by Calculated Risk on 3/14/2010 09:33:00 PM

Sunday, March 14, 2010

Housing Market Index, Housing Starts, Snow and Spec Homes

As mentioned in the Weekly Summary and a Look Ahead post, the NAHB Housing Market Index for March, and Housing Starts for February, will both be released early this week.

Here is a graph showing the relationship between the two series: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the January data for single family starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Since the NAHB index increased slightly in February (it is released a month ahead of starts), we might expect some increase in February single family housing starts. Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

Of course the snow might be a factor, although few new homes are built in the northeast compared to the rest of the country. Of course D.C. is in the South region (as is Virginia), so it might be hard to tell. Here is a map of states in each region for the Census Bureau report.

There might also be an increase in speculative starts in some regions (single family) in February since many builders started a few extra homes in anticipation of the expiration of the first time home buyer tax credit. February was probably the last chance to start a spec home to take advantage of the expected buying rush in April - since the builders have to close by the end of June. It usually takes about 6 months to build a home, but 5 months is doable for smaller homes and with so many sub contractors hungry for work.

We will need to look at the details by region this time, but the general trend is sideways ...

Economic Outlook: Review of Possible Upside Surprises to Forecast

by Calculated Risk on 3/14/2010 05:09:00 PM

My general outlook for 2010 is for sluggish and choppy growth. Usually the deeper the recession, the steeper the recovery - however recoveries following economic crisis tend to be sluggish (see: "The Aftermath of Financial Crises", Reinhart and Rogoff, 2009):

An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt.Also the two usual engines of recovery, consumer spending and residential investment, both remain constrained as households rebuild their balance sheets (constraining consumption), and serious problems remain in the housing market including significant excess inventory and high levels of distressed properties.

Last November I listed a few possible upside surprises and downside risks to the above forecast. Here is an update on the possible upside surprises:

On consumer spending, I wrote:

My expectation has been that the saving rate would rise to around 8% over the next couple of years. The saving rate rose sharply in 2009, however the most recent report from the BEA: Personal Income and Outlays, January 2010 showed the saving rate fell to 3.3% in January.Consumer spending. One of the key reasons I think growth will be sluggish in 2010 is because I expect the personal saving rate to increase as households rebuild their balance sheets and reduce their debt burden. But you never know. As San Francisco Fed President Dr. Yellen said yesterday: "Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again." Still, it is hard to imagine much of a spending boom with high unemployment (putting pressure on wages), and limited credit (so some people can spend beyond their income).

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the January Personal Income report.

Although I still expect the saving rate to rise, it is possible that it will not rise as far - or as fast - as I expected. That would mean consumption could grow closer to income growth in 2010.

My comments last year on exports:

Based on the comments of Chinese Premier Wen last night, "don't hold your breath" was probably good advice (although I do expect China to revalue this year). U.S. exports have increased over the last year, but it appears the growth of exports has slowed.Exports. Perhaps we are seeing a shift from a U.S. consumption driven world economy, to a more balanced global economy. An increase in consumption in other countries, combined with the weaker dollar should lead to more U.S. exports. And if China revalued that might lead to a boom in U.S. exports. ... Please don't hold your breath waiting for China!

On Residential Investment:

This has been as weak as expected ...Residential Investment. Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year. That won't happen. But it is possible for single family starts to rebound to 700 thousand SAAR, even with the large overhang of existing housing inventory.

And on another stimulus:

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.It now appears the additional stimulus will be in the $100 billion range, mostly for additional unemployment benefits.

The most likely upside surprise appears to be coming from consumer spending and the lack of an increase in the saving rate. I still think the saving rate will continue to rise - although maybe not as fast as I originally expected.

Also - I still think the recovery will be choppy and sluggish. I'll review the downside risks soon ...

Weekly Summary and a Look Ahead

by Calculated Risk on 3/14/2010 12:03:00 PM

This will be a busy week with two key housing reports released on Monday and Tuesday: Builder confidence and Housing starts.

On Monday, the Fed will release the February Industrial Production and Capacity Utilization report at 9:15 AM ET. Expectations are for no increase in industrial production, and a slight decrease in capacity utilization (snow related).

Also on Monday, the NAHB will release the Housing Market Index of builder confidence for March at 1:00 PM ET (little change expected - still depressed), and the Empire Manufacturing Survey will be released at 8:30 AM.

On Tuesday, the Census Bureau will release Housing Starts for February at 8:30 AM ET. There will probably be a small decline in February starts because of the snow, however housing starts have already been moving sideways since last June as the excess inventory of housing units has slowly been absorbed.

Also on Tuesday, the FOMC statement will be released at 2:15 PM ET. Obviously there will be no change to the federal funds rate, but the statement might be a little more positive on the economy. The key wording -"exceptionally low levels of the federal funds rate for an extended period" - will almost certainly remain the same. The Fed will probably discuss planning for an "exit strategy" and the end of the MBS purchase program at the end of March.

On Wednesday, the MBA Mortgage Applications Index, and the Producer Price index for February will both be released.

