by Calculated Risk on 11/30/2011 10:00:00 AM

Wednesday, November 30, 2011

Misc: Chicago PMI increases to 62.6, Pending Home Sales increase

• Chicago PMI: The overall index increased to 62.6 in November from 58.4 in October. This was above consensus expectations of 58.5.

From the Chicago ISM Chicago Business Barometer™ Rebounded:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER rebounded to a 7-month high in November and marked the 26th month of expansion.The employment index decreased to 56.9 from 62.3. "EMPLOYMENT reversed half of its gains since August"

The new orders index increased to 70.2 from 61.3. "NEW ORDERS expanded to an 8-month high and PRODUCTION expanded to a 7-month high"

Note: any number above 50 shows expansion.

• From the NAR: Pending Home Sales Jump in October

The Pending Home Sales Index, a forward-looking indicator based on contract signings, surged 10.4 percent to 93.3 in October from 84.5 in September and is 9.2 percent above October 2010 when it stood at 85.5. The data reflects contracts but not closings.

...

The PHSI in the Northeast surged 17.7 percent to 71.3 in October and is 3.4 percent above October 2010. In the Midwest the index jumped 24.1 percent to 88.7 in October and remains 13.2 percent above a year ago. Pending home sales in the South rose 8.6 percent in October to an index of 99.5 and are 9.7 percent higher than October 2010. In the West the index slipped 0.3 percent to 105.5 in October but is 8.1 percent above a year ago.

ADP: Private Employment increased 206,000 in November

by Calculated Risk on 11/30/2011 08:19:00 AM

On Central Bank action, from the WSJ: Central Banks Take Coordinated Action and from the Federal Reserve: "The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing coordinated actions to enhance their capacity to provide liquidity support to the global financial system. The purpose of these actions is to ease strains in financial markets and thereby mitigate the effects of such strains on the supply of credit to households and businesses and so help foster economic activity."

Original post:

ADP reports:

ADP today reported that employment in the U.S. nonfarm private business sector increased by 206,000 from October to November on a seasonally adjusted basis. The estimated advance in employment from September to October was revised up to 130,000 from the initially reported 110,000. The increase in November was the largest monthly gain since last December and nearly twice the average monthly gain since May when employment decelerated sharply.This was well above the consensus forecast of an increase of 130,000 private sector jobs in November. The BLS reports on Friday, and the consensus is for an increase of 112,000 payroll jobs in November, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 178,000 in November, which is up from an increase of 130,000 in October. Employment in the private, goods-producing sector increased 28,000 in November, while manufacturing employment increased 7,000.

Government payrolls have been shrinking by about 27,000 per month this year. So this suggests around 206,000 private nonfarm payroll jobs added, minus 27,000 government workers - or around 179,000 total jobs added in November. Of course ADP hasn't been very useful in predicting the BLS report.

Report: Payroll Tax Cut extension is likely

by Calculated Risk on 11/30/2011 12:45:00 AM

From the WSJ: GOP Set to Back Payroll-Tax Cut

Republican leaders said Tuesday they would join Democrats in supporting an extension of the 2011 payroll-tax cut ... virtually assuring that American wage-earners will continue to receive the benefit next year.Probably the two most significant downside risks to the U.S. economy are contagion from the European financial crisis and more rapid fiscal tightening. The extension of the payroll tax cut will lessen the amount of fiscal tightening in 2012 - although government spending will still be a drag on GDP growth next year.

...

Workers this year have seen their payroll taxes cut to 4.2% of their salary from 6.2%. Democrats want to cut it further, to 3.1%, but Republicans are unlikely to support that.

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Tuesday, November 29, 2011

Preparing for the end of the Euro

by Calculated Risk on 11/29/2011 08:10:00 PM

The top story in the Financial Times says it all: Businesses plan for possible end of euro

Here is a quote from someone at Volkswagen: “The conclusion is that overall the impact would not be so negative to our company, as we are mainly an exporter ..."

