by Calculated Risk on 12/10/2011 07:17:00 PM

Saturday, December 10, 2011

Schedule for Week of Dec 11th

Earlier:

• Summary for Week ending Dec 9th

Retail sales for November is the key report this week. For manufacturing, the December NY Fed (Empire state) and Philly Fed surveys, and the November Industrial Production and Capacity Utilization report will be released on Thursday.

On prices, the November Producer Price index (PPI) will be released Thursday, and CPI will be released on Friday. Also - there is an FOMC meeting on Tuesday.

No releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for November.

7:30 AM: NFIB Small Business Optimism Index for November. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 90.2 in October from 88.9 in September. The index has increased for two consecutive months and is expected to increase further in November.

8:30 AM: Retail Sales for November.

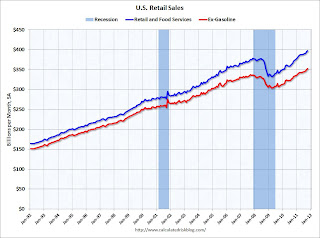

8:30 AM: Retail Sales for November. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 19.5% from the bottom, and now 5.1% above the pre-recession peak (not inflation adjusted).

The consensus is for retail sales to increase 0.5% in November, and for retail sales ex-autos to increase 0.4% .

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for November (a measure of transportation).

10:00 AM: Manufacturing and Trade: Inventories and Sales for October. The consensus is for a 0.6% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general, the number of job openings (yellow) has been trending up, and are up about 22% year-over-year compared to September 2010.

2:15 PM: FOMC Meeting Announcement. No changes are expected to interest rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 390,000 from 381,000 last week. The 4-week average has recently declined to slightly below 400,000.

8:30 AM: Producer Price Index for November. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

8:30 AM ET: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of +3.0, up from +0.61 in November (above zero is expansion).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November. The second graph shows industrial production since 1967. Industrial production increased in October to 94.7 The consensus is for a 0.2% increase in Industrial Production in November, and for no change at 77.8% for Capacity Utilization.

10:00 AM: Philly Fed Survey for December. The consensus is for a reading of 5.0 (above zero indicates expansion, up slightly from 3.6 last month.

8:30 AM: Consumer Price Index for November. The consensus is a 0.1% increase in prices. The consensus for core CPI is also an increase of 0.1%.

Unofficial Problem Bank list declines to 977 institutions

by Calculated Risk on 12/10/2011 01:35:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 9, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Perhaps the FDIC is giving its closing teams the balance of the year off as there is only one weekend left before Christmas and New Year's weekend. This week there were three removals to the Unofficial Problem Bank List. After the removals, the list has 977 institutions with assets of $399.5 billion. A year ago, the list held 919 institutions with assets of $411.4 billion.

Removals include two unassisted mergers -- Fullerton Community Bank, FSB, Fullerton, CA ($636 million); and Santa Lucia Bank, Atascadero, CA ($232 million Ticker: SLBA). The other removal was the voluntary liquidation of Greystone Bank, Raleigh, NC ($90 million). Props go out to bank management and the North Carolina State Banking Department for winding down a problem bank at no cost to the deposit insurance fund.

Click on graph for larger image.

Click on graph for larger image.Here is a repeat of the graph of bank failures by week (cumulative) for the last several years.

In 2008, 25 banks failed, 140 banks failed in 2009, 157 in 2010, and only 90 so far in 2011.

If there are any more bank failures this year, they will probably be closed next Friday.

Earlier:

• Summary for Week ending Dec 9th

Summary for Week ending Dec 9th

by Calculated Risk on 12/10/2011 08:15:00 AM

This was a light week for economic data and most of the focus was on Europe.

The good news included fewer initial weekly unemployment claims, an increase in consumer sentiment and an increase in rail traffic. However the ISM non-manufacturing index was weaker than expected, and - of course - house prices continued to decline.

Also, the data this week had implications for Q4 GDP, from Goldman Sachs:

[D]ata on inventories in the manufacturing and wholesale sectors was much stronger than expected for October. We now expect a modest inventory build in Q4 instead of a contraction. [I]mport growth was weaker than expected (because imports are subtracted from GDP, this is a positive). ... We revised up our tracking estimate for the quarter by nine tenths from 2.5% (annualized) at the start of the week to 3.4% currently.However, Goldman still expects growth to slow in the first half of 2012 to around 1%, due to spillover from the Euro-area crisis, and from U.S. fiscal tightening.

