by Calculated Risk on 6/15/2011 07:18:00 AM

Wednesday, June 15, 2011

MBA: Mortgage Purchase Application activity increases

The MBA reports: MMortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 16.5 percent from the previous week. The seasonally adjusted Purchase Index increased 4.5 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates have declined for 8 of the past 9 weeks. Coming off of the Memorial Day holiday, refinance application volume increased significantly, as borrowers jumped to lock in the lowest mortgage rates since last November," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The volume of refinance applications still remains 28 percent below levels seen at that time, as borrowers with an incentive to refinance remain constrained from doing so by lack of equity in their homes."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.51 percent from 4.54 percent, with points increasing to 1.05 from 0.94 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year average rate since November 19, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of purchase activity is still at about 1997 levels. Of course there is a very high percentage of cash buyers right now, but this suggests weak existing home sales through mid-year (not counting cash buyers). Note that mortgage rates have fallen to the lowest level since last November and refinance activity has increased.

Tuesday, June 14, 2011

Residential Remodeling Index increases in April

by Calculated Risk on 6/14/2011 11:02:00 PM

The BuildFax Residential Remodeling Index was at 109.7 in April, up from 98.0 in March. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 15% year-over-year—and for the eighteenth straight month—in April to 109.7, the highest April number in the index to date.

...

In April, all regions posted month-over-month gains, and only the Midwest posted a year-over-year loss.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, “April traditionally sets a baseline for the rest of the year in residential remodeling activity, and April 2011 is the best we’ve seen since the beginning of the index in April 2004.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This is the highest level for the month of April since the index was started in 2004 - and even slightly above the levels for May in 2005 and 2006 (during the home equity and remodel boom).

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 15% from April 2010.

As I mentioned earlier today in Key Question: Is the slowdown temporary?, Residential Investment (RI) is a leading indicator for the economy, and RI will will probably make a positive contribution to the economy this year for the first time since 2005. Even though new home construction is still moving sideways, it appears that two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

LA Port Traffic in May: Both Imports and Exports increased

by Calculated Risk on 6/14/2011 07:46:00 PM

The first graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for May. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is up 0.4% from April, and outbound traffic also up 0.4%.

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of May, loaded inbound traffic was up 5% compared to May 2010, and loaded outbound traffic was also up 5% compared to May 2010.

Exports are near the pre-recession peak in 2008, although imports in May were still below the levels of May 2006 and May 2007.

Exports are near the pre-recession peak in 2008, although imports in May were still below the levels of May 2006 and May 2007.

This suggests the trade deficit with China (and other Asians countries) probably increased seasonally in May.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/14/2011 04:11:00 PM

From economist Tom Lawler:

Based on my tracking of regional MLS that have reported data so far (not as large a sample as I would like), I estimate that existing home sales, as estimated by the National Association of Realtors, ran at a seasonally adjusted annual rate of 4.8 million in May, down about 5% from April’s pace, and down 15.5% from last May’s pace. Unadjusted sales should show a smaller YOY decline, as this May had one more business day than last May.

On the inventory front, active listings appeared to have increased modestly from April to May nationwide, but were down from a year ago in the vast majority of places – in some cases by a lot, in aggregate in the 7-8% range. What that means for the NAR’s inventory estimate, however, is not clear. Over the last several years the NAR’s existing home inventory estimate has shown MASSIVELY larger gains from March to April than have other listings sources (including realtor.com), but then showed either smaller gains or larger declines than other sources from April to May. In addition, NAR’s YOY inventory decline in April seemed materially lower than other data listing sources suggested.

Based on limited historical data I’d estimate that the NAR’s methodology will result in a reported 2.5% monthly decline in existing home inventory. That combination of sales and inventories would produce a NAR-defined “month’s supply” of 9.4 months, up from 9.2 months in April.

Shifting to pending sales, April’s seasonally adjusted 11.6% drop was surprisingly sharp and only partly explainable by “questionable” seasonal factors. Looking at the limited number of regional realtor associations/MLS/boards that report on “new” pending sales, it appears as if pending sales in aggregate showed a significant rebound from April to May. I estimate that the NAR’s Pending Home Sales Index will show a seasonally adjusted gain from April to May of around 11% -- suggesting that weather, flooding, oil prices, and “other stuff” may have had a temporarily negative impact on contract signings in April and closed sales in May, as well as a temporarily negative impact on other economic data for May.

CR Notes: The NAR reported existing home sales at a 5.05 million seasonally adjusted annual rate (SAAR) in April and inventory of 3.87 million units.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis through April. Sales in April 2011 (5.05 million SAAR) were 0.8% lower than in March, and were 12.9% lower than in April 2010.

