by Calculated Risk on 7/18/2010 08:45:00 AM

Sunday, July 18, 2010

SoCal: Office Vacancy Rate increases, Rents Fall

From Roger Vincent at the Los Angeles Times: Office vacancies rise, rents drop in Southland again

Overall vacancy in Los Angeles, Orange, San Bernardino and Riverside counties rose to nearly 20% from 17% a year earlier, while average asking rents dropped to $2.37 a square foot per month from $2.52 ...More excess supply, but at least the new construction has stopped.

The weakest market was the Inland Empire, where vacancy surpassed 25% in the second quarter. Orange County was also weak, with 22% of its office space unleased.

Saturday, July 17, 2010

Double Dip Discussion

by Calculated Risk on 7/17/2010 07:47:00 PM

The frequency of "double dip" searches keeps increasing, see Google Trends ...

Paul Krugman writes: De Facto Double Dips

Let’s be clear: a recovery that involves growth so slow that unemployment and excess capacity rise, not fall, isn’t really a recovery. If we have only have 1 1/2 percent growth, that will amount to a double dip in all the senses that matter.I've been focused on a technical double dip (see Recession Dating and a "Double Dip"), but I agree with Krugman that a further slowdown - following the below trend first half of 2010 - will definitely feel like a recession - and it will probably lead to an unemployment rate "double dip".

And from Nouriel Roubini: Double-Dip Days

The global economy, artificially boosted since the recession of 2008-2009 by massive monetary and fiscal stimulus and financial bailouts, is headed towards a sharp slowdown this year as the effect of these measures wanes.The 2nd half slowdown is here. I still think we will avoid a technical double-dip recession, but it will probably feel like one.

...

At best, we face a protracted period of anemic, below-trend growth in advanced economies as deleveraging by households, financial institutions, and governments starts to feed through to consumption and investment.

...

The global slowdown – already evident in second-quarter data for 2010 – will accelerate in the second half of the year. ... The likely scenario for advanced economies is a mediocre U-shaped recovery, even if we avoid a W-shaped double dip. In the US, annual growth was already below trend in the first half of 2010 (2.7% in the first quarter and estimated at a mediocre 2.2% in April-June). Growth is set to slow further, to 1.5% in the second half of this year and into 2011.

...

Fasten your seat belts for a very bumpy ride.

Some day growth will pickup again. The debt problems will be with us for some time, but one of the keys for more growth is absorption of excess capacity. New investment is already happening for semiconductor manufacturing (see AMAT and other semi-equipment manufactures, and the WSJ Applied Materials Boosts Revenue Forecast)

But there is too much capacity in most of the economy. We see this in housing (the good news is there will be a record low number of new housing units delivered this year), and in overall industrial capacity utilization. As an example, domestic auto production is still about 25% below the level of 2006 - so there is no need to expand production. There is also excess capacity in office space, retail space, and other categories of commercial real estate.

The U.S. population is still growing, new households are being formed, and eventually this excess capacity will be absorbed. Until then the recovery will be sluggish and choppy (at best) ... and there are still the debt issues.

As Nouriel wrote: "Fasten your seat belts for a very bumpy ride."

Unofficial Problem Bank List at 796 Institutions

by Calculated Risk on 7/17/2010 04:13:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 16, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent several changes this week as the FDIC resumed shuttering banks and the OCC release their actions through the middle of June. There were nine additions and nine deletions, which leaves the total number of institutions on the Unofficial Problem Bank List unchanged at 796.

Deletions include the six failed institutions -- First National Bank of the South ($682 million Ticker: FNSC), Metro Bank of Dade County ($442 million), Woodlands Bank ($379 million), Turnberry Bank ($263 million), Olde Cypress Community Bank ($169 million), and Mainstreet Savings Bank, FSB ($97 million Ticker: MSFN). Other removals for action termination include West Coast Bank ($2.7 billion Ticker: WCBO), First National Community Bank ($155 million), and The First National Bank of Logan ($25 million).

Additions include Monroe Bank & Trust, Monroe, MI ($1.4 billion Ticker: MBTF); Bank of Whitman, Colfax, WA ($786 million); American Bank of Texas, National Association, Marble Falls, TX ($756 million); Landmark Bank, National Association, Fort Lauderdale, FL ($351 million); The Central National Bank of Alva, Alva, OK ($246 million); Pilot Bank, Tampa, FL ($238 million); Trans-Pacific National Bank, San Francisco, CA ($176 million); The First National Bank of Grant Park, Grant Park, IL ($123 million); and Community National Bank at Bartow, Bartow, FL ($75 million).

Other changes include the OTS issuing a Prompt Corrective Action order against Bayside Savings Bank ($66 million) and the OCC converting a Formal Agreement to a Consent Order against Merchants Bank of California, National Association ($91 million). Next week, we anticipate the FDIC will release its actions for June, so the list will likely undergo many changes.

Another example of state and local government distress

by Calculated Risk on 7/17/2010 11:48:00 AM

From Lauren Etter at the WSJ: Roads to Ruin: Towns Rip Up the Pavement

Paved roads ... are being torn up across rural America and replaced with gravel or other rough surfaces as counties struggle with tight budgets and dwindling state and federal revenue. State money for local roads was cut in many places amid budget shortfalls.Back to the stone age ...

