by Calculated Risk on 3/11/2010 12:14:00 PM

Thursday, March 11, 2010

Flow of Funds Report: Mortgage Debt Declines by $53Billion in Q4

Update: corrected mortgage debt amount.

The Federal Reserve released the Q4 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.8 Trillion from the peak in 2007, but up $5.0 trillion from the trough last year. A majority of the decline in net worth is from real estate assets with a loss of about $7.0 trillion in value from the peak. Stock market losses are still substantial too. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 43.6% from the all time low of 40.8% last year. The increase was due to both an increase in the value of household real estate and a $72 billion decline in mortgage debt.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 43.6% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $53 billion in Q4. Mortgage debt has now declined by $290 billion from the peak, but that seems insignificant compared to the $7 trillion decline in household real estate value.

Hotel Occupancy and RevPAR Increase compared to same week in 2009

by Calculated Risk on 3/11/2010 11:23:00 AM

From HotelNewsNow.com: STR: RevPAR increases in US weekly results

The United States hotel industry posted only its third revenue-per-available-room increase in 18 months for the week ending 6 March 2010, rising 0.9 percent to US$52.75, according to data from Smith Travel Research. It was the first time the increase wasn’t holiday-related.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Overall, the industry’s occupancy ended the week with a 4.0-percent increase to 54.9 percent and average daily rate dropped 3.0 percent to finish the week at US$96.05.

“The growth in year-over-year RevPAR is significant because the occupancies are clearly showing an improvement and the decline in rates is finally starting to slow,” said Randy Smith, co-founder and CEO of STR. “While the size of the RevPAR increase is not significant, it is a clear sign that the outlook for the industry is improving.

“We do expect to see positive weekly RevPAR performances for the industry through the end of April,” Smith added. “If gasoline prices hold steady, this positive RevPAR performance could be a good indicator of a better summer than we’ve had for the past couple years, which of course is the key season for most hoteliers.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

It appears that occupancy rates may have bottomed, but the level is still very low - the average occupancy rate for this week is around 62%, well above the current 54.9%. This low occupancy rate is still pushing down room rates although revenue per available room (RevPAR) increased slightly.

The other good news for the industry (although bad news for construction employment) is that the pipeline of new hotel projects has slowed sharply, see: STR: US pipeline for February 2010

The total active U.S. hotel development pipeline includes 3,551 projects comprising 368,740 rooms, according to the February 2010 STR/TWR/Dodge Construction Pipeline Report released this week. This represents a 35.9-percent decrease in the number of rooms in the total active pipeline compared to February 2009. The total active pipeline data includes projects in the In Construction, Final Planning and Planning stages, but does not include projects in the Pre-Planning stage.The new supply is slowing sharply, and demand seems to have bottomed - but it is a long way up to normal.

“We’re seeing comparable declines in room development across all regions of the country,” said Duane Vinson, vice president at STR. “The Mountain Region has posted the sharpest year-over-year decline due to a 75-percent (16,000-room) decline in the Las Vegas pipeline.”

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Trade Deficit decreases slightly in January

by Calculated Risk on 3/11/2010 09:07:00 AM

The Census Bureau reports:

[T]otal January exports of $142.7 billion and imports of $180.0 billion resulted in a goods and services deficit of $37.3 billion, down from $39.9 billion in December, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2010.

Both imports and exports decreased in January. On a year-over-year basis, exports are up 15% and imports are up 12%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.89 in December - up 88% from the low in February 2009 (at $39.22). Oil import volumes declined in January.

In general trade has been increasing, although both imports and exports are still below the pre-financial crisis levels. China and oil account for most of the trade deficit.

Weekly Initial Unemployment Claims: Still Suggesting Job Losses

by Calculated Risk on 3/11/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 6, the advance figure for seasonally adjusted initial claims was 462,000, a decrease of 6,000 from the previous week's revised figure of 468,000. The 4-week moving average was 475,500, an increase of 5,000 from the previous week's revised average of 470,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 27 was 4,558,000, an increase of 37,000 from the preceding week's revised level of 4,521,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 5,000 to 470,500.

The dashed line on the graph is the current 4-week average. The current level of 462,000 (and 4-week average of 470,500) is still very high, and suggests continuing job losses at the beginning of March.

RealtyTrac: Foreclosure Activity Decreases Slightly

by Calculated Risk on 3/11/2010 04:26:00 AM

From RealtyTrac: U.S. Foreclosure Activity Decrease 2 Percent in February

[F]oreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 308,524 U.S. properties during the month, a decrease of 2 percent from the previous month but still 6 percent above the level reported in February 2009.Blame it on the snow!

