by Calculated Risk on 5/05/2011 11:29:00 AM

Thursday, May 05, 2011

NMHC Quarterly Apartment Survey: Market Conditions Tighten

From the National Multi Housing Council (NMHC): Apartment Sector Sets Records In Market Tightness And Equity Availability, NMHC Market Conditions Survey Finds

The Market Tightness Index, which examines vacancies and rents, rose to a record 90 from 78 last quarter. ... Almost four in five respondents (79%) said markets were tighter (lower vacancies and/or higher rents) and—for the first time ever—not a single respondent thought conditions were looser.

“The apartment industry rebounded strongly in 2010 as demand for apartment residences outpaced the sluggish recovery in the job market nationally,” said NMHC Chief Economist Mark Obrinsky. “These results show the apartment industry continues to do well even though the nation’s overall rate of economic growth has slowed. This is driven largely by the increased appeal of renting generally but also by the large number of young people entering the housing market for the first time—and young people are much more likely to rent than buy.”

Click on graph for larger image in graph gallery.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last five quarters and increased to a record 90 in April. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

This fits with the recent Reis data showing apartment vacancy rates fell in Q1 2011 to 6.2%, down from 6.6% in Q4 2010, and 8% in the Q1 2010.

Two key points I've made over and over are 1) with falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply this year (but still be well below normal), and 2) this pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. This survey reinforces both points.

A final note: This index helped me call the bottom for effective rents (and the top for vacancy rate) a year ago.

Clear Capital Home Price Index shows Double Dip

by Calculated Risk on 5/05/2011 09:41:00 AM

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.

From Clear Capital: Clear Capital® Reports National Double Dip

Clear Capital (www.clearcapital.com) today released its monthly Home Data Index™ (HDI) Market Report, and reports prices have double dipped nationally 0.7 percent below prior lows experienced in March 2009.

...

“The latest data through April shows a continued increase in the proportion of distressed sales that are taking hold in markets nationwide,” said Dr. Alex Villacorta, director of research and analytics at Clear Capital. “With more than one-third of national home sales being REO, market prices are being weighed down ..."

Click on graph for larger image in new window.

Click on graph for larger image in new window.These graphs from Clear Capital show their home price index and the percent REO saturation.

We know that a higher percentage of distress sales put downward pressure on house prices, and these graphs make that relationship pretty clear.

Note: REO saturation usually peaks early in the year - so some of the recent increase is seasonal.

From Clear Capital:

This comparison leads to concern over home price declines through the rest of 2011. The trends of 2008 were quickly reversed with the introduction of stimulus measures. However, home prices today are already down nearly 25 percent since the 2008 period, creating increasing home affordability, in addition to gradually improving employment measures. Unlike the 2008 period where the downward trend ended in the winter, we're now heading into the home buying seasons of spring and summer. Regardless, the housing market still faces many challenges that will only be solved through increased buying activity or a reduction in the distressed segment―neither of which is assured in 2011.

Weekly Initial Unemployment Claims sharply higher

by Calculated Risk on 5/05/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

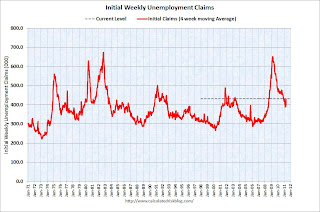

In the week ending April 30, the advance figure for seasonally adjusted initial claims was 474,000, an increase of 43,000 from the previous week's revised figure of 431,000. The 4-week moving average was 431,250, an increase of 22,250 from the previous week's revised average of 409,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 431,250.

Note: There were special circumstances last week, via MarketWatch:

A Labor official attributed much of the increase to temporary layoffs in the auto sector and in the state of New York, where workers in the educational field such as bus drivers are eligible for compensation during the week of spring break.Even without the special reasons, weekly claims have been increasing in recent weeks.

Wednesday, May 04, 2011

Update on Debt Ceiling Charade

by Calculated Risk on 5/04/2011 09:10:00 PM

The WSJ has an update on the charade: GOP, White House Talk Deal on Debt

GOP leaders and the White House are discussing a deal that would enact strict deficit targets and some spending cuts ... The deal would defer contentious decisions about Medicare, Medicaid and taxes until after the 2012 elections.I find this amusing. First the current CBO projection shows the deficit at 3% of GDP in 2015 - so this is a big yawn, plus a future congress can change the rules. Of course the 3% includes the expiration of the tax cuts at the end of 2012, but that just means another battle after the election. (Note: the tax cuts were really "tax shifts" since they shifted the burden to future taxpayers).

