by Calculated Risk on 5/07/2010 08:09:00 PM

Friday, May 07, 2010

Bank Failures #67 & 68: Arizona and California

Stopping and starting Friday's

A long road ahead.

Like hollowed pumpkins

Scooped out, carved up, value-less

Fearful faces left.

by Soylent Green is People

From the FDIC: Commerce Bank of Arizona, Tucson, Arizona, Assumes All of the Deposits of Towne Bank of Arizona, Mesa, Arizona

Towne Bank of Arizona, Mesa, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: City National Bank, Los Angeles, California, Assumes All of the Deposits of 1st Pacific Bank of California, San Diego, California

As of March 31, 2010, Towne Bank of Arizona had approximately $120.2 million in total assets and $113.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.8 million. Towne Bank of Arizona is the 67th FDIC-insured institution to fail in the nation this year ...

1st Pacific Bank of California, San Diego, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....That makes four today.

As of March 31, 2010, 1st Pacific Bank of California had approximately $335.8 million in total assets and $291.2 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $87.7 million. .... 1st Pacific Bank of California is the 68th FDIC-insured institution to fail in the nation this year, and the fifth in California.

Three Major Stories

by Calculated Risk on 5/07/2010 07:56:00 PM

A break from our usual Friday afternoon custom ... there were three major stories today.

1) On Europe: there is a reasonable chance of a major announcement this weekend. Earlier today there were rumors of a €600 billion loan facility for European banks. One key analyst thinks the Fed might re-open the dollar swap lines for Europe - one, or both, or something else could be announced on Sunday.

Tonight, Bloomberg is reporting: EU to Craft Financial Backstop to Prevent Spread of Crisis

Leaders of the 16 countries sharing the currency said finance ministers will meet tomorrow to hash out the details of a “stabilization mechanism to preserve the financial stability in Europe.”Krugman has the best line: O Nao!

I really really hope the ECB staff are huddling right now ... Otherwise Anno Domini 2010 is shaping up to be Anno Domino instead.2) On the Stock Market: From the SEC: Statement of the Securities and Exchange Commission and the Commodity Futures Trading Commission

“We are continuing to review the unusual trading activity that took place briefly yesterday afternoon to pinpoint its cause and contributing factors.The causes of the weird price changes still haven't been determined.

...

“Our market oversight units are reviewing trading and market data from the exchanges, self regulatory organizations and market participants to examine yesterday's unusual trading activity. We are scrutinizing the extent to which disparate trading conventions and rules across various markets may have contributed to the spike in volatility.

“We are devoting significant resources and expertise to this effort.

“As we determine the cause and contributing factors, we will make our findings and any recommendations public. ...

3) Employment Report: Usually the big story of the day would be the 290K (224K ex-Census) increase in payroll employment. Here were my earlier posts:

Bank Failures #65 & 66: Florida and Minnesota

by Calculated Risk on 5/07/2010 06:37:00 PM

Injections of capital

Could not save this bank

One thousand point drop

Ten thousand banks may yet fail

Is it time for gold?

by Soylent Green is People

From the FDIC: First Federal Bank of Florida, Lake City, Florida, Assumes All of the Deposits of The Bank of Bonifay, Bonifay, Florida

Bank of Bonifay, Bonifay, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Prinsbank, Prinsburg, Minnesota, Assumes All of the Deposits of Access Bank, Champlin, Minnesota

As of March 31, 2010, The Bank of Bonifay had approximately $242.9 million in total assets and $230.2 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $78.7 million. ... The Bank of Bonifay is the 65th FDIC-insured institution to fail in the nation this year, and the tenth in Florida. The last FDIC-insured institution closed in the state was Riverside National Bank of Florida, Fort Pierce, on April 16, 2010.

Access Bank, Champlin, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of March 31, 2010, Access Bank had approximately $32.0 million in total assets and $32.0 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.5 million..... Access Bank is the 66th FDIC-insured institution to fail in the nation this year, and the fifth in Minnesota. The last FDIC-insured institution closed in the state was State Bank of Aurora, Aurora, on March 19, 2010.

