by Calculated Risk on 8/13/2011 08:31:00 AM

Saturday, August 13, 2011

Summary for Week Ending August 12th

This was another wild and crazy week with significant volatility in the stock market. The two key concerns this week were the European financial crisis and the weaker economic outlook (not new concerns, just more worrisome). In Europe there were growing concerns about France and French banks, and this led to several countries banning some stock short selling by the end of the week. (short-selling bans always seems like desperation).

In the U.S., the debate of a “double dip” recession really picked up. In response to the weaker outlook, the Fed significantly extended the “extended period” language. The FOMC “anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013." This statement put many analysts on “QE3 watch”.

While the market was on a roller-coaster, there was little economic data last week. Retail sales were solid in July – a bit surprising since there were so many reports of the economy freezing for almost two weeks during the debt ceiling debate. And initial weekly unemployment claims were under 400 thousand for the first time since early April.

The trade deficit was larger than expected in June, suggesting Q2 GDP will be revised down, possibly below 1%. Consumer sentiment was very weak in early August – the lowest level in 30 years – probably because of the debt ceiling debate. And small business optimism declined further in July.

Here is a summary in graphs:

• Retail Sales increased 0.5% in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales seemed to stall in March, but are now moving higher again.

On a monthly basis, retail sales increased 0.5% from June to July (seasonally adjusted, after revisions), and sales were up 8.5% from July 2010. Retail sales excluding auto also increased 0.5% in July.

The increase was slightly below expectations for total retail sales, however, including the upward revision for June, this was a solid report.

• Trade Deficit increased in June

The Department of Commerce reports:

[T]otal June exports of $170.9 billion and imports of $223.9 billion resulted in a goods and services deficit of $53.1 billion, up from $50.8 billion in May, revised. June exports were $4.1 billion less than May exports of $175.0 billion. June imports were $1.9 billion less than May imports of $225.8 billion.The trade deficit was well above the consensus forecast of $48 billion.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.Both exports and imports decreased in June (seasonally adjusted). Exports are well above the pre-recession peak and up 13% compared to June 2010; imports are almost back to the pre-recession peak, and up about 13% compared to June 2010.

Oil averaged $106.00 per barrel in June, down from $108.70 per barrel in May. There is a bit of a lag with prices, and import prices will fall further in July.

The trade deficit with China increased to $26.7 billion; trade with China remains a significant issue.

• Weekly Initial Unemployment Claims declined to 395,000

The DOL reports:

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 395,000, a decrease of 7,000 from the previous week's revised figure of 402,000. The 4-week moving average was 405,000, a decrease of 3,250 from the previous week's revised average of 408,250.

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 405,000.

The 4-week average is still elevated, but has been moving down since mid-May. This is the lowest level for the 4-week average since early April and the first week under 400,000 since April 2nd.

• Consumer Sentiment declines sharply in August

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July.

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However I think this month was different. I think consumer sentiment declined sharply because of the heavy coverage of the debt ceiling debate.

• BLS: Job Openings "essentially unchanged" in June

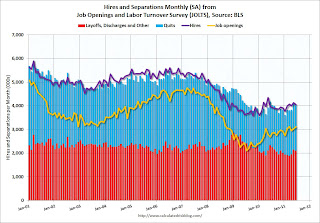

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. This report is for June, the most recent employment report was for July.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.In general job openings (yellow) have been trending up - and job openings increased slightly again in June - and are up about 16% year-over-year compared to June 2010.

Overall turnover is increasing too, but remains low. Quits decreased slightly in June, but have been trending up - and quits are now up about 4% year-over-year.

• Ceridian-UCLA: Diesel Fuel index decreased slightly in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in JulyThis graph shows the index since January 2000.

This index has mostly been moving sideways all year. Note: This index does appear to track Industrial Production over time (with plenty of noise).

• NFIB: Small Business Optimism Index declines in July

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward Trajectory

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward TrajectoryThis graph shows the small business optimism index since 1986. The index decreased to 89.9 in July from 90.8 in June.

Optimism has declined for five consecutive months now.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• Other Economic Stories ...

• FOMC Statement: "exceptionally low levels for the federal funds rate at least through mid-2013"

• The QE3 Watch

• FHFA, Treasury, HUD Seek Input on Disposition of REOs

Have a great weekend!