by Calculated Risk on 3/11/2010 07:04:00 PM

Thursday, March 11, 2010

Bank Failure #27: LibertyPointe Bank, New York, New York

"Spring Forward" .... taken too far

What day is today?

by Soylent Green is People

From the FDIC: Valley National Bank, Wayne, New Jersey, Assumes All of the Deposits of LibertyPointe Bank, New York, New York

LibertyPointe Bank, New York, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....Is it Friday?

As of December 31, 2009, LibertyPointe Bank had approximately $209.7 million in total assets and $209.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.8 million. ... LibertyPointe Bank is the 27th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution closed in the state was Waterford Village Bank, Williamsville, July 24, 2009.

The Countdown: Federal Reserve MBS Purchases 98.4% Complete

by Calculated Risk on 3/11/2010 05:10:00 PM

Some key points:

Here is the Federal Reserve balance sheet break down from the Atlanta Fed weekly Financial Highlights released today (as of last week):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Source: Altanta Fed.

From the Atlanta Fed:

The balance sheet contracted $6.9 billion for the week ended March 3.Holdings of agency debt and mortgage backed securities shrank $4.7 billion, and other assets declined by $2.2 billion. The balance sheet is expected to peak during the first half of this year after the MBS purchase program is completed and purchases settle on the balance sheet.

The second graph shows the MBS purchases by week. From the Atlanta Fed:

The second graph shows the MBS purchases by week. From the Atlanta Fed: The NY Fed purchased an additional net $10 billion in MBS for the week ending ending March 10th. This puts the total purchases at $1.230 trillion or almost 98.4% complete. Just $20 billion more and three weeks to go ...The Fed purchased a net total of $10 billion of agency-backed MBS through the week of March 3. This purchase brings its total purchases up to $1.22 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 98% complete).

The Fed's balance sheet released today shows "only" $1.029 trillion in MBS on March 10th. As mentioned above, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles.

The countdown ends in 3 weeks, and I don't expect any fireworks ...

Q4 2009: Mortgage Equity Withdrawal Strongly Negative

by Calculated Risk on 3/11/2010 02:32:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is very little MEW right now!), normal principal payments and debt cancellation. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2009, the Net Equity Extraction was minus $75 billion, or negative 2.7% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined in Q4, and this was partially because of debt cancellation per foreclosure sales, and some from modifications, and partially due to homeowners paying down their mortgages as opposed to borrowing more. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be negative.

Equity extraction was very important in increasing consumer spending during the housing bubble and I don't expect the Home ATM to be reopened any time soon. So any significant increase in consumer spending will come from income growth or a lower saving rate, not borrowing.

Flow of Funds Report: Mortgage Debt Declines by $53Billion in Q4

by Calculated Risk on 3/11/2010 12:14:00 PM

Update: corrected mortgage debt amount.

The Federal Reserve released the Q4 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.8 Trillion from the peak in 2007, but up $5.0 trillion from the trough last year. A majority of the decline in net worth is from real estate assets with a loss of about $7.0 trillion in value from the peak. Stock market losses are still substantial too. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 43.6% from the all time low of 40.8% last year. The increase was due to both an increase in the value of household real estate and a $72 billion decline in mortgage debt.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 43.6% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $53 billion in Q4. Mortgage debt has now declined by $290 billion from the peak, but that seems insignificant compared to the $7 trillion decline in household real estate value.

Hotel Occupancy and RevPAR Increase compared to same week in 2009

by Calculated Risk on 3/11/2010 11:23:00 AM

From HotelNewsNow.com: STR: RevPAR increases in US weekly results

The United States hotel industry posted only its third revenue-per-available-room increase in 18 months for the week ending 6 March 2010, rising 0.9 percent to US$52.75, according to data from Smith Travel Research. It was the first time the increase wasn’t holiday-related.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Overall, the industry’s occupancy ended the week with a 4.0-percent increase to 54.9 percent and average daily rate dropped 3.0 percent to finish the week at US$96.05.

“The growth in year-over-year RevPAR is significant because the occupancies are clearly showing an improvement and the decline in rates is finally starting to slow,” said Randy Smith, co-founder and CEO of STR. “While the size of the RevPAR increase is not significant, it is a clear sign that the outlook for the industry is improving.

