by Calculated Risk on 4/09/2011 11:15:00 AM

Saturday, April 09, 2011

Summary for Week ending April 8th

This was a light week for U.S. economic data mixed in with a little political theater in D.C. The ISM non-manufacturing index showed further expansion, but at a slower rate. Rail traffic increased in March, and house prices fell further in February (no surprise).

Reis reported their Q1 quarterly data for office, mall and apartment vacancy rates. The office vacancy rate declined slightly, the mall vacancy rate increased - but the big story was the sharp decline in the apartment vacancy rate.

In Europe, Portugal finally asked for a bailout. The package is estimated at €80 billion and the austerity will probably be severe.

Next week will be busy. Below is a summary of economic data last week mostly in graphs:

• ISM Non-Manufacturing Index indicates slower expansion in March

The March ISM Non-manufacturing index was at 57.3%, down from 59.7% in February. The employment index indicated slower expansion in March at 53.7%, down from 55.6% in February. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below expectations of 59.5%.

• CoreLogic: House Prices declined 2.7% in February, Prices now 4.1% below 2009 Lows

From CoreLogic: CoreLogic Home Price Index Shows Year-Over-Year Decline for Seventh Straight Month

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 6.7% over the last year, and off 34.5% from the peak.

This is the seventh straight month of year-over-year declines, and the eighth straight month of month-to-month declines. The index is now 4.1% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

• House Prices: Nominal, Real, Price-to-Rent

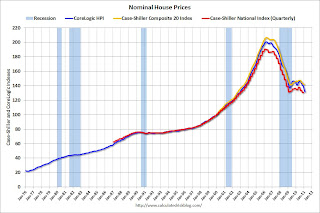

This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through January release) and CoreLogic House Price Indexes (through February release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is slightly above the May 2009 lows, and the CoreLogic index back to January 2003.

This graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

This graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to January 2000.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels, and the CoreLogic index is back to January 2000.

• Reis: Office, Mall and Apartment Vacancy Rates in Q1

On Offices from Bloomberg: Office Market in U.S. Begins Recovery as Vacancy Rate Declines

Reis is reporting the vacancy rate was at 17.5% in Q1 2011, down slightly from 17.6% in Q4 2010, and up from 17.3% in Q1 2010. This was a small decline in the vacancy rate - but it was the first decline since 2007.

Reis is reporting the vacancy rate was at 17.5% in Q1 2011, down slightly from 17.6% in Q4 2010, and up from 17.3% in Q1 2010. This was a small decline in the vacancy rate - but it was the first decline since 2007.

This graph shows office investment in real dollars (left axis in blue) seasonally adjusted annual rate (SAAR), and the office vacancy rate from Reis (right axis in red).

The two arrows point at two previous periods when investment picked up as the vacancy rate declined. In the mid-'90s, it isn't clear if we should say investment picked up at the beginning of '95 or '96, but it was when the vacancy rate was around 13% or 14% and falling.

On Apartments from Reuters: U.S. apartment vacancies fall in Q1, rents edge up

"Reis Inc's quarterly report showed the vacancy rate dropped to 6.2 percent in the first three months of the year, down from 6.6 percent in the fourth quarter. It was the steepest fall since the commercial real estate research firm began tracking the market in 1999."

"Reis Inc's quarterly report showed the vacancy rate dropped to 6.2 percent in the first three months of the year, down from 6.6 percent in the fourth quarter. It was the steepest fall since the commercial real estate research firm began tracking the market in 1999."

This is a very large decline from the record vacancy rate set a year ago at 8%.

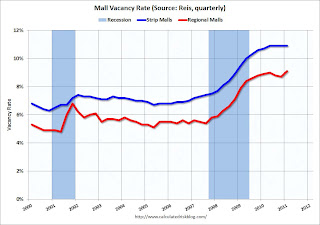

On Malls from Bloomberg: Mall Vacancies Climb to Highest in Decade as U.S. Retailers Close Stores

"The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.

"The vacancy rate [at U.S. regional malls] climbed to 9.1 percent from 8.9 percent a year earlier and 8.7 percent in the fourth quarter, [Reis reported]. It was the highest since Reis began publishing data on regional malls in the beginning of 2000.

At neighborhood and community shopping centers, which usually are anchored by discount and grocery stores, the vacancy rate rose to 10.9 percent from 10.7 percent a year earlier. The rate was unchanged from the three previous quarters and the highest since it reached 11 percent in 1991, according to Reis."

The previous record for regional malls was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

• Other Economic Stories ...

