by Calculated Risk on 3/14/2010 09:45:00 AM

Sunday, March 14, 2010

Senator Dodd's Financial Overhaul Bill to be introduced Monday

From Sewell Chan at the NY Times: Dodd to Unveil a Broad Financial Overhaul Bill

Here are the key points:

The derivative regulation is a positive step forward. I'm not sure about the systemic risk council, but this could be helpful. The consumer financial protection agency as part of the Fed is really no change.

Chinese Premier: Currency not undervalued, warns of "Double Dip" Recession

by Calculated Risk on 3/14/2010 01:15:00 AM

From Bloomberg: China’s Wen Rebuffs Yuan Calls, Is ‘Still Worried’ About Dollar

"I don’t think the yuan is undervalued,” Wen said at a press conference in Beijing marking the end of China’s annual parliamentary meetings. Dollar volatility is a “big” concern and “I’m still worried” about China’s U.S. currency holdings, he said.And from the WSJ: Chinese Premier Warns of 'Double Dip' Recession

Saturday, March 13, 2010

Saturday Night Greece

by Calculated Risk on 3/13/2010 10:13:00 PM

It has been a month since Jean-Claude Juncker, Luxembourg's prime minister and chairman of the 16 euro-zone finance ministers, said that Greece had until March 16th to show progress on their budget. The euro-zone finance ministers meet this week, and apparently Greece has meet the short term goals.

From Reuters: Euro finance ministers to agree on Greek aid: source

Euro zone finance ministers are likely to agree on Monday on a mechanism for aiding Greece financially, if it is required, but will leave out any sums until Athens asks for them, an EU source said on Saturday. ...And from the WSJ: No Need for Greek Bailout Now, France's Lagarde Says

"I think we should be able to agree on principles of a euro area facility for coordinated assistance. The European Commission and the Eurogroup task force would have the mandate to finalize the work," [a] source said. ... "You would have a framework mechanism and you would have blank spaces for the numbers because there has been no request (from Greece) yet."

Credible efforts by Greece's government to clean up its finances have so far negated the need for any bailout from the European Union, French Finance Minister Christine Lagarde said Friday.

Unofficial Problem Bank List at 640

by Calculated Risk on 3/13/2010 06:00:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

There were several additions and removals during the week that left the Unofficial Problem Bank List totals almost unchanged. This week there are 640 institutions with assets of $325.6 billion compared to 641 institutions and $325.5 billion of assets last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Removals include the four failures -- The Park Avenue Bank ($520 million), Old Southern Bank ($336 million), Statewide Bank ($243 million), and LibertyPointe Bank ($217 million), and one action termination -- Union Federal Savings Bank ($192 million).

Additions include Heritage Oaks Bank, Paso Robles, CA ($942 million); Idaho Banking Company, Boise, ID ($228 million); Albina Community Bank, Portland, OR ($199 million); and Ravalli County Bank, Hamilton, MT ($191 million).

Other changes include for institutions already on the list are Prompt Corrective Action Orders issued against Maritime Savings Bank ($379 million), Horizon Bank ($199 million), and Ideal Federal Savings Bank ($6 million). We anticipate for the OCC to issue their enforcement actions for February 2010 next week.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Nearing Retirement and Unemployed or Underemployed

by Calculated Risk on 3/13/2010 02:05:00 PM

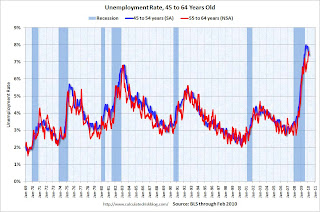

One of the groups seriously impacted by the great recession is the "pre retirement" generation - currently the "Baby Boomers" - the workers between the ages of 45 and 64. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rates for two groups: 45 to 54 (seasonally adjusted), and 55 to 64 (only NSA data is available).

The unemployment rate for these age groups hit an all time high during the great recession (highest since WWII).

Michael Winerip at the NY Times has a story about the plight of several "Boomers" who he has tracked for the last year: Time, It Turns Out, Isn’t on Their Side (ht Ann)

A YEAR ago, I wrote about a job fair at the Sheraton in Midtown Manhattan, where over 5,000 mainly white collar, middle-aged jobless men and women waited in the cold for more than two hours, hoping to find work. ...Kind of hard to sing "Yeah, time time time is on my side ..." when you are 60 and unemployed or underemployed.

For that column, I interviewed two dozen boomers. Given recent reports from the federal government and Manpower, the employment agency, that the hiring outlook is beginning to improve, I thought it would be worthwhile to go back to those highly motivated people. ...

The short answer is, of the 16 I interviewed again, 9 describe themselves as still struggling. Eight continue to be unemployed or are working part-time jobs that pay near minimum wage. Several were so concerned about bias, they did not want to give their ages. ...

Of the 16, only one, Mr. Kramer, who was unemployed eight months before being hired in July as a closing manager at a Best Yet supermarket, has found a job that pays more than his old position. More typical of the seven who’ve found full-time work is Ben Brief, 60, a printing supervisor, who’d been jobless two months when I interviewed him on Sixth Avenue in the 20-degree weather. Mr. Brief was out of work nine more months, before finding a printing job that paid 20 percent less than his previous position. “I’m glad to be working, but people know they can pay you a lot less in this economy,” he said.

