by Calculated Risk on 4/02/2011 08:17:00 AM

Saturday, April 02, 2011

Unofficial Problem Bank List at 985 Institutions, Correction for Capitol Bancorp

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 1, 2011.

Changes and comments from surferdude808:

All enforcement actions against the banks on the Unofficial Problem Bank List were terminated this week leaving us nothing to publish. April Fools! In reality, however, it was a fairly safe & sound week as no new banks were added to the list nor were there any failures. The only change was the OTS issuing a Cease & Desist Order against Brooklyn Federal Savings Bank, Brooklyn, NY ($489 million Ticker: BFSB), which was already operating under a Supervisory Agreement.

The only thing left to do this week is to issue an apology to Capitol Bancorp for an inaccurate comment last week stating they had a failed subsidiary. The confusion come from the similar name of the Capitol Bancorp subsidiary High Desert Bank and the failed High Desert State Bank coupled with the FDIC issuing cross-guarantee waivers to former or current subsidiaries of Capitol Bancorp. A closer inspection of their complex structure history finds they have reduced their subsidiary count from 64 in 2008 to 24 currently. The reduction in 40 charters results from 13 sales and 27 affiliate mergers. As can be determined, the FDIC has issued cross-guaranty waivers to at least 11 former or current subsidiaries of Capitol Bancorp, which is unusual given that there has not been a loss to the insurance fund yet.

Friday, April 01, 2011

FHFA: Where the Conforming Loan Limit Might Fall on October 1

by Calculated Risk on 4/01/2011 09:29:00 PM

Earlier:

• March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Employment Graph Gallery

• U.S. Light Vehicle Sales 13.1 million SAAR in March

CR Note: The FHFA released two Mortgage Market Notes notes this week, one of the Qualified Residential Mortgage (QRM) standard and the other on the conforming loan limit.

Economist Tom Lawler discusses the conforming loan limit: FHFA: Where the Conforming Loan Limit Might Fall on October 1

Without legislative action, the conforming loan limit will revert back to those established under the Housing and Economic Recovery Act (HERA) of 2008. That act upped the conforming loan limit in many parts of the country, but the HERA hike was “trumped” by the Economic Stimulus Act (ESA) of 2008 and the Continuing Appropriations Act of 2011. The “formulas” that determined the conforming loan limits under the latter legislations, which were based on a % of an area’s 2007 median sales price, were liberally interpreted by regulators in that the median sales price for the county with the highest median sales in a metro area was used to derive the loan limit for the whole metro area, resulting in a loan limit that in many counties was two or more times that county’s median sales price.

According to a “Mortgage Market Note” published by FHFA this week, if loan limits were to revert back to the HERA limits, the loan limits would likely decline in only about 250 counties (or county-equivalents) -- and only 205 counties if you exclude Puerto Rico and Northern Mariana Islands. Moreover, in many of these counties the conforming loan limit would not fall by much – and in most areas the loan limits would be MASSIVELY above the most recent year’s median sales prices.

FHFA estimates that Fannie and Freddie combined acquired only about 50,000 mortgages originated in 2010 with loan balances in between the current loan limits and the HERA loan limits.

The county where the loan limits would fall the most is Monterey, California (from $729,750 to $483,000), followed by Monroe, Florida (from $729,750 to $529,000). Monroe County is at the southern tip of Florida, and includes the Florida Keys.

“Letting” the conforming loan limits go down on October 1st is not a big deal from the standpoint of the housing market, and the new limits would still leave the VAST bulk of home sales transactions eligible for GSE acquisition. However, it is a “big deal” in terms of it being the first (though very small) step to reduce the government’s/GSE’s “footprint” in the US mortgage market.

CR Note: This was from Tom Lawler

U.S. Light Vehicle Sales 13.1 million SAAR in March

by Calculated Risk on 4/01/2011 04:30:00 PM

On Employment earlier:

• March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Employment Graph Gallery

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.1 million SAAR in March. That is up 12% from March 2010, and down 1.2% from the sales rate last month (Feb 2011).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 13.1 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is finally off the bottom of the '90/'91 recession - and there were fewer registered drivers and a smaller population back then.

This was slightly below the consensus estimate of 13.2 million SAAR, possibly because of rising oil prices. I don't think the Japanese supply disruptions have impacted sales much yet.

Misc: Autos, ISM Manufacturing, NY Fed's Dudley

by Calculated Risk on 4/01/2011 12:34:00 PM

On Employment earlier:

• March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

Autos: I'll post graphs of the Seasonally Adjusted Annual Rate (SAAR) around 4 PM ET.

• From MarketWatch: GM’s auto sales rise 9.6% in March

• From MarketWatch: Ford U.S. auto sales in March up 19.2% to 212,777

• From MarketWatch: Chrysler March U.S. sales surge 31% to 121,730

ISM Manufacturing:

• From the Institute for Supply Management: January 2011 Manufacturing ISM Report On Business®

• From the Institute for Supply Management: January 2011 Manufacturing ISM Report On Business®

Click on graph for larger image in new window.