...

Targets that would aim to bring the deficit below 3% of gross domestic product by 2015 ...

Of course there is a huge battle ahead over the budget for the next fiscal year (the fiscal year starts on October 1st), but the debt ceiling debate is all a charade - although it allows Congress to force Treasury to do some extra work. The only smart vote would be to eliminate the debt ceiling vote in the future, and let the annual budget process automatically set the debt limit. But then there wouldn't be as much camera time ...

Earlier:

• ISM Non-Manufacturing Index indicates sharply slower expansion in April

• ISM Indexes and BLS Payroll Employment

Martin Marietta Materials: Residential end-use market volume grew 15% YoY

by Calculated Risk on 5/04/2011 05:53:00 PM

Martin Marietta Materials, Inc. released their Q1 results today, and this statement caught the eye of several analysts:

"The residential end-use market volume grew 15% compared with the prior-year quarter, reflecting increased multi-family construction activity."From the Q&A: (ht Brian)

Analyst: In the press release you talked about your residential business being up 15% on multi-family construction. I'm surprised that that's skewing the number that much given the size of the market. What exactly is going on?This reinforces several themes we've been discussing ...

MLM CEO: Well, I guess the big thing I would say to you is it's been a market that has been dead for so long that when any degree of activity comes back to it, it tends to have a remarkable swing in it. ... [W]hen we step back and take a look at what's going on broadly in multi-family ... My recollection is that we were looking in February last year at around 400 different permits that had been handed out for multi-family construction [in portions of Texas] - and during the same time this year, over 2,000.

• There will be a record (or near record) low number of housing units completed this year, and there will be a record low number of multi-family completions this year.

• With falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply (but still be well below normal). It takes over a year on average to complete a multi-family building, so these units will start to be delivered in 2012 - but the impact on construction starts this year. As the MLM CEO said: "a market that has been dead for so long ... any degree of activity ... tends to have a remarkable swing".

• This pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. As ADP noted this morning: "In April, employment in the construction industry increased 9,000, only the second monthly increase since June 2007. Since December 2010, however, construction employment has, on balance, risen, suggesting that finally employment in this sector has bottomed out. The total decrease in construction employment since its peak in January 2007 is 2,115,000." Nine thousand jobs added compared to over 2 million jobs lost is just a drop in the bucket, but it is a start ...

Fed's Williams expects inflation to peak mid-year, "then edge back downward"

by Calculated Risk on 5/04/2011 03:30:00 PM

This is San Francisco Fed President John Williams' first policy speech: Maintaining Price Stability in a Global Economy. Excerpt on inflation:

[W]e’ve seen a very substantial pickup in prices for many energy, food, and industrial commodities. For example, in the past year, copper prices have risen 26 percent, crude oil 35 percent, and corn 75 percent.3 This is cause for serious concern. Sharply higher prices for many raw materials are driving up the prices of a range of consumer goods and services, including gas and food, and are pushing readings of overall inflation noticeably higher. The measure of prices that we at the Fed tend to watch most closely—the personal consumption expenditures price index—increased at a 3.8 percent annual rate in the first quarter of this year. This figure is well above the longer-term inflation objective of 2 percent, or a bit less, that most participants in our policymaking body, the Federal Open Market Committee, prefer.Before becoming the San Francisco Fed president, John Williams was a key economist at the Fed and his views on inflation will carry weight with other policymakers.

This brings me to the second question: What is driving inflation so high? Well, as I mentioned, rising commodity prices, especially for food and energy, have been the culprit. Indeed, so-called core inflation, which strips out food and energy prices, was only 1.5 percent in the first quarter and averaged only 0.9 percent over the past four quarters. Now I know that core inflation has come under a lot of criticism. After all, people need to put food on the table and fill the tanks of their cars. I totally agree. It is the price of the entire household consumption basket of goods and services that we at the Fed care about in terms of our inflation goal, and that certainly includes food and energy. But, we find it useful to look at various measures of underlying inflation, including core inflation, to help us disentangle the various elements in the overall inflation picture. And statistical analysis shows that, over recent decades, measures of underlying inflation, such as core inflation, have been helpful in predicting the future course of overall inflation.

