by Calculated Risk on 7/20/2010 10:08:00 PM

Tuesday, July 20, 2010

Quick Update: Bernanke rescheduled to 2 PM ET

The Semiannual Monetary Policy Report to the Congress 02:00 PM - 05:00 PM ET

Bernanke Testimony Preview

by Calculated Risk on 7/20/2010 07:45:00 PM

Tomrrow, starting at 10 AM ET, Fed Chairman Ben Bernanke will report to the Senate Banking Committee: The Semiannual Monetary Policy Report to the Congress

David Wessel at the WSJ has a preview: The View From Bernanke's Perch at the Fed

Neil Irwin at the WaPo has some comments: Why Wall Street doesn't understand the Fed

Bernanke will very likely tell the Senate Banking Committee on Wednesday that cutting [interest on excess reserves] is one of a handful of options that the Fed is evaluating should the economic recovery continue to stumble. The others ... are strengthening its promise to keep interest rates low for an extended period and buying enough mortgage securities to replace those that mature. He will indicate openness to buying more long-term assets, but only if the economy appears to be heading back toward recession.I doubt Bernanke will mention options for further easing in his prepared statement, however he will probably be asked about what options are available in the Q&A. As Andrew Tilton at Goldman Sachs noted yesterday: "Any commentary on easing options seems more likely to come in the question-and-answer session rather than prepared remarks. One way for Chairman Bernanke to keep specific ideas at arm’s length might be to couch them in terms of a discussion of what other central banks have done."

I think Bernanke will mention the recent weak economic data in his prepared testimony, and it will interesting to see how he phrases it. As far as policy options, I think the options Irwin mentions are possible - and also possible is setting target ceiling rates for 3 to 5 year Treasury securities (he discussed this in his 2002 speech: Deflation: Making Sure "It" Doesn't Happen Here).

Obama Housing Scorecard

by Calculated Risk on 7/20/2010 04:31:00 PM

The Obama Administration released the June Housing Scorecard today. The graphs are a little hard to read, but they do provide a list of sources.

On modifications they provide a graph showing 2.95 million total modifications for Hope Now, HAMP, and FHA loss mitigation (page 3). There are also private modifications too (not mentioned) - so quite a few borrowers have had some sort of loan modification.

For housing supply (page 2 last graph), they show existing home inventory and "vacant housing units, held off market, year round, other" from the Census Bureau. I suppose they are using this number (about 3.6 million now - usually around 2.7 million) as a measure of shadow inventory. I think a better measure of the excess supply is to use the vacancy rates from the Census Bureau. The Q2 vacancy rates will be released next week on July 27th.

HAMP data: Only 15,000 trial modifications started in June

by Calculated Risk on 7/20/2010 01:07:00 PM

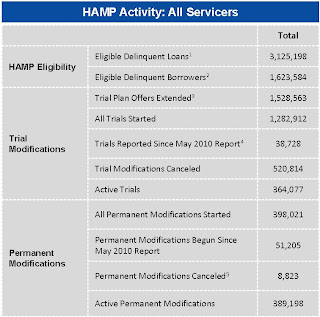

From Treasury: HAMP Servicer Performance Report Through June 2010

About 389 thousand modifications are now "permanent" - up from 347 thousand last month - and 521 thousand trial modifications have been cancelled - up sharply from 430 thousand last month.

According to HAMP, there are 364,077 "active trials", down from 467,672 last month. There is still a large number of borrowers in limbo since only 235 thousand trials were started over the last 5 months. I expect another large number of cancellations in July.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 15,000 in June (down from 30,000 in April 2010). This is the slowest pace since the program started, probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers. The program is winding down ...

Debt-to-income ratios

If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.8% - the same as last month. And the back end DTI was an astounding 79.9 (up slightly from last month).

Think about that for a second: for the median borrower, about 80% of the borrower's income went to servicing debt. And the median is 63.7% after the modification.

And that is the median - and just imagine the characteristics of the borrowers who can't be converted!

Summary:

Note: On page 3, HAMP added the delinquency rates for "permanent" modifications. As an example, 5.9% of borrowers are 60+ days delinquent six months after their modifications became "permanent". Over 8,800 "permanent" modifications have been cancelled, and only 195 have been paid off (probably sold property). The others probably are in foreclosure (or other distress sale).

State Unemployment Rates: Generally lower in June

by Calculated Risk on 7/20/2010 10:03:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

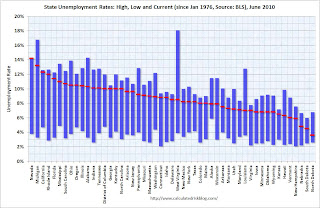

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. Arizona and New Jersey are close.

Nevada set a new series high at 14.2% and now has the highest state unemployment rate. Michigan held the top spot for over 4 years until May.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in June. Thirty-nine states and the District of Columbia recorded unemployment rate decreases, five states had increases and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada again reported the highest unemployment rate among the states, 14.2 percent in June. The rate in Nevada also set a new series high. (All region, division, and state series begin in 1976.) The states with the next highest rates were Michigan, 13.2 percent; California, 12.3 percent; and Rhode Island, 12.0 percent.

emphasis added

Housing Starts decline in June

by Calculated Risk on 7/20/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

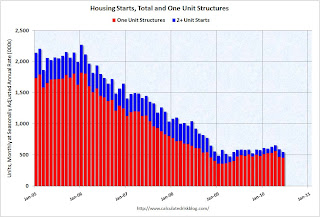

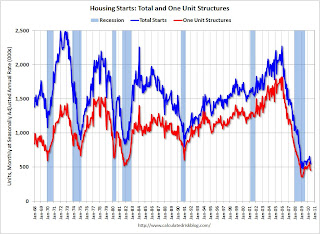

Total housing starts were at 549 thousand (SAAR) in June, down 5% from the revised May rate of 578,000 (revised down from 593 thousand), and up 15% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts declined 0.7% to 454,000 in June. This is 26% above the record low in January 2009 (360 thousand).  The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This is way below expectations of 580 thousand (I took the under!), and is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 549,000. This is 5.0 percent (±13.2%)* below the 13.2%) revised May estimate of 578,000 and is 5.8 percent (±10.5%)* below the June 2009 rate of 583,000.