“We do expect to see positive weekly RevPAR performances for the industry through the end of April,” Smith added. “If gasoline prices hold steady, this positive RevPAR performance could be a good indicator of a better summer than we’ve had for the past couple years, which of course is the key season for most hoteliers.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

It appears that occupancy rates may have bottomed, but the level is still very low - the average occupancy rate for this week is around 62%, well above the current 54.9%. This low occupancy rate is still pushing down room rates although revenue per available room (RevPAR) increased slightly.

The other good news for the industry (although bad news for construction employment) is that the pipeline of new hotel projects has slowed sharply, see: STR: US pipeline for February 2010

The total active U.S. hotel development pipeline includes 3,551 projects comprising 368,740 rooms, according to the February 2010 STR/TWR/Dodge Construction Pipeline Report released this week. This represents a 35.9-percent decrease in the number of rooms in the total active pipeline compared to February 2009. The total active pipeline data includes projects in the In Construction, Final Planning and Planning stages, but does not include projects in the Pre-Planning stage.The new supply is slowing sharply, and demand seems to have bottomed - but it is a long way up to normal.

“We’re seeing comparable declines in room development across all regions of the country,” said Duane Vinson, vice president at STR. “The Mountain Region has posted the sharpest year-over-year decline due to a 75-percent (16,000-room) decline in the Las Vegas pipeline.”

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Trade Deficit decreases slightly in January

by Calculated Risk on 3/11/2010 09:07:00 AM

The Census Bureau reports:

[T]otal January exports of $142.7 billion and imports of $180.0 billion resulted in a goods and services deficit of $37.3 billion, down from $39.9 billion in December, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2010.

Both imports and exports decreased in January. On a year-over-year basis, exports are up 15% and imports are up 12%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.89 in December - up 88% from the low in February 2009 (at $39.22). Oil import volumes declined in January.

In general trade has been increasing, although both imports and exports are still below the pre-financial crisis levels. China and oil account for most of the trade deficit.

Weekly Initial Unemployment Claims: Still Suggesting Job Losses

by Calculated Risk on 3/11/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 6, the advance figure for seasonally adjusted initial claims was 462,000, a decrease of 6,000 from the previous week's revised figure of 468,000. The 4-week moving average was 475,500, an increase of 5,000 from the previous week's revised average of 470,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 27 was 4,558,000, an increase of 37,000 from the preceding week's revised level of 4,521,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 5,000 to 470,500.

The dashed line on the graph is the current 4-week average. The current level of 462,000 (and 4-week average of 470,500) is still very high, and suggests continuing job losses at the beginning of March.

RealtyTrac: Foreclosure Activity Decreases Slightly

by Calculated Risk on 3/11/2010 04:26:00 AM

From RealtyTrac: U.S. Foreclosure Activity Decrease 2 Percent in February

[F]oreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 308,524 U.S. properties during the month, a decrease of 2 percent from the previous month but still 6 percent above the level reported in February 2009.Blame it on the snow!

...

Default notices (Notices of Default and Lis Pendens) were reported on a total of 106,208 U.S. properties during the month, an increase of 3 percent from the previous month but down 3 percent from February 2009. ...

Foreclosure auctions (Notices of Trustee’s Sale and Notices of Sheriff’s Sales) were scheduled for the first time on a total of 123,633 U.S. properties, a decrease of 1 percent from the previous month but still 16 percent higher than the level reported in February 2009. ...

Bank repossessions (REOs) were reported on a total of 78,683 U.S. properties during the month, a 10 percent decrease from the previous month but an increase of 6 percent from February 2009. ...

“This leveling of the foreclosure trend is not necessarily evidence that fewer homeowners are in distress and at risk for foreclosure, but rather that foreclosure prevention programs, legislation and other processing delays are in effect capping monthly foreclosure activity — albeit at a historically high level that will likely continue for an extended period." [said James J. Saccacio, chief executive officer of RealtyTrac.]

“In addition, severe winter weather appears to have temporarily slowed the processing of foreclosure records in some Northeastern and Mid-Atlantic states.”

