by Calculated Risk on 7/17/2010 11:48:00 AM

Saturday, July 17, 2010

Another example of state and local government distress

From Lauren Etter at the WSJ: Roads to Ruin: Towns Rip Up the Pavement

Paved roads ... are being torn up across rural America and replaced with gravel or other rough surfaces as counties struggle with tight budgets and dwindling state and federal revenue. State money for local roads was cut in many places amid budget shortfalls.Back to the stone age ...

Sovereign Debt Series Summary

by Calculated Risk on 7/17/2010 08:24:00 AM

For those that missed any part of the series ...

Part 1: How Large is the Outstanding Value of Sovereign Bonds?

Part 2. How Often Have Sovereign Countries Defaulted in the Past?

Part 2B: More on Historic Sovereign Default Research

Part 3. What are the Market Estimates of the Probabilities of Default?

Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

UPDATE on Sunday: Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

Coming soon: Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange.

Friday, July 16, 2010

A quick summary of the week

by Calculated Risk on 7/16/2010 11:59:00 PM

I'll have the weekly summary on Sunday, but the news flow was definitely downbeat.

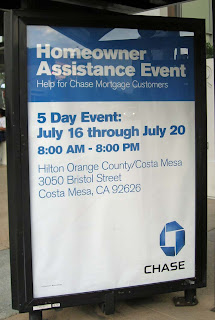

Chase Homeowner Assistance Event comes to Orange County

by Calculated Risk on 7/16/2010 09:33:00 PM

I think this is a traveling road show, but the size is pretty amazing ... I'll try to drop by next week. From the O.C. Register: 5-day loan mod event starts Friday

From the O.C. Register: 5-day loan mod event starts Friday

Chase is having a 5-day event in Costa Mesa to help struggling homeowners who have Chase, EMC or WaMu-serviced mortgages.Local Sign at bus stop, photo credit: Bill

...

More than 50 of Chase’s home loan counselors will be available ...

Bill writes: "There must be a lot of troubled

Bank Failures #92 to #96: Florida, Michigan, South Carolina

by Calculated Risk on 7/16/2010 06:13:00 PM

Grim Reaper scythes down the weeds

Only stubble left

by Soylent Green is People

From the FDIC: NAFH National Bank, Miami, Florida, Acquires All the Deposits of Two Institutions in Florida and One Institution in South Carolina

Metro Bank of Dade County, Miami, Turnberry Bank, Aventura, Florida, and First National Bank of the South, Spartanburg, South Carolina

As of March 31, 2010, Metro Bank of Dade County had total assets of $442.3 million and total deposits of $391.3 million; Turnberry Bank had total assets of $263.9 million and total deposits of $196.9 million; and First National Bank of the South had total assets of $682.0 million and total deposits of $610.1 million.From the FDIC: CenterState Bank of Florida, National Association, Winter Haven, Florida, Assumes All of the Deposits of Olde Cypress Community Bank, Clewiston, Florida

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Metro Bank of Dade County will be $67.6 million; for Turnberry Bank, $34.4 million; and for First National Bank of the South, $74.9 million.

...

These closings bring the total for the year to 94 banks in the nation, and the fifteenth and sixteenth in Florida and the third in South Carolina. Prior to these failures, the last bank closed in Florida was Peninsula Bank, Englewood, on June 25, 2010, and the last bank closed in South Carolina was Woodlands Bank, Bluffton, earlier today.

As of March 31, 2010, Olde Cypress Community Bank had approximately $168.7 million in total assets and $162.4 million in total deposits.From the FDIC: Commercial Bank, Alma, Michigan, Assumes All of the Deposits of Mainstreet Savings Bank, FSB

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.5 million. ... Olde Cypress Community Bank is the 95th FDIC-insured institution to fail in the nation this year, and the seventeenth in Florida. The last FDIC-insured institution closed in the state was Turnberry Bank, Aventura, earlier today.

As of March 31, 2010, Mainstreet Savings Bank, FSB had approximately $97.4 million in total assets and $63.7 million in total deposits.Will we see 100 today?

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million. ... Mainstreet Savings Bank, FSB is the 96th FDIC-insured institution to fail in the nation this year, and the fourth in Michigan. The last FDIC-insured institution closed in the state was New Liberty Bank, Plymouth, on May 14, 2010.

Bank Failure #91: Woodlands Bank, Bluffton, South Carolina

by Calculated Risk on 7/16/2010 05:09:00 PM

Woodlands Bank squanders their trust

Grasshoppers rescued

by Soylent Green is People

From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Woodlands Bank, Bluffton, South Carolina

As of March 31, 2010, Woodlands Bank had approximately $376.2 million in total assets and $355.3 million in total depositsFriday arrives ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $115.0 million. ... Woodlands Bank is the 91st FDIC-insured institution to fail in the nation this year, and the second in South Carolina. The last FDIC-insured institution closed in the state was Beach First National Bank, Myrtle Beach, on April 9, 2010.

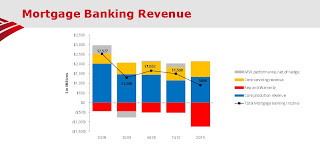

Mortgage Repurchase: The growing writedown

by Calculated Risk on 7/16/2010 02:01:00 PM

Another graph from the BofA Second Quarter 2010 Earnings Presentation (ht Brian)

This graph shows the components of BofA mortgage banking revenue. The increasing red contribution is from "Rep and warranty" - these are the loans being pushed back on BofA.

Notice the pipeline of repurchase requests continues to grow, the high rescission rate of 40-50%, and the loss severity of 50-55% (the loss to First Horizon on mortgages they have to repurchase).

Note: the FHFA issued subpoenas last week "seeking documents related to private-label mortgage-backed securities" in which Fannie Mae and Freddie Mac invested. That could lead to more repurchase requests for the Wall Street banks.

BofA 30+ Day Delinquency and FHA

by Calculated Risk on 7/16/2010 11:32:00 AM

The following graph from the BofA Second Quarter 2010 Earnings Presentation says more about the FHA than BofA (ht Brian):

For BofA, the 30+ day deliquency trends continue to improve.

That red line at the top that is still increasing? That includes FHA insured residential mortgages ...

Notice how the risk has been shifted to the FHA.

Reuters University of Michigan's Consumer Sentiment drops sharply in July

by Calculated Risk on 7/16/2010 10:01:00 AM

From Reuters: Consumer Sentiment Sinks To Lowest in 11 Months

The survey's preliminary July reading on the overall index on consumer sentiment plummeted to 66.5 from 76.0 in June.

The figure was below the median forecast of 74.5 among economists polled by Reuters.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - and this is further evidence of an economic slowdown.

Interesting - the survey's one-year inflation expectations increased to 2.9% even as measured inflation has been falling.

Consumer Price Index declines 0.1% in June

by Calculated Risk on 7/16/2010 08:30:00 AM

From the BLS report on the Consumer Price Index this morning:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 1.1 percent before seasonal adjustment.Even with the slight monthly increase, Owners' equivalent rent (OER) is down year-over-year.

...

The index for all items less food and energy rose 0.2 percent in June after increasing 0.1 percent in May. ... The 12-month change in the index for all items less food and energy remained at 0.9 percent for the third month in a row.

...

The index for owners' equivalent rent also rose 0.1 percent, its first increase since August 2009 ...

The general disinflationary trend continues - CPI is unchanged over the last 8 months - and with all the slack in the system (especially the 9.5% unemployment rate), CPI will probably stay low or even fall further.