by Calculated Risk on 3/31/2010 10:56:00 AM

Wednesday, March 31, 2010

Restaurant Index increases in February

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The current situation for restaurants is still weak, but the index improved because of the outlook for sales growth, capital spending plans, and staffing levels.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index.

From the National Restaurant Association (NRA): Positive Outlook Pushes Restaurant Performance Index To Highest Level in More Than Two Years

[T]the National Restaurant Association’s Restaurant Performance Index (RPI) rose to ... 99.0, up 0.7 percent from January and its strongest level since November 2007.

“The RPI’s strong gain in February was the result of broad-based improvements among the forward-looking indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators’ optimism for sales growth stood at its strongest level in 29 months, with capital spending plans also rising to a two-year high.”

“In addition, restaurant operators reported a positive outlook for staffing gains for the first time in more than two years,” Riehle added. “This bodes well for replacing the more than 280,000 eating and drinking place jobs lost during the recession.”

...

Restaurant operators reported negative same-store sales for the 21st consecutive month in February, with the overall results similar to the January performance.

...

Customer traffic also remained soft in February, as restaurant operators reported net negative traffic for the 30th consecutive month.

...

Along with continued soft sales and traffic performances, capital spending activity continued to drop off.

emphasis added

MBA: Mortgage Applications Increase

by Calculated Risk on 3/31/2010 08:55:00 AM

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 1.3 percent on a seasonally adjusted basis from one week earlier. ...

“Purchase applications have increased over the past month, and are now at their highest level since last October when many homebuyers were rushing to get loans closed before the expected expiration of the homebuyer tax credit,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “We may be seeing a similar pattern now, as the extended version of the tax credit ends next month.”

The Refinance Index decreased 1.3 percent from the previous week and the seasonally adjusted Purchase Index increased 6.8 percent from one week earlier. This is the highest Purchase Index since the week ending October 30, 2009. ...

The refinance share of mortgage activity decreased to 63.2 percent of total applications from 65.0 percent the previous week. This is the lowest refinance share recorded in the survey since the week ending October 23, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.04 percent from 5.01 percent, with points increasing to 1.07 from 0.76 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

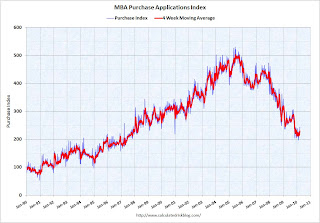

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The recent uptick in purchase applications is probably related to buyers trying to beat the expiration of the tax credit.

I've heard from some real estate agents that activity seems to have picked up, more than the normal seasonal increase, and the MBA data would seem to suggest this is happening. However I expect any increase in activity this year to be less than the increase last year.

ADP: Private Employment decreased 23,000 in March

by Calculated Risk on 3/31/2010 08:15:00 AM

ADP reports:

Nonfarm private employment decreased 23,000 from February to March on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from January 2010 to February 2010 was revised down slightly, from a decline of 20,000 to a decline of 24,000.Note: ADP is private nonfarm employment only (no government jobs).

The March employment decline was the smallest since employment began falling in February of 2008. Yet, the lack of improvement in employment from February to March is consistent with the pause in the decline of initial unemployment claims that occurred during the winter.

Since employment as measured by the ADP Report was not restrained in February by the effects of inclement weather, today’s figure does not incorporate a weather-related rebound that could be present in this month’s BLS data. In addition, today’s figure does not include any federal hiring in March for the 2010 Census. For both these reasons, it is reasonable to expect that Friday’s employment figure from the BLS will be stronger than today’s estimate in the ADP National Employment Report.

This is far below the consensus forecast of an increase of 40,000 private sector jobs in March.

The BLS reports on Friday, and the consensus is for an increase of 200,000 payroll jobs in March, on a seasonally adjusted (SA) basis, because of Census 2010 hiring and a bounce back from the snow storms. The underlying trend will be much lower ...

Tuesday, March 30, 2010

Live Chat with BLS experts on Friday

by Calculated Risk on 3/30/2010 11:58:00 PM

The BLS will host a live chat on Friday starting at 9:30 AM ET.

You can submit questions in advance here or submit questions during the event. I'm planning on posting the event on the blog (I'm not involved), so you can (hopefully) read the Q&A and ask questions from the blog on Friday morning.

I sent an advance question asking how we should adjust the seasonally adjusted headline payroll number for the NSA 2010 Census hiring data to try to determine the underlying trend (not counting the snow storms!).

| Friday, April 2, 2010 from 9:30 to 10:30 a.m. EDT. From the BLS: "BLS subject matter experts will take your questions on national employment and unemployment data, with a particular focus on the figures for March that will be released that morning at 8:30 a.m. EDT." |

LA Times: 'Gated Ghetto' in SoCal

by Calculated Risk on 3/30/2010 08:51:00 PM

Building gated communities for young families in exurbia was a great idea ...

From Alana Semuels at the LA Times: From bucolic bliss to 'gated ghetto'

The 427-home Willowalk tract, built by developer D.R. Horton, featured eight distinct "villages" within its block walls. Along with spacious homes, Willowalk boasted four lakes, a community pool and clubhouse. Fanciful street names such as Pink Savory Way and Bee Balm Road added to the bucolic image.

...

Home foreclosures have devastated neighborhoods throughout the country, but the transformation from suburban paradise to blighted community has been especially stark in places like Willowalk -- isolated developments on the far fringes of metropolitan areas that found ready buyers when home prices were soaring but then saw an exodus as values crashed.

