by Calculated Risk on 12/16/2009 08:30:00 AM

Wednesday, December 16, 2009

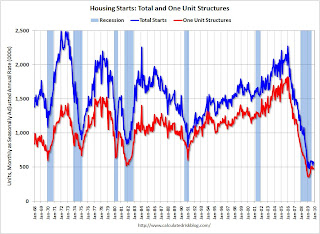

Housing Starts in November: Moving Sideways

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 574 thousand (SAAR) in November, up 8.9% from the revised October rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for six months.

Single-family starts were at 482 thousand (SAAR) in November, up 2.1% from the revised October rate, and 35 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for six months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This is both good news and bad news. The good news is the low level of starts means the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover. The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 574,000. This is 8.9 percent (±10.2%) above the revised October estimate of 527,000, but is 12.4 percent (±9.1%) below the November 2008 rate of 655,000.

Single-family housing starts in November were at a rate of 482,000; this is 2.1 percent (±9.2%) above the revised October figure of 472,000. The November rate for units in buildings with five units or more was 83,000.

Housing Completions:

Privately-owned housing completions in November were at a seasonally adjusted annual rate of 810,000. This is 8.7 percent (±13.7%)* above the revised October estimate of 745,000, but is 25.3 percent (±10.1%) below the November 2008 rate of 1,084,000.

Single-family housing completions in November were at a rate of 524,000; this is unchanged (±11.7%)* compared with the revised October figure. The November rate for units in buildings with five units or more was 270,000.

Tuesday, December 15, 2009

Citigroup's "Massive" Tax Break

by Calculated Risk on 12/15/2009 11:11:00 PM

The WaPo has an article about a tax break for Citigroup: U.S. gave up billions in tax money in deal for Citigroup's bailout repayment

The Internal Revenue Service on Friday issued an exception to long-standing tax rules for the benefit of Citigroup and a few other companies partially owned by the government. As a result, Citigroup will be allowed to retain billions of dollars worth of tax breaks that otherwise would decline in value when the government sells its stake to private investors.Who benefits? The value of the shares the U.S. owns should increase, but only 34% of the share price increase accrues to U.S. taxpayers The other current shareholders receive the rest. So this doesn't seem to make sense ...

While the Obama administration has said taxpayers are likely to profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

...

Federal tax law lets companies reduce taxable income in a good year by the amount of losses in bad years. But the law limits the transfer of those benefits to new ownership as a way of preventing profitable companies from buying losers to avoid taxes. Under the law, the government's sale of its 34 percent stake in Citigroup, combined with the company's recent sales of stock to raise money, qualified as a change in ownership.

The IRS notice issued Friday saves Citigroup from the consequences by stipulating that the government's share sale does not count toward the definition of an ownership change.

AIA: Architecture Billings Index Shows Contraction in November

by Calculated Risk on 12/15/2009 08:10:00 PM

The American Institute of Architects’ Architecture Billings Index declined to 42.8 in November from 46.1 in October. Any reading below 50 indicates contraction.

"There continues to be a lot of uncertainty in the construction industry that likely will delay new projects in the near future," said Kermit Baker, chief economist at the American Institute of Architects. (via WSJ, press release not online yet) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Bernanke Responds to Senator Bunning

by Calculated Risk on 12/15/2009 05:07:00 PM

Chairman Bernanke has responded in writing to a series of question from Senator Bunning.

There are questions on Fed policy, gold, the dollar, and much more. Here are a couple of questions:

Bunning: 58. Are you concerned that the debt to GDP ratio in this country is more than 350%? Do you believe a high debt to GDP ratio is reason for tightening Fed policy? Why or why not?Two points: we see graphs all the time showing the total debt to GDP at around 350%, but that double counts financial intermediation.

Bernanke: The current ratio of public and private debt to GDP, including not only the debt of the nonfinancial sector but also the debt of the financial sector, is about 350 percent. (Many analysts prefer to focus on the debt of the nonfinancial sectors because, they argue, the debt of the financial sector involves some double-counting--for example, when a finance company funds the loans it provides to nonfinancial companies by issuing bonds. The ratio of total nonfinancial debt to GDP is about 240 percent.) Private debt has been declining as households and firms have been reducing spending and paying down pre-existing obligations. For example, households, who are trying to repair their balance sheets, reduced their outstanding debt by 1.3 percent (not at an annual rate) during the first three quarters of this year.

