by Calculated Risk on 8/13/2011 08:31:00 AM

Saturday, August 13, 2011

Summary for Week Ending August 12th

This was another wild and crazy week with significant volatility in the stock market. The two key concerns this week were the European financial crisis and the weaker economic outlook (not new concerns, just more worrisome). In Europe there were growing concerns about France and French banks, and this led to several countries banning some stock short selling by the end of the week. (short-selling bans always seems like desperation).

In the U.S., the debate of a “double dip” recession really picked up. In response to the weaker outlook, the Fed significantly extended the “extended period” language. The FOMC “anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013." This statement put many analysts on “QE3 watch”.

While the market was on a roller-coaster, there was little economic data last week. Retail sales were solid in July – a bit surprising since there were so many reports of the economy freezing for almost two weeks during the debt ceiling debate. And initial weekly unemployment claims were under 400 thousand for the first time since early April.

The trade deficit was larger than expected in June, suggesting Q2 GDP will be revised down, possibly below 1%. Consumer sentiment was very weak in early August – the lowest level in 30 years – probably because of the debt ceiling debate. And small business optimism declined further in July.

Here is a summary in graphs:

• Retail Sales increased 0.5% in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales seemed to stall in March, but are now moving higher again.

On a monthly basis, retail sales increased 0.5% from June to July (seasonally adjusted, after revisions), and sales were up 8.5% from July 2010. Retail sales excluding auto also increased 0.5% in July.

The increase was slightly below expectations for total retail sales, however, including the upward revision for June, this was a solid report.

• Trade Deficit increased in June

The Department of Commerce reports:

[T]otal June exports of $170.9 billion and imports of $223.9 billion resulted in a goods and services deficit of $53.1 billion, up from $50.8 billion in May, revised. June exports were $4.1 billion less than May exports of $175.0 billion. June imports were $1.9 billion less than May imports of $225.8 billion.The trade deficit was well above the consensus forecast of $48 billion.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.Both exports and imports decreased in June (seasonally adjusted). Exports are well above the pre-recession peak and up 13% compared to June 2010; imports are almost back to the pre-recession peak, and up about 13% compared to June 2010.

Oil averaged $106.00 per barrel in June, down from $108.70 per barrel in May. There is a bit of a lag with prices, and import prices will fall further in July.

The trade deficit with China increased to $26.7 billion; trade with China remains a significant issue.

• Weekly Initial Unemployment Claims declined to 395,000

The DOL reports:

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 395,000, a decrease of 7,000 from the previous week's revised figure of 402,000. The 4-week moving average was 405,000, a decrease of 3,250 from the previous week's revised average of 408,250.

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 405,000.

The 4-week average is still elevated, but has been moving down since mid-May. This is the lowest level for the 4-week average since early April and the first week under 400,000 since April 2nd.

• Consumer Sentiment declines sharply in August

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July.

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However I think this month was different. I think consumer sentiment declined sharply because of the heavy coverage of the debt ceiling debate.

• BLS: Job Openings "essentially unchanged" in June

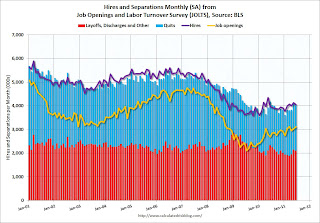

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. This report is for June, the most recent employment report was for July.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.In general job openings (yellow) have been trending up - and job openings increased slightly again in June - and are up about 16% year-over-year compared to June 2010.

Overall turnover is increasing too, but remains low. Quits decreased slightly in June, but have been trending up - and quits are now up about 4% year-over-year.

• Ceridian-UCLA: Diesel Fuel index decreased slightly in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in JulyThis graph shows the index since January 2000.

This index has mostly been moving sideways all year. Note: This index does appear to track Industrial Production over time (with plenty of noise).

• NFIB: Small Business Optimism Index declines in July

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward Trajectory

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward TrajectoryThis graph shows the small business optimism index since 1986. The index decreased to 89.9 in July from 90.8 in June.