Based on Tom Lawler's estimate, this will be the lowest level of inventory in May since 2006 and sales will decline 15.5% YoY. Of course sales in 2010 were boosted by the homebuyer tax credit.

No word yet on when the NAR will release their benchmark revision (expected this summer - and expected to show significant downward revisions to sales and inventory for the last several years).

Bernanke: "Failing to raise the debt ceiling would be self-defeating"

by Calculated Risk on 6/14/2011 02:45:00 PM

From Fed Chairman Ben Bernanke: Fiscal Sustainability

Fiscal sustainability is a long-run concept. Achieving fiscal sustainability, therefore, requires a long-run plan, one that reduces deficits over an extended period and that, to the fullest extent possible, is credible, practical, and enforceable. In current circumstances, an advantage of taking a longer-term perspective in forming concrete plans for fiscal consolidation is that policymakers can avoid a sudden fiscal contraction that might put the still-fragile recovery at risk.CR Note: The debt ceiling debate is a charade, and it helps to point out that at some point even the phony posturing will be "self-defeating".

...

Recently, negotiations over our long-run fiscal policies have become tied to the issue of raising the statutory limit for federal debt. I fully understand the desire to use the debt limit deadline to force some necessary and difficult fiscal policy adjustments, but the debt limit is the wrong tool for that important job. Failing to raise the debt ceiling in a timely way would be self-defeating if the objective is to chart a course toward a better fiscal situation for our nation.

...

In debating critical fiscal issues, we should avoid unnecessary actions or threats that risk shaking the confidence of investors in the ability and willingness of the U.S. government to pay its bills.

Key Question: Is the slowdown temporary?

by Calculated Risk on 6/14/2011 12:18:00 PM

The recent economic data indicated a slowdown in May: only 54,000 payroll jobs were added, auto sales declined significantly, retail sales were sluggish even excluding autos, growth in manufacturing slowed sharply, house prices continued to decline to new post-bubble lows (as of March), and home sales slowed.

This raises a key question: Is the recent economic slowdown temporary or is the U.S. heading into a "double dip" recession?

Some of the recent slowdown was related to the tragic events in Japan that started with the earthquake on March 11th. These events impacted the supply chain, especially for the automakers, and these disruptions negatively impacted manufacturing output in the U.S.

Also the sharp increase in oil and gasoline prices - partially attributable to events in the Middle East and North Africa - has impacted consumer sentiment and retail spending. Oil and gasoline prices have fallen in recent weeks, but are still up sharply from the end of 2010. (WTI futures averaged $85 per barrel in Q4 2010 and are now at $98 per barrel).

A third possible temporary impact has been the severe weather this year. Although there is always severe weather somewhere, the weather has been especially extreme this year from the massive snowstorms in the east, to the recent flooding along the Mississippi river.

But are these impacts temporary?

The supply chain disruptions are clearly temporary, and the good news is the supply issues are being resolved ahead of schedule. From Edmunds.com:

“Manufacturing disruptions appear to have peaked in April and May, and recent news points to steady improvements moving forward,” said Lacey Plache, chief economist at Edmunds.com. “Toyota said it expects North American production of its top-selling Camry and Corolla models to be back at 100 percent [in June], and Nissan’s key engine plant in Japan is returning to full production [in May]. Even Honda, which was the hardest hit of the big three Japanese automakers, is making optimistic statements about its recovery."Also the recent decline in oil and gasoline prices will help, although $100 oil is still a drag on the economy. The weather is unpredictable, but hopefully it will be less severe.

There are also several other ongoing drags on the economy. These include:

• Less Federal stimulus spending in 2011. The American Recovery and Reinvestment Act of 2009 (ARRA) is winding down, and will be a drag on GDP growth.

• The ongoing cuts in state and local spending.

• The festering financial crisis in Europe. Although the direct impact on U.S. trade would be minimal, there could be a significant financial impact on the U.S. if Greece (and other countries) default.

• The slowdown in China impacting U.S. exports.

• Another downturn in house prices.

Note: Since it appears that most of the impact from QE2 is due to the stock effect (as opposed to flow), the end of the buying program will probably have little impact on the economy.

And of course this is all on top of the generally fragile economy. My general outlook since mid-2009 has been for a sluggish and choppy recovery. Usually the deeper the recession, the steeper the recovery - however recoveries following a credit bubble-financial crisis tend to be sluggish.

There is still too much excess capacity in most of the economy for a large contribution from new investment (except in equipment and software). We see this excess capacity in housing, and in overall industrial production. As an example, domestic auto production is still only about 2/3 the level of 2006 - so there is no need to expand production. There is also excess capacity in office space, retail space, and other categories of commercial real estate. In addition, household debt, as a percent of income, remains very high and household deleveraging is ongoing.