In contrast, public debt is growing rapidly. Putting fiscal policy on a sustainable trajectory is essential for promoting long-run economic growth and stability. Currently, the ratio of federal debt to GDP is increasing significantly, and those increases cannot continue indefinitely. The increases owe partly to cyclical and other temporary factors, but they also reflect a structural federal budget deficit. Stabilizing the debt to GDP ratio at a moderate level will require policy actions by the Congress to bring federal revenues and outlays into closer alignment in coming years.

The ratio of government debt to GDP does not have a direct bearing on the appropriate stance of monetary policy. Rather, the stance of monetary policy is appropriately set in light of the outlook for real activity and inflation and the relationship of that outlook to the Federal Reserve’s statutory objectives of maximum employment and price stability. Of course, government indebtedness may exert an indirect influence on monetary policy through its potential implications for the level of interest rates consistent with full employment and low inflation. But in that respect, fiscal policy is just one of the many factors that influence interest

rates and the economic outlook.

emphasis added

The 240% number is probably a better representation of the debt burden of the United States. Here is an example from Rolfe Winkler at Reuters (source: Reuters)

On the structural deficits: I've been writing about this for years. Nothing is more concerning than a large structural deficit during periods of high employment (like earlier in this decade when Bernanke was Chairman of the CEA). I don't recall Bernanke every mentioning the structural deficit when he was on the CEA.

Senator Bunning: 5. We saw the crowding out of the private mortgage market caused by Freddie and Fannie’s overwhelming control of mortgages during 2002 to 2006 period. Do you think there is a danger to allowing an extended public-controlled mortgage market? And what steps is the Fed taking to reestablish a private mortgage market?OK, this was a trick question, but Bernanke missed it. We did NOT see the crowding out of the private mortgage market in the period mentioned - in fact the private mortgage market expanded dramatically in the 2004 through 2006 period as shown in the following graph from San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans). [T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations.There is much more in the Q&A.

DataQuick: SoCal Home Sales Increase in November

by Calculated Risk on 12/15/2009 02:36:00 PM

This is no surprise - existing home sales will be through the roof nationwide in November as buyers rushed to beat the initial deadline for the homebuyer tax credit. Also ignore the median price - it is skewed by the mix of properties sold.

A few key points:

From DataQuick: Southland home sales and prices up

A total of 19,181 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 13.3 percent from October’s 22,132, and up 14.7 percent from 16,720 for November 2008, according to MDA DataQuick of San Diego.

Sales almost always decline from October to November. The year-over-year increase was the 17th in a row. In DataQuick’s statistics, which go back to 1988, the average November had 22,312 sales. ...

Sales have been stoked in recent months by several factors: A federal tax credit for first-time buyers, which had been set to expire last month before it was extended and expanded; robust investor activity, especially inland; super-low mortgage rates; the availability of government-insured, low-down-payment mortgages for first-time buyers; and the allure of a potential “deal” on a distressed property.

“This market is still really lopsided. Foreclosures and short sales are huge factors. There’s still not a lot of discretionary buying and selling outside the more affordable markets....” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in November that had been foreclosed on in the prior 12 months – made up 39.1 percent of all Southland resales. That was the lowest since May 2008 when it was also 39.1 percent. It hit a high of 56.7 percent last February.

... Last month 38.1 percent of all purchase loans were FHA-insured mortgages, the same as in October and up from 34.5 percent a year ago. Two years ago FHA accounted for just 2.5 percent of purchase loans.

Absentee buyers purchased 19.1 percent of all homes sold last month ...

Foreclosure activity remains high by historical standards, although mortgage default notices have flattened out or trended lower in many areas.

NAHB: Builder Confidence Declines in December

by Calculated Risk on 12/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 16 in December. This is a decline from 17 in November. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November starts will be released Wednesday Dec 16th).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

To be blunt: Those expecting a sharp rebound in starts from the bottom are wrong. And remember - residential investment is usually the best leading indicator for the economy.

Press release from the NAHB: Builder Confidence Edges Down in December

The December HMI fell one point to 16, its lowest point since June of this year. Two out of three component indexes also were down, with a one-point decline to 16 registered for current sales conditions and a two-point decline to 26 registered for sales expectations in the next six months. The component gauging traffic of prospective buyers remained unchanged for a third consecutive month, at 13.

