by Calculated Risk on 1/16/2011 08:22:00 PM

Sunday, January 16, 2011

Spain: "I Live Here Alone"

Here is an article on housing in Spain (in Spanish): Aquí vivo solo (ht Jim)

Google translate page:

There is only life in a corner with nothing around, rather than highways, roads, farmland, a corner living Paula and Pavel and another 1,200 people. Un 4% de lo previsto. 4% of schedule. Hay muchas formas de vivir solo. There are many ways to live alone. Esta es una de ellas. This is one of them. La urbanización fue proyectada para 30.000, más de un tercio de la población de Guadalajara capital. The complex was designed for 30,000 ...Check out the photos and captions too! The one guy has a golf course to himself ... at least the grass is green.

Earlier:

• Summary for Week ending January 15th

• Schedule for Week of January 16th

CoStar: Commercial Real Estate Prices declined in November

by Calculated Risk on 1/16/2011 02:22:00 PM

Some interesting comments on the trifurcation of the commercial real estate market ...

From CoStar: CoStar Commercial Repeat-Sale Indices

• CoStar’s three national commercial real estate repeat sales indices were down for the month of November despite notable price increases for high profile core transactions in Washington D.C. and New York City

• The Investment Grade index was down 4.1% for the month giving back some, but not all of the 8.1% net gains observed over August, September and October. Notwithstanding November’s decline, the Investment Grade index is still up 7.6% since its cyclical low earlier this year.

Negative national trends contrast with the strong and increasing interest in trophy properties within core markets where prices have continued to climb during 2010. Collectively they show a market that is not just bifurcated but possibly trifurcated, with trophy assets commanding bidding wars, smaller assets languishing, particularly in secondary and tertiary markets; and distressed properties trickling onto the market as banks recycle assets at a relatively measured pace.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CoStar shows the indexes for investment grade, general commercial and a composite index. All three indexes declined in November.

It is important to remember that there are very few CRE transactions (compared to residential), and that there is a high percentage of distressed sales, so prices are very volatile.

Earlier:

• Summary for Week ending January 15th

• Schedule for Week of January 16th

Summary for Week ending January 15th

by Calculated Risk on 1/16/2011 08:24:00 AM

Note: here is the economic Schedule for Week of January 16th.

Below is a summary of the previous week, mostly in graphs.

• Retail Sales increased 0.6% in December

On a monthly basis, retail sales increased 0.6% from November to December(seasonally adjusted, after revisions), and sales were up 7.9% from December 2009.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline). Retail sales are up 13.5% from the bottom, and now 0.2% above the pre-recession peak.

This was below expectations for a 0.8% increase. Retail sales ex-autos were up 0.5%; also below expectations of a 0.7% increase. Although slightly lower than expected, retail sales are now above the pre-recession peak in November 2007.

• Industrial Production, Capacity Utilization increased in December

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in December after having risen 0.3 percent in November. ... The capacity utilization rate for total industry rose to 76.0 percent, a rate 4.6 percentage points below its average from 1972 to 2009.

This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.5% from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 76.0% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

This was above consensus expectations of a 0.5% increase in Industrial Production, and an increase to 75.6% for Capacity Utilization.

• Trade Deficit declined slightly in November

The trade deficit in November was $38.3 billion, down slightly from $38.4 billion in October This graph shows the monthly U.S. exports and imports in dollars through November 2010.

The trade deficit in November was $38.3 billion, down slightly from $38.4 billion in October This graph shows the monthly U.S. exports and imports in dollars through November 2010.Imports have been mostly flat since May, and exports have started increasing again after the mid-year slowdown.

The petroleum deficit increased in November as import prices continued to rise - averaging $76.81 per barrel in November. Prices will be even higher in December. The deficit with China increased to $25.634 billion from $25,517 in October. Once again oil and China deficits are essentially the entire trade deficit (or even more).

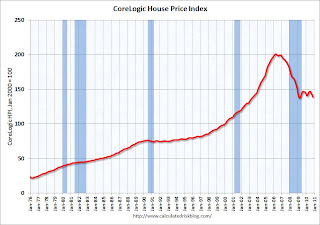

• CoreLogic: House Prices declined 1.6% in November

CoreLogic reported that house prices declined again in November. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

CoreLogic reported that house prices declined again in November. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 5.07% over the last year, and off 30.9% from the peak.