On Thursday, the closely watched initial weekly unemployment claims, and the February Consumer Price Index (consensus is for a 0.1% increase - subdued inflation) will be released. Of special interest will be the Owners' Equivalent Rent index that has been declining for several months.

Also on Thursday, the March Philly Fed survey will be released.

On Friday the FDIC will probably close several more banks. I'm still expecting some activity in Puerto Rico soon, and the Chicago Tribune reported this week that bids are being taken on several banks in the Chicago area:

The Federal Deposit Insurance Corp. is putting at least a half-dozen struggling Chicago-area banks out for bid to healthy institutions that might want to buy their deposits and asset.On Saturday, Fed Chairman Ben Bernanke will be speaking at the Community Bankers convention in Florida.

...

People familiar with the FDIC process say that, among the undercapitalized banks, those that the regulator is trying to line up buyers for include Amcore Bank, Broadway Bank, Lincoln Park Savings Bank, Wheatland Bank, Citizens Bank & Trust Co. of Chicago and New Century Bank.

And a summary of last week ...

On a monthly basis, retail sales increased 0.3% from January to February (seasonally adjusted, after revisions), and sales were up 4.5% from February 2009 (easy comparison). However January was revised down sharply from a 0.5% increase to 0.1%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

Retail sales are up 6.0% from the bottom, but still off 6.4% from the peak. Retail ex-gasoline are up 3.6% from the bottom and still off 5.4% from the peak.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The Census Bureau reports:

The Census Bureau reports: [T]otal January exports of $142.7 billion and imports of $180.0 billion resulted in a goods and services deficit of $37.3 billion, down from $39.9 billion in December, revised.The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

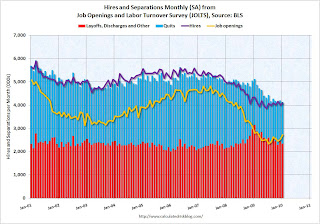

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the BLS JOLTS report. Red and light blue added together equals total separations.

According to the JOLTS report, there were 4.08 million hires in January (SA), and 4.122 million total separations, or 42 thousand net jobs lost. The comparable CES report showed a loss of 26 thousand jobs in January (after revision).

According to the JOLTS report, there were 4.08 million hires in January (SA), and 4.122 million total separations, or 42 thousand net jobs lost. The comparable CES report showed a loss of 26 thousand jobs in January (after revision).Separations have declined sharply from early 2009, but hiring has barely picked up. Quits (light blue on graph) are at near the low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a weak labor market.

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Five states and D.C. set new series record highs: California, South Carolina, Florida, Georgia and North Carolina. Two other states tied series highs: Nevada and Rhode Island.

Best wishes to all.

Senator Dodd's Financial Overhaul Bill to be introduced Monday

by Calculated Risk on 3/14/2010 09:45:00 AM

From Sewell Chan at the NY Times: Dodd to Unveil a Broad Financial Overhaul Bill

Here are the key points:

The derivative regulation is a positive step forward. I'm not sure about the systemic risk council, but this could be helpful. The consumer financial protection agency as part of the Fed is really no change.

Chinese Premier: Currency not undervalued, warns of "Double Dip" Recession

by Calculated Risk on 3/14/2010 01:15:00 AM

From Bloomberg: China’s Wen Rebuffs Yuan Calls, Is ‘Still Worried’ About Dollar

"I don’t think the yuan is undervalued,” Wen said at a press conference in Beijing marking the end of China’s annual parliamentary meetings. Dollar volatility is a “big” concern and “I’m still worried” about China’s U.S. currency holdings, he said.And from the WSJ: Chinese Premier Warns of 'Double Dip' Recession

Saturday, March 13, 2010

Saturday Night Greece

by Calculated Risk on 3/13/2010 10:13:00 PM

It has been a month since Jean-Claude Juncker, Luxembourg's prime minister and chairman of the 16 euro-zone finance ministers, said that Greece had until March 16th to show progress on their budget. The euro-zone finance ministers meet this week, and apparently Greece has meet the short term goals.

From Reuters: Euro finance ministers to agree on Greek aid: source

Euro zone finance ministers are likely to agree on Monday on a mechanism for aiding Greece financially, if it is required, but will leave out any sums until Athens asks for them, an EU source said on Saturday. ...And from the WSJ: No Need for Greek Bailout Now, France's Lagarde Says

"I think we should be able to agree on principles of a euro area facility for coordinated assistance. The European Commission and the Eurogroup task force would have the mandate to finalize the work," [a] source said. ... "You would have a framework mechanism and you would have blank spaces for the numbers because there has been no request (from Greece) yet."

Credible efforts by Greece's government to clean up its finances have so far negated the need for any bailout from the European Union, French Finance Minister Christine Lagarde said Friday.

