by Calculated Risk on 12/13/2011 02:16:00 PM

Tuesday, December 13, 2011

FOMC Statement:: Economy expanding "moderately", Global growth slowing

Information received since the Federal Open Market Committee met in November suggests that the economy has been expanding moderately, notwithstanding some apparent slowing in global growth. While indicators point to some improvement in overall labor market conditions, the unemployment rate remains elevated. Household spending has continued to advance, but business fixed investment appears to be increasing less rapidly and the housing sector remains depressed. Inflation has moderated since earlier in the year, and longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee’s dual mandate. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee also decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Charles L. Evans, who supported additional policy accommodation at this time.

Ceridian-UCLA: Diesel Fuel index increased 0.1% in November

by Calculated Risk on 12/13/2011 12:44:00 PM

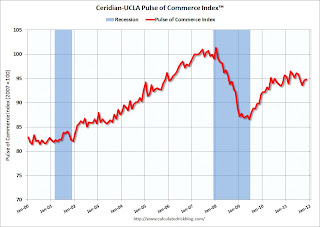

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.1 Percent in November

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.1 percent in November following a 1.1 percent increase in October.

On a year-over-year basis, the PCI grew 0.9 percent in November compared to the 1.3 percent year-over-year increase in October. “The continuing weakness in the PCI is out-of-sync with real retail sales. The year-over-year increase in real retail sales through October was 3.6 percent compared with an increase in the PCI of 1.3 percent. The disconnect between real retail sales and the PCI suggests that retailers have learned to better manage their inventory. Therefore, shoppers can anticipate fewer bargains in the month ahead, and relatively little stock left for the after-Christmas sales,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.

...

Based on the latest PCI data, our forecast for November Industrial Production is a 0.06 percent increase when the government estimate is released on December 15.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and has only partially rebounded over the last two months. Mostly this has been sideways this year (only up 0.9% from November 2010).

Note: This index does appear to track Industrial Production over time (with plenty of noise).

BLS: Job Openings "essentially unchanged" in October

by Calculated Risk on 12/13/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in October was 3.3 million, essentially unchanged from 3.4 million in September. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in October was 1.2 million higher than in July 2009 (the most recent trough for the series). The number of job openings has increased 35 percent since the end of the recession in June 2009.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings declined slightly in October, but the number of job openings (yellow) has generally been trending up, and are up about 13% year-over-year compared to October 2010.

Quits declined in October, but have mostly been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Retail Sales increased 0.2% in November

by Calculated Risk on 12/13/2011 08:30:00 AM

On a monthly basis, retail sales were up 0.2% from October to November (seasonally adjusted, after revisions), and sales were up 6.7% from November 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $399.3 billion, an increase of 0.2 percent (±0.5%)* from the previous month and 6.7 percent (±0.7%) above November 2010.Retail sales excluding autos increased 0.2% in November.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.7% for all retail sales).

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.7% for all retail sales). This was below the consensus forecast for retail sales of a 0.5% increase in November, and a 0.4% increase ex-auto.

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/13/2011 07:43:00 AM

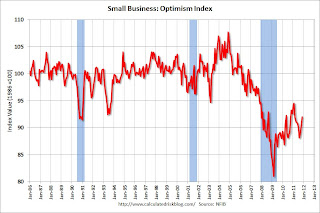

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon?

Small-business optimism rose for the third consecutive month, gaining 1.8 points in November, and settling at a still weak 92.0, according to the National Federation of Independent Business’ (NFIB’s) latest index. ... Optimism appears to have climbed because fewer owners expect business conditions or sales to be worse in six months, indicating some hope on the horizon. Improvement, although small, was widespread with the forward-looking components indicating positive trends for the first time in many months.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“After so many months of pessimism, November’s modest gain made it feel like spring, again,” said NFIB Chief Economist Bill Dunkelberg. “We have good reason to be optimistic about last month’s report and hopeful about what it means for the future."

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This is the third increase in a row after declining for six consecutive months.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months. According to NFIB: “The employment picture brightened last month, ending five months of decline. In November, NFIB owners reported an overall increase in employment of 0.12 workers per firm in November. ... Future hiring plans were also positive. Over the next three months, a seasonally adjusted net seven percent of owners plan to create new jobs—a 4 point improvement from October and the strongest reading in 38 months."

