by Calculated Risk on 5/22/2010 09:01:00 AM

Saturday, May 22, 2010

Fed's Dudley on the Economy

From NY Fed President William Dudley's commencement speech at New College of Florida:

[T]he recovery is not likely to be as robust as we would like for several reasons.A few comments:

First, households are still in the process of deleveraging. The housing boom created paper wealth that households borrowed against. This pushed the consumption share of nominal gross domestic product to a record high of about 70 percent. When the boom turned into a bust, those paper gains evaporated. In fact, many households now find that the value of their homes is less than the amount of their mortgage debt. This has created a difficult time for many families and has caused the hangover to last longer.

Second, the banking system is still under significant stress. This is particularly the case for small- and medium-sized banks that have significant exposure to commercial real estate loans. This stress means that banks have been slow to ease credit standards as the economy has moved from recession to recovery.

Third, some of the sources that have supported the nascent recovery are temporary. The big swing from inventory liquidation during the recession back to accumulation will soon end as inventory levels come back into better balance with sales. And fiscal stimulus from the federal government is subsiding and will soon reverse.

...

In this environment, finding a job will be tough, but when you hit the pavement remember that the job market is improving. Don't get discouraged.

First, the household "deleveraging" seemed to start last year, but consumers were back to spending more than they earned in Q1. Personal consumption expenditures (PCE) increased to over 71% of GDP in Q1 - higher than the 70% during the boom that Dudley mentioned. Some of this increase in PCE was due to government transfer payments (all of the increase in income in Q1 came from government transfer payments). I still think the personal saving rate will rise over the next year or two - and that will keep growth in PCE below the growth in income.

Second, I think the transitory inventory boost is about over. There were hints of this in the manufacturing surveys last week from the Federal Reserve Banks of Philadelphia and New York - and also in the Census Bureau's Manufacturing and Trade inventories report for March. Also, as Dudley notes, the boost from the stimulus "is subsiding and will soon reverse" (the peak stimulus spending is right now - in Q2 2010).

These are significant headwinds, and I think growth will slow in the 2nd half of 2010.

Friday, May 21, 2010

Unofficial Problem Bank list hits 737

by Calculated Risk on 5/21/2010 11:49:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 21, 2010.

Changes and comments from surferdude808:

As anticipated, the OCC released its actions for April 2010, which contributed to an increase in the number of institutions on the Unofficial Problem Bank List. The list includes 737 institutions with aggregate assets of $363.5 billion, up from 725 institutions with assets of $363.1 billion last week.

The FDIC released its industry profile this week and they reported 775 institutions with assets of $431 billion on the official problem bank list. With the industry release, we were able to update assets for the first quarter of 2010. For institutions on the unofficial list last week, their combined assets fell by $8.3 billion during the quarter.

Notable additions this week include City National Bank of Florida, Miami, FL ($4.6 billion); The National Republic Bank of Chicago, Chicago, IL ($1.3 billion); Butte Community Bank, Chico, CA ($523 million Ticker: CVLL). Other additions include the add back of Mountain West Bank, National Association, Helena, MT ($795 million Ticker: MTWF); and Pikes Peak National Bank, Colorado Springs, CO ($84 million), which were removed from the May 7th list when the OCC terminated their respective Supervisory Agreements. These agreements were replaced by stronger Consent Orders.

The only removal is the failed Pinehurst Bank. Other changes are for name changes with the Bank of Lenox, Lenox, GA now known as The Trust Bank; Goshen Community Bank, Goshen, IN now known as Indiana Community Bank; and Lehman Brothers Bank, FSB, Wilmington, DE now known as Aurora Bank FSB.

"Love, Your Broken Home"

by Calculated Risk on 5/21/2010 10:01:00 PM

Since Sheila is done for the day ... a new song by Tim Miller on the mortgage crisis: "Love, Your Broken Home" (language)

Link to YouTube version if this doesn't load.

Bank Failure #73: Pinehurst Bank, St. Paul, Minnesota

by Calculated Risk on 5/21/2010 06:08:00 PM

The bill could not help Pinehurst.

Ineffectual

by Soylent Green is People

From the FDIC Coulee Bank, La Crosse, Wisconsin, Assumes All of the Deposits of Pinehurst Bank, St. Paul, Minnesota

As of March 31, 2010, Pinehurst Bank had approximately $61.2 million in total assets and $58.3 million in total deposits.Busy week ... but Friday is here!

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.0 million.... Pinehurst Bank is the 73rd FDIC-insured institution to fail in the nation this year, and the sixth in Minnesota. The last FDIC-insured institution closed in the state was Access Bank, Champlin, on May 7, 2010.

Las Vegas land prices: 80% off peak

by Calculated Risk on 5/21/2010 04:13:00 PM

From Buck Wargo at the Las Vegas Sun: Foreclosures on land pushing prices back to 2003 levels

Since the peak of the market in 2007’s fourth quarter of $939,400 per acre for land not on the Strip, prices have fallen 80.6 percent, [Applied Analysis Principal Brian] Gordon said.And how about this ...

