by Calculated Risk on 8/18/2011 09:55:00 PM

Thursday, August 18, 2011

Key Measures of Inflation in July

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in July on a seasonally adjusted basis ... The gasoline index rebounded from previous declines and rose sharply in July, accounting for about half of the seasonally adjusted increase in the all items index. ... The index for all items less food and energy increased as well, though the 0.2 percent increase was slightly smaller than the two previous months.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in July. The 16% trimmed-mean Consumer Price Index increased 0.3% (3.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for July here.

Over the last 12 months, the median CPI rose 1.8%, the trimmed-mean CPI rose 2.1%, the CPI rose 3.6%, and the CPI less food and energy rose 1.8%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, and near the Fed's target.

On a monthly basis, the median Consumer Price Index increased 2.9% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 3.3% annualized in July, and core CPI increased 2.7% annualized.

With the slack in the system - and falling gasoline prices, the year-over-year measures will probably stay near or be below 2% by the end of this year.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Bank Failure #65: On a Thursday?

by Calculated Risk on 8/18/2011 07:01:00 PM

From the FDIC: Capital Bank, National Association, Rockville, Maryland, Assumes All of the Deposits of Public Savings Bank, Huntingdon Valley, Pennsylvania

As of June 30, 2011, Public Savings Bank had approximately $46.8 million in total assets and $45.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.0 million. ... Public Savings Bank is the 65th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.Thursday failures are pretty unusual.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Early Read: 2012 Social Security Cost-Of-Living Adjustment on track for 3%+ increase

by Calculated Risk on 8/18/2011 03:47:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.1 percent over the last 12 months to an index level of 222.686 (1982-84=100)."

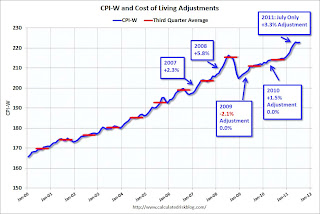

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

• CPI-W in July 2011 was 222.686. This is above the Q3 2008 average, although we still have to wait for the August and September CPI-W. CPI-W could be very volatile over the next couple of months, but if the current level holds, COLA would be around 3.3% for next year (the current 222.686 divided by the Q3 2008 level of 215.495).

This is still early - and gasoline prices are falling - but it appears that COLA will increase this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't increase much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 to $110,000 from the current $106,800.

Remember - this is an early look and is only for one month in Q3. What matters is average CPI-W during Q3 (July, August and September).

NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Existing Home Sales: Comments and NSA Graph

by Calculated Risk on 8/18/2011 01:14:00 PM

A few comments and a graph (of course):

• First, from Freddie Mac: Mortgage Rates Lowest in Over 50 Years

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, reaching all-time record lows ... The 30-year fixed averaged 4.15 percent, breaking the previous record low of 4.17 percent set November 11, 2010.• The NAR reported that inventory decreased in July from June, and that inventory is off 8.9% from July 2010. Other data sources suggest that the NAR is overstating inventory (inventory will be part of the coming revisions). Inventory is probably down more year-over-year (YoY) than the NAR reported.

• The NAR provided an update on the timing of the "benchmark revisions":

Update on Benchmark Revisions: ... Preliminary data based on the new benchmark is expected to be available for review by professional economists in coming weeks. This process is expected to take some time before finalized revisions can be published to address any issues that may surface in the review process and to update monthly seasonal adjustment factors; NAR is committed to providing accurate, reliable data. Publication of the revisions is not likely before this fall, but we expect to provide a notice one month in advance of the publication date.This revision is expected to show significantly fewer homes sold over the last few years (perhaps 10% to 15% fewer homes in 2010 than originally reported), and also fewer homes for sale.

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The red columns are for 2011.

Sales NSA are above last July - of course sales declined sharply last year following the expiration of the tax credit in June 2010.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 29 percent of transactions in July, unchanged from June; they were 30 percent in June 2010; investors account for the bulk of cash purchases.

First-time buyers purchased 32 percent of homes in July, up from 31 percent in June; they were 38 percent in July 2010. Investors accounted for 18 percent of purchase activity in July compared with 19 percent in June and 19 percent in July 2010.

Earlier:

• Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales graphs

Philly Fed Survey: "Regional manufacturing activity has dipped significantly"

by Calculated Risk on 8/18/2011 11:36:00 AM

Earlier from the Philly Fed: August 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a slightly positive reading of 3.2 in July to -30.7 in August. The index is now at its lowest level since March 2009 [any reading below zero is contraction]. The demand for manufactured goods, as measured by the current new orders index, paralleled the decline in the general activity index, falling 27 points. The current shipments index fell 18 points and recorded its first negative reading since September of last year. Suggesting weakening activity, indexes for inventories, unfilled orders, and delivery times were all in negative territory this month.This indicates contraction in August and was well below the consensus of 4.0.

...

Firms’ responses suggest a deterioration in the labor market compared with July. The current employment index fell 14 points, recording its first negative reading in 12 months. About 18 percent of the firms reported an increase in employment, but 23 percent reported a decrease. ...

Diffusion indexes for prices paid and prices received were lower this month and suggest a continued trend of moderating price pressures.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The averaged Empire State and Philly Fed surveys are well below zero suggesting a further decline in the ISM index.

Earlier:

• Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

• Existing Home Sales graphs

Existing Home Sales in July: 4.67 million SAAR, 9.4 months of supply

by Calculated Risk on 8/18/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Down in July but Up Strongly From a Year Ago

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, fell 3.5 percent to a seasonally adjusted annual rate of 4.67 million in July from 4.84 million in June, but are 21.0 percent above the 3.86 million unit pace in July 2010, which was a cyclical low immediately following the expiration of the home buyer tax credit.