Twenty five percent of small business owners reported that weak sales continued to be their top business problem in November.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly over the last three months. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, December 12, 2011

A little better GDP Growth in Q4

by Calculated Risk on 12/12/2011 08:50:00 PM

From the WSJ: Economy Poised for Growth Spurt, but Risks Abound

Forecasting firm Macroeconomic Advisers on Friday raised its estimate to 3.7%, from 3.5%, while Goldman Sachs has raised its target to 3.4% from the 2.5% it was predicting two weeks ago.It does look like GDP growth will be slightly above trend in Q4, but this is still weak growth considering all the slack in the economy. Back in Q4 2009 and early 2010, real GDP increased at around 3.8% annualized for a few quarters, but almost all of that growth was from increases in private inventories (a classic inventory cycle). This quarter most of the increase will be from final demand.

Nomura Global Economics lifted its target from 3.7% to 3.9%, which, if achieved, would match the fastest quarterly growth of the recovery.

However some of this "growth spurt" is just a bounce back from earlier events - auto sales have finally recovered from the impact of the tsunami, and consumer and business spending have bounced back a little from the threat of a U.S. default in August during the debt ceiling debate.

And recently personal spending has been increasing faster than personal incomes, and the saving rate has been declining. That isn't sustainable.

Also, there are significant concerns about the first half of 2012 both from the European financial crisis and from fiscal tightening in the U.S. (fiscal policy in the U.S. will subtract from GDP in 2012 even if the payroll tax cut is extended).

Overall I still expect sluggish growth in early 2012, but at a slower pace than in Q4.

NAR: Downward Revisions for 2007 to 2011 Home Sales and Inventory to be released on Dec 21st

by Calculated Risk on 12/12/2011 04:52:00 PM

From the WSJ: Realtors to Revise 2007-2011 Sales Data Lower

The National Association of Realtors, which publishes the monthly report on sales of previously occupied homes, said it will release revisions to home sales for 2007 through 2010 and for the first 10 months of this year. The data is scheduled to be released on Dec. 21, along with the group’s monthly report on home sales in November.Last year the NAR reported sales of 4.9 million previously occupied homes. I expect 2010 sales to be revised down by 10% to 15%. Using the HousingTracker data, I've estimated 2010 sales will be revised down to around 4.25 million.

Jobs needed to reach 8% unemployment rate by November 2012

by Calculated Risk on 12/12/2011 03:48:00 PM

On 60 Minutes, President Obama was asked if he thought the unemployment rate could decline to 8% by next November (currently 8.6%).

From the 60 Minutes interview:

Kroft: With the unemployment [rate at] 8.6 [percent], you've still got soft consumer demand. You've got no business investment. There's still a fairly steady downturn in housing prices. Do you see some hope? Do you think that things are gonna get better? Well, do you think that you might have the unemployment rate down to eight percent by the time the election rolls around?Many forecasters think the unemployment rate will increase next year because of sluggish growth. Right now the FOMC is forecasting the unemployment rate will be in the 8.5% to 8.7% range in Q4 2012, and private forecasters are even more pessimistic. Goldman Sachs is forecasting 9% in Q4 2012, and Merrill Lynch is forecasting 8.8%.

Obama: I think it's possible. But, you know, I'm not in the job of prognosticating on the economy.

But it is possible that we could see 8% by the election. It depends on job creation and the participation rate.

Here is a table looking at several participation rates (the current rate is 64.0%, down from 66.0% at the beginning of the recession). The participation rate is the percent of the working age population that considers themselves in the labor force.

| Projections: Jobs needed to reach 8% unemployment rate by Nov 2012 All numbers in thousands. | ||||

|---|---|---|---|---|

| Participation Rate | Labor Force | Employed at 8% unemployment Rate | Jobs Added over Year | Jobs added per month |

| 63.5% | 153,776 | 141,474 | 894 | 74 |

| 64.0% | 154,987 | 142,588 | 2,008 | 167 |

| 64.5% | 156,198 | 143,702 | 3,122 | 260 |

| 65.0% | 157,409 | 144,816 | 4,236 | 353 |

Note: I estimated that the civilian noninstitutional population will grow at the same pace over the next year as the past year (add 1.726 million people). Also - this is jobs added in the household survey, not the establishment survey.

If the participation rate falls to 63.5%, the economy needs to add 74 thousand jobs per month for the unemployment rate to fall to 8%. But a further decline in the participation rate would not be good news. I expect the participation rate to increase if the economy improves at all.

Most likely I think the participation rate will be in the 64.0% to 64.5% range next November. That would mean the economy would need to add somewhere between 167,000 and 260,000 jobs per month. The bottom end of that range seems possible with sluggish growth, but the top end is less likely.

