by Calculated Risk on 6/09/2011 08:32:00 PM

Thursday, June 09, 2011

Las Vegas Lands sells for 15 percent of 2007 price

From Buck Wargo at the Las Vegas Sun: Land that sold for $30 million fetches $4.4 million after foreclosure

A 23.53-acre property at the Las Vegas Beltway and Hacienda Avenue that sold for $30.2 million in 2007 and was later foreclosed upon has been sold for $4.4 million.It is amazing that people were still paying crazy prices in 2007.

This is mixed use land, and the commercial real estate bust started later than the residential bust, but the usual pattern is for commercial real estate to follow residential real estate - both up and down. The housing bust was obvious to everyone by late 2006, so I'd think developers would have been avoiding commercial by then too. Apparently not ...

Earlier:

• Weekly Initial Unemployment Claims increase to 427,000

• Trade Deficit decreased to $43.7 billion in April

• Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

• Graphs: Weekly Claims, Trade Deficit, Flow of Funds

Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

by Calculated Risk on 6/09/2011 03:34:00 PM

CR Note: Economist Tom Lawler has written several articles on the different measures of homeownership and vacancy rates. Although some readers’ eyes will glaze over, this information is critically important for analyzing housing and the U.S. economy. I'm still thinking about the implications!

Ricky Ricardo, "I Love Lucy", 1951

From economist Tom Lawler:

My frustration with the conflicting data on US housing that comes from different reports from the Census Bureau, and the inability of Census analysts to explain the differences or even tell “private” analysts what time-series data they should use to analyze US housing trends, has existed for at least a decade. Occasionally that long-standing “frustration” has led me to write that it almost appears as if Census officials and analysts “don’t care” about the conflicting data.

Whether that was or was not the case in the past, it most certainly is not the case today. In fact, some Census folks called me up yesterday to discuss some of the issues, and to let me know that (1) they are “concerned” about the differences; (2) they understand that the differences in measures of key variables have significant implications for the outlook for housing and the outlook for construction employment, with potentially significant public policy implications; and (3) they are going to devote considerable time and effort to investigate the differences.

While this phone call was not “on the record” and as a result I won’t discuss any details, one senior Census official agreed that Census has got “some ‘splaining to do!” I view this as a most, most welcome sign!

As a reminder of the key differences, below is a summary table of a few vacancy rate and homeowner rates from the decennial Census, the Housing Unit Coverage Study (HUCs) estimates (reflecting post-decennial-Census analysis), and the Housing Vacancy Survey (first-half averages).

| Select Housing Measures: Decennial Census (4/1) | |||||

|---|---|---|---|---|---|

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Rental Vacancy Rate | 8.5% | 6.8% | 9.2% | 0.7% | 2.4% |

| Homeowner Vacancy Rate | 2.1% | 1.7% | 2.4% | 0.3% | 0.7% |

| Gross Vacancy Rate | 10.1% | 9.0% | 11.4% | 1.3% | 2.4% |

| Vacancy Rate ex Seasonal/Recreational/Occasional Use | 7.3% | 6.1% | 8.1% | 0.8% | 2.0% |

| Homeownership Rate | 64.2% | 66.2% | 65.1% | 0.9% | -1.1% |

| Gross Vacancy Rate, HUCS (4/1) | |||||

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Gross Vacancy Rate, HUCS1 | 10.5% | 9.2% | 11.4% | 0.9% | 2.1% |

| Select Housing Measures: HVS/CPS (H1) | |||||

| 1990 | 2000 | 2010 | 2010 vs 1990 | 2010 vs 2000 | |

| Rental Vacancy Rate | 7.2% | 7.9% | 10.6% | 3.4% | 2.7% |

| Homeowner Vacancy Rate | 1.7% | 1.5% | 2.6% | 0.9% | 1.1% |

| Gross Vacancy Rate | 11.4% | 11.7% | 14.5% | 3.1% | 2.8% |

| Vacancy Rate ex Seasonal/Recreational/Occasional Use | 7.5% | 7.5% | 9.9% | 2.4% | 2.4% |

| Homeownership Rate | 63.9% | 67.2% | 67.0% | 3.1% | -0.2% |

1 Obviously, there has not yet been a “Housing Unit Coverage Study” for Census 2010!!!

Q1 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

by Calculated Risk on 6/09/2011 12:45:00 PM

The Federal Reserve released the Q1 2011 Flow of Funds report this morning: Flow of Funds.

