by Calculated Risk on 8/10/2011 04:14:00 PM

Wednesday, August 10, 2011

Dow Down 500+, S&P 500 down 4.4%

This was the third big down day this month ...

From the WSJ: Stocks Slide 4.6%, Erasing Tuesday Gains

The Dow Jones Industrial Average fell 520.29 points, or 4.6%, to 10719.48, while the Standard & Poor's 500-stock index slid 51.83 points, or 4.4%, to 1120.70 and the Nasdaq Composite lost 101.47 points, or 4.1%, to 2381.05.The table below shows the largest down days on the S&P 500 since 1950.

... In a reflection of investor concern, the CBOE Market Volatility Index, the "fear gauge" known as the VIX, surged 18%

| Largest S&P 500 One Day Percentage Declines since 1950 | ||||||

|---|---|---|---|---|---|---|

| Date | Percent Decline | Close | Previous Close | Six Months Later | ||

| 1 | 10/19/1987 | -20.5% | 224.84 | 282.7 | 15.3% | |

| 2 | 10/15/2008 | -9.0% | 907.84 | 998.01 | -4.7% | |

| 3 | 12/1/2008 | -8.9% | 816.21 | 896.24 | 15.7% | |

| 4 | 9/29/2008 | -8.8% | 1106.42 | 1213.27 | -28.8% | |

| 5 | 10/26/1987 | -8.3% | 227.67 | 248.22 | 15.3% | |

| 6 | 10/9/2008 | -7.6% | 909.92 | 984.94 | -5.9% | |

| 7 | 10/27/1997 | -6.9% | 876.99 | 941.64 | 23.7% | |

| 8 | 8/31/1998 | -6.8% | 957.28 | 1027.14 | 28.0% | |

| 9 | 1/8/1988 | -6.8% | 243.4 | 261.07 | 11.7% | |

| 10 | 11/20/2008 | -6.7% | 752.44 | 806.58 | 17.9% | |

| 11 | 5/28/1962 | -6.7% | 55.5 | 59.47 | 10.6% | |

| 12 | 8/8/2011 | -6.7% | 1,119.47 | 1199.38 | --- | |

| 13 | 9/26/1955 | -6.6% | 42.61 | 45.63 | 14.1% | |

| 14 | 10/13/1989 | -6.1% | 333.65 | 355.39 | 3.2% | |

| 15 | 11/19/2008 | -6.1% | 806.58 | 859.12 | 10.1% | |

| 16 | 10/22/2008 | -6.1% | 896.78 | 955.05 | -5.0% | |

| 17 | 4/14/2000 | -5.8% | 1356.56 | 1440.51 | -2.0% | |

| 18 | 10/7/2008 | -5.7% | 996.23 | 1056.89 | -18.1% | |

| 19 | 6/26/1950 | -5.4% | 18.11 | 19.14 | 10.0% | |

| 20 | 1/20/2009 | -5.3% | 805.22 | 850.12 | 18.1% | |

| 21 | 11/5/2008 | -5.3% | 952.77 | 1005.75 | -4.8% | |

| 22 | 11/12/2008 | -5.2% | 852.3 | 898.95 | 4.8% | |

| 23 | 10/16/1987 | -5.2% | 282.7 | 298.08 | -8.1% | |

| 24 | 11/6/2008 | -5.0% | 904.88 | 952.77 | 2.7% | |

| 25 | 9/17/2001 | -4.9% | 1038.77 | 1092.54 | 12.2% | |

| 26 | 2/10/2009 | -4.9% | 827.16 | 869.89 | 21.8% | |

| 27 | 9/11/1986 | -4.8% | 235.18 | 247.06 | 23.4% | |

| 28 | 8/4/2011 | -4.8% | 1200.07 | 1260.34 | --- | |

| 29 | 9/17/2008 | -4.7% | 1156.39 | 1213.6 | -31.3% | |

| 30 | 9/15/2008 | -4.7% | 1192.7 | 1251.7 | -36.8% | |

| 31 | 3/2/2009 | -4.7% | 700.82 | 735.09 | 47.1% | |

| 32 | 2/17/2009 | -4.6% | 789.17 | 826.84 | 27.2% | |

| 33 | 8/10/2011 | -4.4% | 1,120.75 | 1172.53 | --- | |

| 34 | 4/14/1988 | -4.4% | 259.75 | 271.58 | 7.0% | |

| 35 | 3/12/2001 | -4.3% | 1180.16 | 1233.42 | -8.0% | |

| 36 | 4/20/2009 | -4.3% | 832.39 | 869.6 | 31.7% | |

| 37 | 3/5/2009 | -4.3% | 682.55 | 712.87 | 46.2% | |

| 38 | 11/30/1987 | -4.2% | 230.3 | 240.34 | 10.0% | |

| 39 | 11/14/2008 | -4.2% | 873.29 | 911.29 | 4.2% | |

| 40 | 9/3/2002 | -4.2% | 878.02 | 916.07 | -6.4% | |

| 41 | 10/2/2008 | -4.0% | 1114.28 | 1161.06 | -25.1% | |

| 42 | 10/25/1982 | -4.0% | 133.32 | 138.83 | 20.3% | |

