by Calculated Risk on 2/05/2011 03:15:00 PM

Saturday, February 05, 2011

NMHC Quarterly Apartment Survey: Market Conditions Tighten

From the National Multi Housing Council (NMHC): Equity Capital Eyes The Apartment Sector Says NMHC Quarterly Market Conditions Survey

For the second consecutive quarter, 60% of respondents said markets were tighter (lower vacancies and/or higher rents) than three months ago. The Market Tightness Index recorded its second-highest January reading on record at 78.

...

"Rising apartment demand reflects a drop in demand for homeownership in today's marketplace," said NMHC Chief Economist Mark Obrinsky. "This growing demand against the backdrop of the lowest apartment starts in 40 years—barely enough to offset the units lost to demolition and obsolescence—will result in further tightening in the apartment sector in the near term."

Click on graph for larger image in graph gallery.

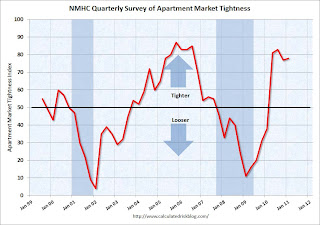

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last four quarters. A reading above 50 suggests the vacancy rate is falling.

This fits with the recent Reis data showing apartment vacancy rates fell in Q4 2010 to 6.6%, down from 7.1% in Q3 2010, and 8% in the Q4 2009.

Also this data is a survey of large apartment owners only. The data released last week from the Census Bureau showed the rental vacancy rate also declined for all rental units too. The Census Bureau rental vacancy rate declined sharply to 9.4% in Q4 2010, from 10.3% in Q3 2010.

A final note: This index helped me call the bottom for effective rates (and the top for vacancy rate) last year. Based on limited historical data, this index appears to lead reported apartment rents by about 6 months to 1 year.

Color Commentary for the Week

by Calculated Risk on 2/05/2011 11:21:00 AM

Commentary this week:

• Monday: QE2 Speculation and Summary

• Tuesday: Economic Outlook and Daily Summary

• Wednesday: Daily Color: D-List Data

• Thursday: Employment Situation: A Lighter Shade of Gray

• Friday: Daily Color: Two Employment Surveys, Different Results

Click on graph for larger image.

Click on graph for larger image.

A repeat from yesterday ...

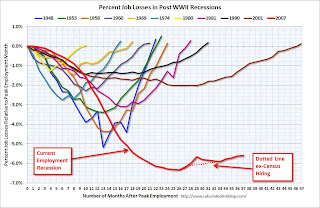

This graph shows the job losses from the start of the employment recession, in percentage terms - aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Here are the employment posts from yesterday (with graphs):

• January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education, Diffusion Indexes

• Employment Graph Gallery

Unofficial Problem Bank list at 946 Institutions

by Calculated Risk on 2/05/2011 08:29:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 4, 2011.

Changes and comments from surferdude808:

Mergers, both unassisted and FDIC- assisted, contributed to a slight reduction in the number of institutions on the Unofficial Problem Bank List this week. There were five removals and two additions, which leaves the list with 946 institutions with assets of $411.1 compared with 948 institutions with $410.9 billion last week.

The removals include the three failures this week -- American Trust Bank, Roswell, GA ($249 million); North Georgia Bank, Watkinsville, GA ($166 million); and Community First Bank - Chicago, Chicago, IL ($57 million).

Since the on-set of this banking crisis, there have been 55 failures in the state of Georgia that have cost the FDIC approximately $8.06 billion or 33 percent of $24.4 billion of failed assets.

The other removals were unassisted acquisitions of Professional Business Bank, Pasadena, CA ($281 million) by California General Bank, which re-named itself Professional Business Bank; and Midwest Community Bank, Plainville, KS ($99 million) by The Wilson State Bank.