The index is only 1.2% above the post-bubble low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

• Ceridian-UCLA: Diesel Fuel index increased in December

Ceridian-UCLA reported "The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May."

Ceridian-UCLA reported "The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers and consumers, surged 2.4 percent in December and pushed the PCI above its previous 2010 peak established in May."This graph shows the index since January 1999.

• NFIB: Small Business Optimism index declined slightly in December

This graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.

This graph shows the small business optimism index since 1986. The index decreased slightly to 92.6 in December from 93.2 in November.According to the NFIB: "This marks the 36th month of Index readings in the recession level".

The decline this month was small, and in general this index has been improving - but very slowly.

• Other Economic Stories ...

• From the Financial Times: Lisbon succeeds with debt auction

• From the NY Times: Portugal Bond Sale Succeeds Despite Budget Woes

• From the WSJ: Strong Demand at European Debt Auctions

• From the Association of American Railroads: AAR: Rail Traffic increased in December

• Fed's Beige Book: "Economic activity continued to expand moderately"

• From RealtyTrac: Record Foreclosure activity in 2010

• Unofficial Problem Bank list increases to 933 Institutions

Best wishes to all!

Saturday, January 15, 2011

State and Local Budget Update

by Calculated Risk on 1/15/2011 11:04:00 PM

State and local budgets are a key issue this year. The HuffPo has some details: State Budgets: Year Ahead Looms As Toughest Yet Here are a few states:

New York Gov. Andrew Cuomo proposed eliminating 20 percent of state agencies by combining duties, such as merging the Insurance Department, Banking Department and the Consumer Protection Board into the Department of Financial Regulation. It's part of "radical reform" to pull his state out of its fiscal crisis.And on and on. As the article notes, state revenue is slowing increasing this year, but the support from the stimulus program is starting to fade - so this will be another very difficult year for the states.

And Gov. Chris Christie in New Jersey skipped a $3.1 billion payment to the state's pension system in a push to cut benefits for public workers, while proposing higher employee contributions and a boost in the retirement age from 62 to 65.

In Illinois, lawmakers voted for a ... hike in personal income tax, from 3 percent to 5 percent, in a bid to resolve a $15 billion deficit ...

In oil-rich Texas ... hard times are looming. The shortfall is projected to be between $15 billion and $27 billion over the coming two-year budget cycle.

In South Carolina, outgoing Gov. Mark Sanford has proposed a spending plan that would end funding for museum and arts programs, slash college funding and give many state employees a 5 percent pay cut.

And from the NY Times: U.S. Bills States $1.3 Billion in Interest Amid Tight Budgets (ht Mr. Slippery)

a new bill is coming due — from the federal government, which will charge them $1.3 billion in interest this fall on the [$41 billion] they have borrowed from Washington to pay unemployment benefits during the downturn ...Ouch. Another straw on the camel's back.

These budget cuts and tax hikes will be a drag on growth and employment this year as the states try to get their fiscal houses in order.

Note: Here is the Schedule for Week of January 16th

Hamilton: Historical Oil Shocks

by Calculated Risk on 1/15/2011 04:10:00 PM

Here is a summary from Jim Hamilton of a new paper "Historical Oil Shocks" including a nice table of all post WW-II oil shocks: Oil shocks and economic recessions

And his conclusion:

The correlation between oil shocks and economic recessions appears to be too strong to be just a coincidence (Hamilton, 1983a, 1985). ... This is not to claim that the oil price increases themselves were the sole cause of most postwar recessions. Instead the indicated conclusion is that oil shocks were a contributing factor in at least some postwar recessions.With rising oil prices, this is a timely paper.

Note: Here is the Schedule for Week of January 16th

Schedule for Week of January 16th

by Calculated Risk on 1/15/2011 11:45:00 AM

Three key housing reports will be released this week: January homebuilder confidence on Tuesday, December housing starts on Wednesday, and December existing home sales on Thursday.

Note: Some large bank reporting included for possible comments on foreclosures.