Single-family housing starts in June were at a rate of 454,000; this is 0.7 percent (±10.7%)* below the revised May figure of 457,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 586,000. This is 2.1 percent (±2.1%)* above the revised May rate of 574,000, but is 2.3 percent (±2.0%) below the June 2009 estimate of 600,000.

Single-family authorizations in June were at a rate of 421,000; this is 3.4 percent (±1.8%) below the revised May figure of 436,000.

Monday, July 19, 2010

Update: Unemployment Benefits extension likely to pass

by Calculated Risk on 7/19/2010 07:40:00 PM

Earlier I mentioned I wasn't sure if the unemployment benefit extension would pass - it looks like it will pass tomorrow.

The WSJ reports Senate Set to Extend Jobless Benefits

On Tuesday, Democrats are likely to get the 60 votes they need to extend the benefits through November. ... The House is expected to approve the Senate's version Wednesday and send it to Mr. Obama for his signature.Note: this is an extension of the qualification dates for existing tiers of extended unemployment benefits, not additional weeks of benefits.

Moody's: Commercial Real Estate Price Index increases in May

by Calculated Risk on 7/19/2010 04:40:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 3.6% in May. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is possible that commercial real prices have bottomed - in general - but it is hard to tell because the number of transactions is very low and there are a number of distressed sales.

Commercial real estate values are now down 6.3% over the last year, and down 38.9% from the peak in late 2007.

Comments from PIMCO

As I've noted every month, this is a very thin market that is skewed by distressed sales. John Murray at PIMCO also cautioned about the CPPI index in a recent note: PIMCO U.S. Commercial Real Estate Project

National price indices such as the Moody’s Commercial Property Price Index (CPPI) can provide misleading indications of a recovery in CRE asset price levels. Since November 2009, the index has rebounded 3%.Comments from MIT Professor David Geltner

While it is natural to draw comparisons between the CPPI and the S&P/Case-Shiller index used to gauge residential home prices, we caution that indexes such as the CPPI are relatively meaningless in today’s limited transaction environment – commercial real estate transaction volume fell nearly 90% from 2007 to 2009.

Our ride along meetings highlight another limitation of the CPPI. Based on repeat transactions, the index excludes the truly distressed or overpriced properties acquired in the past few years that have yet to trade, and is instead skewed by the high proportion of trophy asset and Agency-financed multifamily transactions.

Dr. Geltner writes a column that appears on the Real Estate Analytics LLC website on the lower right under "Professor's Corner". This is based on last month's data, but still explains the market dynamics:

CPPI advanced in April, due to the very strong performance of “healthy” properties (i.e., those without the RCA “troubled asset” flag). Figure 4 shows that the healthy property breakout index (estimated using the same methodology as the CPPI only dropping out the “troubled assets”) rose 6.3% from March to April while the “distressed” index declined more than 5%. The “healthy property index” is now only 33% below the October 2007 peak, while properties falling into distress since then are still selling more than 50% below 2007 values on average.

Graph from Dr. Geltner.

Graph from Dr. Geltner.Whereas 2009 saw the advent of a bifurcated market between “healthy” and “distressed” properties, 2010 is now seeing what might be called a “trifurcated” market. Not only are distressed properties selling at sharp discounts, but “trophy” properties and solid “core” assets are selling at very respectable prices well above the general market average.Roughly, CRE prices are moving up for "trophy" properties, moving sideways for the general market, and falling again for distressed properties. But this is based on very few transactions ...

Lawler: Preview on Existing Home Sales

by Calculated Risk on 7/19/2010 03:10:00 PM

CR Note: Last month, housing economist Tom Lawler's forecast was well below the consensus of 6.2 million (SAAR) for May and close to the actual reported existing home sales (he does a bottom up calculation every month, and he has been very close). Here is his preview for this month:

The pace of existing home sales in June varied dramatically across the country in June, with some of the difference reflecting the pace of closings of contracts signed to beat the federal home buyer tax credit. Long Island was a “standout” to the upside, with home closings in June coming in at 73.8% higher than last June, reflecting the longer-than-national norm time to close signed contracts. Most other markets saw materially slower YOY sales growth in June compared to May, with a number of areas seeing YOY declines. And many markets where a year ago sales were dominated by foreclosure sales saw YOY sales declines, with the drops mainly reflecting significantly lower foreclosure sales.

Based on all the data I have so far, I estimate that existing home sales ran at a seasonally adjusted annual rate of about 5.3 million in June, down about 6.4% from May’s pace. July sales, of course, will see a MUCH bigger drop.

On the inventory front, the local realtor/MLS were on balance consistent with my national tracking, which showed active residential listings up about 1.6% from May. I don’t know if the NAR data will show the same thing however; the NAR apparently doesn’t use available national listings but instead uses reports from the sample of realtor/MLS groups it gets each month, and uses that to “gross up” total inventory in a fashion that clearly produces some “spurious” volatility.

CR Note: this was from housing economist Tom Lawler. The National Association for Realtors (NAR) will release the June existing home sales report on Thursday. The consensus is for a decline to 5.3 million sales in June (SAAR, seasonally adjusted annual rate).