by Calculated Risk on 6/06/2011 02:45:00 PM

Monday, June 06, 2011

Lawler: Existing Home Active Listings show Big Declines in Wide Range of Metro Areas

The following is from economist Tom Lawler:

Over the weekend I “downloaded” historical data on active listings of SF homes and condos for 54 metro areas back to April 2006 from housingtracker.net (it was a pain). The historical data are monthly averages of weekly listings, and in May the 54 metro areas combined had 1,111,996 listings.

CR Note: the following graph combines two graphs from Lawler.

Below is a chart for all 54 metro areas [and] of the NAR’s estimate of the inventory of existing homes for sale over the same period (May 2011 data are not yet available).

![]() Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

May listings for the 54 metro areas were down 6.8% from last May; down 10.2% from May 2009; and down 26.1% from May 2008!

Obviously, the trend in listings for the 54 metro areas is materially different from the NAR’s inventory estimates over this period. Here is a table showing April 2011 listings compared to listings in April for the previous 5 years.

| % Change in Residential Listings/Existing Home Inventory, April 2011 from: | ||

|---|---|---|

| NAR | HT 54 metro areas | |

| Apr-10 | -3.9% | -8.3% |

| Apr-09 | -1.7% | -12.6% |

| Apr-08 | -14.9% | -26.0% |

| Apr-07 | -8.3% | -20.9% |

| Apr-06 | 13.3% | -1.7% |

There are numerous possible reasons for these differences. First, of course, the 54 metro areas in housingtracker.net’s report are probably not as a group representative of the US market as a whole. There is a heavy representation of “bubble” markets in housingtracker.net’s list where listings soared in 2006/07 but have since fallen sharply (not true, btw, for all troubled markets, with Vegas and Reno being obvious exceptions). Second, HT’s listings may include some new homes listed for sale, which I think NAR tries to exclude.

Another big reason, however, is related to the NAR’s methodology for estimated existing home inventories. The NAR collects sales and “months’ supply” data from around 160 boards/MLS across the country, almost all of which are located in or adjacent to metropolitan statistical areas. The NAR assumes that the % changes in sales from these Boards/MLS reflect total sales across the country, and they apply these changes to “benchmark” estimates of total existing home sales derived from an analysis of decennial Census/AHS data (the last benchmarking was based on 2000/01 data, but that same methodology can’t be done with the Census 2010 data). For inventories the NAR uses the “months’ supply” data from these Boards/MLS to derive a months’ supply estimate for the nation as a whole, and “solves” for the inventory level. (Though multiplication!)

Most analysts believe – as does the NAR, by the way – that the NAR’s methodology has overstated existing home sales for the past four years or so, with the overstatement emerging no later than 2007 and growing over subsequent years. Given the NAR’s methodology of using sales and months’ supply to generate inventories, an overstatement in sales would also produce an overstatement in inventories, and a rise in the degree to which sales are overstated would result in an increasing overstatement of inventories as well. (In discussions of the NAR’s “overstatement” of existing home sales, some analysts incorrectly concluded that one implication was that the months’ supply numbers were understated. That is not correct.) Thus, inventories over the last 4-5 years have probably declined by more than that suggested in the NAR report.

There may be other differences as well. E.g., Boards/MLS do not all report active listings on a consistent basis.

But flipping back to the housingtracker.net numbers, it seems pretty clear that inventories in a large number of metro areas have declined significantly over the last several years, and have declined significantly more than a look at the NAR data might suggest.

To be sure, declining listings across most of the country is not necessarily “bullish” for housing, as home sales have also declined – that is, there has been declining demand as well as declining supply. Still, the declining supply is welcome news.

A table showing May 2011 listings compared to listings in the May of the previous 3 years is shown [below].

| Active Listings, May 2011 Compared to May of Previous 3 Years, Various Metro Areas | |||||||

|---|---|---|---|---|---|---|---|

| 2010 | 2009 | 2008 | 2010 | 2009 | 2008 | ||

| Albuquerque | -4.9% | -9.5% | -20.8% | Minneapolis | -10.9% | -11.5% | -28.8% |

