by Calculated Risk on 12/13/2009 09:27:00 AM

Sunday, December 13, 2009

WaMu Freedom of Information Request Denied

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Kirsten Grind provides some of the responses to the Puget Sound Business Journal's requests for information: The fight for WaMu documents (ht Spatch)

The Puget Sound Business Journal for months has asked the Office of Thrift Supervision (OTS), the federal agency that regulated Washington Mutual, to release internal communications between WaMu's regulators.In her article last week, Kirsten asks: Why Did They Close WaMu?. From the piece:

The newspaper made its requests under the U.S. Freedom of Information Act, the decades-old law that requires federal agencies to disclose public documents.

Of particular interest were internal emails, which could help explain why regulators seized the bank in September 2008 even though WaMu appeared to meet regulatory standards for operating banks, despite its burden of bad loans. (You can read the second installment of our six-month investigation about that decision here. The first in the series, about the bank's final days is here.)

On Wednesday, an OTS official told the Business Journal in an email: “After careful review, I have determined that your request, as it pertains to the above-referenced documents, is denied in full.”

[D]ocuments and interviews with former WaMu employees show that regulators closed WaMu even though it had liquidity and capital that were well above the levels at which a bank might normally be threatened with closure.It appears that WaMu employees considered the untapped FHLB and Fed lines of credit of over $14 billion as part of WaMu's $29 billion in net liquidity - and unmentioned (but likely) is that the Seattle FHLB and the Fed were probably about ready to pull those lines - and the FDIC probably knew that was about to happen and closed WaMu. Of course we don't know from the FOIA documents!

Typically, a bank is in danger of being seized if its net liquidity dips below 5 percent of total assets, according to banking experts and former regulators. On the day regulators shut WaMu, the bank had $29 billion in net liquidity—about 9.4 percent of assets, and nearly twice the closure threshold. The figure was provided by a former senior WaMu manager who closely tracked the bank’s liquidity at the time. It was confirmed by a former top WaMu executive who had full knowledge of the bank’s liquidity position.

“With the cash it had, WaMu should never have been seized,” said a senior banking regulator familiar with the matter.

...

Other documents also support the view that WaMu had sufficient liquidity to stay open. The last liquidity report from inside WaMu shows that on September 11 the bank could borrow $6.2 billion from the Federal Home Loan Banks in Seattle and San Francisco. It could borrow an additional $8.2 billion from the Federal Reserve Bank, a line that it hadn’t accessed at the time of its seizure, according to two people familiar with the matter.

But this would be just like a homeowner with an unused HELOC. Just when the homeowner is about to use the HELOC, the bank reduces or eliminates the line, and the homeowner's "liquidity" vanishes. Funny thing about liquidity - it can be there one day, and gone the next.

Saturday, December 12, 2009

Jim the Realtor: McMansion Foreclosures Coming

by Calculated Risk on 12/12/2009 10:48:00 PM

Jim shows several more homes in foreclosure in a nice area of north county coastal San Diego.

FDIC Bank Failure Update

by Calculated Risk on 12/12/2009 07:37:00 PM

Here is a graph of bank failures, by number of institutions and assets, from the December Congressional Oversight Panel’s Troubled Asset Relief Program report. (ht Catherine Rampell):  Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the report (page 45):

Figure 11 shows numbers of failed banks, and total assets of failed banks since 1970. It shows that, although the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion.167 Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.168Note: This is in 2005 dollars and this includes the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

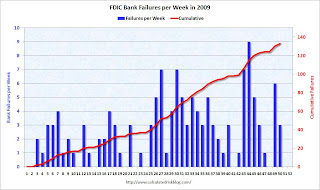

The second graph shows bank failures by week in 2009.

Note: Week 1 on graph ended Jan 2nd.

Note: Week 1 on graph ended Jan 2nd.There have been 133 bank failures this year, and there are only two more weeks left to close banks in 2009 (Dec 18th and maybe Dec 24th). This will set the over-under line for 2010 - will there be more bank failures in 2010 than in 2009?

I'll take the over (more failures in 2010 than in 2009).

Refinancing with Negative Equity

by Calculated Risk on 12/12/2009 03:37:00 PM

From David Streitfeld in the NY Times: Rates Are Low, but Banks Balk at Refinancing (ht Dave)

On refinancing with negative equity:

Mark Belvedere bought a condominium in a San Francisco suburb in early 2004 and refinanced it in 2005. He now owes $235,000 on a property that would sell for barely half that today.Unfortunately David Streitfeld doesn't provide any further information on Belvedere's loan. If the loan was held by a bank, then it might make sense for the bank to refinance the loan (this lowers the bank's risk of default). However Belvedere's "lender" might be a servicing company and the loan may have been securitized. Then it is impossible to refinance because the current holders of the note would be paid off, and no new lender would make a loan greater than the value of the collateral.

Mr. Belvedere said he would be willing to live with all that lost equity if he could refinance his loan from a variable rate, which could eventually go as high as 12 percent, into a 30-year fixed term.

His lender said no, citing the diminished value of the property. “It makes no sense and is so frustrating,” Mr. Belvedere said. “I’m ready and willing to pay the mortgage for the next 30 years, but they act like they’d rather have me walk away.”

As Streitfeld notes, the GSEs have a program called Home Affordable Refinance Program (HARP) that will allow lenders to refinance loans upto 125% of the property value. But this is only for loans the GSEs already holds or insures (and because refinancing lowers the risk of default). This wouldn't help Belvedere because he owes almost twice what his property is worth.

