by Calculated Risk on 6/23/2010 04:00:00 PM

Wednesday, June 23, 2010

Fannie Mae cracks down on "Walk Aways"

Note: Earlier post on New Home sales: New Home Sales collapse to Record Low in May

From Fannie Mae: Fannie Mae Increases Penalties for Borrowers Who Walk Away

Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure. Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.I'm not sure how they can tell if someone "walks away" (a borrower who could afford to make their mortgage payments, but instead strategically defaults), or if the borrower had no real choice.

...

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

But this suggests that the number of strategic defaults is increasing.

And this reminds us of one of the tragedies of the bubble: many people bought before they were ready, or bought too much home. Whether they are "walking away" or losing their home because they can't afford it, they will be out of the market for some time.

FOMC Statement: Less Positive

by Calculated Risk on 6/23/2010 02:15:00 PM

The comments on the economy were slightly more negative than last meeting. The Fed noted the financial issues in Europe, and also commented that "underlying inflation has trended lower". Each statements was slightly less positive ...

From the Fed:

Information received since the Federal Open Market Committee met in April suggests that the economic recovery is proceeding and that the labor market is improving gradually. Household spending is increasing but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

Prices of energy and other commodities have declined somewhat in recent months, and underlying inflation has trended lower. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer-run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.

Estimate of June Decennial Census impact on payroll employment: minus 243,000

by Calculated Risk on 6/23/2010 12:16:00 PM

The Census Bureau released the weekly payroll data for the week ending June 12th this morning (ht Bob_in_MA). If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring on payroll employment.

The Census Bureau releases the actual number with the employment report.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

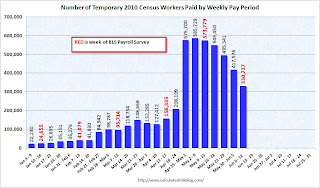

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

The Census payroll decreased from 573,779 for the week ending May 15th to 330,737 for the week ending June 12th.

So my estimate for the impact of the Census on June payroll employment is minus 243 thousand (this will be close). The employment report will be released on July 2nd, and the headline number for June - including Census numbers - will almost certainly be negative. But a key number will be the hiring ex-Census (so we will add back the Census workers this month).

New Home Sales collapse to Record Low in May

by Calculated Risk on 6/23/2010 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 300 thousand. This is a sharp decrease from the revised rate of 446 thousand in April (revised from 504 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In May 2010, 28 thousand new homes were sold (NSA). This is a new record low.

The previous record low for the month of May was 34 thousand in 2009; the record high was 120 thousand in May 2005. The second graph shows New Home Sales vs. recessions for the last 45 years.

The second graph shows New Home Sales vs. recessions for the last 45 years.

Sales of new single-family houses in May 2010 were at a seasonally adjusted annual rate of 300,000 ... This is 32.7 percent (±9.9%) below the revised April rate of 446,000 and is 18.3 percent (±13.0%) below the May 2009 estimate of 367,000.And another long term graph - this one for New Home Months of Supply.

Months of supply increased to 8.5 in May from 5.8 April. The all time record was 12.4 months of supply in January 2009. Since the sales rate declined sharply, the months of supply increased - this is still very high (less than 6 months supply is normal).

Months of supply increased to 8.5 in May from 5.8 April. The all time record was 12.4 months of supply in January 2009. Since the sales rate declined sharply, the months of supply increased - this is still very high (less than 6 months supply is normal). The seasonally adjusted estimate of new houses for sale at the end of May was 213,000. This represents a supply of 8.5 months at the current sales rate.

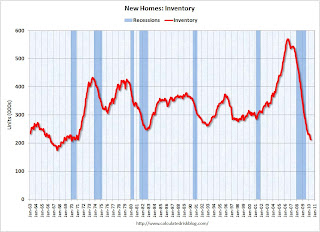

The final graph shows new home inventory.

The final graph shows new home inventory. New home sales are counted when the contract is signed, so the tax credit related pickup in sales activity happened in April. This pulled demand forward, and April was probably the peak for new home sales this year.

The 300 thousand annual sales rate is a new all time record low. The previous record low annual sales rate was 338 thousand in September 1981.

MBA: Mortgage Purchase Applications Decrease in Weekly Survey

by Calculated Risk on 6/23/2010 07:55:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 7.3 percent from the previous week and the seasonally adjusted Purchase Index decreased 1.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.75 percent from 4.82 percent, with points increasing to 1.07 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year contract rate observed in the survey since the week ending May 15, 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for 4-week average of the purchase index since February 1997.

Tuesday, June 22, 2010

AIA: Architecture Billings Index declines in May

by Calculated Risk on 6/22/2010 11:59:00 PM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index declined to 45.8 in May from 48.5 in April. Any reading below 50 indicates contraction.

The ABI press release is not online yet. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

This suggests the slump for commercial real estate design is ongoing. According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment through all of 2010, and probably well into 2011.