| Atlanta | -9.9% | -21.3% | -41.6% | Nashville | -9.0% | -7.3% | -10.0% |

| Austin | -16.8% | -4.2% | -11.2% | New Orleans | -10.1% | -6.1% | -14.4% |

| Baltimore | -2.7% | -4.9% | -14.0% | New York | 6.6% | 6.6% | 1.7% |

| Boise City | -30.6% | -39.9% | -47.7% | Newark | 7.9% | 5.2% | -3.4% |

| Boston | 1.7% | 4.4% | -20.4% | Oklahoma City | 5.8% | 4.6% | 0.4% |

| Cape Coral | -33.1% | -40.2% | -46.6% | Omaha | -2.3% | 9.5% | -9.3% |

| Chicago | -11.5% | -13.9% | -27.9% | Orange County | 0.0% | 10.2% | -8.7% |

| Cincinnati | -5.6% | 11.7% | 2.5% | Orlando | -23.1% | -48.3% | -57.7% |

| Cleveland | -3.1% | 1.6% | -21.8% | Philadelphia | 4.5% | 6.5% | 5.2% |

| Columbus | 10.6% | 14.3% | -10.8% | Phoenix | -21.0% | -31.7% | -45.8% |

| Dallas | -3.2% | -2.6% | -18.1% | Portland | -14.4% | -17.7% | -32.2% |

| Denver | -8.2% | -8.3% | -25.7% | Raleigh | -5.5% | 0.1% | -3.2% |

| Detroit | -18.9% | -38.4% | -56.1% | Reno | 8.7% | 3.5% | 2.2% |

| Edison | 9.4% | 10.2% | 1.1% | Riverside | 2.6% | -4.1% | -39.0% |

| Honolulu | -5.9% | -20.5% | -27.9% | Sacramento | -2.6% | 8.4% | -22.5% |

| Houston | -5.7% | 6.2% | -16.0% | Salt Lake City | -15.0% | -20.3% | -20.3% |

| Indianapolis | -8.4% | -4.1% | -19.4% | San Antonio | -0.8% | -1.4% | -7.6% |

| Jacksonville | -17.4% | -18.0% | -32.0% | San Diego | 2.9% | 30.8% | -15.4% |

| Kansas City | -3.0% | -2.4% | -22.4% | San Francisco | -3.7% | -3.3% | -29.1% |

| Las Vegas | 4.6% | -2.8% | -2.4% | San Jose | -6.7% | -9.8% | -28.2% |

| Long Island | 1.2% | -1.7% | -4.0% | Seattle | -15.0% | 12.1% | -5.1% |

| Los Angeles | 2.7% | 6.1% | -23.1% | St. Louis | -7.4% | 2.9% | -13.4% |

| Louisville | -4.0% | -4.1% | -11.0% | Tampa | -9.5% | -25.5% | -37.9% |

| Memphis | -6.7% | -12.9% | -32.7% | Tucson | -7.4% | -3.3% | -20.1% |

| Miami | -25.3% | -45.9% | -56.8% | Va. Beach | -6.0% | 4.3% | -1.1% |

| Milwaukee | -8.2% | -3.1% | -10.1% | DC | -4.4% | -11.5% | -30.7% |

| Source: Housingtracker.net | |||||||

Housing Starts and the Unemployment Rate

by Calculated Risk on 6/06/2011 11:34:00 AM

An update by request: The following graph shows single family housing starts (through April) and the unemployment rate (inverted) through May. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and have declined recently, but mostly starts have moved sideways for the last two and a half years. This is one of the reasons the unemployment rate has stayed elevated compared to previous recoveries.

This is what I expected when I first posted the above graph almost two years ago. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector hasn't been participating.

The good news is residential investment should increase modestly in 2011, mostly from multi-family and home improvement, and that will help push down the unemployment rate. But I still think the labor market recovery will be sluggish until the excess housing supply is absorbed.

Survey: Small Business Hiring plans turn negative

by Calculated Risk on 6/06/2011 08:48:00 AM

The National Federation of Independent Business (NFIB) will release their April survey on Tuesday, June 14th. Here is a pre-release of the employment results from NFIB: NFIB Jobs Statement: On Main Street, Job Creation is Collapsing

“After solid job gains early in the year, progress has slowed to a trickle ... meaningful job creation on Main Street has collapsed.

...

[I]ndications of minimal future growth include the fact that in the next three months, 13 percent plan to increase employment (down 3 points), and 8 percent plan to reduce their workforce (up 2 points). That yields a seasonally adjusted net negative 1 percent of owners planning to create new jobs, a 3 point loss from April.

...