NMHC Quarterly Survey: Apartment Market Conditions Tighten

by Calculated Risk on 5/07/2010 04:00:00 PM

From the National Multi Housing Council (NMHC): Apartment Industry Shows Widespread Improvement According to NMHC Quarterly Survey of Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years. Fully 64 percent of respondents said markets were tighter (meaning lower vacancies and/or higher rents). Only two percent reported looser markets. This is the sixth straight increase for this measure.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth. ... Even so, a sustained recovery in the apartment market needs a firm economic and demographic foundation ... in the near-term the industry’s prospects still depend upon a stronger rebound in both the job market and household formation.” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year. Right now I expect BLS reported rents to continue to decline through most of 2010.

This data is a survey of large apartment owners. The data released last week from the Census Bureau showed a 10.6% rental vacancy rate for all rental units.

A final note: at some point the apartment market would start to tighten from the very high vacancy rates (record levels according to the Census Bureau and Reis).

The question asked was:

Q: [O]n balance, apartment market conditions in your markets today are:

Of those surveyed, 64% answered: "Tighter than three months ago" and 34% answered "About unchanged from three months ago". So it appears the bottom in vacancy rates was reached in Q4 2009.

The improvement in the labor market is probably leading to more household formation - and combined with a record low number of new apartment units being completed this year - the apartment market is now starting to tighten. It will take some time for the overall vacancy rate to fall to normal levels, but the excess housing units are now being absorbed. (See Housing Stock and Flow for an analysis of the absorption of excess housing units).

European Liquidity Issues

by Calculated Risk on 5/07/2010 01:29:00 PM

There is a rumor circulating that the ECB is prepared to announce a €600 billion loan facility for European banks over the next few days. One key analyst has suggested that the FOMC might re-open the dollar swap lines for Europe. Update: I don't usually post rumors during the day, but this is being widely circulated as a possibility.

Note that the Bank of Japan moved last night, from the Financial Times: Bank of Japan pumps funds into market

The Bank of Japan offered Y2,000bn ($21.6bn) in overnight liquidity on Friday to “increase markets’ sense of security” because of turmoil resulting from the debt crisis in Greece. ... the bank’s action reflects global demand for dollar liquidity as investors move out of the euro.And from the WSJ: European Banks Head Toward New Funding Crunch

excerpt with permission

Europe's sovereign debt crisis is making it harder for European banks to get their hands on dollars and may require their central banks to step in with short-term liquidity ...The Libor rate has increased, but it is still at a very low level. This could be something to watch.

Temporary Help and Diffusion Index

by Calculated Risk on 5/07/2010 12:51:00 PM

Here are a couple more graphs based on data in the employment report ...

Temporary Help

From the BLS report:

Temporary help services continued to add jobs (26,000); employment in this industry has increased by 330,000 since September 2009.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees (hours worked increased slightly in April) and also hire temporary employees. Since the number of temporary workers increased sharply over the last seven months, some people think this might be signaling the beginning of a strong employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Note that the temporary hiring for the Census is excluded from this graph.

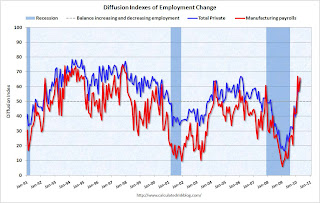

Diffusion Index

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This fits with the headline payroll report and is a positive.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 5/07/2010 09:59:00 AM

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio increased to 58.8% in April (from 58.6% in March), after plunging since the start of the recession. This is about the same level as in December 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased to 65.2% from 64.9% in March. This is the percentage of the working age population in the labor force. This is still well below the 66% to 67% rate that was normal over the last 20 years. As people return to the labor force, as the employment picture improves, this will put upward pressure on the unemployment rate - even with job growth.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 9.2 million in April. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.152 million in April.

The all time record of 9.24 million was set in October.

These workers are included in the alternate measure of labor underutilization (U-6) that was at 17.1% in April.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.72 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.34% of the civilian workforce. (note: records started in 1948)

Although the headline number of 290,000 payroll jobs was a positive (this is 224,000 after adjusting for the 66,000 Census 2010 temporary hires), the underlying details were mixed. The positives: the employment-population ratio increased (after plunging sharply), and average hours increased.

Negatives include the unemployment rate increasing to 9.9%, a near record number of part time workers (for economic reasons) pushing U-6 to 17.1%, and a record number of workers unemployed for more than 26 weeks.

The number of long term unemployed is one of the key stories of this recession, especially since many of them are now losing their unemployment benefits. Note: In Q1, all of the increase in income - and much of the increase in consumption - came from government transfer payments for unemployment benefits.

I'll have even more later ...

Earlier employment post today:

April Employment Report: 290K Jobs Added, 9.9% Unemployment Rate

by Calculated Risk on 5/07/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 290,000 in April, the unemployment rate edged up to 9.9 percent, and the labor force increased sharply, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 290,000 in April. The economy has lost 1.4 million jobs over the last year, and 7.8 million jobs since the recession started in December 2007.

The unemployment rate increased to 9.9 percent as people returned to the workforce.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 66,000 (NSA) in April.

This was well above expectations, especially given the level of Census 2010 hiring. The increase in the unemployment rate was because of people returning to the work force - the decline in the participation rate during the recession was stunning, and it is no surprise that people are once again looking for work. I'll have much more soon ...

Thursday, May 06, 2010

Employment Report Preview

by Calculated Risk on 5/06/2010 11:59:00 PM

The BLS will release the April Employment situation report tomorrow (Friday) morning at 8:30 AM ET. The consensus is around 200K payroll jobs and the unemployment rate declining slightly to 9.6%.

The estimates for temporary Census 2010 hiring are around 100K, so the market expectation is for about 100K payroll jobs ex-Census. That is the key number (the underlying job creation). Note: the largest increase in Census 2010 hiring will happen in May - perhaps 500K payroll jobs - and then all of those jobs will be unwound over the next 6 months.

The earlier data this week has been somewhat mixed. ADP reported 32K private sector jobs in April, the largest monthly increase since January 2008.

The ISM manufacturing report suggested fairly robust hiring in the manufacturing sector:

ISM's Employment Index registered 58.5 percent in April, which is 3.4 percentage points higher than the 55.1 percent reported in March. This is the fifth consecutive month of growth in manufacturing employment.Of course the manufacturing sector is relatively small.

And the ISM non-manufacturing report suggested job losses in the much larger service sector:

Employment activity in the non-manufacturing sector contracted in April for the 28th consecutive month. ISM's Non-Manufacturing Employment Index for April registered 49.5 percent. This reflects a decrease of 0.3 percentage point when compared to the 49.8 percent registered in March.The weekly initial unemployment claims was elevated throughout April suggesting continuing weakness in employment, but the Monster employment index was strong.

The Monster Employment Index rose eight points in April as a number of industries initiated springtime recruitment efforts. The annual growth rate further accelerated, rising by 11 percent, the highest rate of increase since July 2007.Anything above 100K ex-Census will be viewed as a solid report. As far as the unemployment rate, it usually drops 0.1% to 0.2% during the peak of the Census hiring (April and May) - however the participation rate fell so far during the recession, it is possible that the unemployment rate will tick up as more people reenter the workforce. We will know in a few hours ...

Market Selloff: Looking for clues

by Calculated Risk on 5/06/2010 09:20:00 PM

From Graham Bowley at the NY Times: Markets Plunge, Then Stage a Rebound

[I]n Washington a team of Treasury officials began combing through market tapes trying to figure out what was going on. By the evening they still had not gotten to the bottom of it, but they discovered some aberrations — market blips — in trading coming out of Chicago.And from Scott Patterson at the WSJ: Did Shutdowns Make Plunge Worse?

...

As of about 6 p.m., all the officials knew was that there had been what one official called “a huge, anomalous, unexplained surge in selling, it looks like in Chicago, at about 2:45.” The source remained unknown, but it had apparently set off algorithmic trading strategies, which in turn rippled across everything, pushing trading out of whack and feeding on itself — until it started to reverse.

Federal officials fielded rumors ... But they did not know the truth.

What happens to the day’s market losers will depend on what the cause was and whether it can be identified. That is a question for the S.E.C.

A number of high-frequency firms stopped trading Thursday in the midst of the market plunge, possibly adding to the market's unprecedented selloff.No answers yet - just rumors.

Tradebot Systems Inc., a large high-frequency firm based in Kansas City, Mo., closed down its computer trading systems when the Dow Jones Industrial Average had dropped about 500 points ... Tradeworx Inc., a N.J. firm that operates a high-frequency fund, also stopped trading during the market turmoil ...