by Calculated Risk on 3/20/2011 02:43:00 PM

Sunday, March 20, 2011

Supply Chain Stress Test

It is hard to guess the impact of the supply chain disruption. A week or two shutdown will probably have minimal impact on sales, but a delay until May would be significant.

From Steve Lohr at the NY Times: Stress Test for the Global Supply Chain

[T]he disaster in Japan, experts say, presents a first-of-its-kind challenge, even if much remains uncertain.And from the WSJ: Supply Shortages Stall Auto Makers

Japan is the world’s third-largest economy, and a vital supplier of parts and equipment for major industries like computers, electronics and automobiles. The worst of the damage was northeast of Tokyo, near the quake’s epicenter, though Japan’s manufacturing heartland is farther south. But greater problems will emerge if rolling electrical blackouts and transportation disruptions across the country continue for long.

Throughout Japan, many plants are closed at least for days, with restart dates uncertain.

A shortage of Japanese-built electronic parts will force GM to close a plant in Zaragoza, Spain, on Monday and cancel shifts at a factory in Eisenach, Germany, on Monday and Tuesday, the company said Friday.And from the WSJ: Nissan to Resume Production in Japan

...

Japanese auto makers Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. have halted production in Japan in the way of last week's earthquake and tsunami.

... Honda [warned] U.S. dealers that it isn't sure if it will be able to resume full production at certain Japanese plants before May ...

Nissan Motor Co. said Sunday that it will start parts production and vehicle assembly operations this week in Japan, becoming the first car maker to restart its entire auto production process after a devastating quake brought the country's auto industry to a standstill.

Schedule for Week of March 20th

by Calculated Risk on 3/20/2011 08:55:00 AM

Here is the Summary for Week ending March 18th and some preliminary Census 2010 Housing Vacancy Data.

The key releases this week will be existing home sales on Monday, new home sales and Wednesday, durable goods on Thursday, and the final estimate for Q4 GDP on Friday.

8:30 AM ET: Chicago Fed National Activity Index (February). This is a composite index of other data.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 5.15 million at a Seasonally Adjusted Annual Rate (SAAR) in February, down from 5.36 million SAAR in January.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Housing economist Tom Lawler is forecasting a decline to 5 millon (SAAR) in February. This would put the months-of-supply in the low 8 months range.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected to be announced mid-year.

8:00 AM: Cleveland Fed President Sandra Pianalto will speak at the University of Akron Economic Summit "The Economy: 2011 and Beyond."

10:00 AM: FHFA House Price Index for January. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Richmond Fed Manufacturing Survey for March. The consensus is for a slight decrease to 24 from 25 in February.

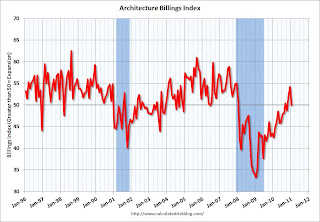

Early: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).

This graph shows the Architecture Billings Index since 1996. The index showed billings were at the same level in January as in December (at 50).This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through the first few months of 2011.

10:00 AM: New Home Sales for February from the Census Bureau. The consensus is for an increase in sales to 290 thousand (SAAR) in February from 284 thousand in January.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.New home sales collapsed in May and have averaged only 293 thousand (SAAR) over the last nine months. Prior to the last nine months, the record low was 338 thousand in Sept 1981.

12:00 PM: Fed Chairman Ben Bernanke will speak at the Independent Community Bankers of America National Convention and Techworld, San Diego, California "Community Banking in a Period of Recovery and Change"

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 383,000 from 385,000 last week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders after increasing 2.7% in January.

7:30 PM: Fed Governor Elizabeth Duke will speak at the Virginia Association of Economists Sandridge Lecture, Richmond, Virginia "Changing Circumstances: The Impact of the Financial Crisis on Wealth"

8:30 AM: Gross Domestic Product, 4th quarter 2010 (third estimate);

Corporate Profits, 4th quarter 2010. This is the third estimate for Q4 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 3.1% annualized from the second estimate of 2.8%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a decrease to 68.0 from the preliminary reading of 68.2. This has declined because of higher gasoline prices, and possibly world events.

10:00 AM: Regional and State Employment and Unemployment for February 2011

12:00 PM: Industrial Production and Capacity Utilization (Annual Revision)

Note: Speeches from Philadelphia Fed President Charles Plosser, Minneapolis Fed President Narayana Kocherlakota, and Atlanta Fed president Dennis Lockhart.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Best wishes to All!