Export to whom?

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Europe: EFSF viewed as insufficient, Greece to receive aid payment

by Calculated Risk on 11/29/2011 04:46:00 PM

• From the Athens News: Eurogroup signs off on 8bn euro aid payment

Eurozone finance ministers agreed on Tuesday to release an 8bn euro aid payment to Greece, part of an 110bn euro package of support agreed with the government last year ...It looks like Greece will not default in December, but there is a huge hurdle in January when the private creditors are supposed to "voluntarily" agree to large haircuts.

• Surprise! The EFSF is insufficient.

From the WSJ: Euro Zone Sees Shortfall in Rescue Fund

Euro-zone finance ministers acknowledged on Tuesday that the bloc's bailout fund would have less capacity to help troubled nations than once hoped, and stepped up calls on the European Central Bank and the International Monetary Fund to come to their aid.From the Financial Times: Fears of shortfall lead to moves to boost EFSF

An analysis presented at a meeting of finance ministers here suggested the fund would be able to raise a maximum of €500 billion to €700 billion ($666 billion to $932 billion), far short of the €1 trillion or even €2 trillion that many had expected. ... ministers are exploring further measures to stem the crisis, which they hope to announce at a European summit on Dec. 8-9.

Eurozone finance ministers are weighing more radical options to strengthen their firewall against the sovereign debt crisis, after acknowledging that plans to expand the €440bn eurozone rescue fund could deliver as little as half the extra punch that was anticipated.• European bond yields were mostly lower today after (from Bloomberg) Italy Pays More Than 7% at Auction of EU7.5 Billion of Bonds

Excerpt with permission

Italy was again forced to pay above the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts when it sold 7.5 billion euros ($10.1 billion) in bonds today, short of the maximum target for the auction.The Italian 2 year yield was down to 7.1%, and the 10 year yield was at 7.24%.

The Spanish 2 year yield was down to 5.6%, and the 10 year yield was down to 6.39%.

The Belgian 10 year yield was down to 5.33%, and the French 10 year yield was down to 3.52%.

Note: There is a link below the first post for the table of European bond yields.

• Tim Duy has more: Another European "Solution" Coming?

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Philly Fed State Coincident Indexes increase in October

by Calculated Risk on 11/29/2011 03:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2011. In the past month, the indexes increased in 43 states, decreased in five, and remained unchanged in two (Georgia and New Mexico) for a one-month diffusion index of 76. Over the past three months, the indexes increased in 42 states, decreased in seven, and remained unchanged in one (Delaware) for a three-month diffusion index of 70.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In October, 45 states had increasing activity, up from 39 in September. This is the highest level since April.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from September.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from September.Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 11/29/2011 12:46:00 PM

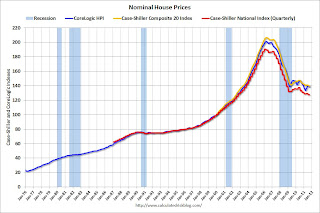

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through September) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to April 2003 levels, and the CoreLogic index is back to June 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 1999 levels, the Composite 20 index is back to May 2000, and the CoreLogic index back to April 2000.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to May 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels and will probably be back to 1999 levels in the next few months.

Earlier:

• CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

• Case Shiller: Home Prices decline in September

CoreLogic: 10.7 Million U.S. Properties with Negative Equity in Q3

by Calculated Risk on 11/29/2011 10:55:00 AM

CoreLogic released the Q3 2011 negative equity report today.

CoreLogic ... today released negative equity data showing that 10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011. This is down slightly from 10.9 million properties, or 22.5 percent, in the second quarter. An additional 2.4 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the third quarter.Here are a couple of graphs from the report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada has the highest negative equity percentage with 58 percent of all of its mortgaged properties underwater, followed by Arizona (47 percent), Florida (44 percent), Michigan (35 percent) and Georgia (30 percent). This is the first quarter that Georgia entered the top five, surpassing California which had been in the top five since tracking began in 2009.