The additions were First Georgia Banking Company, Franklin, GA ($802 million) and Atlantic Bank and Trust, Charleston, SC ($268 million). Hat tip to reader Bill for noting the action against First Georgia Banking Company while perusing its 10-K filing. In an oddly worded statement, First Georgia Banking Company stated it had entered into a "Stipulation and Consent Order" with the Georgia State Banking Department in August 2010 that "was acknowledged by the FDIC." However, the action is not available through the FDIC enforcement action search engine. Similarly, the action against North Georgia Bank, which failed this week, was never available on the FDIC website. Perhaps these actions were like being on "double secret probation" with the FDIC.

Friday, February 04, 2011

Bank Failure #14 for 2011: Community First Bank – Chicago

by Calculated Risk on 2/04/2011 09:20:00 PM

Here are the earlier employment posts (with graphs):

• January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Daily Color: Two Employment Surveys, Different Results

• Duration of Unemployment, Unemployment by Education, Diffusion Indexes

• Employment Graph Gallery

Cold hard cash assets frozen

Till White Knight appears.

by Soylent Green is People

From the FDIC: Northbrook Bank and Trust Company, Northbrook, Illinois, Assumes All of the Deposits of Community First Bank – Chicago, Chicago, Illinois

As of December 31, 2010, Community First Bank – Chicago had approximately $51.1 million in total assets and $49.5 million in total deposits.... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.7 million.

Bank Failures #12 & 13 for 2011

by Calculated Risk on 2/04/2011 06:30:00 PM

Here are the earlier employment posts (with graphs):

• January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Daily Color: Two Employment Surveys, Different Results

• Duration of Unemployment, Unemployment by Education, Diffusion Indexes

• Employment Graph Gallery

Note: I'm going to group bank failures (for fewer posts).

No UFO's in Roswell

"Take me to your bank"

by Soylent Green is People

From the FDIC: Renasant Bank, Tupelo, Mississippi, Assumes All of the Deposits of American Trust Bank, Roswell, Georgia

As of December 31, 2010, American Trust Bank had approximately $238.2 million in total assets and $222.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $71.5 million.

Another Georgia failure.

Assimilated.

by Soylent Green is People

From the FDIC: BankSouth, Greensboro, Georgia, Assumes All of the Deposits of North Georgia Bank, Watkinsville, Georgia

As of December 31, 2010, North Georgia Bank had approximately $153.2 million in total assets and $139.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $35.2 million.

Duration of Unemployment, Unemployment by Education, Diffusion Indexes

by Calculated Risk on 2/04/2011 04:12:00 PM

By request, here are three more graphs ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

In January 2011, the number of unemployed for 27 weeks or more declined to 6.21 million (seasonally adjusted). It appears the number of long term unemployed has peaked, but it is still very difficult for these people to find a job - and this is a very serious employment issue.

Both the 'less than 5 weeks', and the '5 to 14 weeks' categories declined in January - this followed the decline in initial weekly unemployment claims. The '15 to 26 weeks' category increased slightly in January, but the general trend appears to be down too.

Note: Even though these numbers are all seasonally adjusted, they can't be added together to calculate the unemployment rate.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are now trending down (at least somewhat).

Early last year the group with "less than a high school diploma" recovered a little better than the more educated groups - possibly because of the tax credit related increase in construction - but that changed in September as the unemployment rate increased sharply.

This is a little more technical. The BLS diffusion index for total private employment was at 59.4 in January. For manufacturing, the diffusion index increased to 69.1.

This is a little more technical. The BLS diffusion index for total private employment was at 59.4 in January. For manufacturing, the diffusion index increased to 69.1. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The decrease in these indexes during the summer of 2010 was a cause for concern, however the level of both indexes were a clear positive in the January employment report.

Best to all

Here are the earlier employment posts (with graphs):

• January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Daily Color: Two Employment Surveys, Different Results

• Employment Graph Gallery

Daily Color: Two Employment Surveys, Different Results

by Calculated Risk on 2/04/2011 12:38:00 PM

FAQ: How can the unemployment rate fall sharply if the economy is adding so few jobs, especially since the population is growing?