Saturday, March 19, 2011

Birthday Houses

by Calculated Risk on 3/19/2011 09:10:00 PM

Something a little lighter from David Bracken at the newsobserver.com: Home is fine, offers are not (ht Sebastian)

When Ann Robertson first put her Raleigh home up for sale, she timed it so that it would be part of the Oakwood neighborhood's annual Candlelight Tour held each December.As Jim the Realtor always says, there's nothing that price won't fix. Instead these owners are chasing the prices down - very slowly.

...

That was 826 days ago.

Today, Robertson's house remains on the market. It is part of a growing collection of homes that real estate insiders dub "birthday houses," a term that refers to any property that has gone unsold longer than a year.

...

In the past, sellers' agents could, if they wanted, conceal the total days on the market by taking homes off for a day or two and relisting under a new MLS number. But now the MLS displays a cumulative days-on-the-market figure that is tied to a home's address.

Note: Here is the listing with "days on site" at the bottom.

Earlier:

• Unofficial Problem Bank list increases to 982 Institutions

• Census 2010 Housing Vacancy Data

• Summary for Week ending March 18th

Census 2010 Housing Vacancy Data

by Calculated Risk on 3/19/2011 04:55:00 PM

The Census Buraeu has released data for 42 states so far. These states account for about 83% of the U.S. housing stock based on the 2000 and 1990 Census data. All of the data will be released by April 1st.

Here is a table of the data released so far - total housing units, Occupied and Vacant - for each state, plus the vacancy rate for 2010, 2000 and 1990. The data is sortable by column.

We can use this data to estimate the number of excess vacant housing units as of April 1, 2010 by comparing to earlier vacancy rates. I'll be posting some analysis soon (here is a spreadsheet of the 2010, 2000 and 1990 data too).

Earlier:

• Unofficial Problem Bank list increases to 982 Institutions

• Summary for Week ending March 18th

Summary for Week ending March 18th

by Calculated Risk on 3/19/2011 11:41:00 AM

World events are obscuring somewhat better U.S. economic data, excluding, of course, new home construction. And even for residential investment, there has been a clear pickup in home improvement and multi-family construction. The first two graphs below show this divergence: the Philly Fed and Empire State manufacturing surveys indicated faster growth, yet housing starts were near a record low. This is no surprise – housing starts will stay low until more of the excess inventory of existing homes is absorbed.

There was also some good labor news last week – initial weekly unemployment claims continued to decline, and the regional manufacturing surveys showed increased hiring. But overall hiring is still very low. And unfortunately the overall employment situation remains grim with the unemployment rate at 8.9%, and with 13.7 million Americans currently unemployed. There are 7.5 million fewer payroll jobs now than before the recession started in 2007 and another 8.3 million people are working part time for economic reasons. About 4 million more workers have left the labor force. And of those unemployed, 6 million have been unemployed for six months or more.

So the U.S. economy might be improving, but the economy is leaving millions behind.

Of course all this data was obscured by world events. Most of the focus was on the Japanese nuclear issues, but North Africa (Libya), and the Middle-East (Yemen and Bahrain) were also front page news.

The European financial crisis eased a little last week, and the next meeting of all 27 EU leaders will be in Brussels on March 24th and 25th (this coming Thursday and Friday).

On a personal note, my thoughts are with all the people suffering through these difficult times.

Below is a summary of economic data last week mostly in graphs:

• Philly Fed and Empire State Manufacturing Surveys show strong growth

From the Philly Fed: Highest reading since January 1984 and from the NY Fed Empire State Manufacturing Survey indicates faster growth in March

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

This early reading suggests the ISM index will be in the 60s again this month. These were two strong reports, although price increases remain a concern.

• Housing Starts decreased sharply in February

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 11.8% to 375 thousand in February - the lowest level since early 2009. This was well below expectations of 560 thousand starts, and near the record low.

This low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Note: This is the lowest level for Building permits since the Census Bureau started tracking permits.

• NAHB Builder Confidence increased slightly in March, Still depressed

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased slightly to 17 in March. This was at expectations of an increase to 17. Any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased slightly to 17 in March. This was at expectations of an increase to 17. Any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts.

Press release from the NAHB: Builder Confidence Edges Up One Point in March . Builders are still depressed, and the HMI has been below 25 for forty-five consecutive months - almost 4 years.

• Residential Remodeling Index shows strong increase year-over-year

The BuildFax Residential Remodeling Index was at 99.0 in January. This is based on the number of properties pulling residential construction permits in a given month.

The BuildFax Residential Remodeling Index was at 99.0 in January. This is based on the number of properties pulling residential construction permits in a given month.

