by Calculated Risk on 10/12/2011 08:05:00 PM

Wednesday, October 12, 2011

Europe Update: Slovakia clears hurdle on EFSF, More Capital for Banks, Leverage for EFSF?

A few European stories ... the next key date is Sunday, October 23rd, when European Union leaders will hold a summit meeting.

This is probably the last mention of Slovakia for some time, from the WSJ: Europe's Bailout Fund Overcomes a Hurdle

Slovakia's largest opposition party ... cleared the way Wednesday for the country to endorse changes to the €440 billion ($600 billion) euro-zone bailout fundFrom the NY Times: E.U. Tells Banks to Garner Bigger Reserves

Under proposals outlined by the European Commission president, José Manuel Barroso, banks would be required to temporarily bolster their protection against losses ... Mr. Barroso also called on the 17 European Union members that use the euro to maximize the capacity of their 440 billion euro ($600 billion) bailout fund — a clear hint that he favors leveraging the rescue fund to increase its firepower to as much as 2 trillion euros ($2.8 trillion)From the Financial Times: Insurance plan to boost rescue fund’s reach

European policymakers are moving towards a plan that would enable the eurozone’s €440bn rescue fund to insure investors against some losses on government bonds, arguing it presents the fewest legal and political hurdles to quickly increasing the fund’s firepower.On Thursday, Greek prime minister George Papandreou is is meeting with Herman van Rompuy, president of the European council, and Jean-Claude Juncker, chair of euro finance ministers in Brussels.

excerpt with permission

The Greek 2 year yield isat 73.5%. The Greek 1 year yield is at 156.4% (a new high).

The Portuguese 2 year yield is at 17.3% and the Irish 2 year yield is at 7.4%.

The Spanish 10 year yield is at 5.1% and the Italian 10 year yield is at 5.7% (the Italian bond yield is moving up).

Lawler: Existing Home Foreclosures and Short Sale percentages for a few areas

by Calculated Risk on 10/12/2011 04:07:00 PM

There are only a few areas where the MLS breaks down monthly sales by foreclosure, short sales and conventional (non-distressed) sale. I've been tracking the Sacramento market to watch for changes in the mix over time. (here was my post yesterday: Distressed House Sales using Sacramento Data)

Economist Tom Lawler sent me the following table today for a few other areas. The usual suspects have the highest percentage of distressed sales: Las Vegas and Phoenix. Sacramento is similar to Phoenix.

The Mid-Atlantic area - covered by the MRIS (Metropolitan Regional Information Systems, Inc.) has a relatively low level of distressed sales.

Why short sales in Minneapolis are so low relative to foreclosures is a mystery ...

I'll be watching for when the percentage of distressed sales starts to decline (I might have to be patient!).

| September MLS Sales Share, Selected Areas | |||

|---|---|---|---|

| Foreclosure Share | Short Sales Share | "Non-Distressed" Share | |

| Las Vegas | 49.4% | 23.5% | 27.1% |

| Reno (SF) | 38.0% | 31.0% | 31.0% |

| Phoenix | 37.1% | 27.0% | 35.9% |

| Sacramento | 37.9% | 26.1% | 36.0% |

| Minneapolis | 28.4% | 11.3% | 60.3% |

| "Mid-Atlantic"* | 14.4% | 12.6% | 73.0% |

| *area covered by MRIS, including DC and Baltimore metro areas | |||

FOMC Minutes: "Considerable uncertainty surrounding the outlook for a gradual pickup in economic growth"

by Calculated Risk on 10/12/2011 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, September 20-21, 2011. Excerpts:

Participants saw considerable uncertainty surrounding the outlook for a gradual pickup in economic growth.On policy:

...

Several commented that, with households and businesses seeking to reduce leverage rather than to borrow and with housing markets in distress, some of the normal mechanisms through which monetary policy actions are transmitted to the real economy appeared to be attenuated. Many participants saw significant downside risks to economic growth. While they did not anticipate a downturn in economic activity, several remarked that, with growth slow, the recovery was more vulnerable to adverse shocks. Risks included the possibility of more pronounced or more protracted deleveraging by households, the chance of a larger-than-expected near-term fiscal tightening, and potential spillovers to the United States if the financial situation in Europe were to worsen appreciably. Participants agreed to consider further how best to use their monetary policy and liquidity tools to deal with such shocks if they were to occur.

In the discussion of monetary policy for the period ahead, most members agreed that the revisions to the economic outlook warranted some additional monetary policy accommodation to support a stronger recovery and to help ensure that inflation, over time, was at a level consistent with the Committee's dual mandate.

...

Those viewing greater policy accommodation as appropriate at this meeting generally supported a maturity extension program that would combine asset purchases and sales to extend the average maturity of securities held in the SOMA without generating a substantial expansion of the Federal Reserve's balance sheet or reserve balances.

...

Two members said that current conditions and the outlook could justify stronger policy action, but they supported undertaking the maturity extension program at this meeting as it did not rule out additional steps at future meetings. Three members concluded that additional accommodation was not appropriate at this time.

BLS: Job Openings "little changed" in August

by Calculated Risk on 10/12/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in August was 3.1 million, little changed from July. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in August was 944,000 higher than in July 2009 (the most recent trough). The number of job openings is up 26 percent since the end of the recession in June 2009.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (dark blue) and total separations (red and blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up, and are up about 7% year-over-year compared to August 2010. Layoffs and discharges are down about 10% year-over-year.