HousingTracker: Homes For Sale inventory down 13.3% Year-over-year in mid-August

by Calculated Risk on 8/10/2011 03:39:00 PM

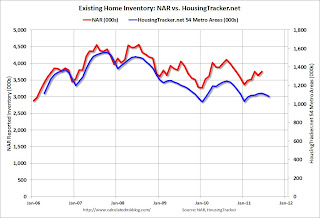

Back in June, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory). Sometime this fall, the NAR is expected to revise down their estimates of inventory and sales for the last few years.

While we wait for the NAR revisions, I think the HousingTracker data that Tom mentioned might be a better estimate of changes in inventory (and always more timely). Ben at HousingTracker.net is tracking the aggregate monthly inventory for 54 metro areas.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through mid-August. The HousingTracker data shows a steeper decline (as mentioned above, the NAR will probably revise down their inventory estimates this summer).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the mid-August listings - for the 54 metro areas - declined 13.3% from last year.

Of course there is a large percentage of distressed inventory, many seriously delinquent loans and various categories of "shadow inventory" too. But the decline in listed inventory is something to watch carefully.

The QE3 Watch

by Calculated Risk on 8/10/2011 01:01:00 PM

It was obvious the Fed would not announce QE3 yesterday. Instead they announced an extended "extended period". But they also hinted at QE3 in the last couple of sentences of the statement:

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ these tools as appropriate.That led Goldman Sachs chief economist Jan Hatzius to write last night: "QE3 Now Our Base Case"

We now see a greater-than-even chance that the FOMC will resume quantitative easing later this year or in early 2012.Last year, Fed Chairman Ben Bernanke paved the way for QE2 at the Jackson Hole economic symposium. Here is his speech from last August.

This year Bernanke will speak on August 26th at the Kansas City Economic Symposium in Jackson Hole, Wymong.

More from Hatzius:

Although QE3 is now our base case, it is not a certainty. We see three main ways in which our revised call could turn out to be incorrect. First, of course, the economy may turn out to be stronger than our forecast. ... Second, inflation might pose a higher hurdle to additional easing than we have allowed. ... Third, the anti-Fed backlash late last year might argue against further QE.Earlier Bernanke made it clear that further accommodation would require both a weaker economy and a renewed threat of deflation. Although the economy is weaker than the Fed expected, I think the Fed will wait for more evidence of a threat of deflation.

BLS: Job Openings "essentially unchanged" in June

by Calculated Risk on 8/10/2011 10:15:00 AM

From the BLS: Job Openings and Labor Turnover Summary

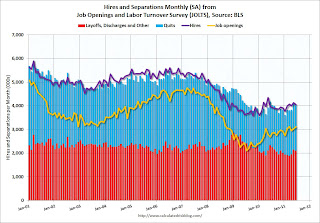

The number of job openings in June was 3.1 million, essentially unchanged from May. Although the number of job openings in June was 997,000 higher than in July 2009 (the series trough), it has been relatively flat since February 2011 and remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in June - and are up about 16% year-over-year compared to June 2010.

