by Calculated Risk on 12/15/2010 09:15:00 AM

Wednesday, December 15, 2010

Industrial Production, Capacity Utilization increase in November

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in November after a decline of 0.2 percent in October. The rate of change for industrial production was revised down in October but up in September; the net effect of the revisions from June to October left the level of industrial production in October about the same as was previously reported. ... At 93.9 percent of its 2007 average, total industrial production in November was 5.4 percent above its level a year earlier. The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This was slightly above consensus expectations of a 0.3% increase in Industrial Production, and an increase to 75.0% for Capacity Utilization. The increases in Industrial Production and Capacity Utilization have slowed significantly since May.

Three Stories: Spain, NY Manufacturing, Inflation

by Calculated Risk on 12/15/2010 08:30:00 AM

• From the Financial Times: Spain threatened with fresh downgrade

Moody’s ... has said it may downgrade Spanish government bonds because of the country’s likely difficulty in raising large sums of money next year, the problems of its savings banks and the debts incurred by its autonomous regions.This has pushed the yields on Spain 10-year bonds to a new record high of 5.52%.

excerpt with permission

• From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions improved in December for New York State manufacturers. After dropping sharply into negative territory in November, the general business conditions index bounced back above zero, climbing 22 points to 10.6. The new orders and shipments indexes also rose above zero, while the unfilled orders index remained negative. The inventories index was negative, indicating that inventory levels were lower over the month. The indexes for both prices paid and prices received were positive and higher than last month, suggesting that prices rose, while employment indexes were negative, indicating that employment declined.This was the one regional survey that indicated contraction in November.

• From the BLS: Consumer Price Index increased 0.1 percent in November

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.1 percent before seasonal adjustment.

...

The index for all items less food and energy rose 0.1 percent in November [Core CPI], its first increase since July. The index for shelter rose 0.1 percent in November, the same increase as the previous month. The rent index rose 0.2 percent, its largest increase since March 2009, while the index for owners' equivalent rent rose 0.1 percent ...

MBA: Mortgage Applications decline, Mortgage rates rise sharply

by Calculated Risk on 12/15/2010 07:35:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 0.7 percent from the previous week. This is the fifth straight weekly decline for the Refinance Index. The seasonally adjusted Purchase Index decreased 5.0 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.84 percent from 4.66 percent, with points increasing to 1.34 from 0.94 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at about the levels of 1997 - and about 17% below the levels of April this year - suggesting weak existing home sales through the end of the year and into January.

Tuesday, December 14, 2010

Tax Legislation: Senate Votes on Wednesday

by Calculated Risk on 12/14/2010 11:07:00 PM

The Senate will "convene and resume consideration" of the tax legislation tomorrow at 10 AM ET. There will be some posturing debate, followed by the vote. The bill is expected to pass the House within a few days.

Earlier today:

• NFIB Small Business Optimism Index Rises. NFIB graphs here.

• Retail Sales increased 0.8% in November

• FOMC Statement: No Change

• Lawler: Early Read on November Existing Home Sales: 4.57 million SAAR

Wednesday:

• 7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• 8:30 AM: Consumer Price Index for November.

• 8:30 AM: NY Fed Empire Manufacturing Survey for December.

• 9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November.

• 10 AM: The December NAHB homebuilder survey.

Best to all

posturing

Mortgage Rates pushing 5%

by Calculated Risk on 12/14/2010 07:14:00 PM

From "Soylent Green is People":

My favorite word of the day, remarked by another LO, is "gruesome". That's what's going on in the mortgage market.From economist Tom Lawler:

...

A "true" -0- point, -0- lender fee refinance rate is in the mid 5's which is wholly unappealing to consumers. Benchmark FHA 30 fixed loans are in the 4.75% rate range, also for 1.0 point origination.

The US MBS market had a very bad day, and secondary market yields surged from early this morning. For example, Freddie Mac’s required net yield on a 60-day commitment to purchase conventional conforming 30-year fixed-rate mortgages went from 4.50% at 8:30 this morning to 4.64% at 3:00 PM. For Freddie “PMMS” mortgage rate followers, such a level would, if sustained, suggest that next week’s “Freddie 30-year primary mortgage market rate” would be somewhere in the neighborhood of 4 7/8% and 0.8 point.Usually I track Freddie Mac's Primary Mortgage Market Survey® (PMMS®) and it appears 30 year rates will be pushing 5% this week. "Gruesome" is the word for those in the mortgage industry, especially for refinance activity.

Lawler: Early Read on November Existing Home Sales

by Calculated Risk on 12/14/2010 04:27:00 PM

CR Note: This is from housing economist Tom Lawler:

"Based on available data I’ve seen so far, I estimate that existing home sales ran at a seasonally adjusted annual rate of 4.57 million in November, up 3.2% from October’s pace, though down 29.6% from last November’s tax-credit-goosed pace. The YOY % decline in sales on an unadjusted basis should be around 27.2-27.3%, with the “SA/NSA” difference related to the calendar/different business day counts.

