by Calculated Risk on 3/06/2010 06:38:00 PM

Saturday, March 06, 2010

Volcker on Derivatives "Abuse"

From Bloomberg: Volcker Criticizes Greek Budget Derivatives ‘Abuse’ (ht jb)

“Surely the recent revelations about the use (and abuse) of complex derivatives in obscuring the extent of Greek financial obligations reinforces the need for greater transparency and less complexity,” Volcker said in the text of a speech to the American Academy in Berlin.Ouch.

And at the same event, Bloomberg quotes European Central Bank President Jean-Claude Trichet as saying:

“what I fear really is that we are currently underestimating the systemic instability which is associated with” derivatives.Hopefully a video of Volcker's speech will be available soon.

Christopher Thornberg on Double Dip Recession

by Calculated Risk on 3/06/2010 03:16:00 PM

One of the economists who correctly forecast the housing bust was Christopher Thornberg while at The Anderson School at UCLA. He is now at Beacon Economics. Here are a few comments from Thronberg yesterday ...

From the Contra Costa Times: State's revised jobless rate a cause for worry

[T]he nation and California could tumble back into a fresh economic nose-dive, warned some analysts, including Christopher Thornberg, partner and economist with Beacon Economics.And from Jane Wells at CNBC: 'The Good News—The Recession is Over. The Bad News...'

"There is a substantial chance of a double-dip recession," Thornberg said.

...

"We're at the bottom now right now, but when the stimulus wears off, things could get worse," Thornberg said.

[Chris Thornberg] says that the recession has ended (hurray!), but that's mostly due to massive government intervention. When that aid starts to dry up, "We're gonna have a double dip...but that's not gonna happen."I disagree with Thornberg on 2010 - I don't think it will be a "good year", but I do think we will see sluggish and choppy growth. I suppose 2010 might feel like a "good year" compared to 2008 and 2009. He is also more pessimistic about 2011 than I am.

What?

He says politicians and the Fed will likely continue fiddling with policy to avoid going back into recession ...

"Enjoy 2010 because it's going to be a good year. 2011 is not." [Thornberg said]. When I asked about 2012, he answered, "It depends how bad 2011 is."

Accidental Landlords and the Shadow Inventory

by Calculated Risk on 3/06/2010 10:32:00 AM

From Hilary Stout at the NY Times: The Renter Roadblock (ht Brian)

Over the past year or two, many owners who couldn’t sell — or didn’t dare try — made a ... calculation [to rent]. Rather than accept an impossibly low offer (if they even had an offer), they decided to rent out their properties. The idea was to cover expenses while waiting for the market to right itself.These accidental landlords are part of the "shadow inventory".

But in recent months, a number of these accidental landlords have been surprised to find renewed buyer interest in their properties. The problem is, the renters are happily in place.

My definition of "shadow inventory" are units that aren't currently listed on the market, but will probably be listed soon. This includes REOs (bank Real Estate Owned) that are not currently listed, foreclosures in process and seriously delinquent loans (although some of these may be cured, and some may already be listed as short sales), unlisted new high rise condos (these properties are not included in the new home inventory report) and homeowners waiting for a better market.

That last category includes all the accidental landlords that we've been discussing for years. As the NY Times article suggests, some of these accidental landlords might test the market this year. And there are probably quite a few of them - in a recent interview with Jon Lansner of the O.C. Register, Scott Monroe of South Coast Apartment Association said

"... our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."My estimate is about 3.6 million units were converted from owner occupied (or 2nd home) to rental over the last 5 years.

This included investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), and homeowners renting their previous homes instead of selling. But whatever the reason, many of these properties will probably be offered for sale again - especially the properties owned by the accidental landlords.

