by Calculated Risk on 7/07/2011 02:09:00 PM

Thursday, July 07, 2011

European Financial Crisis: Portugal Update

For a classic hockey stick formation, check on the 2 year yields for Portuguese and Irish bonds (table below). For Portugal, the 2 year yield is up to 17.5%, and for Ireland, the yield is 15.6%.

The yields for Italy and Spain are up too, and of special concern is the sharp increase in the Italian 10 year yield up to 5.2%.

From the ECB this morning: ECB announces change in eligibility of debt instruments issued or guaranteed by the Portuguese government

The Governing Council of the European Central Bank (ECB) has decided to suspend the application of the minimum credit rating threshold in the collateral eligibility requirements for the purposes of the Eurosystem’s credit operations in the case of marketable debt instruments issued or guaranteed by the Portuguese government. This suspension will be maintained until further notice.I guess they are tired of the credit agency downgrades.

The Portuguese government has approved an economic and financial adjustment programme, which has been negotiated with the European Commission, in liaison with the ECB, and the International Monetary Fund. The Governing Council has assessed the programme and considers it to be appropriate. This positive assessment and the strong commitment of the Portuguese government to fully implement the programme are the basis, also from a risk management perspective, for the suspension announced herewith.

The suspension applies to all outstanding and new marketable debt instruments issued or guaranteed by the Portuguese government.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Employment Situation Preview: More Payroll Jobs Added, Still Weak Overall

by Calculated Risk on 7/07/2011 10:50:00 AM

Tomorrow the BLS will release the June Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 110,000 payroll jobs in June, and for the unemployment rate to hold steady at 9.1%.

Last month I argued the consensus for payroll jobs added seemed too high; this month I think the consensus is too low. Note: Recently I've mostly been correct when I've taken the "under" for payroll jobs, but only right about half the time when I've taken the "over" - so flip a coin!

Here is a summary of recent data:

• The ADP employment report (private sector only) showed an increase of 157,000 payroll jobs in June. This was well above the 36,000 reported for May, but still below the 198,000 per month average for the first four months of 2011.

• Initial weekly unemployment claims averaged about 425,000 per week in June, about the same as in December 2010, and January and May 2011. The BLS reported an average of just 90 thousand payroll jobs added during those three months.

• The ISM manufacturing employment index increased to 59.9%, up from 58.2% in May, and the ISM non-manufacturing index increased slightly to 54.1%. Based on a historical correlation between the ISM indexes and the BLS employment report, these readings would suggest close to 200,000 private payroll jobs added for services and manufacturing in June.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices. Of course gasoline prices were falling in June - so this suggests weakness in the labor market.

• And on the unemployment rate from Gallup: Gallup Finds U.S. Unemployment at 8.7% in June

Unemployment, as measured by Gallup without seasonal adjustment, is at 8.7% at the end of June -- similar to the 8.9% in mid-June, but down from 9.2% at the end of May. It is also lower than it was during the same period a year ago.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate increases in June as teenagers join the labor force looking for summer jobs. A decline in the NSA unemployment from May suggests a decline in the SA rate too.

These indicators are mixed. Initial weekly unemployment claims and consumer sentiment suggests a pretty weak payroll report, but the ADP and ISM reports suggest a little better report. And of course state and local governments are still reducing payrolls.

My guess is payroll growth will still be weak in June - as expected following a housing bubble and financial crisis - but I'll take the over on payroll jobs and the under on the unemployment rate.

Weekly Initial Unemployment Claims decline to 418,000

by Calculated Risk on 7/07/2011 08:30:00 AM

The DOL reports:

In the week ending July 2, the advance figure for seasonally adjusted initial claims was 418,000, a decrease of 14,000 from the previous week's revised figure of 432,000. The 4-week moving average was 424,750, a decrease of 3,000 from the previous week's revised average of 427,750.This is the 13th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January.

Special Factor: Minnesota has indicated that approximately 2,500 of their reported initial claims are a result of state employees filing due to the state government shutdown.

The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased slightly this week to 424,750.

Weekly claims were below 400 thousand in March, and have increased back to just over 400 thousand for the last three months.

ADP: Private Employment increased by 157,000 in June

by Calculated Risk on 7/07/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 157,000 from May to June on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from April to May was revised down, but only slightly, to 36,000 from the initially reported 38,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Today’s ADP National Employment Report estimates employment in the service-providing sector rose by 130,000 in June, nearly three times faster than in May, marking 18 consecutive months of employment gains. Employment in the goods-producing sector rose 27,000 in June, more than reversing the decline of 10,000 in May. Manufacturing employment rose 24,000 in June, which has seen growth in seven of the past eight months.

This was well above the consensus forecast of an increase of 70,000 private sector jobs in June. The BLS reports on Friday, and the consensus is for an increase of 110,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

As I mentioned last night, the ISM employment indexes suggest that the consensus for June is a little low - and this ADP report also suggests that the BLS report might be above consensus on Friday.

Last night ...

• Reis: Apartment Vacancy Rate falls to 6% in Q2

Reis: Apartment Vacancy Rate falls to 6% in Q2

by Calculated Risk on 7/07/2011 12:32:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

Vacancies ... fell in 72 of the 82 markets during the second-quarter vacancy rate to 6%, the lowest since 2008 and compared with 7.8% a year earlier, according to Reis.

...

The average effective rent, the amount paid after discounting, was $997 in the second quarter of the year, up from $974 a year earlier ...

Landlords filled a net 33,000 units in the second quarter, a slowdown from the 45,000 units they filled in the first quarter.

...

Meanwhile, supply remains constrained. Roughly 8,700 new apartment units opened during the second quarter, the second-lowest quarterly tally for new completions since Reis began collecting data in 1999.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we've been discussing:

• Vacancy rates are falling fast (the excess supply is being absorbed). Note: The excess housing supply includes both apartments and single family homes.