Optimism has declined for five consecutive months now.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• Other Economic Stories ...

• FOMC Statement: "exceptionally low levels for the federal funds rate at least through mid-2013"

• The QE3 Watch

• FHFA, Treasury, HUD Seek Input on Disposition of REOs

Have a great weekend!

Friday, August 12, 2011

Comparisons to Japan

by Calculated Risk on 8/12/2011 09:28:00 PM

I'm sure we will see more comparisons to Japan like this one (ht jb).

From Matt Phillips and Justin Lahart at the WSJ: This Time, Maybe the U.S. Is Japan

Since Standard & Poor's stripped the U.S. of its triple-A credit rating on Aug. 5 and the Federal Reserve followed on Tuesday with a statement that interest rates will be at near-zero until at least mid-2013, bond traders have been recasting their models. Many have been using the experience of Japan, which was first downgraded from triple-A in 1998 and has had near-zero rates for the better part of a decade.There are differences - like a growing population, but it does look more and more like ... Bernanke-san!

...

As an economist at the New York Federal Reserve, Kenneth Kuttner wrote a paper explaining why, in the aftermath of the dot-com bust, the U.S. was decidedly not like Japan. The stock market decline paled in comparison to the bursting of Japan's real estate bubble, the financial system was strong and the U.S. government had the fiscal leeway to boost spending if the economy weakened. "It was very easy to be smug at that point," says Mr. Kuttner, now a professor at Williams College. "Now, I'm running out of reasons to say the U.S. is all that different."

Earlier:

• Retail Sales increased 0.5% in July

• Consumer Sentiment declines sharply in August

Bank Failure #64 in 2011: First National Bank of Olathe, Olathe, Kansas

by Calculated Risk on 8/12/2011 06:14:00 PM

Dehydrated Kansas Bank

Feds tilling under

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, Clayton, Missouri, Assumes All of the Deposits of First National Bank of Olathe, Olathe, Kansas

As of June 30, 2011, First National Bank of Olathe had approximately $538.1 million in total assets and $524.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $116.6 million. ... First National Bank of Olathe is the 64th FDIC-insured institution to fail in the nation this year, and the first in Kansas."It's Friday, Friday ... Everybody's lookin' forward to the weekend, weekend ..." Rebecca Black

Misc: Market and Italy

by Calculated Risk on 8/12/2011 04:30:00 PM

Below is a stock market graph from Doug Short, but first ...

From the BBC: New Italian debt plan announced

The Italian government, led by Prime Minister Silvio Berlusconi, has announced a fresh round of austerity measures.

The 45bn euro ($64bn, £40bn) plan aims to balance the budget by 2013, a year earlier than planned. ... The cabinet agreed to 20bn euros of cuts in 2012 and 25bn in 2013.

The measures still need to be approved by the Italian parliament.

The measures include a new "solidarity tax" on high earners ...

Click on graph for larger image.

The Dow was up 125 points and the S&P 500 was up 0.5% - a mild day compared to the previous four days. The Dow was off about 175 points for the week.

Appeals Court Rules failure to properly disclose teaser rate for Option ARM might constitute Fraud

by Calculated Risk on 8/12/2011 01:05:00 PM

This is an interesting California Appeal Court ruling in the case BOSCHMA et al., Plaintiffs and Appellants, v. HOME LOAN CENTER, INC.

The plaintiffs are arguing that defendant failed to disclose prior to plaintiffs entering into their Option ARMs: (1) the loans were designed to cause negative amortization to occur; (2) the monthly payment amounts listed in the loan documents for the first two to five years of the loans were based entirely upon a low teaser‘ interest rate (though not disclosed as such by Defendants) which existed for only a single month and which was substantially lower than the actual interest rate that would be charged, such that these payment amounts would never be sufficient to pay the interest due each month; and (3) when [plaintiffs] followed the contractual payment schedule in the loan documents, negative amortization was certain to occur, resulting in a significant loss of equity in borrowers‘ homes, and making it much more difficult for borrowers to refinance the loans [because of the prepayment penalty included in the loan for paying off the loan within the first three years of the loan]; thus, as each month passed, the homeowners would actually owe more money than they did at the outset of the loan, with less time to repay it.

