by Calculated Risk on 12/16/2009 08:30:00 AM

Wednesday, December 16, 2009

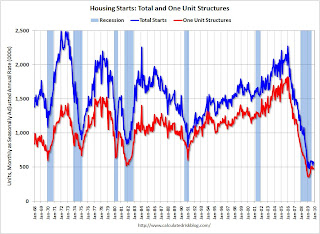

Housing Starts in November: Moving Sideways

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 574 thousand (SAAR) in November, up 8.9% from the revised October rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for six months.

Single-family starts were at 482 thousand (SAAR) in November, up 2.1% from the revised October rate, and 35 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for six months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This is both good news and bad news. The good news is the low level of starts means the excess housing inventory is being absorbed - a necessary step for housing (and the economy) to recover. The bad news is economic growth will probably be sluggish - and unemployment elevated - until residential investment picks up.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 574,000. This is 8.9 percent (±10.2%) above the revised October estimate of 527,000, but is 12.4 percent (±9.1%) below the November 2008 rate of 655,000.

Single-family housing starts in November were at a rate of 482,000; this is 2.1 percent (±9.2%) above the revised October figure of 472,000. The November rate for units in buildings with five units or more was 83,000.

Housing Completions:

Privately-owned housing completions in November were at a seasonally adjusted annual rate of 810,000. This is 8.7 percent (±13.7%)* above the revised October estimate of 745,000, but is 25.3 percent (±10.1%) below the November 2008 rate of 1,084,000.

Single-family housing completions in November were at a rate of 524,000; this is unchanged (±11.7%)* compared with the revised October figure. The November rate for units in buildings with five units or more was 270,000.