Holiday: Martin Luther King Jr. Day. All US markets will be closed.

7:15 AM ET: Philly Fed President Charles Plosser speaks in Santiago, Chile "Thoughts on the Scope of Monetary Policy"

8:00 AM ET: Citigroup Fourth Quarter 2010

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 14.0, up from 10.57 in December.

10 AM: The January NAHB homebuilder survey. The consensus is for a reading of 17, up slightly from 16 in December. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for the last 3 1/2 years.

Early: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate). This index showed expansion (52.0) in November, the highest mark since December 2007. This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly since then.

8:00 AM: Wells Fargo and Goldman Sachs Fourth Quarter 2010

8:30 AM: Housing Starts for December. After collapsing following the housing bubble, housing starts have mostly moved sideways at a very depressed level for the last two years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows total and single unit starts since 1968.

Total housing starts were at 555 thousand (SAAR) in November, up 3.9% from the revised October rate of 534 thousand. Single-family starts increased 6.9% to 465 thousand in November.

The consensus is for a slight decrease to 550,000 (SAAR) in December.

7:30 AM: Morgan Stanley Fourth Quarter 2010

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims increased last week to 445,000, but the trend has been down over the last few months. The consensus is for a decrease to 420,000 from 445,000 last week.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 4.9 million at a Seasonally Adjusted Annual Rate (SAAR) in December, up about 5% from the 4.68 million SAAR in November. Economist Tom Lawler is projecting sales of 5.13 million in December.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in November 2010 (4.68 million SAAR) were 5.6% higher than in October, and were 27.9% lower than November 2009.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in November 2010 (4.68 million SAAR) were 5.6% higher than in October, and were 27.9% lower than November 2009. In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices). The months-of-supply will probably be in the low 8 months range, down sharply from the 9.5 months reported for November. However some of the decline is seasonal, and inventory should increase again in February.

10:00 AM: Philly Fed Survey for January. This survey showed stronger expansion in November and December after showing contraction in the early fall. The consensus is for a reading of 20.4, down slightly from the revised 20.8 in December.

10:00 AM: Conference Board Leading Indicators for December. The consensus is for a 0.6% increase for this index.

8:00 AM: Bank of America Fourth Quarter 2010

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Unofficial Problem Bank list increases to 933 Institutions

by Calculated Risk on 1/15/2011 09:03:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 14, 2011.

Changes and comments from surferdude808:

It was a quiet week for the Unofficial Problem Bank List as there were only two additions and one removal, which leaves the list at 933 institutions with assets of $410.4 billion.

The removal was Sunnyside FS&LA of Irvington, Irvington, NY ($96 million) as the OTS terminated its Cease & Desist Order against the thrift. CR received notice the order had been terminated from an officer of Sunnyside. It is interesting that CR has yet to receive a notice from an institution when it has been placed under a formal action.

The sole failure this week -- Oglethorpe Bank, Brunswick, GA -- was not on the Unofficial Problem Bank List. The failure cost the FDIC $80.4 million or nearly 35 percent of the failed bank's assets. It is becoming more unusual for an institution to fail without being subject to a formal action as banking regulators have mostly caught-up from the onslaught of problems/failures that started in 2008. However, given the high percentage cost in terms of the failed bank's assets, it is difficult to understand how the 52nd bank failure in Georgia was not operating under a corrective action.

The additions this week include First Bank and Trust Company of Illinois, Palatine, IL ($357 million); and First Federal Savings and Loan Association of Hammond, Hammond, IN ($52 million). The other change this week is a new name and ticker symbol for First Standard Bank, Los Angeles, CA ($123 million Ticker: FSTA), which is now operating as Open Bank (Ticker: OPBK).

We thought there might be an outside chance for the OCC to release its actions through mid-December 2010, but that did not happen. Look for the OCC press release next Friday, until then try to practice safe banking.

Friday, January 14, 2011

FOMC 2005 Transcripts: 'Flip That House' as Bubble Sign

by Calculated Risk on 1/14/2011 09:15:00 PM

The Fed released the FOMC transcripts from 2005 today. That was a key year for the housing bubble because that is when activity peaked - also inventory started to rise towards the end of the year and that helped me call the top.