This is very sensitive to the participation rate. If the economy adds 167,000 jobs per month next year, and the participation rate increases to 64.5%, the unemployment rate would be at 8.7%. So 8% is possible, but it seems unlikely unless growth picks up.

MF Global and Rehypothecation

by Calculated Risk on 12/12/2011 12:46:00 PM

Initially I ignored MF Global - it seemed that MF Global had inappropriately used client money and that appeared to be an unusual event. However there is another scarier possibility ...

Last week reader jb sent me a Reuters article: MF Global and the great Wall St re-hypothecation scandal

By way of background, hypothecation is when a borrower pledges collateral to secure a debt. The borrower retains ownership of the collateral but is “hypothetically” controlled by the creditor, who has a right to seize possession if the borrower defaults.As a followup I read an IMF working paper this weekend by Manmohan Singh and James Aitken: The (sizable) Role of Rehypothecation in the Shadow Banking System

...

Re-hypothecation occurs when a bank or broker re-uses collateral posted by clients, such as hedge funds, to back the broker’s own trades and borrowings. The practice of re-hypothecation runs into the trillions of dollars and is perfectly legal.

...

[I]n the UK, there is absolutely no statutory limit on the amount that can be re-hypothecated.

...

U.S. prime brokers have been making judicious use of European subsidiaries. Because re-hypothecation is so profitable for prime brokers, many prime brokerage agreements provide for a U.S. client’s assets to be transferred to the prime broker’s UK subsidiary to circumvent U.S. rehypothecation rules.

Under subtle brokerage contractual provisions, U.S. investors can find that their assets vanish from the U.S. and appear instead in the UK, despite contact with an ostensibly American organisation.

Note: James Aitken of Aitken Advisors correctly called the subprime implosion and has been ahead of the curve on Europe too.

Rehypothecation occurs when the collateral posted by a prime brokerage client (e.g., hedge fund) to its prime broker is used as collateral also by the prime broker for its own purposes. Every Customer Account Agreement or Prime Brokerage Agreement with a prime brokerage client will include blanket consent to this practice unless stated otherwise. In general, hedge funds pay less for the services of the prime broker if their collateral is allowed to be rehypothecated.Bruce Krasting adds: The Fed, MFG and Reg. T

...

A defined set of customer protection rules for rehypothecated assets exists in the United States, but not in the United Kingdom. In the United Kingdom, an unlimited amount of the customer’s assets can be rehypothecated and there are no customer protection rules. By contrast, in the United States, Rule 15c3–3 limits a broker-dealer from using its customer’s securities to finance its proprietary activities.

I think there is sufficient evidence today to conclude that Re-Hypothecation is at the root of the customer losses at MFG. ... Let me add one additional bit of info.If MF Global moved their US client assets to their UK subsidiary (added: moved legally with client approval), and then followed the UK rules on rehypothecated assets - the client money is gone and nothing illegal happened. That would be the worst possible outcome.

The Canadian customers of MFG got their money back within 10 days of the MFG bankruptcy. The accounts that have lost money are either USA or UK based. In Canada, re-hypothecation is not permitted. I got these comments from a Canadian MFG account holder:The trustee where segregated MF Global Canada customers' funds were held was RBC Dominion Securities. I don't think any of these funds ever left the trustee in Canada. Likelihood is if they left, the Canadian government would have made the parent Royal Bank of Canada eat up the losses and make full restitution.

European Bond Yields rising

by Calculated Risk on 12/12/2011 08:52:00 AM

Another summit. More disappointment ...

The Italian 2 year yield is up to 6.14%, and the 10 year yield is up to 6.72%. Both were below 6% last week.

The Spanish 2 year yield is up sharply to 4.7%, and the 10 year yield is up to 5.98%.

From the NY Times: Chronic Pain for the Euro

“More tests will obviously come, and soon,” perhaps as early as the opening of financial markets on Monday, said Joschka Fischer, the former German foreign minister.Yesterday:

...

The European stock markets had slipped by midmorning on Monday and ... Moody’s Investors Service said it could downgrade the sovereign ratings of some European Union countries in coming months, adding that the crisis remained at a “critical and volatile stage.”

...

The issue is how to promote economic growth and competitiveness in the poorer countries at the euro zone’s periphery that ran up large debts and trade deficits. “You need discipline as part of your stabilization strategy, but we also need a much stronger growth strategy for the southern countries,” including Italy, Mr. Fischer said.

• Summary for Week ending Dec 9th

• Schedule for Week of Dec 11th