The incoming data from MLS/realtors/boards are broadly consistent with the realtor.com data pointing to a 3.4% drop in the existing homes-for-sale inventory in November, and if anything the local reports suggest the possibility of a somewhat larger decline."

CR Note: A 3.4% decline in inventory, and sales of 4.57 million SAAR would put the months-of-supply at about 9.8 months in November. That would follow four straight months of double digit supply. Based on this early forecast, inventory would be up about 6% YoY.

Sales are seasonally adjusted, but inventory is not. There is a clear seasonal pattern for inventory (inventory will be even lower in December as sellers take their homes off the market for the holidays). So the seasonal decline in inventory makes the months-of-supply look better.

This is about the same level of sales as in September. Here is the graph gallery for existing home sales through October.

Existing home sales for November will be released on Wednesday December 22nd at 10 AM ET.

FOMC Statement: No Change

by Calculated Risk on 12/14/2010 02:15:00 PM

• The target range for the federal funds rate remains at 0 to 1/4 percent

• The policy of reinvestment of principal payments remains

• no change to the plan to purchase an additional $600 billion of longer-term Treasury securities by the end of June 2011.

• the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" remains

From the Federal Reserve:

Information received since the Federal Open Market Committee met in November confirms that the economic recovery is continuing, though at a rate that has been insufficient to bring down unemployment. Household spending is increasing at a moderate pace, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. The housing sector continues to be depressed. Longer-term inflation expectations have remained stable, but measures of underlying inflation have continued to trend downward.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Sandra Pianalto; Sarah Bloom Raskin; Eric S. Rosengren; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Voting against the policy was Thomas M. Hoenig. In light of the improving economy, Mr. Hoenig was concerned that a continued high level of monetary accommodation would increase the risks of future economic and financial imbalances and, over time, would cause an increase in long-term inflation expectations that could destabilize the economy.

Q3 2010: Mortgage Equity Withdrawal

by Calculated Risk on 12/14/2010 12:36:00 PM

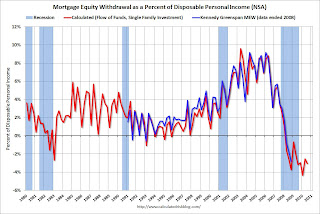

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2010, the Net Equity Extraction was minus $86 billion, or a negative 3.0% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q3, and this was probably mostly because of debt cancellation per foreclosure and short sales, and some from modifications, as opposed to homeowners paying down their mortgages. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

Retail Sales increase 0.8% in November

by Calculated Risk on 12/14/2010 08:50:00 AM

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 12.8% from the bottom, and only off 0.3% from the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.9% on a YoY basis (7.7% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $378.7 billion, an increase of 0.8 percent (±0.5%) from the previous month, and 7.7 percent (±0.7%) above November 2009. Total sales for the September through November 2010 period were up 7.8 percent (±0.5%) from the same period a year ago. The September to October 2010 percent change was revised from +1.2 percent (±0.5%) to +1.7 percent (±0.2%).This was above expectations for a 0.6% increase (and October was revised up). Retail sales ex-autos were up 1.2%, above expectations of a 0.6% increase.

Retail sales are almost back to the pre-recession peak in November 2007.

NFIB: Small Business optimism improves in November

by Calculated Risk on 12/14/2010 07:52:00 AM

From National Federation of Independent Business (NFIB): Small Business Optimism improves in November

Overall, small business owners continued to report more improvements in the economic environment, but the gains were small. The Index of Small Business Optimism gained 1.5 points, but the reading of 93.2 is still very weak, closer to a recession reading than indicative of a recovery. Although the November reading is higher than the prior 34 months, it is still lower than the November - December, 2007 readings by over a point, and those were the lowest 2007 readings as the Index fell all year signaling the coming end to the expansion in December. So the Index has climbed from its recession low of 81 but is far short of even the average value of the Index prior to the start of the recession, and far below values that have typified a recovery period.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. Although the index increased to 93.2 in November (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

The second graph shows the net hiring plans over the next three months.

The second graph shows the net hiring plans over the next three months.Hiring plans have turned positive again and are the highest level since mid-2008. According to NFIB: "Over the next three months, nine percent plan to increase employment (up one point), and 12 percent plan to reduce their workforce (down one point), yielding a seasonally adjusted net four percent of owners planning to create new jobs, a three point gain from

October.."

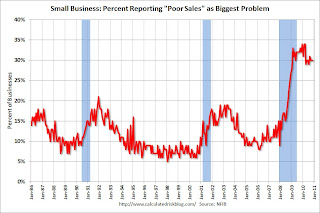

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

Overall this survey is showing improvement, but at a very slow pace.