by Calculated Risk on 8/15/2011 10:00:00 AM

Monday, August 15, 2011

NAHB Builder Confidence index unchanged in August, Still Depressed

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged in August at 15, the same level as in July. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Unchanged in August

Builder confidence in the market for newly built, single-family homes held unchanged at a low level of 15 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today.

...

"Builders continue to confront the same major challenges they have seen over the past year, including competition from the large inventory of distressed homes on the market, inaccurate appraisal values, and issues with their buyers not being able to sell an existing home or qualify for favorable mortgage rates because of overly tight underwriting requirements," said Bob Nielsen, chairman of the National Association of Home Builders (NAHB) and a home builder from Reno, Nev. He noted that 41 percent of respondents to a special questions section of the HMI indicated they had lost sales contracts due to buyers' inability to sell their current homes.

...

Two out of three of the HMI's component indexes posted marginal gains in August. The component gauging current sales conditions gained one point to 16 – its highest level since March of this year – and the component gauging traffic of prospect buyers rose one point to 13 following two consecutive months at 12. However, the component gauging sales expectations for the next six months declined two points to 19, partially offsetting a six-point gain from the last month's revised number.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the August release for the HMI and the June data for starts (July housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Residential Remodeling Index at new high in June

by Calculated Risk on 8/15/2011 09:05:00 AM

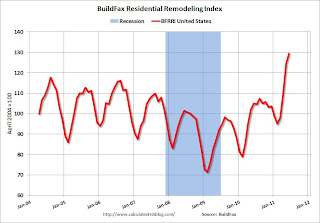

The BuildFax Residential Remodeling Index was at 129.5 in June, up from 124.3 in May. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 23% year-over-year--and for the twentieth straight month--in June to 129.5, the highest number in the index to date. Residential remodels in June were up month-over-month 5.2 points (4%) from the May value of 124.3, and up year-over-year 24.5 points from the June 2010 value of 105.0.

...

In June, the West (7.3 points; 6%), the Midwest (11.2 points; 13%), and the South (< .1 points; < 1%) all had month-over-month gains, while the Northeast saw a decline (3.7 points; 4%). ... “The first half of 2011 brought pain to many sectors of the economy including home sales and jobs, however Americans continue to invest in remodeling, sending the BuildFax Remodeling Index to a new all-time high,” said Joe Emison, Vice President of Research and Development at BuildFax. “With so many Americans unable to sell their current home, it is apparent that they are planning on staying in their current residences and are making renovations and upgrades.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This is the highest level for the index (started in 2004) - even above the levels from 2004 through 2006 during the home equity ("home ATM") withdrawal boom.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

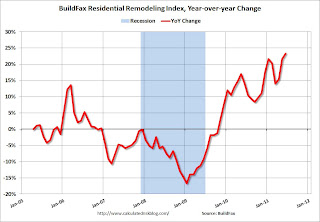

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 23% from June 2010.

Even though new home construction is still moving sideways, it appears that two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

Weekend:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Empire State Survey indicates contraction

by Calculated Risk on 8/15/2011 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The August Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to worsen. The general business conditions index fell four points to -7.7, its third consecutive negative reading. The new orders index also remained below zero, at -7.8, while the shipments index was positive at 3.0.The index decreased from -3.8 in July, and is well below expectations of a reading of 1.0. This is the first regional survey released for August and shows that manufacturing in the NY region is still contracting.

Price indexes continued to retreat, with the prices paid index falling fifteen points to 28.3 and the prices received index falling three points to 2.2. The index for number of employees was slightly positive, while the average workweek index was slightly negative.

Weekend:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Sunday Night Misc: Europe, Japan, Futures

by Calculated Risk on 8/15/2011 12:47:00 AM

There will be a meeting of German chancellor Angela Merkel and French president Nicholas Sarkozy on Tuesday. There were some more rumors of a Eurobond this weekend, but according to the Financial Times that has been ruled out for now: Germany and France rule out eurobonds. Another meeting is not a good sign ...

The NY Times discusses the slowing European economies: Setbacks May Push Europe Into a New Downturn

On Tuesday, economists expect a report on euro area economic activity to show that gross domestic product slowed to 0.3 percent in the second quarter, from 0.8 percent in the first three months of the year.And the NY Times discusses the false rumor last week about funding problems at Société Générale: Source Sought for False Story on French Bank. Pretty amusing story - it seems the rumor might have started with a fictional story in Le Monde (that was clearly labeled fiction).

And from the WSJ: Japan's Economy Shrinks but Beats Expectations

... Japan's economy continues to rebound from the devastating March 11 earthquake and tsunami faster than anticipated. The government reported that real Gross Domestic Product shrank 1.3% in annualized, seasonally adjusted terms in the second quarter. The outcome beat a 2.7% contraction [forecast].The Asian markets are green tonight with the Nikkei up over 1%. The Hang Seng is up over 2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is up about 7 points, and Dow futures are up about 70 points.

