | 1,152 | 16,090 | 1,676 | 18,918 | 558,316 |

| Sep-10 | 1,070 | 15,634 | 1,520 | 18,224 | 563,513 |

| Oct-10 | 2,361 | 12,667 | 1,194 | 16,222 | 532,938 |

| Nov-10 | 1,720 | 14,830 | 1,631 | 18,181 | 588,947 |

| Dec-10 | 3,301 | 18,000 | 2,328 | 23,629 | 598,140 |

| Jan-11 | 2,905 | 12,075 | 2,352 | 17,332 | 612,443 |

| Feb-11 | 2,628 | 10,412 | 1,991 | 15,031 | 619,712 |

| Mar-11 | 3,562 | 12,752 | 2,714 | 19,028 | 553,650 |

| Apr-11 | 2,503 | 13,564 | 2,366 | 18,433 | 575,950 |

| May-11 | 2,211 | 11,945 | 3,377 | 17,533 | 578,933 |

| Jun-11 | 2,655 | 13,368 | 3,082 | 19,105 | 584,822 |

| Jul-11 | 2,259 | 8,075 | 1,629 | 11,963 | 598,921 |

| Aug-11 | 2,068 | 9,950 | 1,815 | 13,833 | 611,822 |

| Sep-11 | 1,581 | 7,346 | 1,501 | 10,428 | 635,096 |

| Oct-11 | 2,109 | 7,183 | 1,426 | 10,718 | 661,554 |

Here is a table showing FHA SF insurance claims for the past few fiscal years (October to September), as well as for October 2011.

| Insurance Claims | 11-Oct | FY 2011 | FY 2010 | FY 2009 |

|---|---|---|---|---|

| Conveyance Foreclosure | 6,649 | 90,340 | 98,868 | 69,009 |

| Pre-Foreclosure Sale | 4,435 | 25,069 | 15,293 | 6,473 |

| Deed-in-Lieu of Foreclosure | 106 | 1,132 | 863 | 835 |

| Other | 48 | 1,646 | 152 | 102 |

| Total | 11,238 | 118,187 | 115,176 | 76,419 |

In its 2011 report to Congress on the financial status of the FHA Mutual Mortgage Insurance fund, HUD noted that the “so-called ‘robo-signing’ crisis” had “created a lengthening of time-in-foreclosure for FHA-insured loans” that produced a drop in conveyance foreclosures and a surge in “open cases,” the final resolution of which was “still to be determined.” Clearly, the pace of conveyance foreclosures continued to be “artificially” depressed in October. FHA pre-foreclosure sales activity surged last year, and October was a record month for pre-foreclosure sales.

CR Note: The above was from Tom Lawler, below are update to REO graphs.

Click on graph for larger image.

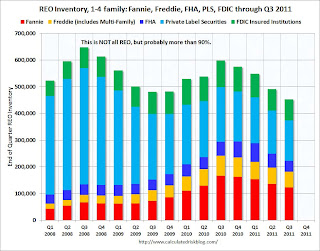

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks (after the settlement) - however I expect quite a few modifications as part of the settlement too, and probably a bulk REO selling program from Fannie and Freddie.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.

The Fannie, Freddie, FHA, PLS, FDIC REO decreased to about 455,000 in Q3 from just under 500,000 in Q2.As Tom Lawler has noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the 1-4 family REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is just around 500,000 in Q3.

Important: REO inventories have declined over the last year. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post last month Housing: REO and Mortgage Delinquencies.

Hotels: Occupancy Rate increases 3.2% year-over-year

by Calculated Risk on 12/15/2011 01:34:00 PM

This is one of the industry specific metrics I track - from HotelNewsNow.com: New Orleans hotels top weekly performance gains

Overall, the U.S. hotel industry’s occupancy increased 3.2% to 53.5%, its ADR increased 3.6% to US$102.12 and its RevPAR finished the week with an increase of 6.9% to US$54.65.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.This year is almost over! The 4-week average of the occupancy rate will decline until mid-January and then start to increase again (the normal seasonal pattern). February and March are the next key period - that is when business travel usually picks up.

Right now the occupancy rate is running at the median rate for 2000 - 2007. But this is just the occupancy rate, room rates are still lower than before the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier:

• Weekly Initial Unemployment Claims decline to 366,000

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

Empire State and Philly Fed Manufacturing Indexes show improvement in December

by Calculated Risk on 12/15/2011 10:15:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that manufacturing activity improved in New York State in December. The general business conditions index rose nine points to 9.5, its highest level since May. The new orders index climbed above zero, to 5.1, and the shipments index advanced eleven points to 20.9. ... Employment indexes were mixed, showing a slight increase in employment levels but a slight decrease in the length of the average workweek.From the Philly Fed: December 2011 Business Outlook Survey

The diffusion index of current activity, the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3. ... The current employment index remained positive at 10.7, only 1 point lower than in November. The average workweek index also remained positive but fell nearly 9 points.Both surveys indicate expansion in December, and at a faster pace than in November. Both indexes were above the consensus forecasts.

