by Calculated Risk on 3/20/2010 01:09:00 PM

Saturday, March 20, 2010

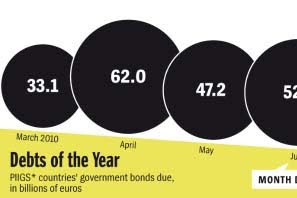

PIIGS Debt Coming Due

Click on graphic for Full Image at Der Spiegel

Click on graphic for Full Image at Der Spiegel

This graphic is from Anne Seith at Der Spiegel: Moment of Truth for Europe's Common Currency

Greece's financial difficulties have exposed numerous weaknesses which threaten Europe's common currency. Now, policy makers and economic experts are trying to find ways to stabilize the euro. SPIEGEL ONLINE takes a look at the proposals.Seith looks at several proposals from the formation a common EU economic government, to having better and automatic economic stablizers, to a Eurpoean Monetary Fund (EMF). None seem likely in the near term ...

"Worst of the IMF, without the benefits of a loan"

And from Le Monde (Google Translation): The cacophony lowers the euro

Greek Prime Minister George Papandreou has ... called for EU leaders to agree at the summit of Heads of State and Government on 25 and 26 March. Otherwise, it could well turn to the IMF. ... Mr. Papandreou stressed that with the austerity measures demanded by Brussels to Athens, his country had, in theory, "the worst of the IMF, but without the benefits of a loan".

...

Meanwhile, the IMF scenario seems to attract more and more within a Euro disoriented. After Germany, it is the Netherlands, Finland and Sweden are out of the woods Friday to support such intervention. Some are opposed, however, as the President of the European Central Bank (ECB), Jean-Claude Trichet.

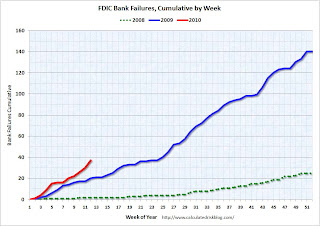

Bank Failure Update

by Calculated Risk on 3/20/2010 09:38:00 AM

There have been 205 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 37 |

| Total | 205 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows bank failures by week in 2008, 2009 and 2010.

The FDIC started fast in 2010, but slowed down when the snow storm hit D.C. - now it looks like the pace is picking back up again.

My (easy) prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 - peak of the S&L crisis (534 banks).

The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.The 140 bank failures last year was the highest total since 1992 (181 bank failures).

For those interested in bank failures by number of institutions and assets, the December Congressional Oversight Panel’s Troubled Asset Relief Program report through Nov 30th for 2009 (see page 45).

Friday, March 19, 2010

Unofficial Problem Bank List increases to 653

by Calculated Risk on 3/19/2010 10:51:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

Publication of actions issued by the OCC and OTS contributed to an increase in the number of institutions and aggregate assets on the Unofficial Problem Bank List this week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

This week the list includes 653 institutions with assets of $332.0 billion, up from 640 institutions with assets of $325.6 billion last week. The list increased despite the FDIC best efforts closing seven institutions of which five were on last week's list. The removals because of failure include Advanta Bank Corp. ($1.6 billion Ticker: ADVNQ), Appalachian Community Bank ($1.0 billion Ticker: APAB), First Lowndes Bank ($137 million), American National Bank ($70 million), and State Bank of Aurora ($28 million).

There were 18 institutions with assets of $9.3 billion added to the list this week. Additions include Los Alamos National Bank, Los Alamos, NM ($1.7 billion); NCB, FSB, Hillsboro, OH ($1.6 billon); Citizens First National Bank, Princeton, IL ($1.3 billion Ticker: PNBC); First Chicago Bank & Trust, Itasca, IL ($1.2 billion); and Norstates Bank, Waukegan, IL ($626 million Ticker: NSFC).