Vacant homes are sprinkled throughout Willowalk, betrayed by foot-high grass. Others are rented, including some to families that use government Section 8 vouchers to live in homes with granite countertops and vaulted ceilings.

...

The contrast between occupied and empty houses is evident on one block, where high grass in weedy clumps gives way to a neatly mowed lawn with handwritten signs pleading "Please do not let your dog poop on our yard."

Government Housing Support Update

by Calculated Risk on 3/30/2010 06:03:00 PM

One of the key questions is: Will house prices fall as the government support for housing eases? From CNBC: Housing Prices May Be Heading for a Double Dip

Anyone thinking housing prices have reached a bottom had better do some recalculating. Despite Tuesday's Case Schiller report showing smaller declines in January, housing prices may already be in another free fall.Few people use the FHFA index anymore, but I do think prices will fall further in many areas. And I think the key housing price indexes, Case-Shiller and First American CoreLogic, have not bottomed yet - although it is possible.

Newly revised numbers are pointing to the decline.

The Federal Housing Finance Agency's (FHFA) adjusted figures show a housing price decline of 2 percent in December and 0.6 percent decline in January—reversing some regional price increases in 2009.

And more pricing dips are predicted.

Right now the Case-Shiller composite 10 index is 4.4% above the bottom of May 2009 (seasonally adjusted), and CoreLogic's index is 3.5% above the bottom of March 2009 (NSA), so it will not take much of a decline to see new post-bubble lows.

Last year I listed some of the temporary Government housing support programs (as opposed to permanent programs like tax breaks). This included:

Marshall & Ilsley Corporation (M&I) today announced it has extended its foreclosure moratorium an additional 90 days – through June 30, 2010. The initial moratorium was announced on December 18, 2008, as part of M&I's Homeowner Assistance Program. The moratorium is on all owner-occupied residential loans for customers who agree to work in good faith to reach a successful repayment agreement. The moratorium applies to applicable loans in all M&I markets.And other lenders are clearly not been aggresive in foreclosing.

So although some key programs are ending (MBS purchase program and housing tax credit), there are still a number of temporary programs providing support for the housing market.

Irish banks may require up to €32 billion

by Calculated Risk on 3/30/2010 02:28:00 PM

From the IrishTimes.com: Irish banks may require up to €32 billion to cover losses

Irish banks may require up to €32 billion to cover the losses from bad property loans transferred to the National Asset Management Agency (Nama), it has emerged.And all the details from the Minister for Finance.

The true scale of the “black hole” left in the sector by toxic property debt was laid bare today as Nama confirmed the initial tranche of bad loans would be acquired at a discount of 47 per cent, substantially more than the Government’s initial estimate of 30 per cent.

| Book value of amounts transferred in Tranche 1 | Price paid by NAMA for tranche 1 | Haircut | |

|---|---|---|---|

| AIB | €3.29 | €1.88 | 43% |

| BOI | €1.93 | €1.26 | 35% |

| Anglo | €10.00 | €5.00(1) | 50% |

| INBS | €0.67 | €0.28 | 58% |

| EBS | €0.14 | €0.09 | 36% |

(1) Estimate; every 1% increase in haircut reduces price paid by NAMA for

tranche 1 by €100m

Philly Fed State Coincident Indicators

by Calculated Risk on 3/30/2010 12:41:00 PM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7

Here is the Philadelphia Fed state coincident index release for February.

In the past month, the indexes increased in 21 states, decreased in 22, and remained unchanged in seven for a one-month diffusion index of -2. Over the past three months, the indexes increased in 18 states, decreased in 25, and remained unchanged in seven for a three-month diffusion index of -14.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Based on this indicator, most of the U.S. was in recession in early 2008.Although the graph shows the recession ending in July 2009 (based on other data), just over half the country was still in recession in February according to this index.

Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Case-Shiller House Price Graphs for January

by Calculated Risk on 3/30/2010 10:44:00 AM

Finally. Every month the S&P website crashes when the Case-Shiller data is released.

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA). Unfortunately this month only the NSA data is currently available. Usually I report the SA data, but that isn't available.

S&P/Case-Shiller released the monthly Home Price Indices for January (actually a 3 month average).

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and down about 0.2% in January (media reports are an increase seasonally adjusted - but that data isn't available).

The Composite 20 index is off 29.6% from the peak, and down about 0.4% in January (NSA). The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is essentially flat compared to January 2009.

The Composite 20 is off 0.7% from January 2009.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA.

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA.

On a SA basis from the NY Times: U.S. Home Prices Prices Inch Up, but Troubles Remain

Twelve of the cities in the index went up in January from December. Los Angeles was the biggest gainer, up 1.7 percent. Chicago was the biggest loser, dropping 0.8 percent.NOTE: Usually I report the Seasonally Adjusted data (see NY Times article), but that data wasn't available. So remember these graphs are NSA.

Case-Shiller House Prices increase in January

by Calculated Risk on 3/30/2010 09:04:00 AM

From Bloomberg: Home Prices in 20 U.S. Cities Increased 0.3% in January

The S&P/Case-Shiller home-price index climbed 0.3 percent from the prior month on a seasonally adjusted basis after a similar gain in December, the group said today in New York. The gauge was down 0.7 percent from January 2009, the smallest year- over-year decrease in two years.Graphs soon (S&P site always crashes when this data is released).

...

“While we continue to see improvements in the year-over- year data for all 20 cities, the rebound in housing prices seen last fall is fading,” David Blitzer, chairman of the index committee at S&P, said in a statement.