Housing Inventory: A Local Observation

by Calculated Risk on 12/12/2009 01:04:00 PM

"For Sale" signs are sprouting up all over my neighborhood again. In fact it is hard to find a block without one or two homes for sale. This is a very high number, especially for December.

My neighborhood may be unusual (fairly high priced SoCal area), but I suspect many homeowners have heard about an "improving market" and are testing the water.

This is one of the key categories of "shadow inventory" that we've discussed before:

Note: Homes in the foreclosure process listed in the MLS as "short sales" are not shadow inventory.

Inventory is usually the best metric to follow for the housing market - and according to recent releases inventory is declining for both new and existing homes - however shadow inventory clouds this picture.

Distressed Sales: Sacramento Market as an Example

by Calculated Risk on 12/12/2009 08:52:00 AM

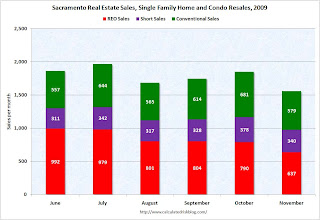

Note: The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the November data.

They started breaking out REO sales last year, but this is only the sixth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in November. The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

Total sales in November were off 16.1% compared to November 2008; the sixth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.4%) or FHA loans (31.4%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in severe distress.

Friday, December 11, 2009

Volcker: "Not time for business as usual"

by Calculated Risk on 12/11/2009 11:38:00 PM

From Bloomberg: Volcker Says ‘Basic Structure’ of Economy to Impede U.S. Growth

“We have another economic problem which is mixed up in this of too much consumption, too much spending relative to our capacity to invest and to export,” [said Former Federal Reserve Chairman Paul Volcker] “It’s involved with the financial crisis but in a way it’s more difficult than the financial crisis because it reflects the basic structure of the economy.”

...

“It’s likely that economic growth is going to be pretty sluggish for a while.”

Click image for video or click for Bloomberg Video |

Unofficial Problem Bank List, Dec 11, 2009

by Calculated Risk on 12/11/2009 09:09:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

NOTE: This was compiled prior to the bank failures today.

Changes and comments from surferdude808:

Last week’s closings by the FDIC contributed to a decline in the number of institutions and assets on the Unofficial Problem Bank List.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list includes 539 institutions with aggregate assets of $298.1 billion down from 542 and $310 billion last week. There were 6 failures last Friday that had combined assets of $12.8 billion, which mostly came from the collapse of AmTrust Bank ($11.4 billion). There was one other removal from the list as the OCC terminated its Supervisory Agreement against Beach First National Bank.

This week there are 4 additions, which include Saehan Bank, Los Angeles, CA ($829 million); Phoenixville Federal Bank and Trust, Phoenixville, PA ($381 million); Pierce Commercial Bank, Tacoma, WA ($267 million); and Bank of Shorewood, Shorewood, IL ($141 million).

Note: The FDIC announced there were 552 bank on the official Problem Bank list at the end of Q3. The difference is a mostly a matter of timing - some enforcement actions haven't been announced yet, and others may be pending.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #132&133: Arizona and Kansas

by Calculated Risk on 12/11/2009 07:16:00 PM

Note: since I get questions now and then - the Haiku was started long ago and is kind of a tradition.

AKA Giant Cash Sinkhole

We can't climb out of

Prairie bank failure

Solution for Solutions:

Arvest to invest

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, Clayton, Missouri, Assumes All of the Deposits of Valley Capital Bank, National Association, Mesa, Arizona

Valley Capital Bank, National Association, Mesa, Arizona, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Arvest Bank, Fayetteville, Arkansas, Assumes All of the Deposits of SolutionsBank, Overland Park, Kansas

As of September 30, 2009, Valley Capital Bank had total assets of approximately $40.3 million and total deposits of approximately $41.3 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.4 million. ... Valley Capital Bank is the 132nd FDIC-insured institution to fail in the nation this year, and the forth in Arizona. The last FDIC-insured institution closed in the state was Bank USA, National Association, Phoenix, on October 30, 2009.

SolutionsBank, Overland Park, Kansas, was closed today by the Office of the State Bank Commissioner of Kansas, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Less than $300 million hit to the DIF so far today ...

As of September 30, 2009, SolutionsBank had total assets of $511.1 million and total deposits of approximately $421.3 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.1 million. ... SolutionsBank is the 133rd FDIC-insured institution to fail in the nation this year, and the third in Kansas. The last FDIC-insured institution closed in the state was First National Bank of Anthony, Anthony, on June 19, 2009.

Bank Failure #131: Republic Federal Bank, National Association, Miami, Florida

by Calculated Risk on 12/11/2009 05:16:00 PM

Palm trees, warm ocean waters

Plus one toasted bank

by Soylent Green is People

From the FDIC: 1st United Bank, Boca Raton, Florida, Assumes All of the Deposits of Republic Federal Bank, National Association, Miami, Florida

Republic Federal Bank, National Association, Miami, Florida, was closed today by the Office of the Comptroller of the Currency (OCC), which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...An early failure ...

As of September 30, 2009, Republic Federal Bank, N.A. had total assets of approximately $433.0 million and total deposits of approximately $352.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $122.6 million. ... Republic Federal Bank, N.A. is the 131st FDIC-insured institution to fail in the nation this year, and the 13th in Florida. The last FDIC-insured institution closed in the state was Commerce Bank of Southwest Florida, Fort Myers, on November 20, 2009.