“Overall, reports of job reductions have returned to historically normal levels. However, the percent of owners hiring has not recovered to levels historically observed after two years of expansion. With one in four owners still reporting ‘weak sales’ as their No. 1 business problem, there is little need to add employees ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the net hiring plans for the next three months.

Hiring plans declined in May and are slightly negative.

Small businesses have a larger percentage of real estate and retail related companies than the overall economy. With the high percentage of real estate (including small construction companies), I expect small business hiring to remain sluggish for some time.

Note that job reductions have fallen to "historically normal levels", but there is little job creation.

Sunday, June 05, 2011

More details on Greek Debt Restructuring

by Calculated Risk on 6/05/2011 05:51:00 PM

We could call it a "soft" restructuring. Or just call it a "default" ...

From the WSJ: Greek Debt Plan Gains Support

Support among European governments is building for ... probably ... what would be the first default of a euro-zone nation in the common currency's history.We will see tomorrow if this plan is seen as a positive for short term debt - the Greek 2 year bond yields fell sharply on Friday to 22.8%. Here are the links for bond yields for several countries (source: Bloomberg):

...

Under the proposed plan, the 17 euro-zone governments would ask Greece's creditors to exchange their soon-to-mature debt for debt with a longer maturity, a process that could begin as early as July after finance ministers approve the new Greek aid package at their meeting June 20 ... A German finance ministry paper ... proposes a seven-year extension on maturing debt.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Earlier ...

• Summary for Week Ending June 3rd

• Schedule for Week of June 5th

Comparing Payroll Job Growth in 2011 to 2010

by Calculated Risk on 6/05/2011 01:58:00 PM

Although payroll job growth slowed sharply in May, with only 54,000 net jobs added, job growth this year is well ahead of 2010. Note: I'll have an update to my economic outlook later.

The first table below shows payroll job growth in 2010 and 2011 through May (excluding Census hires in 2010). The third column is total payroll growth for 2010.

Although job growth is sluggish relative to the slack in the labor market (with the unemployment rate at 9.1%), 2011 is clearly better than 2010 through May.

| Payroll Jobs Added (000s) | |||

|---|---|---|---|

| 2010 through May1 | 2011 through May | Total for 2010 | |

| Total Payroll | 304 | 783 | 955 |

| Private Sector | 358 | 908 | 1,173 |

One of the reasons for the improvement this year is construction. Yes - construction!

For the first time since 2005, residential construction employment will probably be positive in 2011. Just eliminating the drag will help. Also residential investment will probably make a positive contribution to GDP growth for the first time since 2005 - mostly because of an increase in multi-family construction and home improvement. So this is a little bit of good news ... even though most of the recent economic news has been disappointing.

| Annual Change in Construction Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1,053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| May-11 | 31 | 22 | 9 |

Earlier ...

• Summary for Week Ending June 3rd

• Schedule for Week of June 5th

Hotels: Occupancy Rate continues to recover after weak April and early May

by Calculated Risk on 6/05/2011 09:07:00 AM

Here is the weekly update on hotels from HotelNewsNow.com: STR: US performance for week ending 28 May

In year-over-year comparisons, occupancy rose 4.9 percent to 64.2 percent, average daily rate increased 3.8 percent to US$100.93, and revenue per available room finished the week up 8.9 percent to US$64.81.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Back in March the four week average was almost back to 2008 levels, but then hotels hit a soft patch. Over the last couple of weeks, the occupancy rate has increased again - and the four week average is now back close to 2008 levels again - and is even close to normal just as the summer travel season is about to begin.

However, ADR and RevPAR are still well below the pre-recession levels. ADR is about 7% below the level of the same week in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Earlier ...

• Summary for Week Ending June 3rd

• Schedule for Week of June 5th

Saturday, June 04, 2011

Schedule for Week of June 5th

by Calculated Risk on 6/04/2011 08:19:00 PM

Earlier: Summary for Week Ending June 3rd

The key economic release this week will be the trade balance report on Thursday. Fed Chairman Ben Bernanke will speak on Tuesday. The Fed's Beige Book, to be released on Wednesday, should provide some discussion of the recent economic weakness.

No scheduled releases. NY Fed President Dudley and Philly Fed President Plosser both speak later in the day.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general job openings (yellow) have been trending up - and are up 16% from March 2010. However the overall turnover remains low.

3:00 PM: Consumer Credit for April. The consensus is for a $5.0 billion increase in consumer credit.

3:45 PM: Fed Chairman Ben Bernanke, "The U.S. Economic Outlook", At the International Monetary Conference, Atlanta, Georgia

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months suggesting weak home sales through mid-year (not counting all cash purchases).