This data comes from two separate surveys. The unemployment rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households. The payroll jobs number comes from Current Employment Statistics (CES: establishment survey), a sample of approximately “140,000 businesses and government agencies representing approximately 410,000 worksites”.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

A couple of key concepts (from the BLS):

The CES employment series are estimates of nonfarm wage and salary jobs, not an estimate of employed persons; an individual with two jobs is counted twice by the payroll survey. The CES employment series excludes employees in agriculture and private households and the self-employed.And the CPS:

The CPS estimate of employment is for the total number of employed persons. Included are categories of workers that are not covered by the Current Employment Statistics (CES) survey: self-employed persons, private household workers, agriculture workers, unpaid family workers, and workers on leave without pay during the reference period. Multiple jobholders are counted once in the estimate of total employed.In January the headline CES number showed a gain of 36,000 non-farm jobs (by the definitions above). The CPS showed an increase of 117,000 employed people.

Unemployed persons include those who did not have a job during the reference week, had actively looked for work in the prior 4 weeks, and were available for work. Actively looking for work includes activities such as contacting a possible employer, contacting an employment agency or employment center, having a job interview, sending out resumes, filling out job applications, placing or answering job advertisements, and checking union or professional registers.

These two surveys are almost always different, and both are useful for understanding the employment situation.

Q: But the unemployment rate fell sharply even though the CPS only showed an increase of 117,000 employed people. How can that be?

The unemployment rate declined to 9.0% in January from 9.4% in December. The unemployment rate comes from directly from the CPS survey, but we can also think of it in terms of change in the labor force, and changes in the number of unemployed people. The unemployment rate is a ratio, with the numerator the number of unemployed, and the denominator the Civilian Labor Force - so the following changes lowered the unemployment rate to 9.0%.

The CPS also showed a decline in the Civilian Labor Force Level by 504,000. Some of this decline was due to a lower participation rate, and some of this decline was due a lower estimate of the Civilian noninstitutional population. In reality the working age population probably increased in January, but the updated population estimate showed a decrease of 185,000 people in the month.

The BLS provides some estimates with and without the change in population control (see Table C. at bottom of the release). Without the change in population control, the CPS would have shown an increase of 589,000 employed people. Also, without the change in population control, the number of unemployed would have fallen 590,000 (U-3). With the update population estimate, the number of unemployed declined 622,000.

So without the change in the population control - the change can be confusing - the CPS showed a surge in employment and a sharp decline in the unemployed, and that is the reason the unemployment rate declined sharply.

If you want more details, see Monthly Employment Situation Report: Quick Guide to Methods and Measurement Issues

Although the CPS showed the labor force declined in January, over time the labor force will continue to grow - probably around 1.5 to 2.0 million people per year on average, and the CES will probably need to show the addition of around 125,000 jobs per month just to keep the unemployment rate steady (estimates vary of this number).

Also weather usually has a bigger impact on the CES (establishment survey) than the CPS (household survey). We saw this last February when the CES showed a decline in payroll jobs and CPS showed an increase in the number employed and the unemployment rate held steady. Here is the archived February 2010 release. In the following month, March of 2010, the CES showed a relatively large increase in payroll jobs ex-Census (considering the weak labor market), and it was best to average the two reports together.

If the weak payroll report in January was due to the impact of weather we should expect a boost in the February payroll report and average the two together. If the underlying trend is around 150,000 payroll jobs per month, we'd expect to see 300,000 additional payroll jobs when we combine the January and February payroll reports next month.

So remember the jobs and unemployment rate come from two different surveys and they are different measurements of the employment situation (one for positions, the other for people). Some months the numbers may not seem to make sense (few payroll jobs and a sharp decline in the unemployment rate), but over time the numbers will work out.

Here are the earlier employment posts (with graphs):

• January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Employment Graph Gallery

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 2/04/2011 10:13:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the recession.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined from 8.9 to 8.4 million in January. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 8.407 million in January.

These workers are included in the alternate measure of labor underutilization (U-6) that declined sharply to 16.1% in January from 16.7% in December. Still very high, but improving.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.21 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.44 million in December. This is still very high.