Click on graph for larger image.

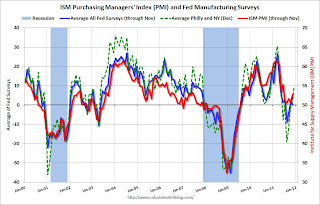

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased again in December and suggests the December ISM index will be in the mid 50s.

Industrial Production decreased 0.2% in November, Capacity Utilization decreased

by Calculated Risk on 12/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in November after having advanced 0.7 percent in October. Factory output moved down 0.4 percent in November; excluding a drop of 3.4 percent in the output of motor vehicles and parts, manufacturing production declined 0.2 percent. Mining production edged up 0.1 percent, while the output of utilities rose 0.2 percent. At 94.8 percent of its 2007 average, total industrial production for November was 3.7 percent above its year-earlier level. Capacity utilization for total industry decreased to 77.8 percent, a rate 2.0 percentage points above its level from a year earlier but 2.6 percentage points below its long-run (1972--2010) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in November to 94.8, however October was revised up (this would have been an increase without the upward revisions to previous months).

The consensus was for a 0.2% increase in Industrial Production in October, and for no change (at 77.8%) for Capacity Utilization. Adjusting for the upward revisions to October (and previous months), this was slightly below consensus.

Weekly Initial Unemployment Claims decline to 366,000

by Calculated Risk on 12/15/2011 08:30:00 AM

The DOL reports:

In the week ending December 10, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 19,000 from the previous week's revised figure of 385,000. The 4-week moving average was 387,750, a decrease of 6,500 from the previous week's revised average of 394,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 387,750.

This is the lowest level for weekly claims - and the lowest level for the 4-week average - since early 2008.

And here is a long term graph of weekly claims:

Wednesday, December 14, 2011

The American Community Survey and Total Housing Units

by Calculated Risk on 12/14/2011 10:55:00 PM

In an earlier post - The Excess Vacant Housing Supply - I mentioned that there are serious question about the Census Bureau's Housing Vacancies and Homeownership (CPS/HVS) survey, and that it is probably not useful for estimating the excess vacant housing supply.

There is another more robust annual survey - the American Community Survey (ACS) - that is based on a sample of 3 million housing units every year. Unfortunately this data doesn't jibe with the decennial Census data.

The table below shows the ACS estimates of total housing units taken every July 1st. In 2000, the ACS was benchmarked to the 2000 decennial Census (as of April 1st). I've included the total completion data for single family, multi-family, manufactured homes - and calculated the implied number of demolitions using the change in the ACS.

For most years the ACS data looks somewhat reasonable, although I'd expect the number of demolitions to have peaked in 2004 through 2006. Over the first nine years of the decade, the change in the ACS averaged about 200 thousand less than total completions - suggesting demolitions of around 200 thousand per year and that is probably reasonable.

However, in April 2010, the decennial Census showed significantly more housing units than the ACS had captured (obviously a negative 1.15 million homes weren't demolished in early 2010!) The decennial Census data itself seems a little off since it suggests only about 645 thousand housing units were demolished during the decade (that would be very low). Most estimates are demolitions are in the 200 to 300 thousand per year range (so the ACS seemed reasonable through the first 9 year of the decade).

These discrepancies really needs to be explained before the ACS can be used for estimating the excess supply of vacant housing units. It is possible the 2000 Census under counted the total number of housing units - or the 2010 Census over counted the total. Or perhaps the completion data from the Census Bureau is low. But this shows one of the reason it is very difficult to estimate the excess vacant housing supply - an error of over 1 million units is huge.

| Source | Date | Period | Total Housing Units | Change | Completions, Total | Calculated Demolitions |