Other changes for institutions already on the list include Prompt Corrective Action Orders issued by the OTS against Savings Bank of Maine ($892 million); Inter Savings Bank, FSB ($701 million); and Woodlands Bank ($388 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #34 through #37: Busy Day at FDIC

by Calculated Risk on 3/19/2010 06:22:00 PM

Bair's team dominate the boards

Four more fall today

by Soylent Green is People

From the FDIC: Community & Southern Bank, Carrollton, Georgia, Assumes All of the Deposits of Appalachian Community Bank, Ellijay, Georgia

...As of December 31, 2009, Appalachian Community Bank had approximately $1.01 billion in total assets and $917.6 million in total deposits. ...From the FDIC: Citizens South Bank, Gastonia, North Carolina, Assumes All of the Deposits of Bank of Hiawassee, Hiawassee, Georgia

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $419.3 million. .... Appalachian Community Bank is the 34th FDIC-insured institution to fail in the nation this year, and the fourth in Georgia. The last FDIC-insured institution closed in the state was Century Security Bank, Duluth, earlier today.

As of December 31, 2009, Bank of Hiawassee had approximately $377.8 million in total assets and $339.6 million in total deposits. ...From the FDIC: First Citizens Bank, Luverne, Alabama, Assumes All of the Deposits of First Lowndes Bank, Fort Deposit, Alabama

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $137.7 million. ... Bank of Hiawassee is the 35th FDIC-insured institution to fail in the nation this year, and the fifth in Georgia. The last FDIC-insured institution closed in the state was Appalachian Community Bank, Ellijay, earlier today.

As of December 31, 2009, First Lowndes Bank had approximately $137.2 million in total assets and $131.1 million in total deposits....From the FDIC: Northern State Bank, Ashland, Wisconsin, Assumes All of the Deposits of State Bank of Aurora, Aurora, Minnesota

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.3 million. ... First Lowndes Bank is the 36th FDIC-insured institution to fail in the nation this year, and the first in Alabama. The last FDIC-insured institution closed in the state was New South Federal Savings Bank, Irondale, on December 18, 2009.

As of December 31, 2009, State Bank of Aurora had approximately $28.2 million in total assets and $27.8 million in total deposits. ...Seven down today. Probably more to come ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.2 million. ... State Bank of Aurora is the 37th FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota. The last FDIC-insured institution closed in the state was 1st American State Bank of Minnesota, Hancock, on February 5, 2010.

Bank Failures #32 & #33: Georgia and Utah

by Calculated Risk on 3/19/2010 05:12:00 PM

Century Security

Or a Paradox?

Utah's Advanta

A mirage in the desert

Phantom worth now gone.

by Soylent Green is People

From the FDIC: Bank of Upson, Thomaston, Georgia, Assumes All of the Deposits of Century Security Bank, Duluth, Georgia

Century Security Bank, Duluth, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: FDIC Approves the Payout of the Insured Deposits of Advanta Bank Corp., Draper, Utah

As of December 31, 2009, Century Security Bank had approximately $96.5 million in total assets and $94.0 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $29.9 million. ... Century Security Bank is the 32nd FDIC-insured institution to fail in the nation this year, and the third in Georgia. The last FDIC-insured institution closed in the state was Community Bank and Trust, Cornelia, on January 29, 2010.

The Federal Deposit Insurance Corp. (FDIC) approved the payout of the insured deposits of Advanta Bank Corp., Draper, Utah....That makes three today - and another payout (no buyer) in Utah.

As of December 31, 2009, Advanta Bank Corp. had approximately $1.6 billion in total assets and $1.5 billion in total deposits. ...

Advanta Bank Corp. is the 33rd FDIC-insured institution to fail this year and the third in Utah since Centennial Bank, Ogden, was closed on March 5, 2010. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $635.6 million.

Bank Failure #31: American National Bank, Parma, Ohio

by Calculated Risk on 3/19/2010 04:32:00 PM

What's this other thing I smell?

Fail, from Ohio

by Soylent Green is People

From the FDIC: The National Bank and Trust Company, Wilmington, Ohio, Assumes All of the Deposits of American National Bank, Parma, Ohio

American National Bank, Parma, Ohio, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Ohio is on the map. I'm thinking Puerto Rico and Illinois ...

As of December 31, 2009, American National Bank had approximately $70.3 million in total assets and $66.8 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.1 million. ... American National Bank is the 31st FDIC-insured institution to fail in the nation this year, and the first in Ohio. The last FDIC-insured institution closed in the state was AmTrust Bank, Cleveland, on December 4, 2009.