...

Total housing inventory at the end of July fell 1.7 percent to 3.65 million existing homes available for sale, which represents a 9.4-month supply at the current sales pace, up from a 9.2-month supply in June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2011 (4.67 million SAAR) were 3.5% lower than last month, and were 21% above the July 2010 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.65 million in July from 3.72 million in June.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 8.9% year-over-year in July from July 2010. This is the sixth consecutive month with a YoY decrease in inventory.

Inventory decreased 8.9% year-over-year in July from July 2010. This is the sixth consecutive month with a YoY decrease in inventory.Months of supply increased to 9.4 months in July, up from 9.2 months in June. This is much higher than normal. These sales numbers were below the consensus, but right at Lawler's forecast of 4.69 million using the NAR method.

Weekly Initial Unemployment Claims increased to 408,000

by Calculated Risk on 8/18/2011 08:30:00 AM

The DOL reports:

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 408,000, an increase of 9,000 from the previous week's revised figure of 399,000. The 4-week moving average was 402,500, a decrease of 3,500 from the previous week's revised average of 406,00.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 402,500.

This is the lowest level for the 4-week average since early April. The 4-week average is still elevated, but has been moving down since mid-May.

Note: CPI increased 0.5% in July (0.2% core). I'll have some graphs later.

Report: U.S. Investigating S&P Ratings of Mortgages

by Calculated Risk on 8/18/2011 12:13:00 AM

From Louise Story at the NY Times: U.S. Inquiry Eyes S.&P. Ratings of Mortgages

The Justice Department is investigating whether the nation’s largest credit ratings agency, Standard & Poor’s, improperly rated dozens of mortgage securities ... the Justice Department has been asking about instances in which the company’s analysts wanted to award lower ratings on mortgage bonds but may have been overruled by other S.& P. business managers ... If the government finds enough evidence to support such a case ... it could undercut S.& P.’s longstanding claim that its analysts act independently from business concernsThere is no question that S&P incorrectly rated mortgage securities, but that was just their "opinion". This investigation is apparently focused on if the analysts wanted to downgrade the ratings, but they were overruled by managers. If so, S&P might lose their first amendment protection and then be open to lawsuits from investors.

Wednesday, August 17, 2011

Chicago Fed: Midwest Farmland Values Soar

by Calculated Risk on 8/17/2011 07:01:00 PM

From the Chicago Fed: Second Quarter Midwest Farmland Values Soar

Farmland values for the second quarter of 2011 climbed 17 percent from the level of a year ago in the Seventh Federal Reserve District. The value of “good” agricultural land increased 4 percent in the second quarter compared with the first quarter of 2011, according to a survey of 226 agricultural bankers in the District.Apparently there is quite a bit of investor buying (Gold, guns and farmland?). The Chicago Fed will hold a conference on farmland values in November: Rising Farmland Values: Causes and Cautions

...

At 17 percent, the year-over-year increase in the value of District farmland for the second quarter of 2011 was the largest recorded since

the 1970s.

Back in the 1980s, when farmland values collapsed, many farmers lost their land - and many banks went under. I just hope the lenders and farmers remember the '80s and keep the loan-to-value for farmland down. I hope the regulators are paying attention too.

New Resource for Tracking Home Sales

by Calculated Risk on 8/17/2011 03:35:00 PM

DataQuick has developed a new resource for tracking home sales that is updated weekly. It can be accessed by going to the DataQuick news site and clicking on the National Home Sales at the top (or directly here: National Home Sales Snapshot).

DataQuick provides sales and median prices using the most current 30/31 days based on 98 of the Top 100 US MSAs (excluding Louisville and Wichita). DataQuick estimates this is almost two-thirds of all US home sales. These are real sales counts (as opposed to the NAR approach that will probably be changed later this year). DataQuick also provides median prices.

Right now DataQuick is combining existing and new home sales, and they were kind enough to break out the data for me.

This resource will allow us to track sales weekly, although we have to remember this data is Not Seasonally Adjusted (NSA), and both the NAR and Census Bureau headline numbers are reported on a Seasonally Adjusted Annual Rate (SAAR) basis.

I decided to compare the DataQuick numbers to the NAR and Census Bureau reports. Both the NAR and Census Bureau report monthly, and the DataQuick data is weekly.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NSA data for DataQuick and the NAR. The dashed line is scaling up the DataQuick numbers by .6625 (their estimate of sales coverage).

The NAR recognizes that their estimate are too high - and they are planning revising down their estimates this fall. However this suggests that the NAR might be overestimating by even more than the 10% to 15% that many analysts think. This also suggests sales in 2011 are very weak.

The second graph compares the DataQuick new home sales numbers with the Census Bureau. The Census Bureau reports when contracts are signed and DataQuick reports when the purchase is closed. So there are some timing issues.

The dashed line is using the same scaling factor as for existing homes. The new home data from the Census Bureau appears to be fairly close to the DataQuick numbers - although it is hard to tell because of the large spikes due to the homebuyer tax credit and because of the lag between contract signings and closings.

The dashed line is using the same scaling factor as for existing homes. The new home data from the Census Bureau appears to be fairly close to the DataQuick numbers - although it is hard to tell because of the large spikes due to the homebuyer tax credit and because of the lag between contract signings and closings.

This appears to be very useful data for tracking home sales.