Regionally, December’s HMI results were somewhat mixed. The Northeast posted a three point gain to 23, while the West posted a one-point gain to 19, the South registered no change at 17, and the Midwest posted a two-point decline, to 12.

Credit Card Charge-Offs Increase

by Calculated Risk on 12/15/2009 11:28:00 AM

From Reuters: Capital One, Discover credit-card charge-offs rise (ht shill)

Capital One Financial Corp (COF.N) and Discover Financial Services (DFS.N) reported that credit-card charge-offs rose in November -- a sign that consumers remain under stress.

In a regulatory filing on Tuesday, Capital One said the annualized net charge-off rate -- debts the company believes it will never collect -- for U.S. credit cards rose to 9.60 percent in November from 9.04 percent in October.

In another regulatory filing, Discover said its charge-off rate rose to 8.98 percent from 8.54 percent after two months of declines.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Capital One credit card charge-offs hit 9.83% in July (annualized) - above the peak in 2005 - and were near the peak again in November. It is likely that charge-offs will be above 10% soon.

Update: US Credit Card Charge-Offs Rise in November

JPMorgan Chase ... said charge-offs -- loans the company does not expect to be repaid -- rose to 8.81 percent in November from 8.02 percent in October.

...

Bank of America... said its charge-off rate fell for third straight month -- to 13.00 percent in November from 13.22 percent in October. However, it is still the credit card issuer with the highest default and delinquency rates.

Industrial Production, Capacity Utilization Increase in November

by Calculated Risk on 12/15/2009 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.8 percent in November after having been unchanged in October. Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. ... At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up from the record low set in June (the series starts in 1967), and still well below the level of last year.

Note: y-axis doesn't start at zero to better show the change.

NY Fed: Manufacturing Conditions "Level Off"

by Calculated Risk on 12/15/2009 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers leveled off in December, following four months of improvement. The general business conditions index fell 21 points, to 2.6. The indexes for new orders and shipments posted somewhat more moderate declines but also moved close to zero. Input prices picked up a bit, as the prices paid index rebounded to roughly its November level; however, the prices received index moved further into negative territory, suggesting that price increases are not being passed along. Current employment indexes slipped back into negative territory.Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002). Any reading above zero is expansion, so this index shows manufacturing was expanding since August. (chart from NY Fed)

Monday, December 14, 2009

Thoughts on TARP Repayment

by Calculated Risk on 12/14/2009 09:56:00 PM

There seems to be a sense that the banks are rushing to repay the TARP funds so they can pay bonuses. I think it is more likely that are just taking advantage of the opportunity to raise capital.

From Eric Dash and Andrew Martin at the NY Times: Wells Fargo to Repay U.S., a Coda to the Bailout Era

Wells joins Citigroup, Bank of America and JPMorgan Chase, its largest rivals, in shedding the stigma of taxpayer support and the restrictions on compensation that came with it.Exactly.

...

[David H. Ellison, a portfolio manager at FBR Funds] said banks appeared to be “rushing in” to pay back the government, so they can offer bigger bonuses to their executives and get lawmakers off their backs.

But the prospect of huge losses on mortgages and commercial real estate loans early next year might also be causing the repayment stampede, he said.

“It may be as much about raising capital as it is paying off TARP,” he said.

What has made this doable now is the massive support for asset prices by the Government (and taxpayers). This includes the Fed's MBS purchase program, the loose lending by the FHA, the FTHB tax credit, the HAMP, and more. These programs have limited the losses at the financial firms. Maybe this will work - as I noted last year, house prices in low end bubble areas might have bottomed - although prices are clearly still too high in many mid-to-high end bubble areas and eventually will decline (at least in real terms) to more supportable levels. And that probably means more losses for the banks.

Also in the article, Dash and Martin write that some financial experts think "If the economy takes a turn for the worse ... these same large banks will return to the government for a new round of aid." I don't think so.

I doubt there will be a TARP II. If any of these banks get in trouble again, they will probably be dissolved, management fired, and the shareholders wiped out. Isn't that implicit in paying back the TARP? Isn't that a key component of financial reform?