Looking Ahead: 2011 Social Security Cost of Living Adjustment

by Calculated Risk on 3/19/2010 03:01:00 PM

Given the low inflation reports, I was curious if Social Security benefits would increase in 2011 ... it might be close, but any increase will probably be small. However the contribution base might increase by a larger percentage. Here is an update:

This year (starting in December 2009) was the first time since the automatic cost of living adjustments (COLA) were adopted in 1975 that Social Security benefits did not increase.

This was also the first year the contribution base (currently $106,800) did not increase.

There is a reasonable chance that there will be little or no increase in benefits in 2011 (starting in December 2010).

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the proceeding year Q3 months. Note: this is not the headline CPI-U.

For 2011, the calculation is not based on Q3 2010 over Q3 2009, but Q3 2010 over the highest preceding Q3 average - the 215.495 in Q3 2008. This means CPI-W in Q3 2010 has to average above 215.495 or there will be no increase in Social Security benefits in 2011.

Last month (February 2010) CPI-W was at 212.544, so CPI-W will have to increase by more than 1.4% over the next 7 months for benefits to increase - this is possible since this number is not seasonally adjusted, and gas prices usually rise in the summer. However any increase in benefits will probably be very small.

Contribution and Benefit Base

The law - as currently written - prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in CPI-W, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.To summarize (assuming no new legislation):

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

U.S. Court of Appeals Rules Fed Must Disclose Bailout Records

by Calculated Risk on 3/19/2010 01:05:00 PM

Just an update ....

From Bloomberg: Federal Reserve Must Disclose Bank Bailout Records (ht jb)

The U.S. Court of Appeals in Manhattan ruled today that the Fed must release records of the unprecedented $2 trillion U.S. loan program ... The ruling upholds a decision of a lower-court judge, who in August ordered that the information be released.It will be interesting to see these documents, but it might not be for a few more years.

...

The opinion may not be the final word in the bid for the documents, which was launched by Bloomberg LP, the parent of Bloomberg News, with a November 2008 lawsuit. The Fed may seek a rehearing or appeal to the full appeals court and eventually petition the U.S. Supreme Court.

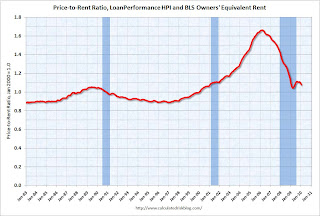

Housing: Price-to-Rent Ratio

by Calculated Risk on 3/19/2010 10:15:00 AM

Here is an update on the price-to-rent ratio using the First Amercican CoreLogic price index released yesterday for house prices through January.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

The following graph uses the First American data ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined slightly again in February. The price index has declined 6 of the last 8 months, although most of the declines have been very small. With rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Rents Expected to decline through 2011 in Seattle

by Calculated Risk on 3/19/2010 08:28:00 AM

From Vanessa Ho at Seattlepi.com: Renters, rejoice: Apartments are cheap and the iPod is free (ht Patrick)

"We've done holiday specials -- a one-night stay in a downtown hotel - or an iPod nano," said [Craig Dwyer, vice-president of Seattle-based Pinnacle Family of Companies] residential division. "We've done a microwave. We even did a 32-inch flat panel TV."I'm starting to hear stories about vacancy rates stabilizing in some markets, although rents are probably still falling in most areas. This will keep pressure on CPI and house prices.

After peaking in 2006 and 2007, rents in King, Snohomish and Pierce counties tanked over the course of last year by nearly 4 percent, according to [Mike Scott, whose firm, Dupre + Scott, researches the Puget Sound apartment market]. He expects rents will continue to plummet this year by 5 percent, and again in 2011, but less dramatically.

In Seattle, property managers say that trend has been more pronounced, with some rents dropping as much as 15 to 20 percent last year. ... Bart Flora, co-owner of Cornell & Associates, which manages 6,500 properties in the city, said some, in-city, one-bedroom apartment now rent for $800 to $850, instead of roughly $1,000 two years ago.

"It's the steepest drop I've ever encountered in 25 years, certainly in my career," said Flora. He added that he believed the market - at least in Seattle - appears to have hit bottom and is stabilizing.