• AAR: Rail Traffic increases in March

• From Reuters: Portugal's Finance Minister: We Now Need EU Aid After All

• From the Irish Times: Portugal told to implement reforms ahead of bailout

• FOMC Minutes: Some Disagreement, Worry about Oil Prices, No Tapering of QE2

• Bernanke in Q&A: "Inflation will be transitory"

• Consumer Bankruptcy filings decrease in Q1 2011

• Unofficial Problem Bank list at 982 Institutions

Best wishes to all!

Unofficial Problem Bank list at 982 Institutions

by Calculated Risk on 4/09/2011 08:32:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 8, 2011.

Changes and comments from surferdude808:

After a quiet week last week, activity picked-up on the Unofficial Problem Bank List as there were five removals and two additions. The changes results in the list having 982 institutions with assets of $433.2 billion compared with last week's total of 985 institutions and assets of $431.1 billion.

The five removals include two failures -- Western Springs National Bank and Trust, Western Springs, IL ($187 million); and Nevada Commerce Bank, Las Vegas, NV ($145 million); two action terminations -- Tradition Bank - Bellaire, Houston, TX ($422 million); and Community Bank of Manatee, Lakewood, FL ($276 million); and one unassisted merger -- Athol-Clinton Co-operative Bank, Athol, MA ($85 million).

The additions were Parkway Bank and Trust Company, Harwood Heights, IL ($2.6 billion); and Mercantile Bank, Quincy, IL ($684 million Ticker: MBR). Mercantile Bank is part of Mercantile Bancorp, Inc., a multi-bank holding company that also has subsidiaries in Florida (The Royal Palm Bank of Florida) and Kansas (Heartland Bank), which are on the Unofficial Problem Bank List as well. We send out props to the Illinois State Banking Department for their transparency as they are the only state banking department that publishes its formal safety & soundness enforcement actions.

Note: A shutdown of the federal government would not interrupt FDIC closing activities as the agency's funding is not appropriated through the budget process. Rather, the FDIC receives its funding from assessments charged to the banking industry. In short, the FDIC would only use taxpayer monies if it had to borrow on its line from the Treasury. Despite having a negative insurance fund, the FDIC has avoided using the borrowing line as they pre-charged the industry an assessment and they have used loss-sharing arrangements in most resolutions, which lessen the cash outlay at the time of failure. While the FDIC is not appropriated by Congress, its insurance fund is included in the federal budget totals. This was an accounting gimmick started in the Johnson Administration used to lower the deficit as the fund normally has a positive balance. Under the pay-go rules of the 1990s, the FDIC's budget came under scrutiny as a reduction in the insurance fund would have added to the federal deficit.

Articles on "Budget Deal"

by Calculated Risk on 4/09/2011 01:10:00 AM

No surprise ...

From the NY Times: Deal at Last Minute Averts Shutdown; $38 Billion in Cuts to Spending This Year

From the WSJ: Last-Minute Deal Averts Shutdown

From the WaPo: Government shutdown averted: Congress agrees to budget deal, stopgap funding

Friday, April 08, 2011

Bank Failure #28: Nevada Commerce Bank, Las Vegas, NV

by Calculated Risk on 4/08/2011 08:38:00 PM

Sloshes down the bankers maw

Eager to consume

by Soylent Green is People

From the FDIC: City National Bank, Los Angeles, California, Assumes All of the Deposits of Nevada Commerce Bank, Las Vegas, Nevada

As of December 31, 2010, Nevada Commerce Bank had approximately $144.9 million in total assets and $136.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.9 million. .... Nevada Commerce Bank is the 28th FDIC-insured institution to fail in the nation this year, and the first in Nevada.

Bank Failure #27 in 2011: Western Springs National Bank and Trust, Western Springs, Illinois

by Calculated Risk on 4/08/2011 07:46:00 PM

The Patricians gnash and wail

Plebeians rejoice.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Western Springs National Bank and Trust, Western Springs, Illinois

As of December 31, 2010, Western Springs National Bank and Trust had approximately $186.8 million in total assets and $181.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.0 million. ... Western Springs National Bank and Trust is the 27th FDIC-insured institution to fail in the nation this year, and the fourth in Illinois.If the FDIC agents work on the weekend, will they get paid? Just wondering ...

Five Hours until possible Government Shutdown

by Calculated Risk on 4/08/2011 07:06:00 PM

A few comments ... (midnight ET)

• I still expect an agreement.

• Stan Collender writes: The Shutdown Problem This September is Going to be Even Worse

No matter what happens today with the government shutdown, the situation is going to be even more difficult this September when the House, Senate, and White House fight over the 2012 appropriations. ... Expect another shutdown threat...or an actual shutdown...in less than 6 months.• And from the NY Times Caucus: Conservatives Urge Boehner to Cut a Budget Deal and Move On

[J]ust hours before the first government shutdown in 15 years –some of the most vocal conservatives are urging Republicans to reach a deal before a shutdown occurs.This is probably the cover Boehner needs. But as Collender notes, it will get really ugly in September.