“I think we will continue to see downward pressure on prices for a while,” Gordon said. “The demand for raw land is somewhat weak. There is excess inventory of office, industrial and residential; and development activity has come to a near standstill in many of those sectors, so that they don’t need raw land.”

During the past year, many landowners have simply turned properties back to banks. ... “The reality is the landowners are finding themselves underwater and servicing their debt, and it has become a challenge,” Gordon said. “Many have opted to let the properties go back to the bank, not unlike what we have seen in the housing market.”More strategic defaults.

States: Mortgage Delinquency Rate vs. Unemployment Rate

by Calculated Risk on 5/21/2010 01:07:00 PM

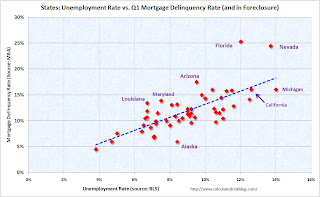

Here is a scatter graph comparing the Q1 2010 delinquency rate for mortgage loans (including all loans in foreclosure) vs. the April unemployment rate for all states. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There definitely is a relationship between delinquency rates and the unemployment rate, although a couple of states really stand out; Florida and Nevada. Florida has a high number of delinquencies because of state specific foreclosure laws - it takes forever to foreclose.

The delinquency rate in Nevada is also very high, probably because of the large percentage of homeowners with negative equity. Both states might also have higher than expected delinquency rates because of significant investor activity during the housing bubble.

This does suggest that a large part of the delinquency problem is related to unemployment.

Note: Sorry I couldn't label all the states. Here are graphs by state for unemployment rates and mortgage delinquency rates.

April State Unemployment Rates: California and Nevada at series highs

by Calculated Risk on 5/21/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly lower in April. Thirty-four states and the District of Columbia recorded unemployment rate decreases, 6 states had increases, and 10 states had no change. ...

Michigan again recorded the highest unemployment rate among the states, 14.0 percent in April. The states with the next highest rates were Nevada, 13.7 percent; California, 12.6 percent; and Rhode Island, 12.5 percent. North Dakota continued to register the lowest jobless rate, 3.8 percent, followed by South Dakota and Nebraska, 4.7 and 5.0 percent, respectively. The rate in Nevada set a new series high.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. New Jersey is close.

Nevada set a new series high; California tied the previous record (since 1976).

Bundestag Approves Bailout, possible Strike in Spain

by Calculated Risk on 5/21/2010 08:41:00 AM

From the Financial Times: Bundestag backs eurozone rescue

Germany’s lower house of parliament on Friday narrowly approved Berlin’s contribution to the European Union’s €750bn package of loan guarantees ...The upper house, the Bundesrat, is expected to vote today and passage is expected.

From Reuters: Spain to 'probably' call general strike-report

Spain's largest workers union Comisiones Obreras could call a general strike to protest the government's austerity measures, its head Ignacio Fernandez Toxo said on Friday ...Sounds like just a one day strike.

The futures are off this morning ... but bouncing around.

Thursday, May 20, 2010

Krugman: Lost Decade Looming?

by Calculated Risk on 5/20/2010 11:58:00 PM

From Paul Krugman in the NY Times: Lost Decade Looming?

... Recent data don’t suggest that America is heading for a Greece-style collapse of investor confidence. Instead, they suggest that we may be heading for a Japan-style lost decade, trapped in a prolonged era of high unemployment and slow growth.The two key numbers: the unemployment rate is at 9.9% and inflation, by all key measures, is low and declining (CPI, core CPI, PCE deflator trimmed mean CPI, etc). Of the two problems, unemployment is real and now - and inflation is a possible future threat. The focus needs to stay on the real and now.

... As of Thursday, the 10-year [Treasury] rate was below 3.3 percent. I wish I could say that falling interest rates reflect a surge of optimism about U.S. federal finances. What they actually reflect, however, is a surge of pessimism about the prospects for economic recovery, pessimism that has sent investors fleeing out of anything that looks risky ...

Low inflation, or worse yet deflation, tends to perpetuate an economic slump ... just ask the Japanese, who entered a deflationary trap in the 1990s and, despite occasional episodes of growth, still can’t get out. And it could happen here.

So what we should really be asking right now isn’t whether we’re about to turn into Greece. We should, instead, be asking what we’re doing to avoid turning Japanese.

...

Will the worst happen? Not necessarily. Maybe the economic measures already taken will end up doing the trick, jump-starting a self-sustaining recovery. Certainly, that’s what we’re all hoping.

Financial Reform: Final Senate Vote Soon

by Calculated Risk on 5/20/2010 07:52:00 PM

Update: Passed 59 to 39.

From Brady Dennis at the WaPo: Senate clears way to vote on financial reform

A final vote on the legislation could come later Thursday evening, congressional aides said. Party leaders were working to resolve a number of procedural hurdles, but it appeared that a series of votes could begin around 7:30 p.m.

"We're passing this bill tonight," said Jim Manley, spokesman to Majority Leader Harry M. Reid (D-Nev.). "We're finishing this tonight."