Overall turnover is increasing too, but remains low. Quits decreased slightly in June, but have been trending up - and quits are now up about 4% year-over-year.

Ceridian-UCLA: Diesel Fuel index decreased slightly in July

by Calculated Risk on 8/10/2011 09:00:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in July

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation dipped 0.2 percent in July on a seasonally and workday adjusted basis, offsetting some of the relatively strong 1.0 percent gain posted in June.

“In July, the U.S. economy remained in ‘she loves me, she loves me not’ mode,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “July’s result falls in the ‘she loves me not’ category and represents a continuation of the idling economic conditions that have persisted for over a year. Over this time period, bad news has been alternating with good, leaving investors and forecasters nervous and unable to identify sustainable trends.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

“Over time, the PCI has also proven to be a leading and amplified indicator of Industrial Production”, explained Craig Manson, senior vice president and Index expert for Ceridian. “For June, the PCI was anticipating Industrial Production to show modest growth of 0.17 percent. The government’s subsequent release on July 15, 2011 turned out to be 0.19 percent, which was almost identical to our forecast. This represented the fifth time in the past six months in which the monthly PCI forecast for U.S. Industrial Production was right in-line with the government’s subsequent report. Based on the weakness evident in the PCI over the last several months, our forecast calls for a flat performance in July Industrial Production when the government estimate is released on August 16.”This index has mostly been moving sideways all year. Note: This index does appear to track Industrial Production over time (with plenty of noise).

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

MBA: Mortgage Refinance Applications Increase Significantly

by Calculated Risk on 8/10/2011 07:41:00 AM

The MBA reports: Mortgage Applications Increase Significantly, Driven by Surge in Refinance Activity

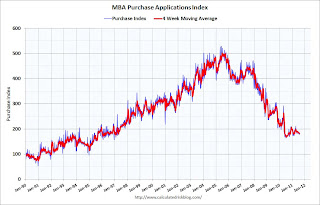

The Refinance Index increased 30.4 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Amid substantial market turmoil last week, mortgage rates dropped to their lowest levels of the year, and refinance applications jumped more than 30 percent to their highest levels of the year," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Over the past month, refinance application volume has increased by 63 percent. Refinance applications for jumbo loans increased by almost 75 percent relative to last week. Despite these low mortgage rates, applications for home purchase have remained little changed through the summer."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.37 percent from 4.45 percent, with points increasing to 1.07 from 0.78 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is at best moving sideways at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

But refinance activity is picking up again!

Tuesday, August 09, 2011

Update: ECB Bond Buying

by Calculated Risk on 8/09/2011 07:27:00 PM

A little calmer in the European debt markets.

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany.

The Italian spread is at 281, down from 371 last week, and the Spanish spread is at 271 down from 387. The yield on the Spanish Ten year bond is down to 5.1%, and the Italian 10 year is down to 5.2%. From the WSJ: ECB Move on Italy, Spain Calms Market

The ECB will disclose its total purchases for the week on Monday, but some analysts estimate the ECB bought at least €3.5 billion ($5 billion) on Monday and billions more Tuesday—however, a small fraction relative to the size of Spain and Italy's debt markets.The yield on the Portuguese 2 year is down to 11.8%. From the NY Times: Portugal Faces Challenges in Meeting Bailout Terms

Three months after approving a €78 billion, or $111 billion, bailout for Portugal, officials from the International Monetary Fund, the European Commission and the European Central Bank are conducting their first review of progress toward meeting conditions set for emergency financing. Those include budget cuts and an economic overhaul intended to stimulate growth.The Irish 2 year yield is down sharply to 10.8%. However the yield on the Greek 2 year is up to 34.6%!

Portuguese officials and business executives expect a broadly favorable assessment ...