Here is a long term graph of the ISM manufacturing index.

This was a strong report and slightly above expectations.

• From NY Fed President William Dudley: The Road to Recovery: Puerto Rico and the Mainland

[I]t is important to emphasize that we at the Federal Reserve have been expecting the economy to strengthen. We provided additional monetary policy stimulus via the asset purchase program to help ensure that the recovery regained momentum. A stronger recovery with more rapid progress toward our dual mandate objectives is what we have been seeking. This is welcome and not a reason to reverse course.No change in course.

Yet, we must not be overly optimistic about the growth outlook. The coast is not completely clear—the healing process in the aftermath of the crisis takes time and there are still several areas of vulnerability and weakness.

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 4/01/2011 10:04:00 AM

Note: ISM Manufacturing survey PMI was at PMI at 61.2% in March, down slightly from 61.4% in February. This is very strong. Here is the report - (I'll post a graph later).

Here are a few more graphs based on the employment report ...

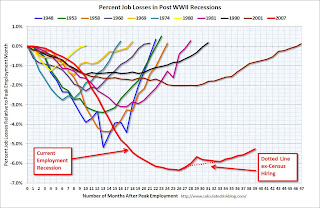

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in March, at 8.4 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.43 million in March from 8.34 million in February.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 15.7% in March from 15.9% in February. Still very high, but improving.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.122 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 5.993 million in February. This remains very high, and is one of the defining features of this employment recession.

Summary

This was an OK report; a little better than most recent reports, but still a long ways to go.

If we average the last three months together that gives about 160,000 payroll jobs per month. That is more than enough to keep up with the growth in the labor force, but it will only push the unemployment rate down slowly. Private payrolls were a little better at an average of 188,000 per month, as state and local governments continued to lay off workers (something we expect all year).

The decline in the unemployment rate from 8.9% to 8.8%, was good news, especially since the participation rate was unchanged at 64.2%. Note: This is the percentage of the working age population in the labor force.

However the increases for the long term unemployed, and for the number of part time workers for economic reasons, was not welcome news - although U-6 declined to 15.7%. All of these levels are very high.

The average workweek declined slightly to 34.1 hours, and average hourly earnings was flat. Both very disappointing.

Overall this was another small step in the right direction.

• Earlier Employment post: March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate

March Employment Report: 216,000 Jobs, 8.8% Unemployment Rate

by Calculated Risk on 4/01/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment increased by 216,000 in March, and the unemployment rate was little changed at 8.8 percent, the U.S. Bureau of Labor Statistics reported today.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for January was revised from +63,000 to +68,000, and the change for February was revised from +192,000 to +194,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate decreased to 8.8% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in March (blue line). This is the lowest level since the early '80s. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was increased slightly to 58.5% in March (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was slightly above expectations for payroll jobs. Over the last three months, the economy has added about 160 thousand payroll jobs per month (188 thousand private payroll jobs per month). I'll have much more soon ...

Thursday, March 31, 2011

Restaurant Performance Index increases in February

by Calculated Risk on 3/31/2011 08:11:00 PM

Earlier:

• Kansas City Manufacturing Survey at Record High, Chicago PMI Strong in March

• Employment Situation Preview: More Jobs, but still Grim

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index increased to 100.7 in February indicating expansion.

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Industry Outlook Improved in February as Restaurant Performance Index Stood Above 100 for the Fifth Time in Six Months

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.7 in February, up 0.4 percent from its January level. In addition, February represented the fifth time in the last six months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.Increased traffic and sales, and a positive outlook for capital spending and hiring ... a solid report. Also, February was a record high sales month for the restaurant industry.

“February’s RPI gain was driven by solid improvements in the same-store sales and customer traffic indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported positive same-store sales and customer traffic results in February, after January’s results were dampened by extreme weather conditions in many parts of the country.”

“In addition to improving sales and traffic indicators, restaurant operators’ outlook for capital spending hit a 40-month high, while their expectations for staffing growth rose to the highest level in nearly four years,” Riehle added.

...

Restaurant operators reported a solid improvement in same-store sales in February. ... Restaurant operators also reported a net increase in customer traffic levels in February.

...

Bolstered by an improving sales outlook, restaurant operators’ plans for capital spending rose to its highest level in 40 months. ... For the fifth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Irish Bank Stress Tests and European Bond Spreads

by Calculated Risk on 3/31/2011 05:18:00 PM

On the Irish banks from the Irish Times: Irish banks require an extra €24 billion recapitalisation

Ireland’s beleaguered banking sector is to be recapitalised by a further €24 billion and restructured around two core retail banks ... This is the fifth attempt to recapitalise the banks and brings the total cost of bailing out the sector from €46 billion to €70 billion.Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of March 30th):

...

[Minister for Finance Michael Noonan] indicated the Government would seek "significant contributions" from subordinated bondholders in the banks to contribute to the cost of recapitalising the sector.