Here is a summary of last week in graphs:

• Trade Deficit declined in October

The Department of Commerce reported:

[T]otal October exports of $179.2 billion and imports of $222.6 billion resulted in a goods and services deficit of $43.5 billion, down from $44.2 billion in September,

revised. October exports were $1.5 billion less than September exports of $180.6 billion. October imports were $2.2 billion less than September imports of $224.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly U.S. exports and imports in dollars through October 2011.

Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted) - partially due to slightly lower oil prices. Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

• ISM Non-Manufacturing Index indicates slower expansion in November

The November ISM Non-manufacturing index was at 52.0%, down from 52.9% in October. The employment index decreased in November to 48.9%, down from 53.3% in October.

The November ISM Non-manufacturing index was at 52.0%, down from 52.9% in October. The employment index decreased in November to 48.9%, down from 53.3% in October. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.8% and indicates slower expansion in November than in October.

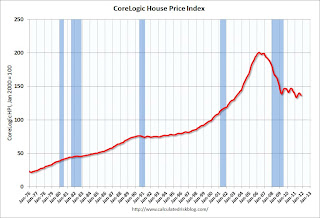

• CoreLogic: House Price Index declined 1.3% in October

CoreLogic released its October Home Price Index showing that "home prices in the U.S. decreased 1.3 percent on a month-over-month basis".

CoreLogic released its October Home Price Index showing that "home prices in the U.S. decreased 1.3 percent on a month-over-month basis".This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.3% in October, and is down 3.9% over the last year.

The index is off 32.0% from the peak - and up just 2.5% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index in early 2012.

• Labor Force Participation Rate

Three recent post on the labor force participation rate:

1) Comments on the Employment-Population Ratio

2) Labor Force Participation Rate by Age Group

3) Labor Force Participation Rate: The Kids are Alright

Here is a repeat of the graph showing the trends by age group since 1990.

Here is a repeat of the graph showing the trends by age group since 1990.Some of the recent decline in the participation rate for the '20 to 24' age group is probably related to the recession.

But probably the main reason for the decline in the participation rate for the younger age groups is that more people are pursuing higher education.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.

This graph uses data from the BLS on participation rate, and the National Center for Education Statistics (NCES) on enrollment rates.This graph shows the participation and enrollment rates for the 18 to 19 year old age group. These two lines are a "mirror image".

Note: I added the participation rate for men and women too. One of the key labor stories in the 2nd half of the 1900s was the surge in participation by women.

In the long run, more education is a positive for the economy (although I am concerned about the surge in student loans).

• Weekly Initial Unemployment Claims decline to 381,000

"In the week ending December 3, the advance figure for seasonally adjusted initial claims was 381,000, a decrease of 23,000 from the previous week's revised figure of 404,000."

"In the week ending December 3, the advance figure for seasonally adjusted initial claims was 381,000, a decrease of 23,000 from the previous week's revised figure of 404,000."This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. This is the fourth week in a row with the 4-week average below 400,000, and this is the lowest level for claims since February.

• Consumer Sentiment increased in December

The preliminary December Reuters / University of Michigan consumer sentiment index increased to 67.7, up from the November reading of 64.1.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices.

However the recent sharp decline was event driven (the debt ceiling debate), and sentiment has rebounded as expected. Note: Back in August I looked at event driven declines in consumer sentiment.

Sentiment is still very weak, although this was above the consensus forecast of 66.0.

• Other Economic Stories ...

• From LPS: LPS Home Price Index Shows 1.2 Percent Decline in September U.S. Home Prices; Early Data Suggests Further 1.1 Percent Drop in October Likely

• Research: New paper on the role of investors in the housing bubble

• Lawler on "Real Estate Investors, the Leverage Cycle, and the Housing Crisis"

• AAR: Rail Traffic increased in November

Friday, December 09, 2011

Bank Donates foreclosed home to homeless agency

by Calculated Risk on 12/09/2011 08:30:00 PM

This is a special case ...

From the Press Democrat: Bank donates Carinalli house to homeless agency (ht Tom)

An aging, two-bedroom ranch house at the west edge of Santa Rosa, seized in foreclosure proceedings from bankrupt financier Clem Carinalli, will soon become a housing complex for people who have lost their homes.

The house, which sits on two acres and is valued at $290,000, was donated by Luther Burbank Savings to Community Housing Sonoma County, a nonprofit that has helped create 179 units of low-income housing since 2003.

The donation of the foreclosure property is unprecedented in Sonoma County and possibly nationwide, housing advocates and bankers involved in the deal said.