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Dow up 420+, S&P up 4.7%

by Calculated Risk on 8/09/2011 04:36:00 PM

Yesterday I posted a table of the largest one day declines since 1950 in percentage terms. Below is a table of the largest one day increases. Note that the largest increases happened in 2008 during the bear market.

From MarketWatch: U.S. stocks stage rapid recovery to close up 4%

U.S. stocks rocketed to their best one-day gain since March 2009 ... The Dow Jones Industrial ended up 429.92 points ... The S&P 500 added 53.07 points, or 4.7% ... The Nasdaq added 124.83 points, or 5.3%.Here is a table of the largest one day increases (in percentage terms) for the S&P 500 since January 1950. There were quite a few large up and down days in 2008 ... today is highlighted in red.

| Largest S&P 500 One Day Percentage Increases since 1950 | ||||||

|---|---|---|---|---|---|---|

| Date | Percent Increase | Close | Previous Close | Six Months Later | ||

| 1 | 10/13/08 | 11.6% | 1003.35 | 899.22 | -16.1% | |

| 2 | 10/28/08 | 10.8% | 940.51 | 848.92 | -7.1% | |

| 3 | 10/21/87 | 9.1% | 258.38 | 236.83 | -0.9% | |

| 4 | 3/23/09 | 7.1% | 822.92 | 768.54 | 29.8% | |

| 5 | 11/13/08 | 6.9% | 911.29 | 852.3 | -3.1% | |

| 6 | 11/24/08 | 6.5% | 851.81 | 800.03 | 4.8% | |

| 7 | 3/10/09 | 6.4% | 719.6 | 676.53 | 41.2% | |

| 8 | 11/21/08 | 6.3% | 800.03 | 752.44 | 13.8% | |

| 9 | 7/24/02 | 5.7% | 843.43 | 797.7 | 4.1% | |

| 10 | 9/30/08 | 5.4% | 1166.36 | 1106.42 | -31.6% | |

| 11 | 7/29/02 | 5.4% | 898.96 | 852.84 | -5.7% | |

| 12 | 10/20/87 | 5.3% | 236.83 | 224.84 | 8.9% | |

| 13 | 12/16/08 | 5.1% | 913.18 | 868.57 | -0.3% | |

| 14 | 10/28/97 | 5.1% | 921.85 | 876.99 | 18.7% | |

| 15 | 9/8/98 | 5.1% | 1023.46 | 973.89 | 25.1% | |

| 16 | 5/27/70 | 5.0% | 72.77 | 69.29 | 15.0% | |

| 17 | 1/3/01 | 5.0% | 1347.56 | 1283.27 | -8.4% | |

| 18 | 10/29/87 | 4.9% | 244.77 | 233.28 | 7.3% | |

| 19 | 10/20/08 | 4.8% | 985.4 | 940.55 | -13.7% | |

| 20 | 3/16/00 | 4.8% | 1458.47 | 1392.14 | 1.8% | |

| 21 | 8/17/82 | 4.8% | 109.04 | 104.09 | 35.4% | |

| 22 | 8/9/11 | 4.7% | 1172.53 | 1119.46 | --- | |

| 23 | 10/15/02 | 4.7% | 881.27 | 841.44 | 1.1% | |

| 24 | 5/29/62 | 4.6% | 58.08 | 55.5 | 6.3% | |

| 25 | 10/9/74 | 4.6% | 67.82 | 64.84 | 22.1% | |

| 26 | 10/23/57 | 4.5% | 40.73 | 38.98 | 5.1% | |

| 27 | 5/10/10 | 4.4% | 1159.73 | 1110.88 | 5.3% | |

| 28 | 4/5/01 | 4.4% | 1151.44 | 1103.25 | -8.2% | |

| 29 | 1/21/09 | 4.3% | 840.24 | 805.22 | 13.6% | |

| 30 | 9/18/08 | 4.3% | 1206.51 | 1156.39 | -35.0% | |

| 31 | 10/16/08 | 4.3% | 946.43 | 907.84 | -8.1% | |

| 32 | 3/18/08 | 4.2% | 1330.74 | 1276.6 | -10.4% | |

| 33 | 10/7/74 | 4.2% | 64.95 | 62.34 | 23.7% | |

| 34 | 10/15/98 | 4.2% | 1047.49 | 1005.53 | 25.9% | |

| 35 | 11/4/08 | 4.1% | 1005.75 | 966.3 | -8.6% | |

| 36 | 7/12/74 | 4.1% | 83.15 | 79.89 | -14.4% | |

| 37 | 3/12/09 | 4.1% | 750.74 | 721.36 | 37.6% | |

| 38 | 9/19/08 | 4.0% | 1255.08 | 1206.51 | -38.8% | |

| 39 | 2/24/09 | 4.0% | 773.14 | 743.33 | 32.7% | |

| 40 | 8/14/02 | 4.0% | 919.62 | 884.21 | -11.0% | |

| 41 | 10/1/02 | 4.0% | 847.91 | 815.28 | 1.2% | |

FOMC Statement: "exceptionally low levels for the federal funds rate at least through mid-2013"

by Calculated Risk on 8/09/2011 02:20:00 PM

From the Federal Reserve:

Information received since the Federal Open Market Committee met in June indicates that economic growth so far this year has been considerably slower than the Committee had expected. Indicators suggest a deterioration in overall labor market conditions in recent months, and the unemployment rate has moved up. Household spending has flattened out, investment in nonresidential structures is still weak, and the housing sector remains depressed. However, business investment in equipment and software continues to expand. Temporary factors, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan, appear to account for only some of the recent weakness in economic activity. Inflation picked up earlier in the year, mainly reflecting higher prices for some commodities and imported goods, as well as the supply chain disruptions. More recently, inflation has moderated as prices of energy and some commodities have declined from their earlier peaks. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee now expects a somewhat slower pace of recovery over coming quarters than it did at the time of the previous meeting and anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, downside risks to the economic outlook have increased. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. The Committee also will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ these tools as appropriate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

Voting against the action were: Richard W. Fisher, Narayana Kocherlakota, and Charles I. Plosser, who would have preferred to continue to describe economic conditions as likely to warrant exceptionally low levels for the federal funds rate for an extended period

FOMC Meeting Thoughts

by Calculated Risk on 8/09/2011 12:31:00 PM

The FOMC statement will be released around 2:15 PM ET today. This is a one day meeting of the FOMC and there will be no press briefing.

I posted some thoughts yesterday and here are few other articles:

• From Binyamin Appelbaum at the NY Times: Fed’s Elusive Prescriptions for an Erratic Ailment

Most public attention has focused on the possibility that the Fed will renew its asset purchases ... Instead, the Fed is more likely to begin any renewed aid campaign with smaller gestures.• From Patti Domm at CNBC: Fed Under Pressure to Soothe Markets

The most basic measure available to the Fed is to promise that it will keep interest rates near zero for at least six months, or a year, or some other specified period of time.

...

The Fed also could make a similar commitment for the first time regarding its huge investment portfolio ... a promise about the portfolio also would extend the Fed’s commitment to maintain low rates.

...

Another available option would be to maintain the size of the portfolio, but to shift its composition toward bonds with longer terms.

Economists have speculated the Fed could also reaffirm in its statement that it will hold rates low for an extended time, and it could also vow to keep its balance sheet extended, at nearly $3 trillion for a long period of time.• From Jon Hilsenrath at the WSJ: Fed Has Some Tricks Left, but None Are Magic

The Fed also could cut the interest rate on reserves from 0.25 percent to zero.

But it is not likely the Fed will embark any time soon on another quantitative easing program.

An announcement of QE3 seems extremely unlikely for the reasons I mentioned yesterday. Obviously the wording of the statement will change, and maybe the FOMC will commit to a longer "extended period", or commit to hold their investment portfolio for an extended period - or some of the other changes mentioned above.