...

Default notices (Notices of Default and Lis Pendens) were reported on a total of 106,208 U.S. properties during the month, an increase of 3 percent from the previous month but down 3 percent from February 2009. ...

Foreclosure auctions (Notices of Trustee’s Sale and Notices of Sheriff’s Sales) were scheduled for the first time on a total of 123,633 U.S. properties, a decrease of 1 percent from the previous month but still 16 percent higher than the level reported in February 2009. ...

Bank repossessions (REOs) were reported on a total of 78,683 U.S. properties during the month, a 10 percent decrease from the previous month but an increase of 6 percent from February 2009. ...

“This leveling of the foreclosure trend is not necessarily evidence that fewer homeowners are in distress and at risk for foreclosure, but rather that foreclosure prevention programs, legislation and other processing delays are in effect capping monthly foreclosure activity — albeit at a historically high level that will likely continue for an extended period." [said James J. Saccacio, chief executive officer of RealtyTrac.]

“In addition, severe winter weather appears to have temporarily slowed the processing of foreclosure records in some Northeastern and Mid-Atlantic states.”

Wednesday, March 10, 2010

Congressional Oversight Panel criticizes handling of GMAC

by Calculated Risk on 3/10/2010 11:59:00 PM

The Congressional Oversight Panel (COP) released a new report: The Unique Treatment of GMAC Under the TARP

[T]he Panel remains unconvinced that bankruptcy was not a viable option in 2008. In connection with the Chrysler and GM bankruptcies, Treasury might have been able to orchestrate a strategic bankruptcy for GMAC. This bankruptcy could have preserved GMAC’s automotive lending functions while winding down its other, less significant operations, dealing with the ongoing liabilities of the mortgage lending operations, and putting the company on sounder economic footing.And a few recommendations from COP:

...

The federal government has so far spent $17.2 billion to bail out GMAC and now owns 56.3 percent of the company. Both GMAC and Treasury insist that the company is solvent and will not require any additional bailout funds, but taxpayers already bear significant exposure to the company, and the Office of Management and Budget (OMB) currently estimates that $6.3 billion or more may never be repaid.

In light of the scale of these potential losses, the Panel is deeply concerned that Treasury has not required GMAC to lay out a clear path to viability or a strategy for fully repaying taxpayers. Moving forward, Treasury should clearly articulate its exit strategy from GMAC. More than a year has elapsed since the government first bailed out GMAC, and it is long past time for taxpayers to have a clear view of the road ahead.

• Treasury should insist that GMAC produce a viable business plan showing a path toward profitability and a resolution of the problems caused by ResCap.This fits with the earlier discussions on the stress tests since GMAC was on the "Stress Test 19". It probably would have cost the taxpayers far less to have GMAC file bankruptcy than the current situation.

• Treasury should formulate, and clearly articulate, a near-term exit strategy with respect to GMAC and articulate how that exit will or should be coordinated with exit from Treasury’s holdings in GM and Chrysler.

• To preserve market discipline and protect taxpayer interests, Treasury should go to greater lengths to explain its approach to the treatment of legacy shareholders, in conjunction with both initial and ongoing government assistance.

"A viable business plan" and an "exit strategy"; Elizabeth Warren is so demanding!

The Next Stress Test Scenarios

by Calculated Risk on 3/10/2010 09:51:00 PM

It is probably time for the U.S. to consider the next set of stress tests for the banks. That is what the Financial Services Authority (FSA) is doing in the U.K.

From the FSA:

We have now embedded our new approach to stress testing into our normal supervisory process. This includes supplementing firms’ own stress testing with supervisory stress testing of major firms. This involves regularly updating the stress test scenarios.So stress tests are now part of the normal oversight process. I think the Treasury should do the same thing, and release two scenarios again: 1) a baseline case matching the consensus view (or the Fed's current forecast), and 2) a more severe case with a double dip recession and further house price declines.

More from the FSA:

In 2009, the macroeconomic scenario used as an input for this supervisory stress testing took the economic position of the beginning of 2009 as its starting point, and projected forward for five years (until the end of 2013). Given the changes in economic performance and prospects since early 2009, it is now appropriate to define a new scenario for 2010 to 2014. We will continue to keep the appropriateness of the macroeconomic scenario under review.Notice that the FSA stress test scenarios are for five years; the Treasury and Fed stress tests scenarios were for only 2 years. I think many of the problems (like extending CRE loans) were pushed beyond the stress test horizon, and make the banks look healthier than they really are.