...

Carinalli's assets, including 248 North Bay real estate properties ... according to bankruptcy documents.

...

Luther Burbank Savings, which had loaned Carinalli $19.5 million, foreclosed on 19 of his properties and sold all but one ...

Considering the glut of foreclosed homes in the county ... [Georgia Berland, executive director of the Sonoma County Task Force for the Homeless] said she hoped other banks might follow Luther Burbank Savings' example.

Biggs said he thought that was unlikely, calling the donation the result of “a unique set of circumstances,” including the cluster of Carinalli foreclosures and the home's marginal appeal to buyers.

Europe Friday

by Calculated Risk on 12/09/2011 03:43:00 PM

A few details and articles.

From the EU: First session of the EU summit: Agreement on immediate action and on new fiscal rule for the eurozone

At a press conference Herman Van Rompuy, President of the European Council, and José Manuel Barroso, President of the European Commission, explained the short-term measures. Up to €200 billion will be made available to the IMF, the European Financial Stability Facility (EFSF) leverage "will be rapidly deployed" and the European Stability Mechanism (ESM) should enter into force in July 2012.Excerpts from the communiqué: "General government budgets shall be balanced or in surplus; this principle shall be deemed respected if, as a rule, the annual structural deficit does not exceed 0.5% of nominal GDP." CR note: there are several ways around this "principle".

For the medium and longer term, the 17 eurozone countries will conclude an international agreement. This fiscal compact, to be signed no later than March 2012, will establish a new, stronger fiscal rule, including more automatism in the excessive deficit procedure. The objective remains to incorporate these provisions into the treaties of the Union as soon as possible. The Heads of State or Government of Bulgaria, Czech Republic, Denmark, Hungary, Latvia, Lithuania, Poland, Romania and Sweden indicated the possibility to take part in this process after consulting their Parliaments where appropriate.

"A mechanism will be put in place for the ex ante reporting by Member States of their national debt issuance plans."

As far as rebalancing, there is mention of "the new macro-economic imbalances procedure".

From the WSJ: EU Leaders Forge Fiscal Pact

The 17 countries of the euro zone formally agreed to run only minimal budget deficits in the future and allowed the European Court of Justice the right to strike down national laws that don't enforce such discipline properly.From the NY Times: A Treaty to Save Euro May Split Europe

In a day of historic, seemingly tectonic shifts in the architecture of Europe, all 17 members of the European Union that use the euro agreed to the new treaty, along with six other countries that wish to join the currency union eventually. Three stragglers, the Czech Republic, Hungary and Sweden entered the fold later, after a strong diplomatic push.Gavyn Davies at the Financial Times is somewhat optimistic: Eurozone crisis might move from acute to chronic phase

My initial take on the deal is that it will be sufficient to dampen the acute phase of the crisis, but that the absence of a clear long-term strategy for growth means that there could still be a long period of chronic problems ahead.And from the FT Alphaville: The gap between summit rhetoric and reality

...

the communiqué ... does mention the “new macro-economic imbalances procedure” ... This is intended to increase the pressure on surplus countries (mainly Germany) ... But this resolution, unlike the fiscal rule, has no teeth ... The missing growth strategy, and the missing plan to eliminate competitiveness imbalances in the eurozone, could prove to be very serious omissions indeed.

AAR: Rail Traffic increased in November

by Calculated Risk on 12/09/2011 12:41:00 PM

The Association of American Railroads (AAR) reports carload traffic in November increased 2.3 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 3.8 percent compared with November 2010.

The Association of American Railroads (AAR) today reported gains in November 2011 rail traffic compared with the same month last year, with U.S. railroads originating 1,476,635 carloads, up 2.3 percent, and 1,162,249 trailers and containers, up 3.8 percent. November 2011 saw the largest year-over-year percentage increase in carload traffic since March 2011.On a seasonally adjusted basis, carloads in November were up 0.9% from last month, and intermodal in Novmeber was up 0.8% from October.

...

“In November, U.S. rail carload traffic saw its highest year-over-year percentage increase in eight months, and year-over-year intermodal traffic grew for the 24th straight month,” said AAR Senior Vice President John Gray. “There are still clearly a lot of things that aren’t right with the economy, but we hope this improvement in rail traffic is a sign that the pace of economic growth is increasing.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Rail carload traffic collapsed in November 2008, and now, over 2 years into the recovery, carload traffic is about half way back to the pre-recession levels.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is close to the peak year in 2006. Usually October is the strongest month for intermodal shipping as retailers stock up for the holiday season. That was true again this year, but shipping held up pretty well in November too.

