by Calculated Risk on 5/06/2010 06:53:00 PM

Thursday, May 06, 2010

NASDAQ to Cancel Certain Trades

Usually I focus more on economics, but ...

Via Reuters:

Nasdaq Operations said it will cancel all trades executed between 2:40 p.m. to 3 p.m. showing a rise or fall of more than 60 percent from the last trade in that security at 2:40 p.m or immediately prior.This needs an explanation ...

Market Update

by Calculated Risk on 5/06/2010 04:00:00 PM

There are two rumors: The first is that there was a trading error (fat finger of a E-mini SP future order), the second is that Euro banks are having a liquidity problem of some sort. Neither is confirmed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in April 1998; over 12 years ago.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Q1 PCE Growth came from Transfer Payments and Reductions in Personal Saving

by Calculated Risk on 5/06/2010 01:02:00 PM

This is a theme I've probably already pounded into the ground ... but here is some more from the Atlanta Fed's Economic Highlights:

This graph is from the Altanta Fed and shows the month-to-month increase in government transfer payments (green) and the change in real personal income less transfer payments (flat red line).

From the Atlanta Fed:

The major contributor to income growth during the past several months has been transfer payments.We could take this a step further ... the following table shows month-to-month increase in transfer payments and the month-to-month reduction in personal saving - and then compares to the month-to-month increase in Personal Consumption Expenditures (PCE). Note: all numbers are annual rates.

| Monthly Increase, Billions (SAAR) | Jan-10 | Feb-10 | Mar-10 |

|---|---|---|---|

| Government Transfer Payments | |||

| Old-age, survivors, disability, and health insurance benefits | -1.5 | 3.1 | 5.1 |

| Government unemployment insurance benefits | -6.6 | -2.2 | 11.8 |

| Other | 33.7 | 6.4 | 7.8 |

| Reduction in Personal saving | 55.1 | 54 | 28.2 |

| Total Saving Reduction and Transfer Payments | 80.7 | 61.3 | 52.9 |

| Increase in Personal outlays | 34.4 | 58.3 | 60.6 |

This shows that the entire increase in consumption in Q1 was due to transfer payments and reductions in the saving rate (now down to 2.7% in March). I suppose the saving rate could go to zero - although I expect it to increase, maybe incorrectly! - but at some point increases in consumption are going to have to come from jobs and income growth, not government transfer payments and reductions in the saving rate.

Bernanke on Stress Tests

by Calculated Risk on 5/06/2010 09:58:00 AM

From Fed Chairman Ben Bernanke: The Supervisory Capital Assessment Program--One Year Later

Importantly, the concerns about banking institutions arose not only because market participants expected steep losses on banking assets, but also because the range of uncertainty surrounding estimated loss rates, and thus future earnings, was exceptionally wide. The stress assessment was designed both to ensure that banks would have enough capital in the face of potentially large losses and to reduce the uncertainty about potential losses and earnings prospects. To achieve these objectives, for each banking organization included in the SCAP, supervisors estimated potential losses for each major category of assets, as well as revenue expectations, under a worse-than-expected macroeconomic scenario for 2009 and 2010. Importantly, the SCAP was not a solvency test; rather, the exercise was intended to determine whether the tested firms would have sufficient capital remaining to continue lending if their losses were larger than expected. The assessment included all domestic bank holding companies with at least $100 billion in assets at the end of 2008--19 firms collectively representing about two-thirds of U.S. banking assets.The good news is the economy has performed better than the "more adverse" scenario, especially house prices and GDP - although unemployment is still much worse than the "baseline" projections.

...

The assessment found that if the economy were to track the specified "more adverse" scenario, losses at the 19 firms during 2009 and 2010 could total about $600 billion. After taking account of potential resources to absorb those losses and capital that had already been raised or was contractually committed, and after establishing the size of capital buffers for the end of the two-year horizon that we believed would support stability and continued lending, we determined that 10 of the 19 institutions would collectively need to raise an additional $75 billion in common equity. Firms were asked to raise the capital within six months, by November 2009. Importantly, we publicly released our comprehensive assessments of each of the firms' estimated losses and capital needs under the more-adverse scenario. Our objective in releasing the information was to encourage private investment in these institutions, and thus bolster their lending capacity. If private sources of capital turned out not to be forthcoming, however, U.S. government capital would be available.

The bad news is one of the key goals has not been met: to "bolster lending". From Bernanke:

Our goal ... was to accomplish more than stability; for example, in the SCAP, by setting reasonably ambitious capital targets, we hoped also to hasten the return to a better lending environment.Several analysts (like Meredith Whitney yesterday) are questioning the health of the banks. Perhaps it is time to repeat the stress tests (make them an annual exercise like the FSA in the UK), publish the scenarios for five years (baseline and more adverse), and also make the results public.

Clearly that objective has not yet been realized, as bank lending continues to contract and terms and conditions remain tight.

Weekly Initial Unemployment Claims decline slightly

by Calculated Risk on 5/06/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 1, the advance figure for seasonally adjusted initial claims was 444,000, a decrease of 7,000 from the previous week's revised figure of 451,000. The 4-week moving average was 458,500, a decrease of 4,750 from the previous week's revised average of 463,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 24 was 4,594,000, a decrease of 59,000 from the preceding week's revised level of 4,653,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 458,500.

The dashed line on the graph is the current 4-week average. The current level of 444,000 (and 4-week average of 458,500) is still high, and suggests continuing weakness in the labor market.

Although declining over the last few weeks, the 4-week average first declined to this level in December 2009, and has been at this level for about five months.

Wednesday, May 05, 2010

Evening Euro

by Calculated Risk on 5/05/2010 10:13:00 PM

Just a bit of an overview ... the European Central Bank (ECB) is meeting in Lisbon, Portugal, and will announce their interest rate decision at 4:45 AM ET. You can watch the news conference here live at 5:30 AM ET.

Great timing to meet in Lisbon since earlier today Moody's warned that Portugal may face a downgrade.

Ratings agency Moody's Investors Service on Wednesday placed Portugal's government bond ratings on review for possible downgrade, citing the recent deterioration of the country's public finances and "long-term growth challenges" to the economy.Three months?

In the event of a downgrade, the country's Aa2 ratings would fall by one or, at most, two notches, the agency said. Moody's said it expects to complete the review within three months.

At the meeting, it is expected that the ECB will leave rates unchanged at 1%.

Professor Krugman argues Greece may end up leaving the euro: Greek End Game

Many commentators now believe that Greece will end up restructuring its debt — a euphemism for partial repudiation. I agree. But the reasoning seems to stop there, which is wrong. In effect, the consensus that Greece will end up defaulting is probably too optimistic. I’m growing increasingly convinced that Greece will end up leaving the euro, too.And there was sad news from Greece, from Reuters: Europe leaders warn of contagion, 3 die in Greece

Freddie Mac: Q1 Net Loss $6.7 billion, Asks for $10.6 billion

by Calculated Risk on 5/05/2010 05:40:00 PM

"[A]s we have noted for many months now, housing in America remains fragile with historically high delinquency and foreclosure levels, and high unemployment among the key risks."

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Press Release: Freddie Mac Reports First Quarter 2010 Financial Results

First quarter 2010 net loss was $6.7 billion. ...The first quarter loss in 2009 was $9.97 billion and the Q4 2009 loss was $6.5 billion. The losses keep coming, but last quarter Haldeman warned about "a potential large wave of foreclosures", so it appears he is a little more optimistic.

Net worth deficit was $10.5 billion at March 31, 2010, driven primarily by a significant adverse impact due to the change in accounting principles. ...

The Federal Housing Finance Agency (FHFA), as Conservator, will submit a request on the company’s behalf to Treasury for a draw of $10.6 billion under the Senior Preferred Stock Purchase Agreement (Purchase Agreement).

emphasis added

Whitney: Banks Under-reserved for 'Double-dip' in House Prices

by Calculated Risk on 5/05/2010 02:25:00 PM

From Nikolaj Gammeltoft and Peter Eichenbaum at Bloomberg: Whitney Says Banks Face ‘Tough’ Quarter, Housing Dip (ht jb)

Banks continue to suffer from losses on non-performing loans, and U.S. home prices will fall again amid increasing supply and sluggish demand, according to [banking analyst Meredith Whitney].I also think the repeat national house price indexes (Case-Shiller, LoanPerformance) will show further price declines later this year. But, we have to recognize that a majority of the national price declines are behind us, and any 'double-dip' in prices will be much smaller than the previous declines.

“I’m steadfast in my belief there’s going to be a double- dip in housing,” she said. “You will see clearly that the banks are under-reserved when housing dips again.”

My guess is some mid-to-high end bubble areas will see the largest future price declines - so the impact on the banks will depend on their exposure to the those areas.

I think BofA with the Countrywide loans, Wells Fargo with Wachovia / Golden West, and JPMorgan with WaMu are all exposed to the mid-to-high end bubble areas. But all the acquiring banks took large write-downs for these loans earlier, so I'm not sure Whitney is correct about them being under-reserved (it is hard to tell). Of course there are the 2nd lien issues too.

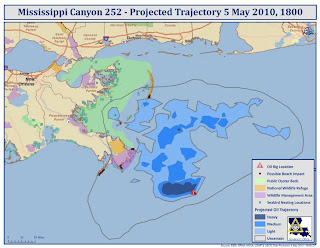

Web Resources for tracking the Oil Spill

by Calculated Risk on 5/05/2010 12:19:00 PM

From NOAA: Deepwater Horizon Incident, Gulf of Mexico

From the Office of the Governor, Louisiana: Gulf Oil Spill 2010 Trajectory

Click on map for larger image in new window.

Update: from Google: Gulf of Mexico Oil Spill (ht Jan)