Of course a sluggish recovery following a financial crisis is not unusual. From "The Aftermath of Financial Crises", Reinhart and Rogoff, 2009:

"An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt."To answer the key question we need to distinguish between the impact of these short terms issues (supply chain disruption, oil prices, weather), and the ongoing drags.

Although we can try to model the impact, it is hard to separate out the various factors. Note: Cleveland Fed economist Kenneth Beauchemin argues that "the shocks we experienced in the first quarter of 2011 have had measurable effects on both economic activity and consumer price inflation. However, as long as energy and other commodity prices do not continue to rise sharply, these effects are likely to be temporary and modest." See: Shocks and the Economic Outlook

I think the data will help us over the next month or two. If the impact was temporary, auto sales and manufacturing should rebound by July. If there are more severe issues, the weakness will persist.

We have to also remember that Residential Investment (RI) will probably make a positive contribution to the economy this year, for the first time since 2005. The five years of drag on GDP from RI (2006 through 2010) is the longest period on record, breaking the previous record of four years from 1930 to 1933. The positive contribution this year will mostly be due to a pickup in multifamily construction (apartments) and in home improvement. Of course single family housing starts will continue to struggle.

Since RI is the best leading indicator for the economy, I think a pickup in RI suggests the recovery will continue. This isn't perfect - nothing is - but RI is usually a strong leading indicator for the business cycle.

So for now I'll stick with my general forecast for 2011: growth will remain sluggish, but I expect 2011 to be better than 2010 for both employment and GDP growth.

Retail Sales declined 0.2% in May

by Calculated Risk on 6/14/2011 08:30:00 AM

On a monthly basis, retail sales decreased 0.2% from April to May (seasonally adjusted, after revisions), and sales were up 7.7% from May 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $387.1 billion, a decrease of 0.2 percent (±0.5%) from the previous month, but 7.7 percent (±0.7%) above May 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.4% from the bottom, and now 2.3% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.1% on a YoY basis (7.7% for all retail sales).

Retail sales ex-gasoline increased by 6.1% on a YoY basis (7.7% for all retail sales). This was above expectations for a 0.5% decrease. Retail sales ex-autos were up 0.3%; at expectations of a 0.3% increase. As expected, auto sales impacted retail sales (due to supply disruptions).

NFIB: Small Business Optimism Index decreases in May

by Calculated Risk on 6/14/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May

The Index of Small Business Optimism fell 0.3 points in May to 90.9. This month marks the third monthly decline in a row. The proximate cause is the fact that 1 in 4 owners still report weak sales as their top business problem. Consumer spending is weak, especially for “services,” a sector dominated by small businesses.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from 91.2 in April.

This has been trending up, although optimism has declined for three consecutive months now.

The second graph shows the net hiring plans for the next three months.

Hiring plans declined in May and are slightly negative.

Hiring plans declined in May and are slightly negative. According to NFIB: “[I]ndications of minimal future growth include the fact that in the next three months, 13 percent plan to increase employment (down 3 points), and 8 percent plan to reduce their workforce (up 2 points). That yields a seasonally adjusted net negative 1 percent of owners planning to create new jobs, a 3 point loss from April."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in May. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in May. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index, probably somewhat due to the high concentration of real estate related companies.

Monday, June 13, 2011

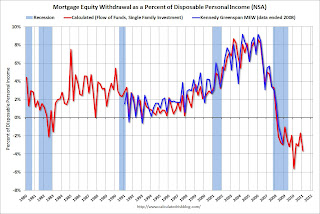

Q1 2011: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 6/13/2011 07:04:00 PM

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q1 2011, the Net Equity Extraction was minus $107 billion, or a negative 3.7% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q1. Mortgage debt has declined by $634 billion over the last twelve quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

DataQuick: SoCal Home Sales Slow in May, Record Low New Home Sales

by Calculated Risk on 6/13/2011 02:43:00 PM

From DataQuick: Southland Home Sales, Median Price Post Steeper Declines From 2010

Southern California home sales held at a three-year low last month amid a sluggish move-up market and record-low sales of newly built homes. ...May was another month of sluggish home sales in SoCal, especially for new home sales. National existing home sales will be reported next week on Tuesday, June 21st, and new home sales will reported on June 23rd - and I expect weak reports.

A total of 18,394 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in May. That was up insignificantly – 0.3 percent – from 18,344 in April, and down 17.4 percent from 22,270 in May 2010, according to San Diego-based DataQuick. ... On average, sales between April and May have increased 5.7 percent since 1988, when DataQuick's statistics begin.

The 1,152 newly built homes that sold across the Southland last month marked the lowest new-home total for the month of May since at least 1988.

...

Distressed property sales continued to account for more than half of the Southland resale market last month, with little change from April. Roughly one out of three homes resold was a foreclosure, while about one in five was a “short sale,” where the sale price fell short of what was owed on the property.