by Calculated Risk on 12/03/2011 08:30:00 PM

Saturday, December 03, 2011

Rare Sighting: A New Mall

This is one of the few remaining undeveloped coastal areas of Orange County (probably the largest undeveloped coastal parcel). Of course this property went into bankruptcy in 2008 (Lehman provided the funding). It looks like it is moving ahead now ...

From the O.C. Register: Future O.C. outlet mall names 21 stores

Plaza San Clemente, an outlet shopping center, has released the names for 21 retailers that have signed leases to open there.Earlier:

The outlet shopping center, located at Avenida Vista Hermosa off the 5 Freeway, is part of the Marblehead oceanfront development. Plaza San Clemente will feature nearly 600,000 square feet of multiple retail uses. It will include 350,000 square feet of outlets and complementing retail, a large multiplex cinema, a mixture of dinner houses and casual dining, a hotel with conference facilities and neighborhood services.

The center is targeting a 2012 start date for construction, but does not have a specific opening date yet ...

• Summary for Week ending Dec 2nd

• Schedule for Week of Dec 4th

Schedule for Week of Dec 4th

by Calculated Risk on 12/03/2011 04:30:00 PM

Earlier:

• Summary for Week ending Dec 2nd

European policymakers are meeting again this week, and an announcement of additional measures is expected by Friday, December 9th.

This will be a light week for economic releases. The key economic releases this week are the November ISM service index on Monday, and the October trade balance report on Friday. Also consumer sentiment might recover some more in early December (released on Friday).

The Federal Reserve will release the Q3 Flow of Funds report on Thursday.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for an increase to 53.8 from 52.9 in October. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for an increase to 53.8 from 52.9 in October. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.3% decline in orders.

12:10 PM: Chicago Fed President Charles Evans speaks on the US economic outlook, Ball State Economic Luncheon.

No releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

3:00 PM: Consumer Credit for October. The consensus is for a $7.5 billion increase in consumer credit.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 395,000 from 402,000 last week. The 4-week average has recently declined to slightly below 400,000.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 395,000 from 402,000 last week. The 4-week average has recently declined to slightly below 400,000.10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.3% increase in inventories.

12:00 PM: Q3 Flow of Funds Accounts from the Federal Reserve.

8:30 AM: Trade Balance report for Octrober from the Census Bureau.

8:30 AM: Trade Balance report for Octrober from the Census Bureau. Exports increased in September, and imports have been mostly moving sideways for the last five months (seasonally adjusted).

The consensus is for the U.S. trade deficit to be around $43.5 billion in October, up from from $43.1 billion in September. Export activity to Europe will be closely watched.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for December.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for December. Consumer sentiment declined sharply in July and August - from 71.5 in June to 55.7 in August, but has rebounded some since then.

The consensus is for an increase in December to 66.0 from 64.1 in November.

Summary for Week ending Dec 2nd

by Calculated Risk on 12/03/2011 11:07:00 AM

Expectations are so low that the U.S. economic data last week looked “good”.

Look at the employment report. There were only 120,000 payroll jobs added in November (although September and October were revised up). This is weak employment growth.

Sure the unemployment rate fell sharply, but that was a combination of the household survey showing more jobs added, and a sharp decline in the labor force. Over time the establishment and household surveys mostly move together, but in recent months the household survey has showed stronger job growth than the establishment survey – and the unemployment rate is from the household survey (the establishment survey is the one to use for jobs). Earlier this year the opposite was true; the establishment survey showed more job growth.

There were other signs in the report of sluggish employment growth. The average workweek was unchanged at 34.3 hours, and average hourly earnings decreased slightly. Average hourly earnings have only increased by 1.8% over the past 12 months. This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

Through the first eleven months of 2011, the economy has added 1.448 million total non-farm jobs or just 131 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.2 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.711 million private sector jobs this year, or about 156 thousand per month.

At a pace of 131 thousand jobs per month, it would take about four more years just to get back to the pre-recession level of payroll jobs. And that doesn’t include population growth. At this stage in a recovery, we’d like to see 300+ thousand jobs added per month.

Another example of “low expectations” was the ISM manufacturing survey. The survey was at 52.7%, the highest level since June – but this is still weak manufacturing growth during a recovery.

Auto sales are increasing sharply, and hit 13.6 million on a seasonally adjusted annual rate (SAAR) basis in November. That is solid compared to recent months and years, but still below the average of over 15 million SAAR from 1984 through 2002 (leaving out the bubble years).

Perhaps the only sector that didn’t beat low expectations was housing. New home sales are moving sideways at a very low level, and house prices are falling again.

Overall the data suggests Q4 real GDP growth will be around 2.5% to 3.0% annualized or so (an early read). That might be the best this year, but it is still slow growth.

Here is a summary in graphs:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

There were only 120,000 payroll jobs added in November. There were 140,000 private sector jobs added, and 20,000 government jobs lost.

The change in total employment was revised up for September and October. "The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000."

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.

The household survey showed an increase of 278,000 jobs in November. This increase in the household survey - along with a 315,000 decline in the labor force - pushed the unemployment rate down sharply to 8.6%.

The participation rate fell to 64.0%, and the employment population ratio increased to 58.5%. This is the fourth straight monthly increase in the employment population ratio from the low in July at 58.1%.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This is the worst post WWII employment recession. However, as bad as this is, the Great Depression would be way off the chart. At the worst, employment fell a little over 6% during the recent employment recession - although the data is a little uncertain - employment probably fell by around 22% during the Great Depression.

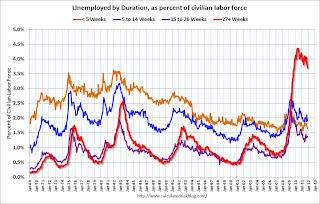

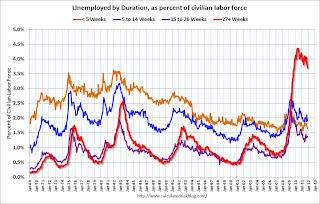

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Only one category increased in November: The "15 to 26 Weeks" group. This is probably spillover from the increase in short term unemployment in August and September. A little bit of good news is that short term unemployment (less than 14 weeks) has declined.

The the long term unemployed declined to 3.7% of the labor force - this is still very high, but the lowest since October 2009. According to the BLS, there are 5.691 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.876 million in October.

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Retailers hired 423.5 thousand workers (NSA) net in November, and 547.2 thousand in October and November combined. This is more hiring than last year, and this is about the same level as in 2006 and 2007. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season.

• New Home Sales in October: 307,000 SAAR

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 60,000 units in October. The combined total of completed and under construction is at the lowest level since this series started.

Sales were slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA).

New home sales have averaged only 299 thousand SAAR over the 18 months since the expiration of the tax credit ... mostly moving sideways at a very low level.

• ISM Manufacturing index indicates slightly faster expansion in November

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%.

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%. From the Institute for Supply Management: November 2011 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%, and suggests manufacturing expanded at a slightly faster rate in November than in October.

• U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).This was above the consensus forecast of 13.4 million SAAR. Note: dashed line is current estimated sales rate. This was the highest sales rate since August 2009 ("Cash-for-clunkers"), and other than August 2009, this was the highest since June 2008.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and so far (October and November) sales have averaged 13.42 million SAAR in Q4, an increase of 7.6% over Q3.

• Case Shiller: Home Prices declined in September

From S&P: Home Prices Weaken as the Third Quarter of 2011 Ends

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 32.5% from the peak, and down 0.4% in September (SA). The Composite 10 is 0.5% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.5% from the peak, and down 0.6% in September (SA). The Composite 20 is at a new post-bubble low.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.Prices are now falling again, and the Case-Shiller Composite 20 (SA) hit a new post-bubble low.

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

This graph shows the Case-Shiller national index, Composite 20 index, and CoreLogic HPI in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the Case-Shiller national index, Composite 20 index, and CoreLogic HPI in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to May 2000, and the CoreLogic index back to April 2000.

In real terms, all appreciation in the '00s is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value.

Using a similar method, here is a graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Using a similar method, here is a graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to May 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels in the next few months.

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

CoreLogic released the Q3 2011 negative equity report this week.

CoreLogic ... today released negative equity data showing that 10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011. This is down slightly from 10.9 million properties, or 22.5 percent, in the second quarter. An additional 2.4 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the third quarter.Here is a graph from the report:

This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic: "Nevada has the highest negative equity percentage with 58 percent of all of its mortgaged properties underwater, followed by Arizona (47 percent), Florida (44 percent), Michigan (35 percent) and Georgia (30 percent). This is the first quarter that Georgia entered the top five, surpassing California which had been in the top five since tracking began in 2009.

The top five states combined have an average negative equity ratio of 41.4 percent, while the remaining states have a combined average negative equity ratio of 17.6 percent."

• Construction Spending increased in October

This morning the Census Bureau reported that overall construction spending increased in October.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 65% below the peak in early 2006, and non-residential spending is 32% below the peak in January 2008.