Unofficial Problem Bank List at 640

by Calculated Risk on 3/13/2010 06:00:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

There were several additions and removals during the week that left the Unofficial Problem Bank List totals almost unchanged. This week there are 640 institutions with assets of $325.6 billion compared to 641 institutions and $325.5 billion of assets last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Removals include the four failures -- The Park Avenue Bank ($520 million), Old Southern Bank ($336 million), Statewide Bank ($243 million), and LibertyPointe Bank ($217 million), and one action termination -- Union Federal Savings Bank ($192 million).

Additions include Heritage Oaks Bank, Paso Robles, CA ($942 million); Idaho Banking Company, Boise, ID ($228 million); Albina Community Bank, Portland, OR ($199 million); and Ravalli County Bank, Hamilton, MT ($191 million).

Other changes include for institutions already on the list are Prompt Corrective Action Orders issued against Maritime Savings Bank ($379 million), Horizon Bank ($199 million), and Ideal Federal Savings Bank ($6 million). We anticipate for the OCC to issue their enforcement actions for February 2010 next week.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Nearing Retirement and Unemployed or Underemployed

by Calculated Risk on 3/13/2010 02:05:00 PM

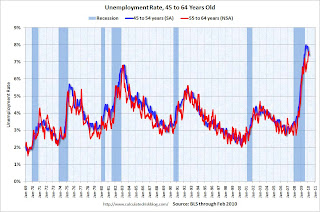

One of the groups seriously impacted by the great recession is the "pre retirement" generation - currently the "Baby Boomers" - the workers between the ages of 45 and 64. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rates for two groups: 45 to 54 (seasonally adjusted), and 55 to 64 (only NSA data is available).

The unemployment rate for these age groups hit an all time high during the great recession (highest since WWII).

Michael Winerip at the NY Times has a story about the plight of several "Boomers" who he has tracked for the last year: Time, It Turns Out, Isn’t on Their Side (ht Ann)

A YEAR ago, I wrote about a job fair at the Sheraton in Midtown Manhattan, where over 5,000 mainly white collar, middle-aged jobless men and women waited in the cold for more than two hours, hoping to find work. ...Kind of hard to sing "Yeah, time time time is on my side ..." when you are 60 and unemployed or underemployed.

For that column, I interviewed two dozen boomers. Given recent reports from the federal government and Manpower, the employment agency, that the hiring outlook is beginning to improve, I thought it would be worthwhile to go back to those highly motivated people. ...

The short answer is, of the 16 I interviewed again, 9 describe themselves as still struggling. Eight continue to be unemployed or are working part-time jobs that pay near minimum wage. Several were so concerned about bias, they did not want to give their ages. ...

Of the 16, only one, Mr. Kramer, who was unemployed eight months before being hired in July as a closing manager at a Best Yet supermarket, has found a job that pays more than his old position. More typical of the seven who’ve found full-time work is Ben Brief, 60, a printing supervisor, who’d been jobless two months when I interviewed him on Sixth Avenue in the 20-degree weather. Mr. Brief was out of work nine more months, before finding a printing job that paid 20 percent less than his previous position. “I’m glad to be working, but people know they can pay you a lot less in this economy,” he said.

IMF Official: World's Regulatory Supervision Shockingly Inadequate

by Calculated Risk on 3/13/2010 11:15:00 AM

From Tom Abate at the San Francisco Chronicle: Financial leaders dissect meltdown

"What is quite shocking," [John Lipsky, a senior official of the International Monetary Fund] said, is how inadequate the world's regulatory supervisors were in curbing the lax lending standards at the heart of the housing and credit bubbles.Shocked? Hmmm ...

LA Area Port Traffic in February

by Calculated Risk on 3/13/2010 08:26:00 AM

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was up 33.8% compared to February 2009. (up 9.5% compared to last year using three month average).

Of course trade collapsed in February 2009, so this is a very easy comparison. Inbound traffic was still down 18.3% vs. two years ago (Feb 2008).

Loaded outbound traffic was up 32.7% from February 2009. (+33.5% using three months average) This was also an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Just as with imports, exports are still off from 2 years ago (off 10.0%).

And more from Ronald White at the LA Times: Trade numbers climb sharply at Southland ports

Trade numbers at the ports of Los Angeles and Long Beach, the nation's busiest seaport complex, rose sharply in February compared with the same month last year, lending strength to the arguments of some experts who believe that a stronger-than-anticipated recovery may be underway.The LA Times article is using the YoY numbers. However looking at the graph (red line), exports recovered in the first half of 2009, but export traffic has been mostly flat since last summer. The YoY increase for March will be much less than for February!

...

"Our feeling is that consumers are coming back. They are spending a bit more of their money. They are less concerned about losing their jobs than they have been in the last three months," said Ben Hackett, founder of Hackett Associates, which tracks international trade at the nation's busiest seaports for the National Retail Federation.

Hackett said his firm had scaled back its expectations for trade growth in 2010, "but we think we'll be seeing a relatively strong year at a 10% to 14% increase. We should see steady improvement, minus the usual seasonal adjustments."

It is harder to tell about imports (blue line) because of the large seasonal swings.