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for May (a measure of transportation).

2:00 PM: Fed's Beige Book. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 419,000 from 422,000 last week.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the monthly U.S. exports and imports in dollars through March 2011.

Oil prices were up in April, but import volumes were probably down. Also imports from Japan were probably down. The consensus is for the U.S. trade deficit to be around $48.9 billion, up from $48.2 billion in March.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 1.0% increase in inventories.

12:00 PM: Q1 Flow of Funds Accounts from the Federal Reserve.

12:10 PM: Fed Vice Chair Janet Yellen, "Housing Market Developments and Their Effects on Low- and Moderate-Income Neighborhoods", Cleveland, Ohio

8:30 AM: Import and Export Prices for May. The consensus is a for a 0.7% decrease in import prices.

Best wishes to All!

Greece Update: Creditors asked to accept longer maturities

by Calculated Risk on 6/04/2011 04:15:00 PM

From the WSJ: Greece Creditors Must Give €30 billion to Bailout

Euro-zone governments have reached a tentative deal ... that will seek roughly €30 billion in contributions from the country's private-sector creditors ...This will be "voluntary" and not trigger a "credit event", but the alternative - according to one official - is default.

[additional] financing will likely come with the condition that the banks, pensions funds and other investors holding Greek bonds agree to exchange them for new bonds with a longer maturity to help fill Greece's financing gap over the next three years

Earlier:

Summary for Week Ending June 3rd

Friday employment posts:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

Summary for Week Ending June 3rd

by Calculated Risk on 6/04/2011 10:56:00 AM

We expected to see a series of weak economic reports last week - falling house prices, weak auto sales, lower ISM manufacturing index, and a weak labor report - and unfortunately that is exactly what happened.

The employment situation report was very disappointing. There were few jobs created (only 54,000 total and 83,000 private sector), and the unemployment rate increased from 9.0% to 9.1%, even though the participation rate was unchanged at 64.2%.

We have to remember that this is just one month – but it was a dismal month. So far the economy has added 908,000 private sector jobs this year, or about 181 thousand per month. The economy has added 783,000 total non-farm jobs this year or 157 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.95 million fewer payroll jobs than at the beginning of the 2007 recession.

The overall employment numbers are very grim: There are a total of 13.9 million Americans unemployed, another 8.5 million working part time for economic reasons, and probably around 4 million more who have just given up looking for a job. And almost half the unemployed - 6.2 million workers - have been unemployed for more than 6 months.

On house prices, Case-Shiller reported that their National Index, and 20 city Composite Index, both hit new post-bubble lows at the end of Q1. David M. Blitzer, Chairman of the Index Committee at S&P Indices said: "Home prices continue on their downward spiral with no relief in sight. Since December 2010, we have found an increasing number of markets posting new lows." However later in the week - and with little press coverage - CoreLogic reported their house price index increased 0.7% in April.

Both auto sales and manufacturing overall were weak in May, although some of this was probably due to supply chain issues in Japan. The good news is the supply issues are being resolved ahead of schedule, so there will probably be a pickup in auto sales in June or July.

But overall this was a very weak week – and May was a very weak month for economic data.

Below is a summary of economic data last week mostly in graphs:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.1% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in May (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.4% in May (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). Here are the employment posts from yesterday:

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery

• Case Shiller: National Home Prices Hit New Post-Bubble Low

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle.

• ISM Manufacturing index shows slower expansion in May

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business® PMI was at 53.5% in May, down sharply from 60.4% in April. The employment index was at 58.2 and new orders at 51.0. (above 50 indicates expansion).

Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 57.5%, but pretty much in line with the regional surveys.

• U.S. Light Vehicle Sales 11.8 million SAAR in May

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.79 million SAAR in May. That is up 1.5% from May 2010, and down 10.2% from the sales rate last month (April 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was well below the absurd consensus estimate of 12.8 million SAAR. It is difficult to tell how much of the decline is due to supply chain issues - but my guess is we see a bounce back over the next few months.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business®

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business® The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May at 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Both moved up slightly in May, and this was slightly above expectations.

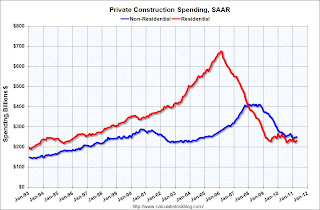

• Construction Spending increased 0.4% in April

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.The small increase in non-residential in April was mostly due to power. Office and lodging construction spending declined.