Public construction spending is now 14% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

• Other Economic Stories ...

• From the NY Fed: Consumer Debt Falls in Third Quarter

• From the Dallas Fed: Texas Manufacturing Activity Declines

• ADP: Private Employment increased 206,000 in November

• From the Chicago ISM Chicago Business Barometer™ Rebounded

• From the NAR: Pending Home Sales Jump in October

• Restaurant Performance Index "essentially unchanged" in October

• Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in October

• Weekly Initial Unemployment Claims increase to 402,000

• LPS: Mortgages In Foreclosure Process at an All-Time High

Unofficial Problem Bank list unchanged at 980 institutions

by Calculated Risk on 12/03/2011 08:11:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 2, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Since the publication of the Unofficial Problem Bank List in August 2009, this is the first week there are no changes to report as the list remains unchanged at 980 institutions with assets of $400.5 billion. A year-ago, the list held 919 institutions with assets of $410.3 billion. The calendar only has about two more Fridays favorable for closures, so the FDIC will have to step it up if it needs to close anything else before year-end. Prime closing candidates may be the 25 institutions operating under a Prompt Corrective Action order.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of bank failures by week (cumulative) for the last several years.

In 2008, 25 banks failed, 140 banks failed in 2009, 157 in 2010, and only 90 so far in 2011.

Friday, December 02, 2011

Homebuilder understatement of the day

by Calculated Risk on 12/02/2011 07:28:00 PM

From Steve Green at the Las Vegas Sun: Homebuilder pulling out of Las Vegas market

Arizona-based Meritage Homes Corp. announced it was winding down operations in Las Vegas and would exit the struggling market in early 2013.I'm surprised to hear the Vegas market is so tough (sorry for sarcasm). Prices are only down 60.6% from the peak, and Nevada still leads the nation with 58% of all mortgaged properties underwater.

“It’s a sad state of affairs there,” executive Brent Anderson said during an interview Friday.

He said home sales by Meritage had fallen to 79 last year from 653 in 2005.

“When the market crashed, it crashed hard,” he said.

Here are the earlier employment posts:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• NEW Employment graph gallery (fast, no scripting)

Survey: Small Business hiring picking up

by Calculated Risk on 12/02/2011 03:25:00 PM

From NFIB on small business hiring: November Brings First Positive Growth in Months

Chief economist for the National Federation of Independent Business (NFIB) William C. Dunkelberg, issued the following statement on the November job numbers, based on NFIB’s monthly economic survey that will be released on Tuesday, December 13, 2011. ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“The jobs report this month bears the first good news in a while. While the net change in employment per firm wasn’t much different from zero, it had a positive sign in front of it for the first time in nearly half a year. On average, owners reported increasing employment an average of 0.12 workers per firm. ...

“Forty-seven (47) percent of small business owners hired or tried to hire in the last three months and 35 percent of them reported few or no qualified applicants for positions, both figures up 4 points from October.

“The percent of owners cutting jobs has returned to ‘normal’ levels. ... And the percent of owners adding employees (creating jobs) continued to trend up. Reports of new job creation should pick up a bit in the coming months.

“Sixteen percent (seasonally adjusted) reported hard to fill job openings up 2 points and the highest reading in 38 months. Over the next three months, 11 percent plan to increase employment (up 2 points), and 11 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 7 percent of owners planning to create new jobs, a 4 point improvement and the strongest reading in 38 months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the net hiring plans for the next three months. Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months.

This fits with data from ADP that also shows a pickup in small business hiring (ht Brian).

Here are the earlier employment posts:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• NEW Employment graph gallery (fast, no scripting)

Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 12/02/2011 12:30:00 PM

Here are the earlier employment posts:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• NEW Employment graph gallery (fast, no scripting)

And a few more graphs ...

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Retailers hired 423.5 thousand workers (NSA) net in November, and 547.2 thousand in October and November combined. This is more hiring than last year, and this is about the same level as in 2006 and 2007. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Only one category increased in November: The "15 to 26 Weeks" group. This is probably spillover from the increase in short term unemployment in August and September. A little bit of good news is that short term unemployment (less than 14 weeks) has declined.

The the long term unemployed declined to 3.7% of the labor force - this is still very high, but the lowest since October 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters, it appears that the college educated category is declining the slowest (and was the only category to increase in November).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 54.7 in November, down from 59.6 in October. For manufacturing, the diffusion index decreased to 49.4, down from 52.5 in October.