Wednesday, March 10, 2010

Congressional Oversight Panel criticizes handling of GMAC

by Calculated Risk on 3/10/2010 11:59:00 PM

The Congressional Oversight Panel (COP) released a new report: The Unique Treatment of GMAC Under the TARP

[T]he Panel remains unconvinced that bankruptcy was not a viable option in 2008. In connection with the Chrysler and GM bankruptcies, Treasury might have been able to orchestrate a strategic bankruptcy for GMAC. This bankruptcy could have preserved GMAC’s automotive lending functions while winding down its other, less significant operations, dealing with the ongoing liabilities of the mortgage lending operations, and putting the company on sounder economic footing.And a few recommendations from COP:

...

The federal government has so far spent $17.2 billion to bail out GMAC and now owns 56.3 percent of the company. Both GMAC and Treasury insist that the company is solvent and will not require any additional bailout funds, but taxpayers already bear significant exposure to the company, and the Office of Management and Budget (OMB) currently estimates that $6.3 billion or more may never be repaid.

In light of the scale of these potential losses, the Panel is deeply concerned that Treasury has not required GMAC to lay out a clear path to viability or a strategy for fully repaying taxpayers. Moving forward, Treasury should clearly articulate its exit strategy from GMAC. More than a year has elapsed since the government first bailed out GMAC, and it is long past time for taxpayers to have a clear view of the road ahead.

• Treasury should insist that GMAC produce a viable business plan showing a path toward profitability and a resolution of the problems caused by ResCap.This fits with the earlier discussions on the stress tests since GMAC was on the "Stress Test 19". It probably would have cost the taxpayers far less to have GMAC file bankruptcy than the current situation.

• Treasury should formulate, and clearly articulate, a near-term exit strategy with respect to GMAC and articulate how that exit will or should be coordinated with exit from Treasury’s holdings in GM and Chrysler.

• To preserve market discipline and protect taxpayer interests, Treasury should go to greater lengths to explain its approach to the treatment of legacy shareholders, in conjunction with both initial and ongoing government assistance.

"A viable business plan" and an "exit strategy"; Elizabeth Warren is so demanding!

The Next Stress Test Scenarios

by Calculated Risk on 3/10/2010 09:51:00 PM

It is probably time for the U.S. to consider the next set of stress tests for the banks. That is what the Financial Services Authority (FSA) is doing in the U.K.

From the FSA:

We have now embedded our new approach to stress testing into our normal supervisory process. This includes supplementing firms’ own stress testing with supervisory stress testing of major firms. This involves regularly updating the stress test scenarios.So stress tests are now part of the normal oversight process. I think the Treasury should do the same thing, and release two scenarios again: 1) a baseline case matching the consensus view (or the Fed's current forecast), and 2) a more severe case with a double dip recession and further house price declines.

More from the FSA:

In 2009, the macroeconomic scenario used as an input for this supervisory stress testing took the economic position of the beginning of 2009 as its starting point, and projected forward for five years (until the end of 2013). Given the changes in economic performance and prospects since early 2009, it is now appropriate to define a new scenario for 2010 to 2014. We will continue to keep the appropriateness of the macroeconomic scenario under review.Notice that the FSA stress test scenarios are for five years; the Treasury and Fed stress tests scenarios were for only 2 years. I think many of the problems (like extending CRE loans) were pushed beyond the stress test horizon, and make the banks look healthier than they really are.

More FSA:

This new scenario takes the developments of 2009 as given and applies a severe but plausible stress to the macroeconomic environment that prevails at the start of 2010.

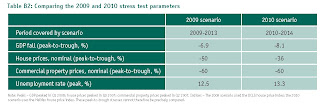

Click on table for larger image.

Click on table for larger image.And here is a table comparing the 2009 stress test scenario and the 2010 scenarios.

From the FSA:

[O]ur new macroeconomic stress scenario models a further decline in GDP of 2.3% from the end of 2009 to the end of 2011, with gradual recovery thereafter. Alongside this fall in GDP, the scenario includes a rise in unemployment to a peak of 13.3% in 2012, and allows for a ‘doubledip’ in property prices, with house prices falling by 23% from current levels and commercial property by more than 34%.And the FSA on the U.S.

Given the UK banks’ overseas exposures, our scenario also includes stressed projections for the US and other economies, which similarly experience further declines in GDP and property prices from current levels.A double dip for the U.S. is included.