More FSA:

This new scenario takes the developments of 2009 as given and applies a severe but plausible stress to the macroeconomic environment that prevails at the start of 2010.

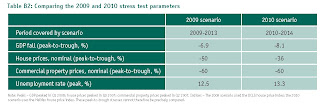

Click on table for larger image.

Click on table for larger image.And here is a table comparing the 2009 stress test scenario and the 2010 scenarios.

From the FSA:

[O]ur new macroeconomic stress scenario models a further decline in GDP of 2.3% from the end of 2009 to the end of 2011, with gradual recovery thereafter. Alongside this fall in GDP, the scenario includes a rise in unemployment to a peak of 13.3% in 2012, and allows for a ‘doubledip’ in property prices, with house prices falling by 23% from current levels and commercial property by more than 34%.And the FSA on the U.S.

Given the UK banks’ overseas exposures, our scenario also includes stressed projections for the US and other economies, which similarly experience further declines in GDP and property prices from current levels.A double dip for the U.S. is included.

Bubbling over in China?

by Calculated Risk on 3/10/2010 07:15:00 PM

From CR: There are so many reports of a housing bubble in China, I asked a friend living in China for his thoughts ... this is his view:

From Michael Kleist in Shanghai:

News of soaring housing prices in China, which are now hovering around late 2007 peaks, naturally invites talk of bubbles and excessive speculation. More so, since the 2007 highs led to a humbling drop in prices for homeowners and investors in 2008. Are things heading that way again in 2010?

Not necessarily.

Let’s start with the news in the papers. See the WSJ today: China Property Prices Surge

It’s clear the housing market in China has been hot, topped by February’s 10.7% YoY increase in prices. In fact, housing prices have been rising for 9 straight months YoY in China, which coincides to some degree with the government’s massive stimulus package that took effect first quarter 2009.

Certainly there is some speculation inside these numbers, as there would be in any hot property market. The government has shown enough concern on this point, and overheating in general, to tell banks last month to curtail lending and increase reserve rations.

But the bigger reason for rising home prices in China may simply be due to an imbalance in supply and demand.

In 2008 the housing market tanked, in large part, because the China government, which was worried about overheating in the property sector, slammed on the brakes in 2007. The government added a hefty tax on homes sold within 5 years of purchase, increased fees, told banks to raise interest rates on home loans and increase minimum down payments, and essentially forced banks to stop lending to developers.

The result was a dried up market, a drastic drop in prices, and an almost complete halt in new home starts.

When in early 2009, in response to the economic crisis, the China government launched its stimulus package it also stoked the property market by once again loosening lending regulations and lowering taxes and fees for both developers and home buyers. Builders began building and people began buying homes again. As a result, prices naturally began to go up.

What we are seeing today is that with fewer homes on the market after a nearly 2 year lull in building, the prices have continued to climb.

This imbalance will likely even out as the homes started in 2009 become available for sale. Most likely, this will result in a stabilization of prices but not a bursting bubble because it’s not even clear there is a housing bubble in China.

Certainly there isn’t a mortgage credit-related bubble. The majority of homes in China are purchased with down payments between 30-40%, which is required by the banks, and nearly 25% of homes are purchased with all cash. Only those qualifying for low-cost housing can purchase a home with a minimum down payment as low as 20%. For this reason foreclosures in China are practically nonexistent.

In addition, the majority of home buyers in China are still either first-time buyers or upgrading their home. Only an estimated around 20% of home buyers in China are pure investors. As with any statistics coming out of China, this figure can be questioned, but regardless, if investors are speculating, they are doing it with large cash down payments.

Still, it is clear that prices in tier 1 cities such as Beijing, Shanghai, and Shenzhen in the south have risen to amazing levels for China. Flats in downtown Shanghai can sell for RMB150,000 (US$ 22,000) per square meter with exclusive homes in prime locations commanding even higher prices. To get a new home for under RMB18,000 (US$2,640) per square meter certainly requires a trip to the suburbs and only a hope of being near a subway line.

With prices at these highs, it is fair to wonder at what point the situation in China can be called a bubble and what risk there is of it bursting.

With regard to the bursting side of this question, two things to keep in mind are the tremendous amount of influence the China government has to manipulate the housing market (both up and down) and its strong desire to keep prices stable or rising comfortably without squashing the market like it did at the end of 2007.