Quits increased in August, and have been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Ceridian-UCLA: Diesel Fuel index declined in September

by Calculated Risk on 10/12/2011 09:00:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Falls for the Third Month in a Row – Down 1.0 Percent in September

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, fell 1.0 percent in September on a seasonally and workday adjusted basis, following a 1.4 percent decline in August and a 0.2 percent decline in July.

...

On a year-over-year basis, the PCI was down 0.2 percent in September. This month, the year-over-year change was below last year for the first time since May 2011, or the second time since January 2010; over the past four months, the year-over-year change has been rapidly declining. “Businesses appear to be unwilling to restock for a potentially vibrant holiday season at the same time as normal and they are planning to ramp up inventories late this year, if and when the sales start to materialize,” explained [Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast].

Due to the continued weakness in the PCI, our forecast for September Industrial Production is a 0.55 percent decline when the government estimate is released on October 17.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

This index has declined for three consecutive months after increasing slightly earlier in the year.

Note: This index does appear to track Industrial Production over time (with plenty of noise).

MBA: Mortgage Purchase Application Index increases in Latest Survey

by Calculated Risk on 10/12/2011 07:34:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 1.3 percent from the previous week. The seasonally adjusted Purchase Index increased 1.1 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average loan size of all loans for home purchase in the US was $210,863 in September 2011, down from $212,736 in August 2011. The average loan size for a refinance was $237,632, down from $241,323 in August.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.25 percent from 4.18 percent ... The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.59 percent from 4.49 percent

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was a small increase in the purchase index. This index declined sharply in August suggesting fairly weak home sales in September in October, not counting cash buyers (other reports suggest a high number of cash buyers in September).

Tuesday, October 11, 2011

Jim the Realtor: "Market is a buzz"

by Calculated Risk on 10/11/2011 11:40:00 PM

I bring you what I'm hearing - and this is an optimistic outlook from Jim the Realtor in San Diego:

"The [real estate] market is a buzz currently. The action is incredible. Offers flying everywhere. I think the buyers are scrambling knowing that these rates are incredible right now. And I think it is going to be a healthy 4th quarter.

...

I think we get into spring time - if rates are still this low - it’s going to be a real frenzy."

Jim Klinge, Oct 2011

Distressed House Sales using Sacramento Data

by Calculated Risk on 10/11/2011 06:50:00 PM

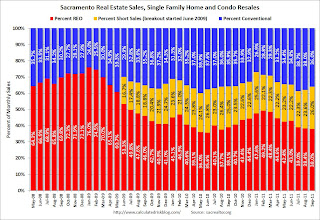

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

As I've written before: "I'm not sure what I'm looking for, but I'll know it when I see it!" (hopefully) At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in September compared to August. In September 2011, 64.0% of all resales (single family homes and condos) were distressed sales. This is up from 62.0% in August, and down slightly from 64.1% in September 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 12.9% over September 2010. Sales were up slightly compared to September 2009.

Active Listing Inventory is down 30% from last September, although "short sale contingent" has increased. Still, we are seeing a sharp decline in inventory in many areas, and that is something to watch. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

So far - no improvement!

Report: Foreclosure starts declined in September

by Calculated Risk on 10/11/2011 03:32:00 PM

This is a report for several western states ... from ForeclosureRadar: After Big Jump in August, Foreclosure Starts Fall Again

After a significant jump in foreclosure starts in August, driven primarily by Bank of America, foreclosure starts returned to levels in line with prior months, far below the numbers reached at the peak. California has seen a drop in activity of 56 percent since its peak, from 58,623 Notice of Default filings in March of 2009 to 25,778 today. Arizona shows a similar swing in Notice of Trustee Sale filings, from 14,722 in March of 2009 to 5,982 filings last month - a decrease of 59.4 percent. Washington shows the greatest decrease of all, with 71.5 percent less Notice of Trustee Sale filings today than at their peak in June of 2009.Investors are very active in most of these states with third party buying at or near record levels.

Foreclosure sales were mixed this month, with declines in Arizona, California and Nevada, while Oregon and Washington both showed increases. Despite the declines, the percentage purchased by third parties, typically investors, was at or near peak levels. In California, third parties made up a record 27.4 percent of all sales last month. In Arizona, that number was even higher at 38.3 percent, also a record. Nevada was just shy of their record, set in August at 29.1 percent. Sales to third parties was up Washington was up 15.6 percent, a record for this year. Oregon was the only state to to show a decrease, down from 15.5 percent in July to 6.0 percent today.

Las Vegas Home Sales stay strong in September due to investor buying

by Calculated Risk on 10/11/2011 01:38:00 PM

I've been tracking the MBA mortgage purchase application index every week, and that index suggests a fairly sharp decline in mortgage purchase applications in August. That decline would normally suggest weaker home sales in September (seasonally adjusted), however that index doesn't include investors who usually pay cash ... and investors are very active in many markets.

Here is an example from the Las Vegas Sun: Realtors: Las Vegas home prices off 8.6 percent from September 2010

Las Vegas-area home ... sales stayed strong thanks to investors snapping up homes [the Greater Las Vegas Association of Realtors] ... said the total number of existing local homes, condominiums and townhomes sold in September was 4,108. That was down from 4,693 sales in August – the second-best month ever for existing home sales in Southern Nevada.

But September’s sales total was up from 3,603 sales one year ago.And from economist Tom Lawler on Las Vegas:

About 45% of last month’s sales were bank-owned properties, down from 50% in August, while short sales comprised 25% of September sales, up from 21% in August. Active listings in September totaled 25,995, down 4.6% from August and down 9.3% from a year agoSo even though the MBA index declined recently, existing home sales might still be fairly strong in September due to investor buying.