That brings us back to the question of why commodity prices have risen so much. Some commentators have suggested that the Fed itself has contributed to the run-up by keeping in place excessive monetary stimulus. According to this argument, the Fed’s policy of very low interest rates and sizable securities holdings are fueling speculation in commodities. Economic theory teaches us that lower interest rates will boost asset prices, including commodity prices, all else equal. But it is unlikely that this effect can explain more than a very small portion of the huge increase in commodity prices that we have witnessed. Economists at the San Francisco Fed recently looked at how commodity prices reacted when the Fed announced new policy actions to stimulate the economy. If Fed policies were responsible for the commodity price boom, then we should have seen those prices jump when the Fed announced more monetary stimulus. In fact, the researchers found that, if anything, commodity prices fell after new policy announcements and were not pushed higher by news about Fed policy. So, I don’t see any convincing evidence that monetary policy has played a significant role in the huge surge in commodity prices.

I see the real culprit as being global supply and demand. Rising commodity prices can be traced to the rapid rebound in the global economy in the past year and a half, led by robust growth in emerging market economies, which display a ravenous appetite for raw materials. For example, Chinese automakers sold some 18 million vehicles last year, a third more than in 2009 and more than any other country in history, including the United States. At the same time, as demand is rising, we’ve seen supplies of some commodities curtailed by weather or political disruptions. In recent months, turmoil in North Africa and the Middle East has reduced the global supply of oil and likely added a substantial risk premium to the price of a barrel of crude as well.

What do these fast-rising commodity prices mean for inflation for the rest of the year and beyond? I believe that the inflation rate will reach a peak around the middle of this year and then edge back downward. In other words, we are seeing a temporary bulge in inflation before we return to an underlying level of about 1¼ to 1½ percent annually. There are several reasons for thinking the inflation bulge will be short-lived.

First, commodity prices are not likely to keep increasing indefinitely at a rapid rate. Indeed, in recent weeks, prices for a number of commodities, including sugar and cotton, have fallen sharply. In addition, the prices of contracts for certain key commodities in the futures markets, such as crude oil, indicate that traders believe these prices won’t keep rising at double-digit rates. For example, the numerous supply disruptions that have pushed up prices of some foodstuffs, such as poor harvests in Russia and China, are not likely to be repeated. So even if commodity prices remain elevated, they won’t keep pushing up inflation.

A second reason for believing that inflation will peak and then trend down is that higher commodity prices generally represent only a small proportion of the cost of the finished goods American consumers buy. For example, corn and sugar make up only a fraction of the cost of a box of Frosted Flakes. Most of the cost comes from the labor involved in manufacturing, distributing, and selling the breakfast cereal, including paying for air time for Tony the Tiger. This means that large percentage increases in commodity prices typically translate into relatively small percentage increases in consumer prices. Of course, some goods, such as gasoline, have very high commodity input shares. But, in today’s economy, these are more the exception than the rule.

The stability of longer-term inflation expectations is a third factor that leads me to expect that inflation will start to ease later this year. It’s true that surveys show that consumers expect moderately high inflation over the next year. Households see gasoline prices going up and up and up, and, not surprisingly, they get worried about near-term inflation prospects. But medium-term measures of inflation expectations have barely budged. In other words, ordinary Americans agree that we are seeing a transitory rise in inflation. Those survey results reflect the fact that inflation has remained low and relatively steady for several decades and that the public believes the Fed is committed to keeping inflation under control. As long as household, business, and investor inflation expectations remain stable, then it’s unlikely that an inflationary dynamic will become established or that underlying inflation will jump sharply.

This leads directly to a fourth reason for thinking inflationary pressures will ease. The structural and institutional factors that led to a runaway inflationary spiral in the 1970s are largely absent today. Four decades ago, many labor contracts provided for automatic cost-of-living adjustments, or COLAs, which meant that higher prices fed into higher wages in a self-reinforcing feedback loop. Today, COLA clauses are mostly things of the past. Meanwhile, measures of wages and labor compensation, such as the employment cost index or average hourly earnings, have been increasing at an annual rate of only around 2 percent. When you factor in productivity gains, the unit labor cost of producing goods and services has been close to flat. These wage trends, which reflect the high level of unemployment in the economy, act as a powerful brake on inflation.

ISM Indexes and BLS Payroll Employment

by Calculated Risk on 5/04/2011 12:23:00 PM

Here are two scatter graphs showing the relationship between the ISM employment indexes for manufacturing and service, and monthly changes in BLS payroll employment.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the relationship between the ISM manufacturing employment index and the change in BLS manufacturing employment (as a percent of the previous month employment).