|---|---|---|---|---|---|---|

| Census | 4/1/2000 | 115,904,473 | ||||

| ACS | 7/1/2000 | 3 Months | 116,300,799 | 396,326 | 468,300 | 71,974 |

| ACS | 7/1/2001 | 1 Year | 117,905,005 | 1,604,206 | 1,719,600 | 115,394 |

| ACS | 7/1/2002 | 1 Year | 119,456,206 | 1,551,201 | 1,771,800 | 220,599 |

| ACS | 7/1/2003 | 1 Year | 121,076,837 | 1,620,631 | 1,784,700 | 164,069 |

| ACS | 7/1/2004 | 1 Year | 122,824,501 | 1,747,664 | 1,866,000 | 118,336 |

| ACS | 7/1/2005 | 1 Year | 124,711,041 | 1,886,540 | 1,980,900 | 94,360 |

| ACS | 7/1/2006 | 1 Year | 126,500,212 | 1,789,171 | 2,068,800 | 279,629 |

| ACS | 7/1/2007 | 1 Year | 128,132,164 | 1,631,952 | 1,831,600 | 199,648 |

| ACS | 7/1/2008 | 1 Year | 129,313,137 | 1,180,973 | 1,370,200 | 189,227 |

| ACS | 7/1/2009 | 1 Year | 129,969,653 | 656,516 | 999,700 | 343,184 |

| Census | 4/1/2010 | 9 Months | 131,704,730 | 1,735,077 | 584,000 | -1,151,077 |

| Decennial Census Change: | 15,800,257 | 16,445,600 | 645,343 | |||

Reports: Iowa AG says Mortgage Settlement by Christmas, Final issue is selection of monitor

by Calculated Risk on 12/14/2011 07:07:00 PM

I missed this last week from Adam Belz at the Des Moines Register: Iowa AG says mortgage settlement should be done by Christmas (ht Kevin)

Iowa Attorney General Tom Miller said Thursday a settlement between almost all state attorneys general and the five largest mortgage servicers should be finalized before Christmas, with or without California.And from Bloomberg today: Ex-Cuomo Aide Said to Be Among 4 Foreclosure-Monitor Candidates

The deal, which Miller has been trying to negotiate since March, would release the five servicers – Ally Financial, Bank of America, Citigroup, J.P. Morgan Chase, and Wells Fargo – from legal claims on past home loan servicing and foreclosures. The deal would not prohibit individuals from suing the banks, or government prosecutors from suing banks over issues related to the packaging of home loans into mortgage-backed securities.

In return the banks will agree to pay for what Miller calls “substantial principal reductions” for homeowners who are underwater, and agree to a set of mortgage servicing standards, interest rate reductions, and cash payments to some homeowners who’ve alrady gone through foreclosure.

Steven M. Cohen, who was the governor’s secretary, is one potential foreclosure monitor, according to the person, who declined to be identified because the negotiations are secret. That person said North Carolina Commissioner of Banks Joseph A. Smith Jr. is also a candidate, as did a second person who asked not to be identified.The discussion of possible principal reductions is too optimistic. They are discussing something like a $25 billion settlement (including California) and only a portion would be for principal reductions. Currently, according to CoreLogic, homeowners with negative equity (including 2nd liens) are an aggregate $699 billion underwater. Even if the entire settlement went to principal reductions, the average underwater homeowner would only see a few percent of their negative equity eliminated.

Selection of a monitor is one of the final issues to be worked out between the banks and state and federal officials, said the people. Selection of the monitor is a key issue for the regulators because success of the agreement will largely depend on his or her work, one of the people said.

Other candidates are Nicolas P. Retsinas, a former assistant secretary of the U.S. Department of Housing and Urban Development, and ex-Federal Deposit Insurance Corp. Chairman Sheila Bair, one of the people said.

The major impact from this settlement on the housing market would be to reduce the number of seriously delinquent loans - either by modifications (including principal reductions) or through foreclosures. Currently, according the LPS, there are 1.76 million loans 90+ days delinquent (not in foreclosure) and another 2.21 million loans in the foreclosure process. I'd expect those numbers to decline fairly rapidly next year following a settlement.

Europe: More Bad News

by Calculated Risk on 12/14/2011 05:00:00 PM

Some headlines ...

From the WaPo: Greece is slipping on reforms, IMF warns

From the WaPo: UK’s unemployment increases to highest level in 17 years as austerity measures bite

From the Financial Times: Dive in deposits at foreign-owned banks in US

From the WSJ: Strains Remain in Interbank Market Despite Cheap Dollars

From CNBC: Fitch Downgrades Five Major European Commercial Banks and Banking Groups

It might be time for another summit.

Fed: Household Debt Service Ratio back to 1994 levels, Mortgage financial obligations remain elevated

by Calculated Risk on 12/14/2011 01:40:00 PM

The Federal Reserve released the Q3 2011 Household Debt Service and Financial Obligations Ratios yesterday. (ht Bob_in_MA) I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

...

The homeowner mortgage FOR includes payments on mortgage debt, homeowners' insurance, and property taxes, while the homeowner consumer FOR includes payments on consumer debt and automobile leases

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt.

The overall Debt Service Ratio has declined back to 1994 levels - thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is also at 1994 levels.

However the homeowner's financial obligation ratio for mortgages (blue) is still high and will probably continue to decline. This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to 2003 levels.