Sovereign Debt Series Summary

by Calculated Risk on 7/17/2010 08:24:00 AM

For those that missed any part of the series ...

Part 1: How Large is the Outstanding Value of Sovereign Bonds?

Part 2. How Often Have Sovereign Countries Defaulted in the Past?

Part 2B: More on Historic Sovereign Default Research

Part 3. What are the Market Estimates of the Probabilities of Default?

Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

UPDATE on Sunday: Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

Coming soon: Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange.

Friday, July 16, 2010

A quick summary of the week

by Calculated Risk on 7/16/2010 11:59:00 PM

I'll have the weekly summary on Sunday, but the news flow was definitely downbeat.

Chase Homeowner Assistance Event comes to Orange County

by Calculated Risk on 7/16/2010 09:33:00 PM

I think this is a traveling road show, but the size is pretty amazing ... I'll try to drop by next week. From the O.C. Register: 5-day loan mod event starts Friday

From the O.C. Register: 5-day loan mod event starts Friday

Chase is having a 5-day event in Costa Mesa to help struggling homeowners who have Chase, EMC or WaMu-serviced mortgages.Local Sign at bus stop, photo credit: Bill

...

More than 50 of Chase’s home loan counselors will be available ...

Bill writes: "There must be a lot of troubled

Bank Failures #92 to #96: Florida, Michigan, South Carolina

by Calculated Risk on 7/16/2010 06:13:00 PM

Grim Reaper scythes down the weeds

Only stubble left

by Soylent Green is People

From the FDIC: NAFH National Bank, Miami, Florida, Acquires All the Deposits of Two Institutions in Florida and One Institution in South Carolina

Metro Bank of Dade County, Miami, Turnberry Bank, Aventura, Florida, and First National Bank of the South, Spartanburg, South Carolina

As of March 31, 2010, Metro Bank of Dade County had total assets of $442.3 million and total deposits of $391.3 million; Turnberry Bank had total assets of $263.9 million and total deposits of $196.9 million; and First National Bank of the South had total assets of $682.0 million and total deposits of $610.1 million.From the FDIC: CenterState Bank of Florida, National Association, Winter Haven, Florida, Assumes All of the Deposits of Olde Cypress Community Bank, Clewiston, Florida

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Metro Bank of Dade County will be $67.6 million; for Turnberry Bank, $34.4 million; and for First National Bank of the South, $74.9 million.

...

These closings bring the total for the year to 94 banks in the nation, and the fifteenth and sixteenth in Florida and the third in South Carolina. Prior to these failures, the last bank closed in Florida was Peninsula Bank, Englewood, on June 25, 2010, and the last bank closed in South Carolina was Woodlands Bank, Bluffton, earlier today.

As of March 31, 2010, Olde Cypress Community Bank had approximately $168.7 million in total assets and $162.4 million in total deposits.From the FDIC: Commercial Bank, Alma, Michigan, Assumes All of the Deposits of Mainstreet Savings Bank, FSB

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.5 million. ... Olde Cypress Community Bank is the 95th FDIC-insured institution to fail in the nation this year, and the seventeenth in Florida. The last FDIC-insured institution closed in the state was Turnberry Bank, Aventura, earlier today.

As of March 31, 2010, Mainstreet Savings Bank, FSB had approximately $97.4 million in total assets and $63.7 million in total deposits.Will we see 100 today?

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million. ... Mainstreet Savings Bank, FSB is the 96th FDIC-insured institution to fail in the nation this year, and the fourth in Michigan. The last FDIC-insured institution closed in the state was New Liberty Bank, Plymouth, on May 14, 2010.

Bank Failure #91: Woodlands Bank, Bluffton, South Carolina

by Calculated Risk on 7/16/2010 05:09:00 PM

Woodlands Bank squanders their trust

Grasshoppers rescued

by Soylent Green is People

From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Woodlands Bank, Bluffton, South Carolina

As of March 31, 2010, Woodlands Bank had approximately $376.2 million in total assets and $355.3 million in total depositsFriday arrives ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $115.0 million. ... Woodlands Bank is the 91st FDIC-insured institution to fail in the nation this year, and the second in South Carolina. The last FDIC-insured institution closed in the state was Beach First National Bank, Myrtle Beach, on April 9, 2010.

Mortgage Repurchase: The growing writedown

by Calculated Risk on 7/16/2010 02:01:00 PM

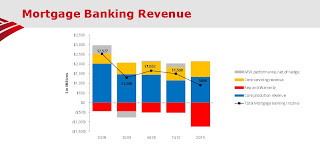

Another graph from the BofA Second Quarter 2010 Earnings Presentation (ht Brian)

This graph shows the components of BofA mortgage banking revenue. The increasing red contribution is from "Rep and warranty" - these are the loans being pushed back on BofA.

Notice the pipeline of repurchase requests continues to grow, the high rescission rate of 40-50%, and the loss severity of 50-55% (the loss to First Horizon on mortgages they have to repurchase).

Note: the FHFA issued subpoenas last week "seeking documents related to private-label mortgage-backed securities" in which Fannie Mae and Freddie Mac invested. That could lead to more repurchase requests for the Wall Street banks.