Summary

This was a decent report with two obvious exceptions: the few payroll jobs added, and the slight decline in the average workweek - both potentially weather related.

The best news was the decline in the unemployment rate to 9.0% from 9.4% in December. However this was partially because the participation rate declined to 64.2% - a new cycle low, and the lowest level since the early '80s. Note: This is the percentage of the working age population in the labor force (here is the graph in the galleries of the participation rate). The participation rate has now fallen 2 percentage points during the recession - a huge decline.

The 36,000 payroll jobs added was far below expectations of 150,000 jobs, however this was probably impacted by bad weather during the survey reference period. If so, there should be a strong bounce back in the February report.

The decreases for the long term unemployed, and for the number of part time workers for economic reasons, are good news - although both levels are still very high. The average workweek declined slightly to 34.2 hours (possibly weather related), and average hourly earnings ticked up 8 cents.

If we blame it on the weather, this was a solid report. And we will know about payrolls in February.

• Earlier Employment post: January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

January Employment Report: 36,000 Jobs, 9.0% Unemployment Rate

by Calculated Risk on 2/04/2011 08:30:00 AM

From the BLS:

The unemployment rate fell by 0.4 percentage point to 9.0 percent inAnd on the benchmark revision:

January, while nonfarm payroll employment changed little (+36,000),

the U.S. Bureau of Labor Statistics reported today.

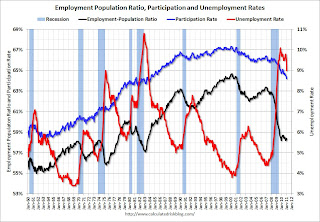

The total nonfarm employment level for March 2010 was revised downward by 378,000 ... The previously published level for December 2010 was revised downward by 452,000.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate decreased to 9.0% (red line).

The Labor Force Participation Rate declined to 64.2% in January (blue line). This is the lowest level since the early '80s. (This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.)

The Employment-Population ratio increased to 58.4% in January (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms from the start of the recession. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms from the start of the recession. The dotted line is ex-Census hiring. For the current employment recession, the graph starts in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was significantly below expectations for payroll jobs. Weather may have been a factor. I'll have much more soon ...

Thursday, February 03, 2011

Norris: From 1983, Hope for Jobs in 2011

by Calculated Risk on 2/03/2011 10:10:00 PM

Note: Earlier I posted some thoughts on employment: Employment Situation: A Lighter Shade of Gray

From Floyd Norris at the NY Times: From 1983, Hope for Jobs in 2011

In January 1983 ... the unemployment rate fell to 10.4 percent from 10.8 percent. It was the first such decline in five years, but few thought it significant.Norris points out some differences and similarities between now and then, and he is hopeful something similar will happen with unemployment this year. But I think he is too optimistic.

“The A.F.L.-C.I.O.,” The Washington Post reported, “said yesterday that there was no real improvement in unemployment last month because the decline was caused primarily by people dropping out of the labor force, rather than finding jobs.”

... the rate at the end of 1983 turned out to be 8.3 percent.

First, in 1983 the participation rate was all of 0.3 percentage points below the recent peak. Now it is 1.9 percentage points lower than the recent peak - suggesting some bounce back is more likely (keeping the unemployment rate elevated).

But a far more important difference between now and then is ... housing. There were just over 1 million housing starts in 1982, and starts picked up sharply in 1983 rising to over 1.7 million!

I've been pounding the table arguing that housing would add to both GDP and employment growth in 2011 for the first time since 2005. But does anyone think housing starts will increase by 650 thousand units in 2011 (more than doubling the just under 600 thousand units in 2010)?

Not. Gonna. Happen. Not with the huge overhang of existing vacant housing units (the overhang is declining, but we still have a ways to go). Housing was a key engine of job growth in 1983, but housing will have less of an impact in 2011.

I hope Mr. Norris is correct and the unemployment rate drops sharply in 2011, but my guess is the decline will be more sluggish this year than in 1983.