This graph shows the year-over-year change from the same month of the previous year. The remodeling index is up 22% from January 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index).

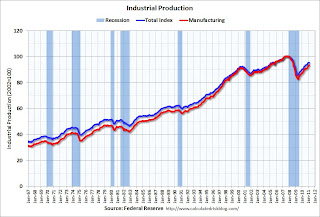

• Industrial Production, Capacity Utilization decline in February

Capacity utilization at 76.3% is still below normal - and well below the pre-recession levels of 81.2% in November 2007.

Capacity utilization at 76.3% is still below normal - and well below the pre-recession levels of 81.2% in November 2007.

This graph shows Capacity Utilization. This series is up 8.1 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production decreased in February to 95.5, however January was revised up from 95.1 to 95.6. The decline was due to warmer weather in February (less production at utilities) and the upward revision to the January data. Production is still 5.2% below the pre-recession levels at the end of 2007.

The consensus was for a 0.6% increase in Industrial Production in February, and an increase to 76.5% (from 76.1%) for Capacity Utilization. Even including the January revisions, this was still below consensus.

• Core Measures show increase in Inflation

Over the last 12 months, core CPI has increased 1.1%, median CPI has increased 1.0%, and trimmed-mean CPI increased 2.1%. This graph shows these three measure of inflation on a year-over-year basis.

Over the last 12 months, core CPI has increased 1.1%, median CPI has increased 1.0%, and trimmed-mean CPI increased 2.1%. This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Also, all three increased in February at a higher annualized rate: core CPI increased at an annualized rate of 2.4%, median CPI 2.4% annualized, and trimmed-mean CPI increased 3.8% annualized. This is the second consecutive month with the annualized rate for these three key measures at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

• Weekly Initial Unemployment Claims decline to 385,000

This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 7,000 to 386,250.

This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 7,000 to 386,250.

This is the 3rd consecutive week with the 4-week average below the 400,000 level, and although there is nothing magical about 400,000, this is a positive step for the labor market. Unfortunately the recent JOLTS data indicated that hiring hasn't picked up significantly yet, even as layoffs and discharges have slowed.

• Other Economic Stories ...

• From John Stark at The Bellingham Herald: FDIC sues WaMu execs, seeks to freeze their assets

• From the Federal Reserve: Federal Reserve completes Analysis of 19 Largest Banks, Allows some Dividends

• From Landon Thomas at the NY Times: E.U.'s Latest Rescue Package Seen Falling Short-Again

• FOMC Statement: No Change, "Economic recovery is on a firmer footing"

• February LA Port Traffic: Exports weak year-over-year

• Unofficial Problem Bank list increases to 982 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 982 Institutions

by Calculated Risk on 3/19/2011 08:15:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 18, 2011.

Changes and comments from surferdude808:

The Unofficial Problem Bank List surged to its highest ever institution count and asset level this week. Contributing factors were the release of actions through mid-February 2011 by the OCC and a deeper dive into the databases of the regulatory agencies. The scrubbing of databases found 12 institutions not previously identified. In all, there were 21 additions and three removals this week, which leaves the Unofficial Problem Bank List at 982 institutions with assets of $430.4 billion, up from 964 institutions with assets of $420.7 billion last week. The previous asset high was $422.4 billion at September 24, 2010.The list keeps growing and growing ...

The three removals were action terminations against Community National Bank, Waterloo, IA ($207 million); Lakewood Bank, National Association, Baxter, MN ($142 million); and Delanco Federal Savings Bank, Delanco, NJ ($136 million Ticker: DLNO).

The 21 new additions brought $10.1 billion of assets to the list. Notable additions include First National Bank, Edinburg, TX ($3.8 billion); Reliance Bank, Des Peres, MO ($1.2 billion Ticker: RLBS); The National Bank, Moline, IL ($1.2 billion); Community South Bank, Parsons, TN ($675 million); Home State Bank, National Association, Crystal Lake, Il ($666 million); South County Bank, National Association, Rancho Santa Margarita, CA ($179 million Ticker: CALW); SouthFirst Bank, Sylacauga, AL ($131 million Ticker: SZBI); and First Carolina State Bank, Rocky Mount, NC ($103 million Ticker: CBCR).

Next week, we anticipate the FDIC will release its actions for February 2011. Given the low cure rate and the slowdown in closing institutions by the FDIC, there is an outside chance for the Unofficial Problem Bank List to reach the 1,000 threshold next week. If not by next week, then the list should be at the 1,000 level by the end of April 2011.

