by Calculated Risk on 11/17/2011 08:30:00 AM

Thursday, November 17, 2011

Weekly Initial Unemployment Claims: Four Week average falls under 400,000

The DOL reports:

In the week ending November 12, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 5,000 from the previous week's revised figure of 393,000. The 4-week moving average was 396,750, a decrease of 4,000 from the previous week's revised average of 400,750.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 396,750.

This is the lowest level for the 4 week average since early April - although this is still elevated.

And here is a long term graph of weekly claims:

Wednesday, November 16, 2011

Research: How Household Debt Contributes to Unemployment

by Calculated Risk on 11/16/2011 08:39:00 PM

Professors Amir Sufi and Atif Mian use county level data to show that household balance sheet problems are directly linked to the high level of unemployment. It is important for policy to understand the reasons unemployment has remained elevated.

From Bloomberg: How Household Debt Contributes to Unemployment: Mian and Sufi

The weakness in household balance sheets and the associated pullback in spending are directly responsible for the lion’s share of employment losses in the U.S. economy. This deficiency remains the most significant impediment to a robust recovery.A summary and two papers:

Our research suggests that 65 percent of the job losses from 2007 to 2009 came from the drop in household spending induced by the collapse in home prices and its effect on a highly levered household sector.

...

The declines in consumption are far too large to be explained by the drop in house prices alone. It was the combination of collapsing home values and high debt levels that proved disastrous. High-debt areas have been plagued with delinquencies, deleveraging, and the inability to refinance into lower rates -- all characteristics of overleveraged households.

Further, low levels of consumption in high-debt areas continue to be a major drag. For instance, in the second quarter of 2011, auto sales in U.S. counties with the most debt remained a whopping 40 percent below their 2006 levels. By contrast, in areas that had healthy balance sheets before the recession began, the declines in spending were short-lived and a robust recovery is under way.

Household Balance Sheets and the Weak Recovery

What Explains High Unemployment? The Aggregate Demand Channel

A drop in aggregate demand driven by shocks to household balance sheets is responsible for a large fraction of the decline in U.S. employment from 2007 to 2009. The aggregate demand channel for unemployment predicts that employment losses in the non-tradable sector are higher in high leverage U.S. counties that were most severely impacted by the balance sheet shock, while losses in the tradable sector are distributed uniformly across all counties. We find exactly this pattern from 2007 to 2009. Alternative hypotheses for job losses based on uncertainty shocks or structural unemployment related to construction do not explain our results.Household Balance Sheets, Consumption, and the Economic Slump

The large accumulation of household debt prior to the recession in combination with the decline in house prices has been the primary explanation for the onset, severity, and length of the subsequent consumption collapse. Using novel county level retail sales data, we show that the decline in consumption was much stronger in high leverage counties with large house price declines.Earlier:

• Industrial Production increased 0.7% in October, Capacity Utilization increased

• Residential Remodeling Index at new high in September

• AIA: Architecture Billings Index increased in October

• Rate of increase slows for Key Measures of Inflation in October

• NAHB Builder Confidence index increases in November

Europe: European Bond Yields and more Debate on ECB

by Calculated Risk on 11/16/2011 06:27:00 PM

Can't go a day without a post on Europe ...

Earlier today - during market hours - Fitch warned about possible contagion to U.S. banks from Europe. From Bloomberg: U.S. Banks Face Serious Risk From Europe Crisis, Fitch Says

“Fitch believes that unless the euro zone debt crisis is resolved in a timely and orderly manner, the broad credit outlook for the U.S. banking industry could worsen,” the New York-based rating company said today in a statement.And on the ECB from the WSJ: Pressure Rises on the ECB

Pressure mounted on the European Central Bank to take drastic action to stabilize euro-zone bond markets, as investors shrugged off the bank's limited bond buying and European politicians sparred over the ECB's role in fighting the debt crisis.It seems that policymakers will have to decide soon between more ECB buying or the breakup of the euro-zone.

ECB purchases of Italian and other euro-zone government bonds on Wednesday largely failed to halt the sell-off of struggling euro nations' debt. Investors continued to dump everything but German bunds and it became increasingly difficult to find private buyers for bonds issued by large, economically struggling countries such as Italy and Spain.

...

But Germany's leaders continued to reject calls for the ECB to print money and buy bonds on a bigger scale, insisting that only economic reforms by national governments can solve the debt crisis.

The ECB, with support from Germany, has so far refused to act as euro governments' lender of last resort, and has steadfastly insisted that its bond-purchasing program is temporary and limited in scope.

Below is a table for several European bond yields (links to Bloomberg).

The Italian 10 year bond yield is down to 7.00%. The Italian 2 year yield is down to 6.41%.

The Spanish 10 year bond yield has increased to 6.41%. The Spanish 2 year yield is up to 5.40%.

