by Calculated Risk on 10/11/2011 10:10:00 AM

Tuesday, October 11, 2011

Europe: EC, IMF, ECB says aid likely for Greece, Slovakia votes on EFSF

Statement by the European Commission, the ECB and IMF on the Fifth Review Mission to Greece

Staff teams from the European Commission (EC), European Central Bank (ECB), and International Monetary Fund (IMF) have concluded their fifth review mission to Greece to discuss recent economic developments. The mission has reached staff-level agreement with the authorities on the economic and financial policies needed to bring the government’s economic program back on track.From the NY Times: Slovak Leader Vows to Resign If Bailout Vote Fails

...

Once the Eurogroup and the IMF’s Executive Board have approved the conclusions of the fifth review, the next tranche of EUR 8 billion (EUR 5.8 billion by the euro area Member States, and EUR 2.2 billion by the IMF) will become available, most likely, in early November.

Lawmakers in Slovakia were scrambling on Tuesday to avert political and financial disaster over the vote on the expansion of the euro rescue fund, after the prime minister tied the fate of her government to the legislation through a confidence vote.It sounds like the EFSF vote might fail in Slovakia before passing later this week. Slovakia is the last country to vote on the enhanced EFSF.

...

The opposition Smer-Social Democracy party could bridge the gap, but its leader, the former prime minister Robert Fico, said he would support the proposal only in exchange for new elections, which could return him to power. He told reporters in Bratislava that his party would abstain from the vote but could support the measure at a later session if it failed.

The next step for Greece is the size of the haircuts, and various reports suggest the haircuts will be close to 50%.

NFIB: Small Business Optimism Index increases slightly in September

by Calculated Risk on 10/11/2011 07:54:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Confidence Sees Modest Gain: The Start of a Trend, or a Blip?

Small-business optimism gained 0.8 points in September, according to the National Federation of Independent Business’ (NFIB’s) latest Index, ending a six-month decline. However, NFIB’s chief economist cautions that in spite of this uptick, there is little among the 10 Index components that can be considered “positive.” ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index increased to 88.9 in September from 88.1 in August.

Optimism had declined for six consecutive months and this is just a small increase.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still low in September, but still positive and the trend is up.

Hiring plans were still low in September, but still positive and the trend is up. According to NFIB: “Over the next three months, 11 percent plan to increase employment (unchanged), and 12 percent plan to reduce their workforce (unchanged), yielding a seasonally adjusted 4 percent of owners planning to create new jobs, also down 1 point from August."

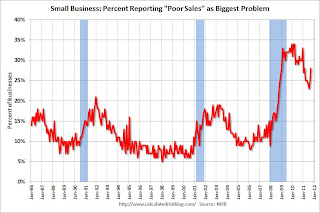

Twenty eight percent of small business owners reported that weak sales continued to be their top business problem in September.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly in September. This index has been slow to recover - probably due to a combination of the recent economic weakness, and also the high concentration of real estate related companies in the index.

Monday, October 10, 2011

Tim Duy: Too Early to Sound the All Clear?

by Calculated Risk on 10/10/2011 08:33:00 PM

From Professor Duy: Too Early to Sound the All Clear?. An excerpt:

[A]lthough there is optimism the European situation can be resolved in three weeks, they seem to be walking a very fine line between attempting to recapitalize the banking system without undermining sovereign debt ratings while maintaining what effectively amounts to a pegged exchange rate system that is fundamentally inconsistent with the economic needs of more than one nation. In addition, they have an odd situation where every nation needs to issue Euro-denominated debt, but no nation can actually print Euros as a backstop. It's as if each nation issues only foreign-denominated debt, with ultimately no lender of last resort on a national level. Of course, the European Central Bank could fill this role, but will they?Duy mentions the optimistic Bloomberg article today: No U.S. Recession as Forecasts Improve

My experience is that when a financial landscape is as ugly as we see here, there is no rescue plan. Things tend to get much worse before they get better. That seems to be what financial market are telling us.

A string of stronger-than-projected statistics -- capped by the news on Oct. 7 of a 103,000 rise in payrolls last month -- has prompted economists at Goldman Sachs Group Inc. and Macroeconomic Advisers LLC to raise their growth forecasts for third quarter growth to 2.5 percent from about 2 percent. That’s nearly double the second quarter’s 1.3 percent rate and would be the fastest growth in a year.Goldman did up their Q3 growth forecast, but they remain cautious on the next few quarters. In a note research note titled "Economy Holds Up, But for How Long?", they argued "real income growth has stalled" and "financial conditions have tightened sharply in recent months". They think growth will slow over the next two quarters.

I still think the a new U.S. recession is unlikely, but there are definite headwinds and downside risks.

Misc: Market and more on Household Income

by Calculated Risk on 10/10/2011 04:35:00 PM

This graph (click on graph for larger image) from Doug Short shows the recent volatility.

And some followup on the story this morning in the NY Times on the median income falling: Recession Officially Over, U.S. Incomes Kept Falling

From David Leonhardt at the NY Times: Behind a Surprising Income Trend.

And Felix Salmon provides a graph of falling income in the U.S.: Chart of the day, median income edition

Every month, the Current Population Survey goes out to a nationally representative sample of more than 50,000 interviewed households and their members. And in one of the questions, those households — or at least the households who didn’t answer the same question the previous month — are asked how much money they made, in total, over the past 12 months. That question has now been asked in 138 successive months, since January 2000. Which means that with a bit of clever analysis, it’s possible to put together an apples-to-apples comparison of what has happened to household income every month.

And when you do that, the results are very scary indeed.

The red line, here, is median real household income, as gleaned from the CPS, indexed to January 2000=100. It’s now at 89.4, which means that real incomes are more than 10% lower today than they were over a decade ago.The gray line is the unemployment rate. Pretty scary indeed!

Here is the report from Sentier Research.

EU Leaders delay summit until Sunday Oct 23rd

by Calculated Risk on 10/10/2011 01:05:00 PM

From Reuters: EU leaders delay summit to agree crisis plan

European Union leaders will delay a summit meeting planned for next Monday [to until October 23] buying time to agree a crisis strategy to boost struggling banks and cope with debt-laden Greece.By the end of the month, the EU will know if Greece will receive the next loan installment, and the EU leaders should announce a plan to recapitalize European banks. Sounds like another exciting Sunday in just under two weeks ...

...

"This timing will allow us to finalize our comprehensive strategy on the euro area sovereign debt crisis," said [European Council President Herman Van Rompuy] ...

"Further elements are needed to address the situation in Greece, the bank recapitalization and the enhanced efficiency of stabilization tools (the EFSF bailout fund)."

The delay also means leaders will know whether Greece qualifies to receive the next tranche of aid under its existing rescue program ... Greece was wrapping up talks with EU and IMF officials on the vital aid, Finance Minister Evangelos Venizelos said on Monday.

Existing Home Inventory continues to decline year-over-year in October

by Calculated Risk on 10/10/2011 10:51:00 AM

I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

A few key points:

• In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales revisions will be down (the NAR has pre-announced this), and the inventory is expected to be revised down too. From the NAR last month: "Publication of the revisions is expected in several months, and we will provide a notice several weeks in advance of the publication date. ... Although there will be a downward revision to sales volume, there will be no notable change to previous characterizations of the market in terms of sales trends, monthly percentage changes, etc."

• Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to late 2005 / early 2006 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

• Existing home inventory surged in the 2nd half of 2005 and that was a key indicator that the housing bubble was about the burst (I was able to call the top in activity mid-2005, and predict prices would start to decline in 2006).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through early October. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early October listings - for the 54 metro areas - declined 16.4% from last year. Inventory was down 16.7% year-over-year in September.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed or "visible" inventory is a key story in 2011 - and listed inventory for October is probably down to the lowest level since October 2005.

Study: Real Median Household Income kept falling even after the recession ended

by Calculated Risk on 10/10/2011 08:54:00 AM

From the NY Times: Recession Officially Over, U.S. Incomes Kept Falling. A few excerpts:

Between June 2009, when the recession officially ended, and June 2011, inflation-adjusted median household income fell 6.7 percent, to $49,909, according to a study by two former Census Bureau officials. During the recession — from December 2007 to June 2009 — household income fell 3.2 percent.So the inflation-adjusted median household income has continued to decline even after the recession ended.

And for people who lost their jobs - and were lucky enough to find a new job:

In a separate study, Henry S. Farber, an economics professor at Princeton, found that people who lost jobs in the recession and later found work again made an average of 17.5 percent less than they had in their old jobs.And on education:

Median annual income declined most for households headed by someone with an associate’s degree, dropping 14 percent, to $53,195, in the four-year period that ended in June 2011, the report said.Grim numbers. This is no surprise given the high level of unemployment and underemployment.

For households headed by people who had not completed high school, median income declined by 7.9 percent, to $25,157. For those with a bachelor’s degree or more, income declined by 6.8 percent, to $82,846.

Weekend:

• Summary for Week Ending Oct 7th

• Schedule for Week of Oct 9th

Sunday, October 09, 2011

Sunday Night Futures

by Calculated Risk on 10/09/2011 11:50:00 PM

From Bloomberg: Merkel, Sarkozy Pledge Bank Recapitalization

Angela Merkel and Nicolas Sarkozy ... gave themselves three weeks to devise a plan to recapitalize banks, get Greece on the right track and fix Europe’s economic governance.The Asian markets are mixed tonight (update: Nikkei is closed).

“By the end of the month, we will have responded to the crisis issue and to the vision issue,” the French president said in Berlin yesterday at a joint briefing with the German chancellor before they dined at her office.

... Merkel said European leaders will do “everything necessary” to ensure that banks have enough capital. Sarkozy said they would deliver a plan by the Nov. 3 Group of 20 summit.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is up about 10 points, and Dow futures are up about 100 points.

Oil: WTI futures are up to $83.50 and Brent is up to $106 per barrel.

Yesterday:

• Summary for Week Ending Oct 7th

• Schedule for Week of Oct 9th

Report: Merkel, Sarkozy Reach General Agreement on Bank Recapitalization

by Calculated Risk on 10/09/2011 04:13:00 PM

No details, but a new "deadline": the end of October. There is a meeting of European leaders scheduled for Oct 17th and 18th summit in Brussels.

• From the Financial Times: Merkel and Sarkozy set euro deadline

France and Germany have set themselves a deadline of the end of October to reach agreement on a comprehensive package of measures to stabilise the eurozone, including the recapitalisation of European banks if they need it.• From the WSJ: Merkel, Sarkozy Claim Broad Agreement to Stabilize Euro Zone

excerpt with permission

German Chancellor Angela Merkel and French President Nicolas Sarkozy said Sunday that they have reached broad agreement on a plan to shore up Europe's battered banks and restore stability to the euro zone. ...Yesterday:

"We are determined to do what is necessary to guarantee the recapitalization of our banks," Mrs. Merkel told reporters. "We will make proposals in a comprehensive package that will enable closer cooperation between euro-zone countries that will include changes to treaties."

• Summary for Week Ending Oct 7th

• Schedule for Week of Oct 9th

Europe Update: Merkel and Sarkozy are meeting today

by Calculated Risk on 10/09/2011 11:51:00 AM

• From the Financial Times: Merkel and Sarkozy hold talks on crisis German Chancellor Angela Merkel and French President Nicolas Sarkozy are holding the talks today in Berlin on the financial crisis. A key point is trying to agree on how to recapitalize European banks. Merkel is pushing for a solution prior to the Oct 17th and 18th summit of European leaders in Brussels.

• From the WSJ: Belgium, France to Nationalize Part of Dexia

The governments of Belgium and France agreed to nationalize the Belgian subsidiary of Dexia SA, paving the way for the embattled Belgian-French lender to be broken up.If Merkel and Sarkozy wait too long, the markets will force an ad-hoc approach.

• From Reuters: Barroso says Greek default would spread crisis: paper

"If we give up on Greece, there is a big danger that the crisis will spread to other countries," [European Commission President Jose Manuel Barroso] told Bild in an interview to be published on Monday ... "This is new territory for us and we are discussing solutions which have not really been tested before," he said.The next two weeks are critical for Europe.

But the European Union was convinced that a Greek bankruptcy was "not cheaper for all participants than the current aid schemes," he said.

Yesterday:

• Summary for Week Ending Oct 7th

• Schedule for Week of Oct 9th