Friday, March 18, 2011

Japan Update

by Calculated Risk on 3/18/2011 10:50:00 PM

An amazing video of people running from the tsunami and then rescuing others (ht rosethorn)

From the NY Times: Japan Races to Restart Reactors’ Cooling System

Scrambling to corral a widening crisis, engineers linked a power cable to the crippled Fukushima Daiichi Nuclear Power Station early Saturday as they struggled to restart systems designed to prevent overheating and keep radiation from escaping.A running blog from Reuters: Japan earthquake LIVE

The Tokyo Electric Power Company, which runs the station 140 miles north of here, said it hoped to connect the electric cord to the cooling equipment inside the facility later Saturday ...

Japan nuclear operator says hopes to connect cable to reactor no.4 by Saturday but may be SundayFrom the LA Times: Options are few to prevent Japan nuclear catastrophe

Document: FDIC Sues WaMu Execs

by Calculated Risk on 3/18/2011 08:25:00 PM

It has been so busy I skipped over this ...

Kirsten Grind at the Puget Sound Business Journal has been following this story: FDIC sues WaMu execs and their wives

The Federal Deposit Insurance Corp. filed suit against former executives of Washington Mutual, including former CEO Kerry Killinger, former President Steve Rotella, and their wives, in a case that seeks to recover unspecified damages at trial.John Stark at The Bellingham Herald has the lawsuit: FDIC sues WaMu execs, seeks to freeze their assets

For those of you who share my horrid fascination with the mortgage meltdown, this document will make interesting reading.The FDIC might not be closing any banks today, but this lawsuit is interesting reading!

...

The lawsuit has lots of quotes from WaMu’s risk managers, sending Killinger and Rotella increasingly frantic warnings about the bank’s unsustainable lending strategies as the housing bubble inflated. The risk managers understood the dangers clearly, and history proved their warnings were correct ...

Florida: 18 Percent of Homes are Vacant

by Calculated Risk on 3/18/2011 04:27:00 PM

From Les Christie at CNNMoney: Nearly 20% of Florida homes are vacant

On Thursday, the Census Bureau revealed that 18% -- or 1.6 million -- of the Sunshine State's homes are sitting vacant. That's a rise of more than 63% over the past 10 years.Here is the data from the 2010 Census:

...

The vacancy problem is more dire in Florida than in any other bubble market: In California, only 8% of units were vacant, while Nevada, the state with the nation's highest foreclosure rate, had about 14% sitting empty. Arizona had a vacancy rate of about 16%.

| Arizona | California | Florida | Nevada | |

|---|---|---|---|---|

| Total: | 2,844,526 | 13,680,081 | 8,989,580 | 1,173,814 |

| Occupied | 2,380,990 | 12,577,498 | 7,420,802 | 1,006,250 |

| Vacant | 463,536 | 1,102,583 | 1,568,778 | 167,564 |

| Percent Vacant | 16.3% | 8.1% | 17.5% | 14.3% |

Once all of the state data is released (by April 1st), I'll compile a comparison of vacant units to the 2000 Census data - and to the quarterly Housing Vacancies and Homeownership data (that is commonly used by analysts to estimate excess vacant units).

It is no surprise that Florida still has a huge number of excess vacant units.

DataQuick: California Home Sales down in February

by Calculated Risk on 3/18/2011 02:53:00 PM

From DataQuick: California February Home Sales

An estimated 27,320 new and resale houses and condos were sold statewide last month. That was down 1.4 percent from 27,706 in January, and down 2.8 percent from 28,111 for February 2010. California sales for the month of February have varied from a low of 20,153 in 2008 to a high of 48,409 in 2004, while the average is 32,117.The number of distressed sales is worth repeating: nearly 60% of existing home sales in California were distressed in February. We are a long way from normal. Short sales are continuing to increase as a percent of all sales (short sales are one way to do principal reductions, although the seller needs to make sure all lenders agree not to pursue the borrower for any deficiency).

...

Distressed property sales made up nearly 60 percent of California’s resale market last month.

Of the existing homes sold in February, 40.1 percent were properties that had been foreclosed on during the past year. That was down from 40.4 percent in January and down from 44.3 percent in February 2010. The all-time high was 58.5 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 18.9 percent of resales last month. That was up from an estimated 18.7 percent in January, 17.6 percent a year earlier, and 11.2 percent two years ago.

Note: Economist Tom Lawler is forecasting the NAR will report existing home sales of around 5 million (SAAR) for February. The NAR is scheduled to report February sales on Monday, March 21st at 10 AM.