How high will Existing Home Months-of-Supply increase this summer?

by Calculated Risk on 6/22/2010 07:28:00 PM

Earlier I posted a graph showing the relationship of existing home months-of-supply to house prices. When months-of-supply is below 6 months, house prices are typically rising - and above 6 months-of-supply, house prices are usually falling (this isn't perfect, but it is a general guide).

So how high will months-of-supply rise this summer?

Here are some estimates of sales via James Haggerty at the WSJ: Outlook for Home Prices Grows Darker

Since April 30, new purchase contracts have plunged ... Lawrence Yun, chief economist for the Realtors, estimated that contracts signed in May were 10% to 15% below the weak level of a year earlier.Contracts signed in May and June lead to sales later in the summer (counted when escrow closes).

Ronald Peltier, chief executive officer of HomeServices of America Inc., which owns real estate brokers in 21 states, said new home-purchase contracts in May and June so far are down about 20% from a year earlier.

Sales in July 2009 were at a 5.14 million rate (SAAR). Usually inventory increases in July, but if we assume inventory is steady at 3.892 million, the following table shows the month-of-supply estimates based on three year-over-year declines sales in July 2009:

| Sales Decline from 2009 | July Sales Rate (millions) | Months-of-Supply |

|---|---|---|

| Off 10% | 4.63 | 10.1 |

| Off 15% | 4.37 | 10.7 |

| Off 20% | 4.11 | 11.4 |

The peak for months-of-supply was 11.2 months in 2008. And house prices? The Case-Shiller composite 20 index fell 17.2% in 2008.

We are much closer to the price bottom now than in 2008, and I don't expect that severe of a price decline. But I do expect house prices to fall in the 2nd half of 2010 and into 2011 - probably another 5% to 10% for the major house price indexes (Case-Shiller and CoreLogic).

Of course inventory could decline or sales increase a little ... and maybe months-of-supply will only be close to double digits.

Market Update, Fed Meeting Preview and more

by Calculated Risk on 6/22/2010 04:03:00 PM

Here is an interactive market graph from Doug Short of dshort.com (financial planner).

Click on graph for interactive version in new window.

The graph has tabs to look at the different bear markets - "now" shows the current market - and there is also a tab for the "four bears".

Tomorrow the Census Bureau will release New Home sales for May (consensus is for around 400,000) and the FOMC statement will be released.

Tom Lawler called the existing home sales number correctly today (he constructed an estimate from local data), and he is taking the under on new home sales too. See: Lawler: Home Sales in May: A Look at the Data.

On Sunday I posted a preview of the FOMC statement: Look Ahead to FOMC Statement on Wednesday. The statement will be a little less upbeat.

And on existing home sales today (with graphs):

Existing Homes: Months of Supply and House Prices

by Calculated Risk on 6/22/2010 02:34:00 PM

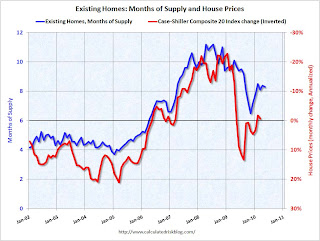

Earlier I mentioned that a normal housing market usually has under 6 months of supply. The current 8.3 months of supply is significantly above normal, and is especially concerning because the reported inventory is already historically very high.

After the tax credit related activity ends, the months of supply will probably increase, and the ratio could be close to double digits later this year. That level of supply will put additional downward pressure on house prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show months of supply and the annualized change in the Case-Shiller Composite 20 house price index (inverted).

Below 6 months of supply (blue line) house prices are typically rising (red line, inverted).

Above 6 months of supply house prices are usually falling (although there were many programs to support house prices over the last year).

Later this year the months of supply will probably increase, and I expect house prices to fall further as measured by the Case-Shiller and CoreLogic repeat sales house price indexes.

Existing Home Sales: Inventory increases Year-over-Year

by Calculated Risk on 6/22/2010 11:28:00 AM

Earlier the NAR released the existing home sales data for May; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inventory increased 1.1% YoY in May. This is the second consecutive month of a year-over-year increases in inventory. Although the YoY increase is small, I expect it will be higher later this year.

This increase in inventory is especially concerning because the reported inventory is already historically very high, and the 8.3 months of supply in May is well above normal. The months of supply will probably stay near this level in June, because of more tax credit related sales (reported at closing), but the months-of-supply could be close to double digits later this year.

And a double digit months-of-supply would be a really bad sign for house prices ... The second graph shows NSA monthly existing home sales for 2005 through 2010 (see Red columns for 2010).

The second graph shows NSA monthly existing home sales for 2005 through 2010 (see Red columns for 2010).

Sales (NSA) in May 2010 were 17.7% higher than in May 2009, and also higher than in May 2008.

We will probably see sales at around this level in June because of the tax credit, however I expect to see existing home sales below last year in the 2nd half of this year.

This was definitely a weak report. Sales were up year-over-year because of the tax credit pulling sales forward, but that does very little for the economy. The key is the inventory and months-of-supply, and if these two measures increase later this year as I expect, then there will be additional downward pressure on house prices.