Mr Noonan also signalled the Government was no longer considering the imposition of losses on senior bondholders in Bank of Ireland and Allied Irish Banks. However, he said the Government but would re-examine the possibility of imposing losses on senior bondholders at Anglo Irish Bank, if that lender required additional capital.

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the Atlanta Fed:

Most peripheral European bond spreads (over German bonds) continue to be elevated, particularly those of Greece, Ireland, and Portugal, with the latter two countries seeing their financial situations worsening.Here are the Ten Year yields for Ireland, Portugal, Greece, and Germany. The spreads to Germany widened more today with Greece up to 948 bps, Ireland up to 687 bps, and Portugal up to 505 bps. The good news is the spreads have been declining for the other European countries.

Since the March FOMC meeting, the 10-year Greece-to-German bond spread has declined by 38 basis points (bps), through March 29. Also, the Spanish spread has declined by 17 bps.

However, the spread for Ireland and Portugal has risen by 49 bps and 44 bps, respectively.

Employment Situation Preview: More Jobs, but still Grim

by Calculated Risk on 3/31/2011 02:36:00 PM

Tomorrow the BLS will release the March Employment Situation Summary at 8:30 AM ET. The consensus is for an increase of 195,000 payroll jobs in March, and for the unemployment rate to hold steady at 8.9%.

• The weak payroll report in January was blamed on the weather (only 63,000 jobs added after revision). So there might have been some bounce back in February (192,000 payroll jobs added). The two month average was 127,500 payroll jobs added (145,000 private). Anything less in March would be very disappointing.

• The BLS reference period is the calendar week that contains the 12th day of the month (or pay period including the 12th for the establishment survey). There were several significant world events in March, especially in Japan (the earthquake was on March 11th) and Libya. Sometimes hiring can be delayed due to world events, but based on the timing, I don't think there will be any impact on the March report.

• Usually the ISM manufacturing and service reports are released before the BLS employment report. Not this month because the first Friday of the month is on the 1st (Happy April Fools' Day!). However all of the regional Fed manufacturing surveys and the Chicago PMI indicated strong expansion in March.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

• Weekly initial unemployment claims averaged 394,250 in March, about the same as in February (392,500). That is the good news (fewer layoffs), but so far hiring hasn't picked up.

Click on graph for larger image in graph gallery.

• ADP reported Private Employment increased by 201,000 from February to March on a seasonally adjusted basis, and has averaged 211,000 over the last four months.

And some less optimistic news:

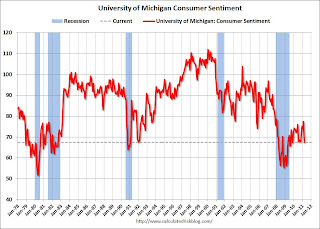

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

• Consumer Sentiment decreased sharply in March. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the decline in March).

The final March Reuters / University of Michigan consumer sentiment index declined to 67.5 from the preliminary March reading of 68.2 - and down from 77.5 in February. This is the lowest level since November 2009.

• And on unemployment: Gallup Finds U.S. Unemployment Rate at 10.0% in March NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. But this does suggest a seasonally adjusted unemployment rate slightly higher than the 8.9% in February.

• Even if the payroll report shows improvement, the employment situation remains grim. There are 7.4 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.3 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6 million have been unemployed for six months or more.

If the BLS reports 200 thousand payroll jobs added tomorrow - that will be welcome - but it is just a small step in the right direction. Many of the unemployed and marginally employed will not see any improvement for some time.

My guess is in the 150,000 to 175,000 range for payroll jobs, with the unemployment rate increasing slightly.

Kansas City Manufacturing Survey at Record High, Chicago PMI Strong in March

by Calculated Risk on 3/31/2011 11:00:00 AM

• Note: The Irish bank stress test results will be released at 4:30 PM local time (11:30 AM ET). The Irish Times has a live blog discussing the results.

• From the Kansas City Fed: Survey of Tenth District Manufacturing

Growth in Tenth District manufacturing activity accelerated rapidly in March, posting a record high for the second straight month. Expectations moderated slightly from last month, but still remained solid. Price indexes for raw materials reached historically high levels, and more firms indicated plans to pass cost increases on to customers.This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

The month-over-month composite index was 27 in March, up from 19 in February and 7 in January. This reading set a new all time survey high. ... The employment index inched higher from 23 to 25, also a new survey record.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through March), and averaged five Fed surveys (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The regional surveys suggest the ISM manufacturing index will in the 60+ range (strong expansion). The ISM index for March will be released tomorrow, April 1st. The consensus is for a decrease to 61.2 from 61.4 in February.

And from earlier this morning ...

• From the Chicago Business Barometer™ Decelerated: The overall index decreased to 70.6 from 71.2 in February. This was slightly above consensus expectations of 70.0. Note: any number above 50 shows expansion, so this is a strong reading.

"EMPLOYMENT grew to its second-highest level since February 1973." The employment index increased sharply to 65.6 from 59.8. This is the highest level since December 1983.

"NEW ORDERS increased to the highest point since December 1983". The new orders index decreased to 74.5 from 75.9.

Prices were up sharply, but over all this was a strong report.