The top five states combined have an average negative equity ratio of 41.4 percent, while the remaining states have a combined average negative equity ratio of 17.6 percent."

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.Some states - like New York - have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: "Of the 10.7 million borrowers in negative equity, there are 6.3 million first liens without home equity loans that have an average mortgage balance of $222,000. They are underwater by an average of $52,000 which equates to an average LTV ratio of 131 percent. The negative equity share for the first lien-only borrowers was 18 percent, and 40 percent had an LTV of 80 percent or higher.

The remaining 4.4 million negative equity borrowers hold first liens and home equity loans with an average mortgage balance of $309,000. These borrowers are underwater by an average of $84,000 and have an average LTV of 137 percent."

Case Shiller: Home Prices decline in September

by Calculated Risk on 11/29/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (a 3 month average of July, August and September). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities) and the national quarterly index for Q3.

Note: Case-Shiller reports NSA, I use the SA data. Here is a table of the year-over-year and monthly changes for both SA and NSA.

| Case Shiller September 2011 | Seasonally Adjusted | Not Seasonally Adjusted | ||

|---|---|---|---|---|

| YoY Change | One Month Change | YoY Change | One Month Change | |

| Composite 10 | -3.3% | -0.4% | -3.3% | -0.4% |

| Composite 20 | -3.6% | -0.6% | -3.6% | -0.6% |

From S&P: Home Prices Weaken as the Third Quarter of 2011 Ends

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 3.9% decline in the third quarter of 2011 over the third quarter of 2010. In September, the 10- and 20-City Composites posted annual rates of decline of 3.3% and 3.6%, respectively. Eighteen of the 20 MSAs and both monthly Composites had negative annual rates in September 2011, the only exceptions being Detroit and Washington DC.

“Home prices drifted lower in September and the third quarter,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “The National Index was down 3.9% versus the third quarter of 2010 and up only 0.1% from the previous quarter. Three cities posted new index lows in September 2011 - Atlanta, Las Vegas and Phoenix. Seventeen of the 20 cities and both Composites were down for the

month.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and down 0.4% in September (SA). The Composite 10 is 0.5% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.5% from the peak, and down 0.6% in September (SA). The Composite 20 is at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.3% compared to September 2010.

The Composite 20 SA is down 3.6% compared to September 2010. This is slightly smaller year-over-year decline than in August.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in September seasonally adjusted. Prices in Las Vegas are off 60.6% from the peak, and prices in Dallas only off 8.6% from the peak.Prices are now falling again, and the Case-Shiller Composite 20 (SA) hit a new post-bubble low.

Monday, November 28, 2011

NY Times: "Crisis in Europe Tightens Credit Across the Globe"

by Calculated Risk on 11/28/2011 11:04:00 PM

From the NY Times: Crisis in Europe Tightens Credit Across the Globe

Europe’s worsening sovereign debt crisis has spread beyond its banks and the spillover now threatens businesses on the Continent and around the world.I've been watching some of the credit indicators we tracked several years ago - like the TED spread and the two year U.S. dollar swap spread - both are rising, but are well below the levels during the financial crisis. Probably the most significant channel of contagion from the European financial crisis would be tightening of U.S. credit conditions - and so far the tightening in the U.S. appears to be minimal. However, as the NY Times story points out, tighter credit could be impacting U.S. trading partners "from Berlin to Beijing".

From global airlines and shipping giants to small manufacturers, all kinds of companies are feeling the strain as European banks pull back on lending in an effort to hoard capital and shore up their balance sheets.

The result is a credit squeeze for companies from Berlin to Beijing ...

Earlier on New Homes:

• New Home Sales in October: 307,000 SAAR

• New Home Prices: Average Lowest since 2003

• All current New Home Graphs