The yellow dot is a forecast for April based on the ISM employment reading of 62.7. This suggests about 50,000 manufacturing jobs added in April (although there is plenty of noise, and R-squared is 0.62.

The second graph shows the relationship between the ISM non-manufacturing employment index and the change in BLS private service employment (also as a percent of the previous month employment).

The second graph shows the relationship between the ISM non-manufacturing employment index and the change in BLS private service employment (also as a percent of the previous month employment).

This is also noisy (R-squared is 0.68), but a reading of 51.9 suggests an increase of about 110,000 service sector payroll jobs in April (blue dot on graph). So the ISM reports suggests private sector job growth in April of close to the 179,000 reported by ADP this morning.

ISM Non-Manufacturing Index indicates sharply slower expansion in April

by Calculated Risk on 5/04/2011 10:00:00 AM

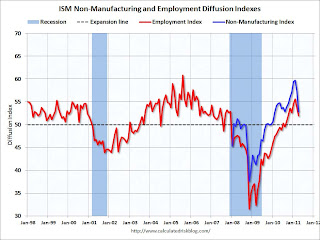

The April ISM Non-manufacturing index was at 52.8%, down from 57.3% in March. The employment index indicated slower expansion in April at 51.9%, down from 53.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: April 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 17th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.This was well below expectations of 58.0%.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52.8 percent in April, 4.5 percentage points lower than the 57.3 percent registered in March, and indicating continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 6 percentage points to 53.7 percent, reflecting growth for the 21st consecutive month, but at a slower rate than in March. The New Orders Index decreased substantially by 11.4 percentage points to 52.7 percent. The Employment Index decreased 1.8 percentage points to 51.9 percent, indicating growth in employment for the eighth consecutive month, but at a slower rate. The Prices Index decreased 2 percentage points to 70.1 percent, indicating that prices increased at a slightly slower rate in April when compared to March. According to the NMI, 17 non-manufacturing industries reported growth in April. Respondents' comments are mixed about overall business conditions; however, they are mostly positive. Respondents' comments also indicate concern over rising fuel costs, commodity costs and the lingering uncertainty about the economy."

emphasis added

ADP: Private Employment increased by 179,000 in April

by Calculated Risk on 5/04/2011 08:15:00 AM

ADP reports:

Employment in the nonfarm private business sector rose 179,000 from March to April on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from February 2011 to March 2011 was revised up to 207,000 from the previously reported increase of 201,000.Note: ADP is private nonfarm employment only (no government jobs).

...

April’s ADP Report estimates employment in the service-providing sector rose by 138,000, marking 16 consecutive months of employment gains. Employment in the goods-producing sector rose 41,000, the sixth consecutive monthly gain, while manufacturing employment rose 25,000, the seventh consecutive monthly gain.

...

In April, employment in the construction industry increased 9,000, only the second monthly increase since June 2007. Since December 2010, however, construction employment has, on balance, risen, suggesting that finally employment in this sector has bottomed out. The total decrease in construction employment since its peak in January 2007 is 2,115,000.

This was slightly below the consensus forecast of an increase of about 195,000 private sector jobs in April. Note the slight increase in construction jobs - it appears this sector has "bottomed out".

The BLS reports on Friday, and the consensus is for an increase of 185,000 payroll jobs in April, on a seasonally adjusted (SA) basis, and for the unemployment rate to hold steady at 8.8%.

MBA: Mortgage Purchase application activity increases slightly, Mortgage Rates lowest in 2011

by Calculated Risk on 5/04/2011 07:19:00 AM

The MBA reports: Latest MBA Weekly Survey Shows Increase in Mortgage Applications, Driven by Refinances

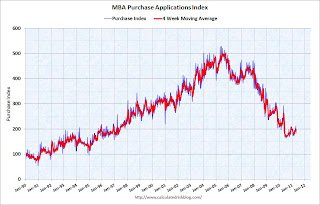

The Refinance Index increased 6.0 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased for the third consecutive week to 4.76 percent from 4.80 percent, with points decreasing to 0.76 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year fixed contract rate since December 3, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity increased as mortgage rates fell to the lowest level since December 2010.

The four week average of purchase activity is at about 1997 levels, although this doesn't include the very high percentage of cash buyers. This suggests weak existing home sales through June (not counting cash buyers).