The Irish 10 year yield is up to 8.21%. The Portuguese 10 year yield is up to 11.3%.

The French 10 year bond yield is up to 3.71%. The Belgium 10 year yield is down slightly to 4.87%.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Rate of increase slows for Key Measures of Inflation in October

by Calculated Risk on 11/16/2011 02:58:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in October on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in October; this was the same increase as last month and matches its smallest increase of the year.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.4% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for October here.

...

The CPI less food and energy increased 0.1% (1.6% annualized rate) on a seasonally adjusted basis. ... Over the last 12 months, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.5%, and the CPI less food and energy rose 2.1%.

On a year-over-year basis, these measures of inflation are increasing, and are slightly above the Fed's target. However, on a monthly basis, the rate of increase is mostly below the Fed's target.

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.4% annualized, and core CPI increased 1.6% annualized.

These key price measures increased at a lower rate than in September.

Earlier:

• Industrial Production increased 0.7% in October, Capacity Utilization increased

• Residential Remodeling Index at new high in September

• AIA: Architecture Billings Index increased in October

• NAHB Builder Confidence index increases in November

AIA: Architecture Billings Index increased in October

by Calculated Risk on 11/16/2011 01:15:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Moves Upward

After a sharp dip in September, the Architecture Billings Index (ABI) climbed nearly three points in October. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 49.4, following a score of 46.9 in September. This score reflects an overall decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 57.3, up from a reading of 54.3 the previous month.

“An increase in the billings index is always an encouraging sign,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “We’re seeing some regions and some construction sectors move into positive territory. But there continues to be a high level of volatility in the marketplace with architecture firms reporting a wide range of conditions from improving to uncertain to poor. It’s likely we will see a similar state of affairs in the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index increased to 49.4 in October from 46.9 in September. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent surveys suggests further declines in CRE investment in 2012.

NAHB Builder Confidence index increases in November

by Calculated Risk on 11/16/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in November to 20 from 17 in October. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Three Points in November

Builder confidence in the market for newly built, single-family homes rose by three points to 20 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for November, released today. The gain builds on a revised three-point increase in October, and brings the confidence gauge to its highest level since May of 2010.

...

“This second consecutive gain in the HMI is evidence that well-qualified buyers in select areas are being tempted back into the market by today’s extremely favorable mortgage rates and prices,” said NAHB Chief Economist David Crowe. “We are anticipating further, gradual gains in the builder confidence gauge heading into 2012 due to these pockets of improving conditions that are slowly spreading.”

...

Each of the HMI’s three component indexes continued to build on gains registered in the previous month in November. The component gauging current sales conditions rose three points to 20 – its highest level since May 2010 – while the component gauging future sales expectations rose two points to 25 – its highest level since March of 2011. The component gauging traffic of prospective buyers rose one point to 15, which was its highest point since May of 2010.

The HMI rose in three out of four regions in November, with a three-point gain to 17 registered in the Northeast, an eight-point gain to 23 registered in the Midwest, and a two-point gain to 21 registered in the South. After posting a big increase in October, the West returned to trend this month with a six-point decline to 15.

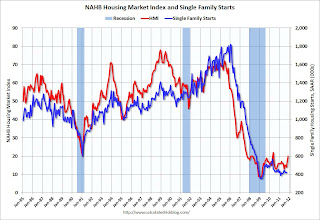

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years. This is still very low, but this is the highest level since May 2010 - and that boost was due to the housing tax credit. Not counting the tax credit, the last time the index was above this level was in 2007.

Industrial Production increased 0.7% in October, Capacity Utilization increased

by Calculated Risk on 11/16/2011 09:30:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production expanded 0.7 percent in October after having declined 0.1 percent in September. Previously, industrial production was reported to have gained 0.2 percent in September; most of this revision resulted from lower estimated output for mining. Factory output increased 0.5 percent in October after having risen 0.3 percent in September. Production at mines climbed 2.3 percent in October, while the output of utilities edged down 0.1 percent. At 94.7 percent of its 2007 average, total industrial production for October was 3.9 percent above its year-earlier level. Capacity utilization for total industry stepped up to 77.8 percent, a rate 2.1 percentage points above its level from a year earlier but 2.6 percentage points below its long-run (1972--2010) average.

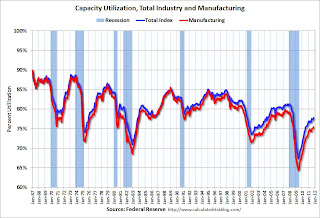

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in October to 94.7, however September was revised down.

The consensus was for a 0.4% increase in Industrial Production in October, and an increase to 77.6% for Capacity Utilization. Adjusting for the downward revision for September, this was about at consensus.