• A record low number of multi-family units will be completed this year (2011). Only 8,700 apartments came on the market in Q1 (in the Reis survey area). This is the second lowest quarter since Reis has been tracking completions - the lowest was 6,000 last quarter.

• The falling vacancy rate is pushing push up effective rents. This also pulls down the price-to-rent ratio for house prices.

• Multi-family starts are increasing, and that will help both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably decline all year.

Wednesday, July 06, 2011

Goldman's Hatzius forecasts 125,000 payroll jobs added in June

by Calculated Risk on 7/06/2011 09:05:00 PM

From CNBC: June Jobs Data to Show 125,000 Added: Hatzius

"Clearly the economy weakened over the last few months so some deceleration makes sense," [Goldman Sachs chief U.S. economist Jan Hatzius] said, but the May figure [54,000 jobs added] was "below what other indicators of labor market activity would suggest."The consensus forecast, according to Bloomberg, is for an increase of 110,000 payroll jobs in June.

The June report, he said, will "provide a correction to that picture," although he said adding 125,000 jobs is "still not particularly strong."

CR Note: The labor indicators are mixed. Initial weekly unemployment claims have been fairly weak (above 400,000 per week all month), and the small business survey suggested June was a "bust". However the ISM employment indexes showed faster expansion in June.

The ISM manufacturing employment index increased to 59.9%, up from 58.2% in May, and the ISM non-manufacturing index increased slightly to 54.1%. Based on a historical correlation between the ISM indexes and the BLS employment report, these readings would suggest close to 200,000 payroll jobs added for private services and manufacturing in June (that seems high, but it is probably one of the indicators that Hatzius is looking at).

Report: $60 Billion Mortgage Servicer Settlement being Discussed

by Calculated Risk on 7/06/2011 05:13:00 PM

In February, the settlement was rumored to be $20 billion.

Then in May the settlement was rumored to be $5 Billion.

Now the NY Post is reporting $60 billion!

From the NY Post: AGs, banks near $60B deal on foreclosures

America's biggest mortgage servicers are closing in on a deal with federal and state officials to settle some of the thorniest foreclosure fiasco problems -- including the robo-signing issue, The Post has learned.But what does "$60 billion" really mean? If the final number is in the $60 billion range, it will probably include already completed principal reductions and modifications. If so, the headline number would be meaningless.

The proposed settlement with the Department of Justice and 50 state attorneys general, once thought to be in the neighborhood of $20 billion, could range as high as $60 billion and include a provision for principal reduction, sources close to the discussions said.

Update: From Barclays Capital analysts via the WSJ: Here’s How a $60B Foreclosuregate Settlement Might Get Divided (ht sum luk)

Survey: Small Business Hiring in June a "Bust", but hiring plans turn positive

by Calculated Risk on 7/06/2011 01:58:00 PM

From National Federation of Independent Business (NFIB): NFIB Jobs Statement: June is a Bust, but July Looks Hopeful (link fixed)

“New jobs are not to be found on Main Street. For small firms, reported job losses per firm declined sharply in June as did the net percent of firms that increased employment over the last 3 months." [said NFIB Chief economist William C. Dunkelberg]

...

"Over the next three months, 11 percent plan to increase employment (down 2 points), and 7 percent plan to reduce their workforce (down 1 point), yielding a seasonally adjusted net 3 percent of owners planning to create new jobs, a 4 point gain from May. So, going forward, the job picture is a bit brighter than June’s actual dismal performance."

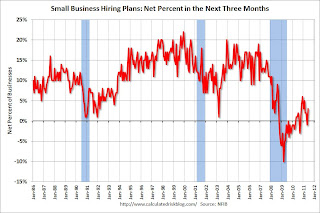

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to remain sluggish for some time.

Conforming Loan Limit Data

by Calculated Risk on 7/06/2011 01:07:00 PM

Just a data post ...

Last night I posted on the new GSE conforming limits and I combined two FHFA spreadsheets to show the change by city. Here is the spreadsheet with the current loan limits and the new loan limits (sorted by largest change in limit).

As Tom Lawler noted back in April, effective Oct 1st "the conforming loan limit will revert back to those established under the Housing and Economic Recovery Act (HERA) of 2008. That act upped the conforming loan limit in many parts of the country, but the HERA hike was trumped by the Economic Stimulus Act (ESA) of 2008 and the Continuing Appropriations Act of 2011."

Here is the source data from the FHFA:

1) Spreadsheet: Maximum Loan Limits for Loans Originated between 10/1/2010 and 9/30/2011 (Same as Limits for 1/1/10-9/30/10 Originations)

2) Spreadsheet: Maximum Loan Limits that Apply to Loans Acquired in Calendar Year 2011 and Originated after 9/30/2011 or Prior to 7/1/2007

ISM Non-Manufacturing Index indicates slower expansion in June

by Calculated Risk on 7/06/2011 10:00:00 AM

The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 19th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 53.3 percent in June, 1.3 percentage points lower than the 54.6 percent registered in May, and indicating continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 0.2 percentage point to 53.4 percent, reflecting growth for the 23rd consecutive month, but at a slightly slower rate than in May. The New Orders Index decreased by 3.2 percentage points to 53.6 percent. The Employment Index increased 0.1 percentage point to 54.1 percent, indicating growth in employment for the 10th consecutive month and at a slightly faster rate than in May. The Prices Index decreased 8.7 percentage points to 60.9 percent, indicating that prices increased at a slower rate in June when compared to May. According to the NMI, 15 non-manufacturing industries reported growth in June. Respondents' comments are mixed about the business climate and vary by industry and company. The most prominent concern remains about the volatility of prices."emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0%.