...

Mike Huckabee, the former governor of Arkansas and a possible presidential candidate, said Friday afternoon in an interview that a shutdown would “hurt the Republicans, not the Democrats.”

...

Senator Tom Coburn of Oklahoma, one of the more conservative Republicans in the Senate, told Bloomberg’s Al Hunt that Republicans should “probably” give up on the policy “riders” that have been holding up negotiations.

AAR: Rail Traffic increases in March

by Calculated Risk on 4/08/2011 03:03:00 PM

Some "D list" transportation data ...

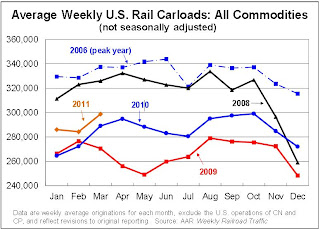

The Association of American Railroads (AAR) reports carload traffic in March 2011 was up up 3.4% over March 2010 and 11.2% over March 2009, and intermodal traffic (using intermodal or shipping containers) was up 8.5% over March 2010 and up 21.6% over March 2009.

U.S. freight railroads originated an average of 298,711 carloads per week in March 2011, for a total of 1,493,553 carloads — up 3.4% over March 2010 and 11.2% over March 2009. March 2011’s percentage increase is the lowest of any month since rail traffic began its recovery in early 2010, but part of that is because of more difficult comparisons (i.e., year-ago traffic no longer as bleak as it had been).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA).

From AAR:

On a seasonally adjusted basis, U.S. rail carloads were up 2.0% in March 2011 from February 2011. That’s the biggest month-to-month increase in six months and the third seasonally-adjusted increase in the past four months.As the first graph shows, rail carload traffic collapsed in November 2008, and now, over 18 months into the recovery, carload traffic has recovered about half way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):In March 2011, U.S. railroads averaged 222,260 intermodal trailers and containers per week, for a total of 1,111,301 for the month. That’s up 8.5% (86,908 intermodal units) over March 2010 and up 21.6% (197,423 units) over March 2009.Intermodal traffic is close to old highs, but carload traffic is only about half way back to pre-recession levels.

Seasonally adjusted U.S. rail intermodal traffic was up 0.5% in March 2011 from February 2011, the fourth straight monthly increase.

excerpts with permission

Refinance Activity and Mortgage Rates

by Calculated Risk on 4/08/2011 01:58:00 PM

Yesteday Scott Reckard at the LA Times wrote about mortgage lenders laying off workers as refinance activity declined: Home lenders shed workers as mortgage rates climb. Here is a graph of refinance activity and mortgage rates:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Although mortgage rates are still below 5%, it takes lower and lower rates to get people to refi (at least lower than recent purchase rates).

With 30 year mortgage rates now about 0.6 percentage points above the lows in October, this is the end of the recent surge in refinance activity - unless rates drop significantly again. With refinance activity down over 50%, and mortgage purchase activity at low levels, the lenders need fewer workers (as Reckard noted).

CNBC: McConnell says Budget Deal Near

by Calculated Risk on 4/08/2011 11:41:00 AM

CNBC: Budget Deal is Near: GOP Senate Minority Leader McConnell

It seemed very unlikely to me that the government would be shut down. I'll have more when the deal is announced.

Europe Update: Austerity in Portugal, Bank Stress Test concerns in Germany

by Calculated Risk on 4/08/2011 09:04:00 AM

An update on the bailout for Portugal from the Irish Times: Portugal told to implement reforms ahead of bailout

Europe's rich countries pushed Portugal to make deeper-than-planned budget cuts in the heat of an election campaign in exchange for an emergency aid package estimated at €80 billion.So what the voters just turned down is a "starting point" now. Ouch.

...

In an unprecedented intervention in national politics, euro-area finance ministers said Portugal can win relief by mid-May as long as it makes cuts that go beyond measures that failed to pass parliament in March and led to the government's downfall.

"We stand ready to negotiate immediately this ambitious program, which should comprehend an ambitious fiscal adjustment, structural reforms," said European Central Bank president Jean-Claude Trichet ...

Last month's austerity plan "is a starting point", European Union economic and monetary commissioner Olli Rehn told reporters ... "It is indeed essential in Portugal to reach a cross-party agreement ensuring that such a program can be adopted in May."

And from Jack Ewing at the NY Times: European Bank Stress Tests to Hit German Banks Hard (Pay)

Banks that fail a planned health checkup by European regulators in June will be required to present a recovery plan that could force some weaker institutions, particularly in Germany, to raise more capital ...

The authority said in a statement Friday that it expected any bank “showing specific weaknesses in the stress test, to agree with the relevant supervisory authority the appropriate remedial measures and execute them in due time.”