Residential Remodeling Index at new high in September

by Calculated Risk on 11/16/2011 06:00:00 AM

The BuildFax Residential Remodeling Index was at 141.4 in September, up from 138.6 in August. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax: Remodeling Activity Reaches Record Levels According to BuildFax Remodeling Index for September

Today, BuildFax®, unveiled its BuildFax Remodeling Index (BFRI) for September 2011, which shows that remodeling activity reached a record high during the month.

...

The latest BFRI showed that September 2011 became the month with the highest level of remodeling activity since the Index was introduced in 2004 and represented the 23rd consecutive month of increases. In addition, BuildFax data revealed the most popular permitted residential remodeling jobs since 2006 have been roof remodels/replacements, followed by deck and bathroom remodels.

...

“Mortgage rates continue to be near record lows, and as homeowners from coast to coast refinance, they are continuing to update their current home and invest in their properties,” said Joe Emison, Vice President of Research and Development at BuildFax. “The data from BuildFax show that homeowners are not only doing important ‘maintenance’ projects, such as fixing their roof, but also taking on projects that add to the ‘livability’ of their homes by adding decks, remodeling their bathrooms and updating their kitchens."

Click on graph for larger image.

Click on graph for larger image.This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 34% from September 2010. This is the highest year-over-year increase in activity since the index started.

Even though new home construction is still moving sideways, two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Tuesday, November 15, 2011

HARP Updates

by Calculated Risk on 11/15/2011 08:40:00 PM

Here are the new Home Affordable Refinance Program (HARP) guidelines from Fannie Mae: Selling Guide Announcement SEL-2011-12

As noted by the FHFA last month, the HARP deadline will be extended, there is no maximum LTV (except in certain cases), and most Reps and warrants have been eliminated.

On the timing, according to Fannie Mae: "The expansion of the LTV ratio limits is effective for Refi Plus mortgage loans with application dates on or after December 1, 2011." Desktop Underwriter® (DU) will be updated in March.

One of the keys is the elimination of most Reps and warrants, from Fannie Mae:

For DU Refi Plus:

• The lender is not responsible for any of the representations and warranties associated with the original loan.

• The lender is relieved of the standard underwriting representations and warranties (eligibility, credit history, liabilities, income and asset assessment) with respect to the new mortgage loan if the lender meets all of the following requirements:

- All data in the loan casefile is complete, accurate, and not fraudulent.

- The lender follows the instructions in the DU Underwriting Findings Report regarding income, employment, asset, and fieldwork documentation.

- The lender complies with all other requirements documented in the Selling Guide, A2-2.1-04, Limited Waiver of Contractual Warranties for Mortgages Submitted to DU.

For Refi Plus:

• With respect to the original loan, the lender must represent and warrant to the following:If I'm reading this correctly, the elimination of Reps and warrants for the original loan applies to Desktop Underwriter® (DU) and that will not be updated until March.

- The loan was eligible for sale in accordance with Fannie Mae’s Charter at the time of delivery to Fannie Mae.

- The loan was originated in compliance with laws. See the A3-2-01, Compliance with Laws.

- The lender represents and warrants that the original loan being refinanced by a Refi Plus mortgage loan was not originated or sold pursuant to any scheme or pattern of fraud ...

DataQuick: SoCal October Home Sales decline

by Calculated Risk on 11/15/2011 06:44:00 PM

From DataQuick: Southland Home Sales Inch Up from 2010; Median Price Down Again

Southland home sales rose slightly in October compared with a year earlier but were still nearly 30 percent below the long-term average. ...New home sales were at a record low (Note: DataQuick reports new home sales at closing - the Census Bureau reports new home sales when contracts are signed - usually about six months earlier). Also over half of existing home sales in SoCal were distressed sales in October; a very unhealthy market.

A total of 16,829 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October. That was down 7.3 percent from 18,149 in September and up 0.5 percent from 16,744 in October 2010, according to San Diego-based DataQuick.

A drop in sales between September and October is not unusual, but last month’s decline was larger than the average change – a decline of 0.7 percent – between those months since 1988, when DataQuick's statistics begin.

...

While October sales of existing (not new) houses and condos rose 2.2 percent and 1.3 percent, respectively, from a year earlier, sales of newly built homes dropped 18.4 percent to the lowest level on record for an October.

...

“The lower conforming loan limits implemented last month help explain the relatively sharp drop in mid- to high-end sales during October. Now we’ll have to see if the private loan market can fill the void,” said John Walsh, DataQuick president.

...

Distressed property sales accounted for 52.5 percent of the Southland resale market last month, up from 50.8 percent in September but down from 53.7 percent a year earlier. Nearly one out of three homes resold last month was a foreclosure, while roughly one in five was a “short sale.”

NAR is scheduled to reported October existing home sales on Monday, November 21st and so far it appears sales will be down in October (seasonally adjusted) compared to September.