IMF Official: World's Regulatory Supervision Shockingly Inadequate

by Calculated Risk on 3/13/2010 11:15:00 AM

From Tom Abate at the San Francisco Chronicle: Financial leaders dissect meltdown

"What is quite shocking," [John Lipsky, a senior official of the International Monetary Fund] said, is how inadequate the world's regulatory supervisors were in curbing the lax lending standards at the heart of the housing and credit bubbles.Shocked? Hmmm ...

LA Area Port Traffic in February

by Calculated Risk on 3/13/2010 08:26:00 AM

Note: this data is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was up 33.8% compared to February 2009. (up 9.5% compared to last year using three month average).

Of course trade collapsed in February 2009, so this is a very easy comparison. Inbound traffic was still down 18.3% vs. two years ago (Feb 2008).

Loaded outbound traffic was up 32.7% from February 2009. (+33.5% using three months average) This was also an easy YoY comparison for exports, because U.S. exports fell off a cliff in near the end of 2008.

Just as with imports, exports are still off from 2 years ago (off 10.0%).

And more from Ronald White at the LA Times: Trade numbers climb sharply at Southland ports

Trade numbers at the ports of Los Angeles and Long Beach, the nation's busiest seaport complex, rose sharply in February compared with the same month last year, lending strength to the arguments of some experts who believe that a stronger-than-anticipated recovery may be underway.The LA Times article is using the YoY numbers. However looking at the graph (red line), exports recovered in the first half of 2009, but export traffic has been mostly flat since last summer. The YoY increase for March will be much less than for February!

...

"Our feeling is that consumers are coming back. They are spending a bit more of their money. They are less concerned about losing their jobs than they have been in the last three months," said Ben Hackett, founder of Hackett Associates, which tracks international trade at the nation's busiest seaports for the National Retail Federation.

Hackett said his firm had scaled back its expectations for trade growth in 2010, "but we think we'll be seeing a relatively strong year at a 10% to 14% increase. We should see steady improvement, minus the usual seasonal adjustments."

It is harder to tell about imports (blue line) because of the large seasonal swings.

Friday, March 12, 2010

Report: Over 2000 Bank Enforcement Actions in 2009

by Calculated Risk on 3/12/2010 10:01:00 PM

A couple excerpts from American Banker: Regulatory Actions Hit a Record Level in '09

According to the FDIC quarterly banking profile, there were 8,012 insured banks at the end of 2009. Some of these actions are double counts since regulators might issue an informal action and then a formal action against the same bank (or multiple formal actions), so we can't say the percentage of banks operating under enforcement actions (either formal or informal), but it could be in the 20% to 25% range.

A couple of quotes from the article:

"For the bank failures that have occurred so far, every one of the large loss reports the inspector general has done or any GAO investigation has concluded the reason the bank has failed is the regulator did not take early enough action or severe enough action." said [Bob Clarke, a senior partner at Bracewell & Giuliani LLP and former comptroller of the currency] said.I've posted a few of the inspector general reports, and it appears the field examiners identified the problems early - but then insufficient actions was taken. And to put it more bluntly:

"The regulators were asleep for 10 years during the boom and there's now this remarkable turf war under way with regulatory reform," said Chris Low, chief economist for First Horizon National Corp.'s FTN Financial.

Bank Failure #29 & #30: Florida and Louisiana

by Calculated Risk on 3/12/2010 06:07:00 PM

Two gulf banks, engulfed by fail

Will they rise again?

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Old Southern Bank, Orlando, Florida

Old Southern Bank, Orlando, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Home Bank, Lafayette, Louisiana, Assumes All of the Deposits of Statewide Bank, Covington, Louisiana

As of December 31, 2009, Old Southern Bank had approximately $315.6 million in total assets and $319.7 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $94.6 million. ... Old Southern Bank is the 29th FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was Marco Community Bank, Marco Island, February 19, 2010.

Statewide Bank, Covington, Louisiana, was closed today by the Louisiana Office of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Louisiana makes an appearance ...

As of December 31, 2009, Statewide Bank had approximately $243.2 million in total assets and $208.8 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.1 million. ... Statewide Bank is the 30th FDIC-insured institution to fail in the nation this year, and the first in Louisiana. The last FDIC-insured institution closed in the state was The Farmers Bank & Trust of Cheneyville, Cheneyville, December 17, 2002.

Bank Failure #28: Park Avenue Bank, New York, New York

by Calculated Risk on 3/12/2010 05:07:00 PM

Park Avenue's failed today

Old Blue Eyes would weep...

by Soylent Green is People

From the FDIC: Valley National Bank, Wayne, New Jersey, Assumes All of the Deposits of the Park Avenue Bank, New York, New York

The Park Avenue Bank, New York, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ..OK, now it is Friday.

As of December 31, 2009, The Park Avenue Bank had approximately $520.1 million in total assets and $494.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $50.7 million. .... The Park Avenue Bank is the 28th FDIC-insured institution to fail in the nation this year, and the second in New York. The last FDIC-insured institution closed in the state was LibertyPointe Bank, New, York, New York, on March 11, 2010.