Oil: WTI futures are up to $85 and Brent is up to $108.

Yesterday:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Sunday, August 14, 2011

Event Driven Declines in Consumer Sentiment

by Calculated Risk on 8/14/2011 05:32:00 PM

On Friday, Reuters and the University of Michigan released the preliminary consumer sentiment index for August. This showed a sharp decline in sentiment to 54.9, the lowest level in 30 years (see graph below).

My reaction was the decline in sentiment was related to the heavy coverage of the debt ceiling debate, and not due to the usual suspects: gasoline prices or a weakening labor market. Of course consumer sentiment was already low because of high gasoline prices and a weak labor market, but gasoline prices are now falling and initial weekly unemployment claims have declined recently (the key for sentiment is that neither appears to be getting worse rapidly).

I looked at some of the previous spikes down in sentiment due to fairly short term events: 1) the 1987 market crash, 2) the Gulf War, 3) 9/11, 4) the Iraq Invasion, and 5) Hurricane Katrina. These events are apparent on the following graph (along with plenty of noise):

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

There are other reasons for declines in sentiment, but I was looking for event driven declines. Note: It is more unusual to see sentiment spike up due to an event - perhaps the capture of Saddam Hussein in Dec 2003 led to an increase in sentiment in the January 2004 report.

Looking at these five events (table below), some of the declines were related to other factors (like an increase in oil prices) - and some lasted longer and had a direct impact on consumption.

My feeling is the debt ceiling decline - assuming the decline was due to the insanity in D.C. - is most similar to the 1987 stock market crash (that scared everyone, but had little impact on the economy) and to Hurricane Katrina (although Katrina led to higher oil prices and a direct impact on consumption in several gulf states).

If I'm correct, then sentiment should bounce back fairly quickly - but only to an already low level. And the impact on consumption should be minimal. Of course sentiment could have declined because of other factors (weak labor market, European financial crisis, etc), and then sentiment will probably not bounce back quickly.

| Event Driven Declines in Consumer Sentiment | ||||

|---|---|---|---|---|

| Event | Date | Bounce Back | Impact on Consumption | Other Factors |

| 1987 Market Crash | Oct-87 | 2 Months | None | None |

| Gulf War | Aug-90 | 6 Months | PCE declined | Recession, Oil Prices Doubled |

| 9/11 | Sep-01 | 4 months | PCE declined 3 out of 4 months | Recession |

| Iraq Invasion | Mar-03 | 2 Months | None | Oil Prices increased 10%+ |

| Hurricane Katrina | Aug-05 | 3 Months | PCE declined 2 months | Oil Prices increased 10%+ |

| Debt Ceiling | Aug-11 | --- | --- | European Crisis, Weak Recovery |

Yesterday:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Hamilton: Economic consequences of recent oil price changes

by Calculated Risk on 8/14/2011 02:11:00 PM

From Professor Hamilton at Econbrowser: Economic consequences of recent oil price changes

Earlier this year, disruptions in Libya and the resurgence of demand from the emerging economies sent oil prices up sharply, a development that many economists believe contributed to the slow growth for 2011:H1. The chaotic markets of the last few weeks saw oil prices drop back down to where they had been in December. Will that be enough to revive the struggling U.S. economy? There is some evidence suggesting that it may be too late.In his post, Hamilton notes that there is usually a lagged response to oil price increases, and the worst impact from the sharp increase earlier this year would usually be expected at the end of this year - even though prices have since declined.

I recently completed a survey of a large number of academic studies that found a nonlinear economic response to oil price changes. One very well-established observation is that although oil price increases were often associated with economic recessions, oil price decreases did not bring about corresponding economic booms. ... An oil price increase that just reverses a recent price decrease does not seem to have the same economic effects as a price move that establishes new highs.

emphasis added

However, Hamilton continues:

My reading of developments during 2011 has been that, because of the very high gasoline prices we saw in 2008, U.S. car-buying habits never went back to the earlier patterns, and we did not see the same shock to U.S. automakers as accompanied some of the other, more disruptive oil shocks.So maybe the impact will be less than for previous price shocks. Lower oil and gasoline prices has to help a little, however as Hamilton concludes, the reasons for the recent oil price decline are not good news for the U.S. economy.

Quote of the Day: "If you don't have the demand, you don't hire the people"

by Calculated Risk on 8/14/2011 10:02:00 AM

From Alana Semuels at the LA Times: Companies are afraid to hire, even if business is improving

Though South Coast Shingle Co. is in the black for the first time in a few years, [Ross Riddle, the president] is fearful of hiring more people in what he believes is a shaky economy.Surveys have been showing that lack of demand has been the number one small business problem for over three years.

"I hear politicians say that businesses have money and they should be hiring," said Riddle ... "But if you don't have the demand, you don't hire the people."