China Central Banker on Exchange Rate Policy

by Calculated Risk on 3/06/2010 09:08:00 AM

A few quotes:

From Dow Jones: Zhou Signals Yuan Policy Shift

"We don't rule out that during some special periods--such as the Asian Financial crisis and the global financial crisis this time--we adopted special policies, including a special exchange rate mechanism," [China central bank Gov. Zhou Xiaochuan] said at a news briefing during the annual session of the legislature, the National People's Congress.Bloomberg: Zhou Says China Should Be ‘Very Cautious’ in Crisis Exit

"Sooner or later, we will exit the policies," he said

“We must be very cautious about the timing of normalizing the policies, and this includes the renminbi rate policy,” Zhou said at a press briefing in Beijing today, using another term for the Chinese currency. A global recovery “isn’t solid,” he said.From Reuters: Days of "special" yuan policy numbered-China c.banker

"Practice has shown that these policies have been positive, contributing to the recovery of both our country's economy and the global economy," Zhou told a news conference."Basically stable" probably gives some room for appreciation of the yuan.

But he added: "The problem of how to exit from these policies arises sooner or later."

...

"If we are to exit from these irregular policies and return to ordinary economic policies, we must be extremely prudent about our choice of timing. This also includes the renminbi exchange rate policy," he added.

...

Zhou was speaking after the bank issued a statement reaffirming a pledge made a day earlier by Premier Wen Jiabao to keep the yuan "basically stable" in 2010.

China had been letting the yuan appreciate slowly, but pegged the yuan to the dollar when the financial crisis started. This has helped China recover, but the fixed exchange rate is a key issue that needs to be resolved.

Friday, March 05, 2010

Unofficial Problem Bank List at 641 Banks

by Calculated Risk on 3/05/2010 10:14:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

Failure Friday contributed to a drop in the number of institutions on the Unofficial Problem Bank List. This week, the list includes 641 institutions with aggregate assets of $325.5 billion, down from 644 institutions and 325.9 billion last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There were 2 additions this week -- Mountain 1st Bank & Trust Company, Hendersonville, NC ($803 million Ticker: FFIS.OB); and Bank of Coral Gables, Coral Gables, FL ($159 million).

Removals include the 4 failures this Friday -- Sun American Bank ($536 million); Centennial Bank ($215 million); Bank of Illinois ($212 million); and Waterfield Bank ($156 million). There was one other removal as the OCC terminated the Formal Agreement against Community National Bank, Waterloo, IA ($235 million).

The other change is a Prompt Corrective Action Order issued against First Federal Bank of North Florida ($393 million), which has been operating under a Cease & Desist Order since November 2009.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #26: Centennial Bank, Ogden, Utah

by Calculated Risk on 3/05/2010 08:12:00 PM

Death by one thousand small cuts

The Fed sanguinates

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of Centennial Bank, Ogden, Utah

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Centennial Bank, Ogden, Utah. ...Another bank that no one wanted ...

The FDIC was unable to find another financial institution to take over the banking operations of Centennial Bank. ...

As of December 31, 2009, Centennial Bank had approximately $215.2 million in total assets and $205.1 million in total deposits. ...

Centennial Bank is the 26th FDIC-insured institution to fail this year and the second in Utah since Barnes Banking Company, Kaysville, was closed on January 15, 2010. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $96.3 million.

Bank Failure #24 & #25: Illinois and Maryland

by Calculated Risk on 3/05/2010 06:12:00 PM

Bankers sneer at citizens:

Our loss,... your burden.

February rain.

March green shoots did not flower

These banks push daisies.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Bank of Illinois, Normal, Illinois

Bank of Illinois, Normal, Illinois, was closed today by the Illinois Department of Financial Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: FDIC Creates a New Depository Institution to Assume the Operations of Waterfield Bank, Germantown, Maryland

As of December 31, 2009, Bank of Illinois had approximately $211.7 million in total assets and $198.5 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $53.7 million. ... Bank of Illinois is the 24th FDIC-insured institution to fail in the nation this year, and the third in Illinois. The last FDIC-insured institution closed in the state was George Washington Savings Bank, Orland Park, on February 19, 2010.

Waterfield Bank, Germantown, Maryland, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...No one wanted Waterfield ...

As of December 31, 2009, Waterfield Bank had $155.6 million in assets and $156.4 million in deposits. At the time of closing, the amount of deposits exceeding the insurance limits totaled about $407,000. ...

The FDIC estimates that the cost to its Deposit Insurance Fund will be $51.0 million. Waterfield Bank is the 25th bank to fail in the nation this year and the first in Maryland. The last FDIC-insured institution to fail in the state was Bradford Bank, Baltimore, on August 28, 2009.