Overall rail traffic improved in November - and this suggests somewhat sluggish growth, and may indicate that the pace of growth is increasing a little.

Consumer Sentiment increases in December

by Calculated Risk on 12/09/2011 09:55:00 AM

The preliminary December Reuters / University of Michigan consumer sentiment index increased to 67.7, (typo corrected) up from the November reading of 64.1.

Click on graph for larger image.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices.

However the recent sharp decline was event driven (the debt ceiling debate), and sentiment has rebounded as expected. Note: Back in August I looked at event driven declines in consumer sentiment.

Sentiment is still very weak, although above the consensus forecast of 66.0.

Trade Deficit declines in October

by Calculated Risk on 12/09/2011 08:30:00 AM

The Department of Commerce reports:

[T]otal October exports of $179.2 billion and imports of $222.6 billion resulted in a goods and services deficit of $43.5 billion, down from $44.2 billion in September,The trade deficit was at the consensus forecast of $43.5 billion.

revised. October exports were $1.5 billion less than September exports of $180.6 billion. October imports were $2.2 billion less than September imports of $224.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through October 2011.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $98.84 per barrel in October, and import oil prices have been declining slowly from $108.70 per barrel in May. The trade deficit with China was unchanged at $28 billion.

Imports have been moving sideways for the last several months - partially due to slightly lower oil prices. However the trade deficit with China continues to be a significant issue.

Thursday, December 08, 2011

Europe Friday: Over promise, Under Deliver Again?

by Calculated Risk on 12/08/2011 11:51:00 PM

The ECB disappointed today, and the EU will probably under deliver again tomorrow.

The following is no surprise - no one expected all 27 countries to agree, just the 17 eurozone countries plus a few more ...

From CNBC: EU Fails to Agree on Treaty Change Among 27 States: Diplomats

The European Union failed to secure backing from all 27 countries to change the EU treaty at a summit on Friday, meaning any deal will now likely involve the 17 euro zone countries plus any others that want to join, three EU diplomats said.From the NY Times: After Rate Cut, Gloom as Europe Leaders Meet

Late Thursday, European leaders here were circulating the draft of a new “fiscal compact” for the currency union, including tighter control of public finances. Disagreement persisted about whether any deal would cover all 27 European Union member states or just the 17-member euro zone, and about whether it would involve amendments to the euro treaty. Leaders were also discussing whether a permanent bailout fund, set to begin operation as early as July, should function as a licensed banker.I'm sure there will be some sort of agreement, but it appears they will under deliver once again.

Earlier in the day in Washington, President Obama voiced frustration that Chancellor Angela Merkel of Germany and other European leaders were focusing on the wrong problem by negotiating long-term changes to the euro treaty, rather than reassuring the markets and staving off a recession by taking bold short-term action.

...

Adding to the anxiety, European regulators said on Thursday that many of the region’s biggest banks, including the German giants Deutsche Bank and Commerzbank, needed to raise more money as reserves against potential losses.

The amounts to be set aside are much higher than regulators had estimated as recently as October, and the inclusion of German banks in the roundup was a reminder that even the region’s richest nation was not immune from the debt crisis contagion.

President Nicolas Sarkozy of France, in Marseille on Thursday before heading here, said, “If we don’t have an agreement Friday, there won’t be a second chance.”

The Asian markets are all red tonight. The Nikkei is down about 1%, the Hang Seng is off 2.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up slightly and the Dow futures are up 25.

Distressed House Sales using Sacramento Data for November

by Calculated Risk on 12/08/2011 07:30:00 PM

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes - and not much has changed yet. At some point, the number and percent of distressed sales should start to decline (excluding seasonal factors and market distortions like the home buyer tax credit).

The percent of distressed sales in Sacramento was unchanged in November compared to October. In November 2011, 64.1% of all resales (single family homes and condos) were distressed sales. This was down slightly from 66.1% in November 2010.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales. There is a seasonal pattern for conventional sales (stronger in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 14.6% compared to November 2010. Active Listing Inventory were down 38.1% from last November, although "short sale contingent" has increased. Cash buyers accounted for 27.4% of all sales (frequently investors), and median prices are off about 8% from last November.

This data might be helpful in determining when the market is improving. So far it looks like REO sales have declined (this is the lowest percentage of REO sales since Sacramento started breaking out REOs), offset by an increase in short sales, so overall there is no improvement.