And it seems like a vicious cycle:

The economy won't improve until businesses hire, but many won't hire without consumer demand, which is weak because of the current state of the job market and concerns about the future.Yesterday:

...

Riddle is also wary. Having ridden out the housing downturn, he seems as eager to pinch pennies as a grandmother who suffered through the Great Depression. He's decided to put off buying new trucks and forklifts this year, although he usually buys one of each annually.

"We're making money now, but we still have five months left in the year," he said. "Who knows what's going to happen?"

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Saturday, August 13, 2011

White House Debates Doing Little or Nothing

by Calculated Risk on 8/13/2011 10:46:00 PM

This is depressing ...from the NY Times: White House Debates Fight on Economy

Mr. Obama’s senior adviser, David Plouffe, and his chief of staff, William M. Daley, want him to maintain a pragmatic strategy of appealing to independent voters by advocating ideas that can pass Congress, even if they may not have much economic impact. These include free trade agreements and improved patent protections for inventors.Tax incentives are the "bigger idea"? It sounds like the debate is between doing nothing and doing very little.

But others, including Gene Sperling, Mr. Obama’s chief economic adviser [argue] for bigger ideas like tax incentives for businesses that hire more workers ...

If I arrived on the scene today - with a 9.1% unemployment rate and about 4.6 million homes with seriously delinquent mortgages or REO - I'd be arguing for an aggressive policy response.

Unofficial Problem Bank list at 988 Institutions

by Calculated Risk on 8/13/2011 07:32:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 13, 2011.

Changes and comments from surferdude808:

The total number of institutions on the Unofficial Problem Bank Lists remains unchanged from last week at 988. However, there were two removals and two additions. Aggregate assets declined slightly by $391 million to $411.3 billion.It seems like the number of mergers has increased recently.

The removals include the failed The First National Bank of Olathe, Olathe, KS ($572 million) and Citizens Bank of Spencer, Tenn., Spencer, TN ($46 million), which merged on an unassisted basis. The additions were State Bank of Herscher, Herscher, IL ($195 million) and Texas Coastal Bank, Pasadena, TX ($32 million).

The other change is the issuance of a Prompt Corrective Action order by the Federal Reserve against Bank of the Eastern Shore, Cambridge, MD ($190 million). Next week, we anticipate the OCC releasing its actions through the middle of July. This will be the first monthly release after the merger of the OCC with the OTS.

Earlier:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Schedule for Week of August 14th

by Calculated Risk on 8/13/2011 02:47:00 PM

Earlier: Summary for Week Ending August 12th

Three key housing reports will be released this week: August homebuilder confidence on Monday, July housing starts on Tuesday, and July existing home sales on Thursday.

For manufacturing, the August NY Fed (Empire state) survey will be released on Monday, the August Philly Fed survey on Thursday, and the July Industrial Production and Capacity Utilization report on Tuesday.

On inflation, the July Producer Price index (PPI) will be released Wednesday and CPI will be released Thursday.

8:30 AM ET: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 1.0, up slightly from -3.8 in July (above zero is expansion).

10 AM ET: The August NAHB homebuilder survey. The consensus is for a reading of 15, unchanged from July. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

10:00 AM ET: NY Fed Q2 Report on Household Debt and Credit

8:30 AM: Housing Starts for July. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years.

8:30 AM: Housing Starts for July. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years. Total housing starts were at 629 thousand (SAAR) in June, up 14.6% from the revised May rate of 549 thousand. Single-family starts increased 9.4% to 453 thousand in June.

The consensus is for a decrease to 600,000 (SAAR) in July.

8:30 AM: Import and Export Prices for July. The consensus is a for a 0.1% decrease in import prices.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for July. This graph shows industrial production since 1967. Industrial production increased in June to 93.1.

The consensus is for a 0.5% increase in Industrial Production in July, and an increase to 77.0% (from 76.7%) for Capacity Utilization. The Ceridian index suggests Industrial Production was flat in July.

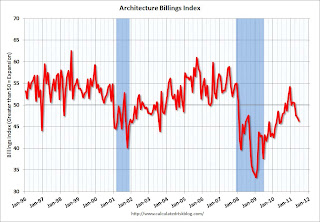

Early: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index decreased in June to 46.3 from 47.2 in May. Anything below 50 indicates a contraction in demand for architects' services.

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months, although refinance activity has picked up recently.

8:30 AM: Producer Price Index for July. The consensus is for no change in producer prices (0.2% increase in core).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 400,000 from 395,000 last week.

8:30 AM: Consumer Price Index for July. The consensus is for a 0.2% increase in prices. The consensus for core CPI is an increase of 0.2%.

10:00 AM: Philly Fed Survey for August. The consensus is for a reading of 4.0 (above zero indicates expansion), up from 3.2 last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July, up from 4.77 million SAAR in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July, up from 4.77 million SAAR in June.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected this fall.

10:00 AM: Conference Board Leading Indicators for July. The consensus is for a 0.2% increase for this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2011