The Fed estimated that the value of household real estate fell $339 billion in Q1 to $16.1 trillion in Q1 2011, from just under $16.5 trillion in Q4 2010. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.8 trillion in Q2 2007. Net worth fell to $49.4 trillion in Q1 2009 (a loss of over $16 trillion), and net worth was at $58.1 trillion in Q1 2011 (up $8.7 trillion from the trough).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2011, household percent equity (of household real estate) declined to 38.1% as the value of real estate assets fell by $339 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.1% equity - and 10.9 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $634 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Trade Deficit decreased to $43.7 billion in April

by Calculated Risk on 6/09/2011 09:15:00 AM

The Department of Commerce reports:

[T]otal April exports of $175.6 billion and imports of $219.2 billion resulted in a goods and services deficit of $43.7 billion, down from $46.8 billion in March, revised. April exports were $2.2 billion more than March exports of $173.4 billion. April imports were $1.0 billion less than March imports of $220.2 billion.The first graph shows the monthly U.S. exports and imports in dollars through April 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased in April and imports declined (seasonally adjusted). Exports are well above the pre-recession peak and up 19% compared to April 2010; imports are up about 16% compared to April 2010.

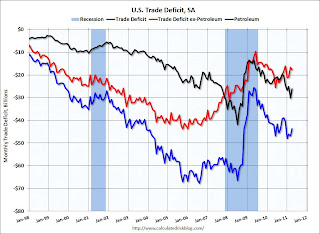

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in April as the quantity imported decreased sharply even as prices increased. Oil averaged $103.18 per barrel in April, up from $77.13 in April 2010. There is a bit of a lag with prices, but it is possible prices will be a little lower in May.

The trade deficit was smaller than the expected $48.9 billion.

Weekly Initial Unemployment Claims increase to 427,000

by Calculated Risk on 6/09/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 4, the advance figure for seasonally adjusted initial claims was 427,000, an increase of 1,000 from the previous week's revised figure of 426,000. The 4-week moving average was 424,000, a decrease of 2,750 from the previous week's revised average of 426,750.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 424,000.

This is the ninth straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January. This suggests the labor market weakness in May is continuing into early June.

Wednesday, June 08, 2011

China: Another Year, Another Prediction of a Housing Bust

by Calculated Risk on 6/08/2011 08:54:00 PM

From the WSJ: The Great Property Bubble of China May Be Popping

Already, in nine major cities tracked by Rosealea Yao, an analyst at market-research firm Dragonomics, real-estate prices fell 4.9% in April from a year earlier. Last year, prices in those nine cities rose 21.5%; in 2009, the increase was about 10%, as China started to recover from the global economic crisis, with much steeper increases toward the end of that year.It is hard to tell what is happening in China - as I've mentioned over the years, at least from what we can tell, the amount of leverage in China is significant less than what we saw in the U.S. during the bubble (residential lending wasn't as crazy). So even if house prices dropped significantly, there wouldn't be as many homeowners with negative equity. Hopefully Professor Pettis will comment on this story!

...

If the Chinese housing market slows faster than people had expected, the impact would be felt in a number of markets that export heavily to China.

Earlier:

• CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply

Hamilton on the OPEC Announcement

by Calculated Risk on 6/08/2011 06:30:00 PM

From Jim Hamilton: The significance of OPEC announcements. Professor Hamilton reviews the OPEC announcement today, and points out that quotas for OPEC have been routinely ignored. He concludes:

I think today's announcement that this "quota" will remain in effect is largely irrelevant. At best the statements issued from these meetings provide a noisy signal of the intentions of some OPEC members.The announcement might be "largely irrelevant" as far as actual production, but there was a market impact with WTI crude futures up over $100 per barrel (and Brent crude close to $118).

But if you're interested in what OPEC members really plan to produce, my view is that actions speak louder than words.

The good news is gasoline prices are down about 24 cents per gallon from the recent peak (down over 30 cents where I live). And it looks like gasoline prices will probably fall some more ... but oil prices at $100 per barrel is still a significant drag on the economy.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Earlier:

• CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply

Fed's Beige Book: Economic activity continued to expand, "some deceleration"

by Calculated Risk on 6/08/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity generally continued to expand since the last report, though a few Districts indicated some deceleration. Some slowing in the pace of growth was noted in the New York, Philadelphia, Atlanta, and Chicago Districts. In contrast, Dallas characterized that region's economy as accelerating. Other Districts indicated that growth continued at a steady pace.And on real estate:

...