This is a little more technical. The BLS diffusion index for total private employment was at 54.7 in November, down from 59.6 in October. For manufacturing, the diffusion index decreased to 49.4, down from 52.5 in October. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was spread across fewer industries in November.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 12/02/2011 10:10:00 AM

This was another weak report, and the headline number was slightly below consensus forecasts. However there were some positives too: the unemployment rate declined to 8.6% and the payroll employment was revised up for September and October.

There were only 120,000 jobs added in November. There were 140,000 private sector jobs added, and 20,000 government jobs lost.

The change in total employment was revised up for September and October. "The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000."

The household survey showed an increase of 278,000 jobs in November. This increase in the household survey - along with a 315,000 decline in the labor force - pushed the unemployment rate down sharply to 8.6%. The participation rate fell to 64.0%, and the employment population ratio increased to 58.5%. This is the fourth straight monthly increase in the employment population ratio from the low in July at 58.1%.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 15.6% - this remains very high. U-6 was in the 8% range in 2007.

The average workweek was unchanged at 34.3 hours, and average hourly earnings decreased slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3 hours in November ... Average hourly earnings for all employees on private nonfarm payrolls decreased in November by 2 cents, or 0.1 percent, to $23.18. ... Over the past 12 months, average hourly earnings have increased by 1.8 percent." This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

Through the first eleven months of 2011, the economy has added 1.448 million total non-farm jobs or just 131 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.2 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.711 million private sector jobs this year, or about 156 thousand per month.

There are a total of 13.3 million Americans unemployed and 5.7 million have been unemployed for more than 6 months. Very grim.

Overall this was another weak employment report and suggests sluggish economic growth.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

The unemployment rate declined to 8.6% (red line).

The unemployment rate declined to 8.6% (red line).

The Labor Force Participation Rate was declined to 64.0% in November (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio increased to 58.5% in November (black line).

Note: the household survey showed another strong gain in jobs, and that - combined with a decline in the labor force - is why the unemployment rate declined sharply with few payroll jobs added.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) dropped by 378,000 over the month to 8.5 million.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) decreased to 8.5 million in November from 9.27 million in October. This just reverses some of the increase in August and September.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 15.6% in November from 16.2% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.691 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.876 million in October. This is still very high, but this is the lowest number since Oct 2009. Long term unemployment remains a serious problem.

More graphs coming ...

November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

by Calculated Risk on 12/02/2011 08:30:00 AM

From MarketWatch: U.S. economy adds 120,000 jobs in November

The U.S. gained 120,000 jobs in November and the unemployment rate fell to 8.6% from 9.0%, the Labor Department said Friday. The government also revised jobs data for October and September to show that 72,000 additional jobs were created. ... Hiring in October was revised up to 100,000 from 80,000 and the job gains in September were revised up to 210,00 from 158,000. In November, companies in the private sector hired 140,000 workers ... Government cut 20,000 jobs...

Click on graph for larger image.

Click on graph for larger image.The following graph shows the unemployment rate. The unemployment rate declined to 8.6%.

Some of the decline in in the unemployment rate was related to a decline in the number of workers in the labor force.

I'll have more on this soon (the BLS website is having a problem).

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. The red line is moving slowly upwards.

This was still a weak report, and slightly below consensus. There were decent upwards revisions to the September and October reports. I'll have much more soon ...

Thursday, December 01, 2011

Europe: Hints of a Deal

by Calculated Risk on 12/01/2011 11:01:00 PM

From the Financial Times: Shape of last-ditch eurozone deal emerges

The deal involves bilateral fiscal agreements - and then possibly the ECB getting more involved.

From the WSJ: A Euro Crisis Deal Emerges

European Central Bank President Mario Draghi signaled the bank could ramp up its role battling the debt crisis if euro-zone governments enforce tougher deficit cutting—suggesting outlines are emerging of a deal that investors have been clamoring to see happen.From the NY Times: French President Warns of Dire Consequences if Euro Crisis Goes Unsolved

Saying that he wanted to tell the truth to the French people, President Nicolas Sarkozy said Thursday night that Europe could be “swept away” by the euro crisis if it does not change. He said that Europe would “have to make crucial choices in the next few weeks,” and that France and Germany together were supporting a new treaty to tighten fiscal discipline and promote economic convergence in the euro zone.The Italian 2 year yield was down sharply to 6.32%, and the 10 year yield was down to 6.65%.

The Spanish 2 year yield was down sharply to 4.78%, and the 10 year yield was down to 5.74%.

The Belgian 10 year yield was down to 4.75%, and the French 10 year yield was down to 3.1%.

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

• LPS: Mortgages In Foreclosure Process at an All-Time High

• Construction Spending increased in October

• U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009