by Calculated Risk on 2/05/2011 03:15:00 PM

Saturday, February 05, 2011

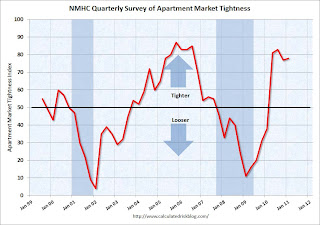

NMHC Quarterly Apartment Survey: Market Conditions Tighten

From the National Multi Housing Council (NMHC): Equity Capital Eyes The Apartment Sector Says NMHC Quarterly Market Conditions Survey

For the second consecutive quarter, 60% of respondents said markets were tighter (lower vacancies and/or higher rents) than three months ago. The Market Tightness Index recorded its second-highest January reading on record at 78.

...

"Rising apartment demand reflects a drop in demand for homeownership in today's marketplace," said NMHC Chief Economist Mark Obrinsky. "This growing demand against the backdrop of the lowest apartment starts in 40 years—barely enough to offset the units lost to demolition and obsolescence—will result in further tightening in the apartment sector in the near term."

Click on graph for larger image in graph gallery.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last four quarters. A reading above 50 suggests the vacancy rate is falling.

This fits with the recent Reis data showing apartment vacancy rates fell in Q4 2010 to 6.6%, down from 7.1% in Q3 2010, and 8% in the Q4 2009.

Also this data is a survey of large apartment owners only. The data released last week from the Census Bureau showed the rental vacancy rate also declined for all rental units too. The Census Bureau rental vacancy rate declined sharply to 9.4% in Q4 2010, from 10.3% in Q3 2010.

A final note: This index helped me call the bottom for effective rates (and the top for vacancy rate) last year. Based on limited historical data, this index appears to lead reported apartment rents by about 6 months to 1 year.