The court ruled that even though someone with industry knowledge could figure out the details, the teaser rate wasn't properly disclosed: The root of the alleged deficiencies in defendant‘s disclosures is defendant‘s use of a significantly discounted teaser rate rather than an initial rate set near the rate that would result from the application of the variable rate formula in the Note (an index plus 3.5/3.25 percent). The teaser rate creates an artificially low (compared to the actual cost of credit) initial payment schedule and guarantees that the actual applicable interest rate (after the first month of the loan) will exceed the interest rate used to calculate the payment schedule for the initial years of the loan. If the initial interest rate were set using the Note‘s variable rate formula, it would actually be possible that interest rates would adjust downward (or stay the same) after the first payment and no negative amortization would occur. In other words, the disclosures‘ conditional language is accurate absent a significantly discounted rate. An Option ARM loan without a teaser rate would result in a higher initial interest rate, higher initial minimum payments pursuant to the payment schedule, and a much narrower gap (even if interest rates increased) between the borrower‘s payment ―options. Of course, without a teaser rate, the surface attractiveness of Option ARMs would have been greatly diminished precisely because the stated (initial) interest rate and (initial) payment would be higher. (emphasis added).

The court wasn't sure about damages though: Did plaintiffs suffer damages as a result of defendant‘s fraud? Plaintiffs‘ theory of damages (lost home equity) is problematic. Every month in which plaintiffs suffered negative amortization was a month in which they enjoyed payments lower than the amount needed to amortize the loan (or even to pay off the accruing interest). In exchange for gradually declining equity, plaintiffs retained liquid cash that they otherwise would have paid to defendant (or another lender). Viewed in this manner, plaintiffs‘ only ―injury is the psychological revelation (whenever it occurred) that they were not receiving a free lunch from defendant: plaintiffs could have low payments or pay off their loan, but not both at the same time. But plaintiffs‘ allegation of lost equity in their homes is sufficient at this stage of the proceedings to overrule defendant‘s demurrer. We construe plaintiffs‘ allegations (including the allegation that the prepayment penalty precluded refinancing into a better loan) broadly to encompass an assertion that they were misled into agreeing to Option ARMs, which led to lost equity in their homes because the terms of the Option ARMs put them in a worse economic position than they would have been had they utilized a different credit product.

Although it is clear one plaintiff used the Option ARM to refinance (so the damages are "problematic"), it is unclear if the other plaintiff used the Option ARM to refinance or to purchase a home. I think the damages would be more clear for a home purchased in 2005 than for a refinance. At that time these products were being used inappropriately as affordability products, and if the teaser rate had been properly disclosed, the plaintiff might not have bought the home and wouldn't have suffered significant losses.

As a reminder, back in 2005 it was common to qualify borrowers not using a fully amortizing rate. Options ARMs were frequently used as an affordability product; they were the only way to buy a home for many borrowers. (I was actively contacting regulators in 2005 to try to get that changed). The rule wasn't changed until the Non-Traditional Mortgage Guidance was released in Sept 2006 (a little too late).

Consumer Sentiment declines sharply in August

by Calculated Risk on 8/12/2011 09:55:00 AM

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However I think this month was different. I think consumer sentiment declined sharply because of the heavy coverage of the debt ceiling debate (update: this was polled before the S&P downgrade).

This was well below the consensus forecast of 63.0.

Retail Sales increased 0.5% in July

by Calculated Risk on 8/12/2011 08:30:00 AM

On a monthly basis, retail sales increased 0.5% from June to July (seasonally adjusted, after revisions), and sales were up 8.5% from July 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $390.4 billion, an increase of 0.5 percent from the previous month, and 8.5 percent above July 2010. ... The May to June 2011 percent change was revised from +0.1 percent to +0.3 percent.Retail sales excluding auto also increased 0.5% in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales seemed to stall in March, but are now moving higher again.