Residential spending is 65.7% below the peak in early 2006, and non-residential spending is 39.4% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

• Other Economic Stories ...

• The Excess Vacant Housing Supply

• Lawler: Census 2010 and the US Homeownership Rate

• Real House Prices and Price-to-Rent: Back to 1999

• CoreLogic: Home Price Index increased 0.7% between March and April

• Restaurant Performance Index indicates expansion in April

• Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

• ADP: Private Employment increased by 38,000 in May

Best wishes to all!

Unofficial Problem Bank list at 997 Institutions

by Calculated Risk on 6/04/2011 08:15:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 3, 2011. (new format)

Changes and comments from surferdude808:

It was a quiet week for the Unofficial Problem Bank List as there was only one removal and one addition. Thus, the institution count remains unchanged at 997 but assets increased by $1.3 billion to $416.7 billion.Yesterday ...

The removal was the failed Atlantic Bank and Trust, Charleston, SC ($208 million) and the addition was Tennessee Commerce Bank, Franklin, TN ($1.5 billion Ticker: TNCC).

Given the quiet week, it gives us a chance to circle back to comments we made on March 25th and retraction on April 1st. We originally published commentary on how the FDIC has not enforced cross-guaranty against Capital Bancorp when one of their subsidiaries failed. Subsequently, we issued a retraction and apology on April 1st based on a message sent by Angela Kimber, Director of Communications, Capitol Bancorp Limited, that said the comments were inaccurate as "...none of Capitol Bancorp's subsidiaries have failed."

Well, it feels like we were punked by Angela Kimber, as a bank controlled by Capitol Bancorp -- Commerce Bank of Southwest Florida, Fort Myers, FL -- failed on November 20, 2009 costing the FDIC an estimated $23.6 million, whose cost has been subsequently been raised to $30.6 million (See FDIC Press Release).

The FDIC has issued at least 12 cross guaranty waivers to facilitate sales of Capitol Bancorp affiliates as part of its recapitalization efforts. The latest waiver was issued to a Capital Bancorp affiliate in North Carolina -- Community Bank of Rowan, Salisbury, NC (See from FDIC). Within this waiver, the FDIC states:

" WHEREAS, on November 20, 2009, Commerce Bank of Southwest Florida, Fort Myers, Florida (Commerce) failed and caused a loss to the Federal Deposit Insurance Corporation (FDIC); and WHEREAS, at the time of its failure, Commerce was controlled by Capitol Bancorp, Ltd., Lansing, Michigan, a bank holding company (BHC)."Over the past few weeks, CR has sent several email requests and phone messages to Angela Kimber requesting clarification on the cross-guaranty waivers and the basis for the retraction request (subsidiary versus control). CR also asked for a list of all Prompt Corrective Actions for banks controlled by Capitol. All CR received two weeks ago from Ms. Kimber was a list of PCAs, a web link to Capitol Bancorp's affiliates and their history. Ms. Kimber wrote that the banks with Prompt Corrective Actions are Bank of Las Vegas, Central Arizona Bank, Michigan Commerce Bank and Sunrise Bank of Arizona.

However this is non-responsive on the issue of subsidiary versus control.

Although no clarification was received, it appears the argument put forth by Capitol Bancorp that none of its subsidiaries has failed is highly technical and is essentially nothing more than hair splitting. In short, the ownership threshold to be a "subsidiary" requiring financial consolidation is typically 50 percent. Hence, Capitol Bancorp likely owned less than 50 percent of Commerce Bank of Southwest Florida, but it owned a sufficient share or exercised sufficient management influence to meet the "commonly controlled" definition in the cross-guarantee powers in the FDIC Act. The cross-guarantee provisions would allow the FDIC to assess Capitol Bancorp for the $30.6 million resolution cost. The main thrust of the March 25th comments were that the FDIC has pursued a strategy to let Capitol Bancorp sell certain banks in the hope of avoiding a larger and perhaps more costly failure event and that this strategy could be imperiled by the recent Prompt Corrective Action orders issued against several banks controlled by Capitol Bancorp.

Thus, we withdraw our retraction and stand by the thrust of our comments as originally published on March 25th. Perhaps Ms. Kimber forgot to add April Fools to her retraction request.

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Birth/Death Model and Unemployment by Duration and Education

• Employment graph gallery