by Calculated Risk on 9/15/2011 09:25:00 AM

Thursday, September 15, 2011

Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in August after having advanced 0.9 percent in July. Manufacturing rose 0.5 percent in August, after a similarly sized gain in July, and the rates of change were revised down slightly in April, May, and June. In August, the output of mines moved up 1.2 percent. The output of utilities decreased 3.0 percent, as temperatures moderated somewhat from the previous month. At 94.0 percent of its 2007 average, total industrial production for August was 3.4 percent above its year-earlier level. Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in Decebmer 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 94.0 (although earlier months were revised down).

After the fairly rapid increase last year, increases in industrial production and capacity utilization have slowed recently.

Weekly Initial Unemployment Claims increased to 428,000

by Calculated Risk on 9/15/2011 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey: "The Empire State Manufacturing

Survey indicates that conditions for New York manufacturers worsened for a fourth consecutive month in September. The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

• CPI increased 0.4% in August (0.2% core). I'll have more later on the Fed survey and CPI.

• The DOL reports:

In the week ending September 10, the advance figure for seasonally adjusted initial claims was 428,000, an increase of 11,000 from the previous week's revised figure of 417,000. The 4-week moving average was 419,500, an increase of 4,000 from the previous week's revised average of 415,500.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 419,500.

The 4-week average has been increasing recently and this is the highest level since early July.

Wednesday, September 14, 2011

First September Surveys

by Calculated Risk on 9/14/2011 11:41:00 PM

Tomorrow we will see if there is any improvement from the dismal August readings for both the Philly Fed and NY Fed (Empire state) manufacturing surveys. On Friday, the preliminary Reuters/University of Mich Consumer Sentiment for September will be released.

Thursday at 8:30 AM ET: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of -3.6, up from -7.7 in August (above zero is expansion).

10:00 AM: Philly Fed Survey for September. This index fell off a cliff in August. The consensus is for a reading of -15.0 (above zero indicates expansion), up from -30.7 last month.

Friday at 9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for September. The consensus is for a slight increase to 56.0 from 55.7 in August.

Last month I argued the sharp decline in sentiment - from an already low level - might be due to the debt ceiling debate. I looked at some of the previous spikes down in sentiment due to fairly short term events - and those events suggested sentiment should recover in 2 to 4 months. So maybe in October or November - but it is too early in September.

Of course sentiment - and the manufacturing surveys - could have declined because of other factors (weak labor market, European financial crisis, etc), and then the surveys might remain weak. We will get our first look tomorrow.

Europe Update: German and France back Greece and much more

by Calculated Risk on 9/14/2011 06:30:00 PM

The first of two key meetings this week was held earlier today via video conference with German Chancellor Angela Merkel, French President Nicolas Sarkozy and Greek prime minister George Papandreou. On Friday, the European finance ministers will meet with Timothy Geithner making an appearance.

From the WSJ: Greece's Future Is With Euro Zone, Say Merkel and Sarkozy

German Chancellor Angela Merkel and French President Nicolas Sarkozy are convinced that Greece's future is within the euro zone, Mrs. Merkel's spokesman said after the two leaders held a three-way conference call with Greek Prime Minister George Papandreou.From the NY Times: Germany and France Back Greece on Austerity Effort

But Mrs. Merkel and Mr. Sarkozy also stressed during the call the need for Greece to put into practice in a strict and effective way the already-agreed measures of its austerity program under a current bailout package, the spokesman, Steffen Seibert, said.

The Greek prime minister vowed to abide by austere cuts in the struggling country’s budget, and the leaders of France and Germany promised to support Greece as a central part of the euro zone, the three officials said Wednesday in a statement after a joint conference call.From the Irish Times: Commission prepares plans to introduce euro area bonds

...

Together, they are pushing all euro zone states to ratify as soon as possible decisions made on July 21, which would expand the European Financial Stability Facility and allow it increased flexibility to protect Greece and other heavily indebted members ...

European Commission president José Manuel Barroso said he is close to proposing options on joint euro-area bond sales, putting officials in Brussels on a collision course with Germany.From Reuters: EU warned of credit crunch threat, French banks hit (ht mp)

Speaking this morning, Mr Barroso said the commission is preparing options for the introduction of eurobonds. He called for much closer political integration and said the EU needed a "new federalist moment" to confront the most serious challenge for the union in a generation.

In a report prepared for ministers meeting in Poland on Friday and Saturday, senior EU officials said the 17-nation currency area faces a "risk of a vicious circle between sovereign debt, bank funding and negative growth."From the Economic Times: Dutch Finance Minister says has not given up on Greece (ht ghostfaceinvestah)

"While tensions in sovereign debt markets have intensified and bank funding risks have increased over the summer, contagion has spread across markets and countries and the crisis has become systemic," the influential Economic and Financial Committee said.

"A further reinforcement of bank resources is advisable," ministers were told ...

The Dutch government has not given up on the rescue of Greece and is determined to do everything possible to save the euro zone, the Dutch finance minister told members of parliament on Wednesday.From Bloomberg: Credit Agricole Debt Ratings Cut by Moody’s Along With Societe Generale’s

"To be clear ... this Cabinet has the firm will to do everything possible to save the euro or the euro zone," Finance Minister Jan Kees de Jager told members of parliament.

He strongly denied Dutch media reports that the government expected Greece to default ...

And from Bloomberg: ECB Will Lend Dollars to Two Euro-Region Banks as Market Funding Tightens

The European Central Bank said it will lend dollars to two euro-area banks tomorrow, a sign they are finding it difficult to borrow the U.S. currency in markets.The Greek 2 year yield declined slightly to 74.5%. The Greek 1 year yield is at 142%.

The ECB allotted $575 million in a regular seven-day liquidity-providing operation at a fixed rate of 1.1 percent. It’s the first time since Aug. 17 that a lender requested dollars from the ECB.

The Portuguese 2 year yield is up to 16.1% and the Irish 2 year yield is at 9.5%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

DataQuick: SoCal August Home Sales Climb

by Calculated Risk on 9/14/2011 03:57:00 PM

Existing home sales for August will be released on Weds Sept 21st. Economist Tom Lawler is estimating the NAR will report sales of 4.91 million on a seasonally adjusted annual rate (SAAR) basis. That would be an increase from 4.67 million in July.

Existing home sales are reported at closing, and new home sales are reported when the contract is signed, so the debt ceiling slowdown will negatively impact reported new home sales much more than existing home sales.

From DataQuick: Southland August Home Sales Climb, Median Price Falls Again

A total of 19,654 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in August. That was up 8.6 percent from 18,090 in July and up 6.0 percent from 18,541 in August 2010, according to San Diego-based DataQuick.So 34.6 percent were foreclosure resales and 17.9 percent were short sales - over 50% were distressed sales in August!

...

August was the first month since June 2010 to post a year-over-year gain in home sales. Last month was also the first since November 2009 in which all six Southland counties logged higher sales than a year earlier. One reason it’s getting easier to beat the year-ago sales numbers: Home sales fell off sharply last summer after federal and state homebuyer tax credits expired.

...

Last month’s sales picture changes when viewed in terms of the average number of homes sold daily. Last month had 23 business days (the most for any August since 2007) on which home sales could be recorded, compared with 20 business days in July and 22 in August 2010. The average number of homes sold daily last month fell about 6 percent from July and rose less than 1 percent compared with a year earlier.

...

Foreclosure resales – properties foreclosed on in the prior 12 months – made up 34.6 percent of the Southland resale market in August, up from 34.5 percent in July but down from 37.6 percent a year earlier. Foreclosure resales peaked at 56.7 percent in February 2009.

Short sales, where the sale price fell short of what was owed on the property, made up an estimated 17.9 percent of Southland resales last month. That was up from 17.3 percent in July but down from 18.9 percent a year ago. Two years ago the estimate was 14.5 percent.

Households Doubling Up and Housing

by Calculated Risk on 9/14/2011 01:54:00 PM

Yesterday David Johnson at the Census Bureau wrote: Households Doubling Up

In coping with economic challenges over the past few years, many of us have combined households with other family members or individuals. These “doubled-up” households are defined as those that include at least one “additional” adult – in other words, a person 18 or older who is not enrolled in school and is not the householder, spouse or cohabiting partner of the householder.David Johnson reported the numbers for spring 2007 and spring 2011. Here are the numbers for all years from spring 2007 through spring 2011. This is based on a survey of "roughly 78,000 households" as part of the Annual Social and Economic Supplement to the Current Population Survey. (Source: Census Bureau research, "Income, Poverty and Health Insurance Coverage in the United States" report)

The Census Bureau reported today that the number and share of doubled-up households and adults sharing households across the country increased over the course of the recession, which began in December 2007 and ended in June 2009. In spring 2007, there were 19.7 million doubled-up households, amounting to 17.0 percent of all households. Four years later, in spring 2011, the number of such households had climbed to 21.8 million, or 18.3 percent.

| Year | Doubled-up Households (000s)1 | Percent of Households2 |

|---|---|---|

| 2007 | 19,747 | 17.0% |

| 2008 | 19,956 | 17.1% |

| 2009 | 20,683 | 17.7% |

| 2010 | 22,000 | 18.7% |

| 2011 | 21,766 | 18.3% |

It appears the percent of households that are doubled-up peaked in 2010, and is starting to decline. This is probably part of the reason for the pickup last year in demand for rental units since most people leaving a doubled-up household probably rent as opposed to buy.

If there were a strong increase in employment, there would probably be a sharp increase in households - both from normal growth and from people moving out of doubled-up households. And that would help absorb the excess supply of housing units. Of course there probably won't be a strong increase in employment until more of the excess housing supply is absorbed!