Retail sales are up 17.4% from the bottom, and now 3.2% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.9% on a YoY basis (8.5% for all retail sales).

Retail sales ex-gasoline increased by 6.9% on a YoY basis (8.5% for all retail sales). The consensus was for retail sales to increase 0.6% in July, and for a 0.3% increase ex-auto.

The reported increase was slightly below expectations for total retail sales, however including the upward revision for June, this was a solid report.

Thursday, August 11, 2011

Gasoline Prices expected to decline sharply

by Calculated Risk on 8/11/2011 10:52:00 PM

Since I haven't posted on gasoline prices in some time ... from Ronald White at the LA Times: Gas prices expected to fall

"If oil remains low, the national average for gasoline will fall to $3.25 to $3.40 in the next two to three weeks as retailers slowly lower their prices to reflect their drop in cost," said Patrick DeHaan, senior energy analyst for GasBuddy.com, a website that lists retail gasoline prices.Another price decline would be good news, but it just takes us back close to the late February and early March levels - and March is when Personal Consumption Expenditure (PCE) growth slowed, and consumer sentiment fell sharply.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Distressed House Sales using Sacramento data

by Calculated Risk on 8/11/2011 06:51:00 PM

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

I'm not exactly sure what I'm looking for, but hopefully I'll know it when I see it! As some point, the number (and percent) of distressed sales will start to decline without foreclosure moratoria, homebuyer tax credits or other distortions.

The percent of distressed sales in Sacramento declined in July compared to June. Some of this decline could be seasonal, and some could be due to further foreclosure delays. In July 2011, 61.3% of all resales (single family homes and condos) were distressed sales. This is down from 65.2% in June, and down from 63.0% in July 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Total sales were up 15.1% over July 2010 (sales fell last July after the tax credit expired, so a year-over-year increase was expected). Sales are down 13% compared to July 2009 and 19% compared to July 2008 - mostly due to fewer distressed sales.

Active Listing Inventory is down 21.1% from last July - we are seeing a decline in inventory in most areas. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

Misc: Dow up 400+, S&P 500 up 4.6%

by Calculated Risk on 8/11/2011 04:26:00 PM

Below is a stock market graph from Doug Short, but first a few stories ...

UPDATE: Regulators Bans some short selling in Belgium, France, Italy and Spain. From European Securities and Markets Authority: ESMA promotes harmonised regulatory action on short-selling in the EU

• From the NY Times: Europe Considers Ban on Short-Selling

The European Securities and Markets Authority, a body that coordinates the European Union’s market policies, has been requesting information from member states about ... short-sales ... “We are discussing with national authorities and together we will decide whether we need coordinated action,” Victoria Powell, a spokeswoman for the authority, said Thursday.Banning short sales always looks like desperation.

• From MarketWatch: Second-quarter GDP view cut after trade data. With the higher than expected trade deficit in June it looks like Q2 real GDP growth might have been below 1% for the 2nd straight quarter. The 2nd estimate of Q2 GDP will be released on August 26th.

• From MasterCard: Total U.S. Retail Sales for July Up 8.7% Year-over-Year

Excluding auto sales retail sales grew by 8.7% year-over-year. Retail sales are on par with the average growth of the previous 3 months, and have held onto their momentum despite concerns from other areas of the economy.Retail sales for July will be released tomorrow.

Michael McNamara, VP of Research and Analysis for MasterCard Advisors SpendingPulse, noted: “Since March, non seasonally-adjusted retail sales have topped 8% year-over-year. However, much of the 8.7 percent growth is from commodity based inflation in areas such as gasoline, food and cotton prices. While the headline year-over-year increase resembles periods of strong economic growth, when you take a closer look at the comp environment and the year-over-year inflation, it tempers the enthusiasm that would normally accompany this level of year-over-year increase.”

Click on graph for larger image.

A crazy week with four straight days of 400+ point swings for the Dow.