Bank Failure #23: Sun American Bank, Boca Raton, Florida

by Calculated Risk on 3/05/2010 05:36:00 PM

Huddled masses cry "Relief!"

Cash burn warms bankers.

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina Assumes All of the Deposits of Sun American Bank, Boca Raton, Florida

Sun American Bank, Boca Raton, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of December 31, 2009, Sun American Bank had approximately $535.7 million in total assets and $443.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $103.8 million. ... Sun American Bank is the 23rd FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was Marco Community Bank, Marco Island, on February 19, 2010.

Update on Post Bubble Real Estate Swindle in San Diego

by Calculated Risk on 3/05/2010 03:36:00 PM

This is an update on a great series by Kelly Bennett of Voice of San Diego.

First a little background: According to Kelly, in 2008 - after the bubble burst - James McConville bought distressed condos from developers in bulk, and then sold them to straw buyers at inflated prices (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

McConville promised to rent the properties, and pay the mortgages from the rental income. Good luck!

This was happening in 2008.

And the update from Kelly Bennett at Voice of San Diego: A Year Later, Losses Pile Up in Complexes Ravaged by Swindle

All of the 81 condos from the Sommerset Villas, Sommerset Woods and Westlake Ranch complexes involved in the scam have been repossessed. Twenty-four have yet to find new buyers. But the other 57 have resold for prices drastically lower than the mortgages were worth, let alone the initial purchase prices.There is much more in the article, but this ties into another article today from Bloomberg: Fannie, Freddie Ask Banks to Eat Soured Mortgages

The U.S. taxpayer is paying for the mounting losses. Across the complexes, the cost to taxpayers is at least $7.8 million.

When the units were just in the beginning stages of foreclosure, it was too soon to tell whether the government-sponsored mortgage companies, Freddie Mac and Fannie Mae, had definitely purchased the shaky loans.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.

That’s the estimate of Oppenheimer & Co. analyst Chris Kotowski, who says U.S. banks could suffer losses of $7 billion this year when those loans are returned and get marked down to their true value.

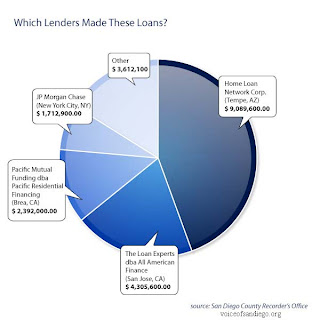

Click on graph for larger image.

Click on graph for larger image.Kelly provided me with this graphic on the San Diego swindle. This shows the lenders that were swindled. Since most of these loans were sold to Fannie and Freddie, there is a good chance the loans will be pushed back on the lenders - if they still exist. We know JPMorgan is still around!

More from Bloomberg:

The banks have to buy back the loans at par, and then take an impairment, because borrowers usually have stopped paying and the price of the underlying home has plunged. JPMorgan said in a presentation last month that it loses about 50 cents on the dollar for every loan it has to buy back.The losses will be much higher than 50 cents on the dollar on these loans.

Frank: Fannie Freddie Investments not Risk Free, Treasury Clarifies

by Calculated Risk on 3/05/2010 01:16:00 PM

UPDATE: From CNBC: Frank Denies Saying No Guarantee on Fannie, Freddie

From Zachary Goldfarb at the WaPo: Rep. Frank questions safety of Fannie Mae, Freddie Mac investments

"People who own Fannie and Freddie debt are not in the same legal position as [those who own] Treasury bonds and I don't want them to be," [Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee] said in an interview Thursday.and from Reuters: U.S. Treasury says stands behind Fannie, Freddie

...

In restructuring the companies, Frank said he wants "to preserve the right to give people haircuts." He added, "I don't want to preclude that."

"As we said in December, there should be no uncertainty about Treasury's commitment to support Fannie Mae and Freddie Mac as they continue to play a vital role in the housing market during this current crisis," the statement from the Treasury said.I think Frank was referring to some future structure of Fannie and Freddie, but the market took his comments as suggesting that current bondholders might take a haircut.

Treasury has reiterated their commitment to Fannie and Freddie (although I wish Treasury would put out statements on their press room site).