Notes:

1 The increase in the number and percent of doubled-up households between 2007 and 2011 was significant. The increase in the number of doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The change in the number of doubled-up households between 2010 and 2011 was not statistically significant. The number of doubled-up households did not change significantly between either 2007 and 2008 or 2010 and 2011.

2 The percentage point increase in doubled up households was significant at the 10% level between 2008 and 2009 and between 2009 and 2010. The percentage point decline in doubled-up households between 2010 and 2011 was also significant at the 10% level. The percentage of doubled-up households as a proportion of all households did not change significantly between 2007 and 2008.

LA Port Traffic in August: Imports decline

by Calculated Risk on 9/14/2011 11:35:00 AM

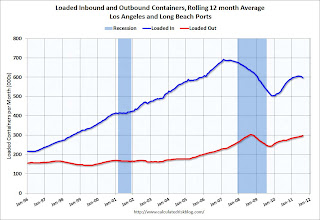

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.9% from July, and outbound traffic is up 0.9%. Inbound traffic is "rolling over" and this suggests that retailers are cautious for the coming holiday season.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of August, loaded inbound traffic was down 9% compared to August 2010, and loaded outbound traffic was up 12% compared to August 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Imports have been soft - this is the 3rd month in a row with a year-over-year decline in imports. This suggests a smaller trade deficit with Asian countries in August.

Retail Sales flat in August

by Calculated Risk on 9/14/2011 08:30:00 AM

On a monthly basis, retail sales were flat from July to August (seasonally adjusted, after revisions), and sales were up 7.2% from August 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $389.5 billion, virtually unchanged (±0.5%)* from the previous month and 7.2 percent (±0.7%) above August 2010.Retail sales excluding autos increased 0.1% in August. Sales for and June and July were revised down.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 17.1% from the bottom, and now 2.9% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.7% on a YoY basis (7.2% for all retail sales).

Retail sales ex-gasoline increased by 5.7% on a YoY basis (7.2% for all retail sales). The consensus was for retail sales to increase 0.2% in August, and for a 0.3% increase ex-auto.

This was another weak report for August.

MBA: Mortgage Purchase Application Index increases, Record Low Mortgage Rates

by Calculated Risk on 9/14/2011 07:29:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The seasonally adjusted Purchase Index increased 7.0 percent from one week earlier. ... The Refinance Index increased 6.0 percent from the previous week, stopping a run of three consecutive weekly decreases.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.17 percent from 4.23 percent, with points decreasing to 0.97 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week. The 30-year fixed contract rate is the lowest in the history of the survey, with the previous low being 4.21 percent in the week ending October 8, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.

Note: Existing home sales will probably increase in August compared to July (sales are counted at closing), but this suggests another decline in September and October.

Tuesday, September 13, 2011

Misc: Household Income declines, Poverty increases, Austerity leads to contraction

by Calculated Risk on 9/13/2011 08:55:00 PM

The Census Bureau released the 2010 Income, Poverty, and Health Insurance Coverage in the United States report. Here is the press release, the report (long), and the slide deck with graphs. A couple of articles:

• From the WSJ: Income Slides to 1996 Levels

The income of the typical American family ... has dropped for the third year in a row and is now roughly where it was in 1996 when adjusted for inflation.• From the WaPo: U.S. poverty rate reaches 15.1 percent

The income of a household considered to be at the statistical middle fell 2.3% to an inflation-adjusted $49,445 in 2010, which is 7.1% below its 1999 peak, the Census Bureau said.

The nation’s poverty rate spiked to 15.1 percent in 2010, the highest level since 1993, the Census Bureau reported on Tuesday ... About 46.2 million Americans lived in poverty last year, marking an increase of 2.6 million over 2009 and the fourth consecutive annual increase in poverty.• And an IMF report that analyzes austerity program, from the WaPo: IMF: Austerity boosts unemployment, lowers paychecks

In a new paper for the International Monetary Fund, Laurence Ball, Daniel Leigh and Prakash Loungani look at 173 episodes of fiscal austerity over the past 30 years—with the average deficit cut amounting to 1 percent of GDP. Their verdict? Austerity “lowers incomes in the short term, with wage-earners taking more of a hit than others; it also raises unemployment, particularly long-term unemployment.”Under an austerity program, high income earners usually do better than lower income earners, and profits tend to bounce back faster than wages. Sounds like the current situation.

More specifically, an austerity program that curbs the deficit by 1 percent of GDP reduces real incomes by about 0.6 percent and raises unemployment by almost 0.5 percentage points. What’s more, the IMF notes, the losses are twice as big when the central bank can’t cut rates (a good description of the present.) Typically, income and employment don’t fully recover even five years after the austerity program is put in place ... if multiple countries are all carrying out austerity at the same time, the overall pain is likely to be greater.