Earlier I excerpted some comments from the June meeting - a meeting focused on housing.

Here is more from Ryan Grim at the HuffPo: Fed Economist To Greenspan In 2005: Discovery Channel's 'Flip That House' Should Cause 'Existential Crisis'

"I offer one more piece of evidence that I think almost surely suggests that the end is near in this sector. While channel-surfing the other night, to the annoyance of my otherwise very patient wife, I came across a new television series on the Discovery Channel entitled 'Flip That House,'" economist David Stockton said, prompting a roomful of laughter according to the transcript. "As far as I could tell, the gist of the show was that with some spackling, a few strategically placed azaleas and access to a bank, you too could tap into the great real-estate wealth machine. It was enough to put even the most ardent believer in market efficiency into existential crisis. [Laughter]"This was from the end of Dec 13th transcript and by then the housing bust had already started.

The Fed, the home of many of the most ardent believers in market efficiency, did not go through an existential crisis, however, and did little to slow down surging prices or warn consumers that "the end is near."

Posts this morning:

• Retail Sales increased 0.6% in December

• Industrial Production, Capacity Utilization increased in December

• Consumer Sentiment declines in January

• Core measures of inflation increase in December

Bank Failure #3 for 2011: Oglethorpe Bank, Brunswick, Georgia

by Calculated Risk on 1/14/2011 05:23:00 PM

Earlier:

• Retail Sales increased 0.6% in December

• Industrial Production, Capacity Utilization increased in December

• Consumer Sentiment declines in January

• Core measures of inflation increase in December

Surgeons remove rotted flesh

Oglethorpe excised

by Soylent Green is People

From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Oglethorpe Bank, Brunswick, Georgia

As of September 30, 2010, Oglethorpe Bank had approximately $230.6 million in total assets and $212.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $80.4 million. ... Oglethorpe Bank is the third FDIC-insured institution to fail in the nation this year, and the first in Georgia.

The FOMC Debates the Housing Bubble in 2005

by Calculated Risk on 1/14/2011 04:05:00 PM

The Federal Reserve just released the transcripts of the FOMC meetings in 2005. This will take some reading, but the June meeting was focused on housing.

From then Atlanta Fed President Jack Guynn:

[T]there is the housing situation, which we talked about for a long time yesterday afternoon. As I’ve been reporting for several meetings, some of our markets, especially those in coastal areas of South Florida and the Florida panhandle, are experiencing a level of building activity and price increases that are clearly, in my view, unsustainable. Nearly every major Florida city now has experienced increases in the double-digit range, and some, like Miami, Palm Beach, Sarasota, and West Palm, have been reporting increases in housing prices on a year-over-year basis of between 25 and 30 percent. While our discussion yesterday did not seem to indicate a consensus on a national housing bubble, based on past experience I’m reasonably comfortable characterizing the housing feeding frenzy in some of our markets as being a bubble or a near bubble.Here are the presentation materials for the June meeting with plenty of graphs on housing.

For example, the number of major projects planned or under construction in Miami now totals 114, most of which are high-rise developments. That includes 61,000 condo units—eight times the number that were built in the last decade—and a total of 100,000 new parking spaces. I know we don’t have any process for introducing exhibits into the record, but I’d like to pass Dave Stockton this pictorial of the new projects in Miami, so that he can continue to worry a little bit along with me. [Laughter]

My supervision and regulation staff thinks this is an accident waiting to happen in our area. And while the local market excesses probably do not represent systemic national risk, the shakeouts could have serious regional consequences. My bank supervision staff points out that housing-related credit risks to our bank lenders are not so much from defaults on permanent mortgage financing that we talked about yesterday, but rather from lending for land acquisition, development, and construction. The ugly picture we have seen before—and that they think we may very likely see again before long—goes something like this: the drying up of sales of new units; the painful decision of developers to go ahead and complete the construction of additional units to make them saleable, further depressing the market; and speculators who had hoped to see big capital gains walking away or defaulting on their contracts, giving their properties back to the lender. Perhaps it’s because of where I sit, but I am less comforted than some of my colleagues about the housing situation. ...

CHAIRMAN GREENSPAN. Let’s take a break for coffee.