The central government in China has multiple tools at its disposal to directly impact the market. This begins with its control over all of the country’s commercial banks. When the Party tells banks to increase or adjust lending there is an immediate response. That’s one reason why the country was able to recover so quickly from the world credit crunch. The government uses this blunt tool when it feels there is a need for a country-wide impact on lending.

More subtly, it can direct banks to adjust mortgage rates or down payment percentages in specific locations that seem to be heating or cooling, it its mind, at an unreasonably pace.

One of the government’s most effective tools against speculation is to raise the down payment ratio and interest rate for buyers with an existing mortgage trying to purchase a second home. Currently, in Shanghai any buyer of a home with an existing mortgage is required to have a minimum down payment of 40% and must pay a higher interest rate on the loan than a first time buyer or buyer without an existing loan. This is a very effective approach that targets speculators without affecting the rest of the market and can be applied locally. In some locations, banks are forbidden to approve any second home loan until the first loan is paid off.

The point here is that as long as China’s government acts by tapping the brakes when and where necessary, a precipitous drop in home prices is unlikely. This assumes the government has learned from its mistakes in late 2007 when it adjusted too hard.

Given the sentiment and concern out of Beijing about keeping a balanced economy as the world recovers, I think the likelihood of any strong movements to dampen the housing market across China are low. More likely, through 2010 it will continue to use the banks and rules on second mortgages to cool specific locations while letting the overall market grow.

Note: Michael lives in Shanghai and has been in China for 8 years. He is a founder of www.tradesparq.com, a trade advertising platform that combines products and categories with social networking web tools to match international buyers and sellers. Michael hopes to address how local Chinese can afford homes in China in a future post.

From CR: This was Michael's view. It is certainly different than what we read in the U.S. I'm looking forward to his next post - US$ 22,000 per square meter (about $2,000 per foot) sounds very expensive to me - but the large downpayments should cushion in spillover if prices do decline.

Greenspan to Testify before Financial Crisis Inquiry Commission

by Calculated Risk on 3/10/2010 04:03:00 PM

From the WSJ: Financial Crisis Panel to Grill Greenspan

Greenspan is scheduled to testify before the Financial Crisis Inquiry Commission in early April. This might be the one real opportunity to understand why regulators missed the lending problems.

Hopefully the Commission will ask about regulatory oversight (and lack thereof). We already know from various Inspector General reports that Fed and FDIC field examiners were expressing significant concerns in 2003 and 2004. What action did Greenspan take at that time with those reports? Put them in a drawer?

Why wasn't action taken earlier to tighten lending standards? Was Greenspan concerned about the "widespread" innovation in the mortgage industry (automated underwriting, reliance on FICO scores instead of the 3 Cs - creditworthiness, capacity, and collateral, agency issues with the widespread use of independent mortgage brokers, expanded securitization, non-traditional mortgage products, etc.)? When lending booms, methods change, and standards weaken - isn't that when the regulators need to be the most vigilant?

Unfortunately the WSJ article discusses "subprime" and Fannie and Freddie - and misses all the key issues.

Rail Traffic Declines Slightly in February

by Calculated Risk on 3/10/2010 01:43:00 PM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in February 2010 was down 1.7% compared to February 2009, and off 0.1% compared to January 2010 (seasonally adjusted). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. It is important to note that excluding coal, traffic is up 7.2% from February 2009, and traffic increased in 14 of the 19 major commodity categories YoY.

Housing: In addition to the decline in coal, two key building materials were also down YoY from February 2009: Forest products (off 1.7% YoY, and 27.5% compared to Feb 2008) and Nonmetallic minerals & prod. (crushed stone, gravel, sand was off 8.6% YoY, and 25.2% compared to Feb 2008). This fits with the recent data on housing starts, new home sales, and the NAHB home builder index that shows residential investment is flat - at best.

From AAR:

• On a non-seasonally adjusted basis, U.S. freight railroads originated 1,089,977 carloads in February 2010 — an average of 272,494 carloads per week. That’s down 1.5% from February 2009 (276,548 average) and down 15.6% from February 2008’s 323,047 average (see chart)Blame it on the snow!

• On a seasonally adjusted basis, U.S. rail carloads fell 0.1% in February 2010 from January 2010 and were down 1.7% from February 2009.

• The heavy snow negatively affected railroads, both by making rail operations more difficult and by preventing rail customers from originating or receiving loads. ... it’s not possible to precisely quantify the snow’s impact on rail traffic.

emphasis added, excerpts with permission

Note: The new truck fuel consumption based Ceridian-UCLA Pulse of Commerce Index™ showed a decline in February too: Disappointing February, Potentially Dampened by Record Snowfalls