Consumer spending was mixed, with most Districts indicating steady to modestly increasing activity. Elevated food and energy prices, as well as unfavorable weather in some parts of the country, were said to be weighing on consumers' propensity to spend. ... Widespread supply disruptions--primarily related to the disaster in Japan--were reported to have substantially reduced the flow of new automobiles into dealers' inventories, which in turn held down sales in some Districts.

...

Manufacturing activity was reported as continuing to increase since the last report in all but two districts, although many noted that the pace of growth had slowed.

...

Labor market conditions continued to improve gradually across most of the nation, with a number of Districts noting a short supply of workers with specialized technical skills. Wage growth generally remained modest, though there were scattered reports of steeper increases for highly skilled workers in certain occupations.

Residential real estate sales markets showed continued weakness in most Districts, while rental markets strengthened. Most Districts indicate that home prices have declined since the last report: Boston, Philadelphia, Richmond, Atlanta, Kansas City, and San Francisco all report some downward drift in selling prices, while reports from the New York and Cleveland Districts indicate that prices have been steady, on balanceThis was based on data gathered before May 27th.

...

Commercial and industrial real estate markets have generally been steady since the last report, though there have been scattered signs of a pickup. Commercial leasing markets showed modest signs of improvement in the Richmond and San Francisco Districts. Boston and Dallas noted some firming in property sales markets, but Kansas City reported declines in prices for office buildings.

CoreLogic House Price Graph, Real Prices, and Prices and Month-of-Supply

by Calculated Risk on 6/08/2011 11:32:00 AM

Updating some graphs ...

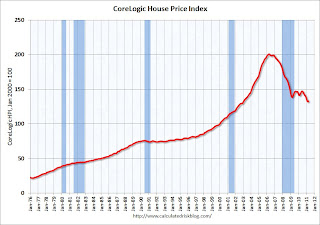

Last week CoreLogic their house price index for April: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010. The CoreLogic HPI is a three month weighted average of February, March, and April (April weighted the most) and is not seasonally adjusted (NSA).

There was a change in how the data is released, so I didn't include a graph last week - here is the graph.

Note: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in April, and is down 7.5% over the last year, and off 33.8% from the peak.

This is the ninth straight month of year-over-year declines, and the index is now 4.0% below the March 2009 low.

Real House Prices

The second graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through April) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through April) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index is back to January 2000.

House Prices and months-of-supply

Here is a look at house prices and existing home months-of-supply.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through March using the composite 20 index. Months-of-supply is through April. Based on this general relationship, I expect Case Shiller house prices to fall further - although there are some questions about the NAR inventory data.

It now appears that inventory is declining year-over-year (something to watch carefully), but of course sales have been declining too.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

Ceridian-UCLA: Diesel Fuel index declines in May

by Calculated Risk on 6/08/2011 09:00:00 AM

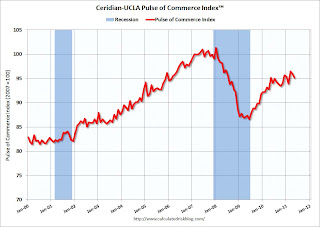

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Pulse of Commerce Index Falls 0.9 percent in May

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation fell 0.9 percent on a seasonally and workday adjusted basis in May, after falling 0.5 percent in April.

“The index has now declined in four of the first five months of 2011, and in eight of the past twelve months,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. ... “On a year over year basis, the PCI was flat in May. This was disappointing in that it ended a string of seventeen straight months of year over year improvement in the index,” Leamer continued. “One small glimmer of good news is that May of last year was the strongest month of 2010, and this month’s result nearly cleared that hurdle. Nevertheless, the PCI showed no growth, and this is another indication that the economy is stuck in neutral.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

“Over time, the PCI has proven to be a leading and amplified indicator of both Industrial Production and GDP,” explained Craig Manson, senior vice president and Index expert for Ceridian. “The May result further reinforces our long-held cautious outlook for below consensus growth in GDP, and suggests that second quarter GDP growth will be less than 2 percent. Similarly, the PCI is anticipating Industrial Production to show modest growth of 0.05 percent for May when the number is released by the Government on June 15, 2011.”This index was useful in tracking the slowdown last summer.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise).