by Calculated Risk on 4/07/2010 08:52:00 AM

Wednesday, April 07, 2010

MBA: Mortgage Refinance Actvity Declines as Rates Rise

The MBA reports: Mortgage Refinance Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 11.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 16.9 percent from the previous week and the seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 58.7 percent of total applications from 63.2 percent the previous week, marking the lowest share observed in the survey since the week ending August 28, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.31 percent from 5.04 percent, with points decreasing to 0.64 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year rate recorded in the survey since the first week of August 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although purchase activity was flat week-to-week, the four week average is moving up due to buyers trying to beat the expiration of the tax credit. I expect any increase in activity this year to be less than the increase last year when buyers rushed to beat the expiration of the initial tax credit.

Tuesday, April 06, 2010

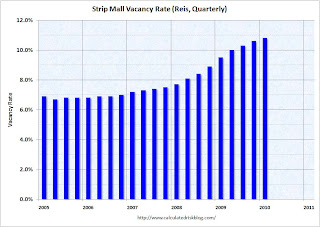

Reis: Strip Mall Vacancy Rate Hits 10.8%, Highest since 1991

by Calculated Risk on 4/06/2010 11:59:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the WSJ: Shopping-Center Malaise

Vacancies at shopping centers in the top 77 U.S. markets increased to 10.8% in the first quarter ... according to Reis.This is up from 10.6% in Q4 2009 and 9.5% in Q1 2009.

It is the highest vacancy rate since 1991, when vacancies reached 11%.

Vacancy rates at malls in the top 77 U.S. markets rose to 8.9% in the January-to-March period ...The 8.9% is the highest since Reis began tracking regional malls in 2000. Lease rates fell for the seventh consecutive quarter.

"The stress might be lessening and rent declines might be moderating," said Reis director of research Victor Calanog. "But we don't see positive rent growth resuming until the middle of next year at the earliest, just because of the typical lag."

FOMC Minutes on Housing

by Calculated Risk on 4/06/2010 07:31:00 PM

I want to highlight the housing comments in the FOMC minutes for the March 16, 2010 meeting:

Participants were also concerned that activity in the housing sector appeared to be leveling off in most regions despite various forms of government support, and they noted that commercial and industrial real estate markets continued to weaken. Indeed, housing sales and starts had flattened out at depressed levels, suggesting that previous improvements in those indicators may have largely reflected transitory effects from the first-time homebuyer tax credit rather than a fundamental strengthening of housing activity. Participants indicated that the pace of foreclosures was likely to remain quite high; indeed, recent data on the incidence of seriously delinquent mortgages pointed to the possibility that the foreclosure rate could move higher over coming quarters. Moreover, the prospect of further additions to the already very large inventory of vacant homes posed downside risks to home prices.And from the staff:

The staff did make modest downward adjustments to its projections for real GDP growth in response to unfavorable news on housing activity, unexpectedly weak spending by state and local governments, and a substantial reduction in the estimated level of household income in the second half of 2009. The staff's forecast for the unemployment rate at the end of 2011 was about the same as in its previous projection.This fits with my comments in response to Minneapolis Fed President Narayana Kocherlakota's speech today: It isn't the size of the sector, but the contribution during the recovery that matters - and housing is usually the largest contributor to economic growth early in a recovery. And as the FOMC notes, there isn't much contribution from residential investment right now (in fact the contribution from RI will probably be negative in Q1 2010).

And on employment, residential investment probably contibuted significantly to employment growth following previous recessions - especially for residential construction employment - although the BLS didn't break out residential construction for the earlier periods.

CNBC's Olick: Foreclosure "Pig in the python is showing its face"

by Calculated Risk on 4/06/2010 03:38:00 PM

From Diana Olick at CNBC: Foreclosures Are Rising

Yes, banks are ramping up loan modifications and ramping up short sales and ramping up deeds in lieu of foreclosure, but the plain fact is that as the systems are oiled, the loans are moving through faster, and the pig in the python is showing its face.The foreclosures are coming! The foreclosures are coming!

We won't get the [foreclosure] numbers until next week, but sources tell me they will likely be a new monthly record.

I don't think there is any question that foreclosures will pick up. And now is a good time to get properties on the market. As an example, Freddie Mac just announced an auction of homes: Freddie Mac, New Vista to Auction Hundreds of Homes on April 24 in Las Vegas, April 25 in California's Inland Empire Before Federal Homebuyer Tax Credit Expires

Freddie Mac (NYSE:FRE) and New Vista today announced plans to auction hundreds of HomeSteps® REO homes to individual homebuyers in Las Vegas on April 24, 2010 and in California’s Inland Empire on April 25, 2010 in support of the federal Neighborhood Stabilization Program (NSP) and to help more first time homebuyers and owner occupants purchase these homes. HomeSteps is the real estate sales unit of Freddie Mac and markets a nationwide selection of Freddie Mac-owned homes.

...

By scheduling these two auctions on April 24 and 25, bidders may still be able to qualify for the federal home purchase tax credit, which is set to expire on April 30, 2010. The tax credit offers eligible first time homebuyers up to $8,000 on qualifying homes.

Fed's Kocherlakota on the Economy

by Calculated Risk on 4/06/2010 01:04:00 PM

Minneapolis Fed President Narayana Kocherlakota spoke today: Economic Recovery and Balance Sheet Normalization

The headline is Kocherlakota thinks the Fed should start selling a non-trivial amount of MBS each month to normalize the Fed's balance sheet.

[T]he passive approach is a slow approach that will leave the Federal Reserve holding significant amounts of MBSs for many years to come. If the Federal Reserve wants to normalize its balance sheet in the next five, 10, or even 20 years, it needs to supplement the passive approach with an active one. In plain English, it will have to sell mortgage-backed securities.He also made some interesting comments on housing:

...

To pick one of many possible plans, suppose we were to commit to the public to sell 15 billion to 25 billion dollars worth per month of MBSs. This path of sales, combined with prepayments, would get the Federal Reserve out of MBSs within five years after the start of selling. The plan would also return the Federal Reserve’s balance sheet to a normal size, so that excess reserves would be normalized at their 2007 levels well before the end of the five-year period. Just as important, I feel confident that this pace of sales would be sufficiently slow that it would have little or no impact on MBS prices and long-term interest rates.

Let me start my outlook with the most troubling information first. Housing starts and sales remain at near historically low levels. These data are disturbing to many observers. And that’s understandable. After many past recessions, residential investment has played a significant role in the subsequent recovery. Arguing by analogy, some are concerned that we cannot have a sustainable economic recovery unless housing starts pick up dramatically from their current low levels.CR: I think a sustainable recovery is possible, but I think it will be sluggish and choppy. I've argued it is difficult to have a robust (V-Shaped) recovery without housing.

I have to say that I’m somewhat skeptical of this thinking. Yes, the housing sector is important, but residential investment makes up just 2.8 percent of the country’s gross domestic product.CR: This is an error in analysis. Back in 2005, several analysts argued I was wrong that a housing bust would eventually take the economy into recession - they said residential investment was only 6% of the U.S. economy! They were wrong because they didn't consider all the add on effects - and the impact of financial distress. Now residential investment is only 2.5 percent of GDP, and Kocherlakota is making the inverse faulty argument. During previous recoveries, housing played a critical role in job creation and consumer spending. It isn't the size of the sector, but the contribution during the recovery that matters - and housing is usually the largest contributor to economic growth early in a recovery.

The U.S. economy is a wonderfully diverse one, and has many possible sources of growth. We can—and I believe that we will—have significant growth in output without seeing a major turnaround in the housing market.I generally agree with this last section. The problem with "flexibility" is there are two key labor mismatches (as discussed last week by Atlanta Fed President Lockhart); The first is lower geographical mobility because of the inability to sell a home. Usually people can move freely in the U.S. to pursue employment, but many people are tied to an anchor (an underwater mortgage).

...

Housing starts are ... strongly affected by the general health of the economy (job growth or loss) and the stock of housing relative to demand. As I see it, the problems in the housing sector right now are largely driven by this second factor. For a number of reasons, the nation has built a lot more houses than it now needs or wants. As a result, my own prediction is that housing starts are going to remain low—possibly for several years.

What does the large supply of housing mean for the general economy? It means that resources formerly dedicated to building and outfitting homes are gradually shifting to other uses. This points out another remarkable feature of the U.S. economy: its flexibility.

The second is a skills mismatch. This is because so many people went into the construction industry because it was the highest paying job. These workers may be highly skilled in their trade, but their skills are probably not transferable to the new jobs being created. It will take some time for these people to learn a new trade.

Both of these mismatches lower the "flexibility" of the economy.

BLS: Low Labor Turnover, Fewer Job Openings in February

by Calculated Risk on 4/06/2010 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.7 million job openings on the last business day of February 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 2.1 percent. The hires rate (3.1 percent) and the separations rate (3.1 percent) were also little changed in February.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue) and separations (red) are pretty close each month. This is the level of turnover each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were

Layoffs and discharges have declined sharply from early 2009 - and that is a good sign.

However, hiring has not picked up - and even though total separations were at a series low, there were few jobs added in February (according to JOLTS). This low turnover rate is another indicator of a weak labor market.

Morning Greece

by Calculated Risk on 4/06/2010 09:01:00 AM

Just an update ...

Market News International reported that Greece may want to cut the International Monetary Fund out of the rescue package. However an unnamed Greece official denied the report, from the WSJ Greece to Pitch Dollar Bond to U.S. Investors

"Don't expect at this point any major push by Athens to get the IMF out of the picture," the official said. "There is unhappiness with the support package because it's vague. And, yes, the involvement of the IMF is something that we could do without," the official said. "But it was us who first raised the IMF card and I don't think the Greek government will or can renegotiate the package. It will show inconsistency."Update: Jason sent me an update from the Street on Greek bonds: "Wider by 50 on the day in the 10 years and 120 in 2 year, it is clear panic has now set in ..."

This official said Greece would like more clarity on any aid package involving the IMF, but the government doesn't plan to demand the agreement be renegotiated to exclude the IMF.

Apartment Vacancy Rate stays at Record Level, Rents increase Slightly

by Calculated Risk on 4/06/2010 12:07:00 AM

From Nick Timiraos at the WSJ: Apartment Rents Rise as Sector Stabilizes

Nationally, the apartment vacancy rate stayed flat at 8%, the highest level since Reis Inc., a New York research firm, began its tally in 1980.... Nationally, effective rents, which include concessions such as one month of free rent, rose 0.3% during the quarter compared with a 0.7% decline in the fourth quarter of last year and a 1.1% drop in the first quarter of 2009. ...Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a near record 10.7% in Q4 2009.

"Rent reductions are not over yet," said Hessam Nadji, managing director at real-estate firm Marcus & Millichap.

Rents plunged in 2009 by the most in the 30 years Reis has been tracking rents - and with vacancies at record levels, the slight increase in Q1 2010 rents doesn't mean the rent declines are over.

Monday, April 05, 2010

FRBSF Economic Letter: The Housing Drag on Core Inflation

by Calculated Risk on 4/05/2010 08:00:00 PM

Some people have argued that measured is inflation is declining mostly because of the Owners' Equivalent Rent component that is being pushed down by the record high rental vacancy rate. Economists at the San Francisco and New York Fed argue that there is "a broad pattern of subdued price increases across most consumption goods and services and [housing] is not distorting the broad downward trend in core inflation measures."

From Bart Hobijn, Stefano Eusepi, and Andrea Tambalotti: The Housing Drag on Core Inflation

One way to consider the effect of the price of housing on core inflation is to calculate a core PCEPI that excludes housing. This is done in Figure 1, which contains three time series. The first is 12-month growth in the core PCEPI. The second is a comparable measure of inflation for the housing component of the core PCEPI. The final time series is a core PCEPI that excludes housing expenditures.Note: The measures of housing inflation try to separate the cost of living in a home from changes in the asset price.

Three things stand out in this figure. First, the standard core inflation measure shows substantial disinflationary pressures at work. ...

Second, part of the drop in measured core inflation is undoubtedly due to the deceleration in the price of housing. ...

Third, it turns out that this drag is rather small. The decrease in housing inflation only accounts for a small part of the overall disinflationary pressure on core PCEPI. ...

Consequently, the evidence in Figure 1 offers little cause for concern that the recent behavior of core inflation might be a misleading signal of the underlying inflation trend.

emphasis added

The Fed has a dual mandate of price stability and maximum sustainable employment. This disinflationary trend (ex-housing) is important because some people at the Fed are more concerned about possible future inflation, whereas others are more concerned with the high level of unemployment.

CNBC'S Olick: Foreclosure Wave about to hit with "Thunderous roar"

by Calculated Risk on 4/05/2010 05:47:00 PM

From Diana Olick at CNBC: Let the Short Sales Begin

I'm ... starting to hear rumblings among the number crunchers that the wave of foreclosures we keep hearing about is about to hit with a thunderous roar.I don't know about a "thunderous roar", but I do think we will see more distressed sales soon. Most trustee sales seem to be "postponed" each month, and perhaps the lenders were just waiting for the HAFA short sales program to begin. That program started today and anyone considering a short sale should ask their lender if they qualify.

Servicers are ramping up the mod process and pushing those who don't qualify out the door more quickly than ever.