by Calculated Risk on 12/02/2009 02:00:00 PM

Wednesday, December 02, 2009

Fed's Beige Book: Economy "improved modestly"

From the Fed: Beige Book

Reports from the twelve Federal Reserve Districts indicate that economic conditions have generally improved modestly since the last report. Eight Districts indicated some pickup in activity or improvement in conditions, while the remaining four--Philadelphia, Cleveland, Richmond, and Atlanta--reported that conditions were little changed and/or mixed.On real estate:

Home sales and construction activity improved across much of the nation, though prices were generally said to be flat or still declining somewhat. A majority of Districts reported that the lower-priced segment of the housing market has outperformed the high end. .... Multifamily housing markets deteriorated further in the New York and Chicago Districts. More broadly, a number of eastern Districts reported continued declines in home prices--specifically, Boston, New York, Philadelphia, and Richmond. In contrast, prices were said to have firmed somewhat in the Dallas and San Francisco Districts and stabilized in the Chicago and Kansas City Districts. Most reports maintained that the lower end of the market has outperformed the higher end: New York, Philadelphia, Richmond, Atlanta, Minneapolis, and Kansas City all noted relative weakness at the high end of the market, with relative strength at the lower end; in most cases, this strength was largely attributed to the homebuyer tax credit (which was recently reinstated and expanded to include existing owners).

Despite the firming in sales, the level of new residential construction activity was generally characterized as weak, though recent trends have been mixed--Atlanta, Kansas City, and Dallas noted some pickup in home construction, whereas the Chicago and St. Louis Districts reported declines. Residential construction was described as flat or stabilizing by Cleveland, Minneapolis, and San Francisco.

Commercial real estate conditions were widely characterized as weak and, in many cases, deteriorating further. Market conditions were reported to have weakened in virtually all Districts, with rising vacancy rates, downward pressure on rents, and little, if any, new development. Expectations for 2010 were also quite low. Boston characterized the commercial real estate outlook as "bleak," Dallas noted that construction was at "historically low levels," and Kansas City described the sector as "distressed." Still, some Districts noted scattered signs of encouragement: Cleveland and Chicago referenced public-works projects as a source of increased business, Richmond noted signs of increased leasing activity from the health and education sectors, Atlanta indicated a modest pickup in new development projects, Minneapolis noted some recently started hotel and retail development, and San Francisco cited slight improvement in availability of financing for new development.

Bank Holding Company files for Bankruptcy, Bank Still Operates

by Calculated Risk on 12/02/2009 12:31:00 PM

In a somewhat unusual move, a bank holding company filed for bankruptcy yesterday while the insured subsidiary (AmTrust Bank) continued to operate. Here was the news from Bloomberg: AmTrust Financial Files for Bankruptcy in Cleveland (ht Brian)

AmTrust Financial Corp., owner of the Cleveland-based AmTrust Bank that expanded rapidly into Florida and Arizona, filed for bankruptcy, blaming investments in home loans that lost value in the recession.SNL has more: AmTrust bankruptcy may do little to save its bank

SNL cites Lawrence White, a former Federal Home Loan Bank Board member and now an economist at New York University's Stern School of Business, suggesting that the bank may have posed a risk to the other business lines of the holding company.

"This sounds to me like a pre-emptive move by the holding company," White said. He added that FDIC action at the bank level could come soon.And SNL quotes economist Ken Thomas of independent bank consultancy K.H. Thomas Associates:

"My guess is that (regulators) shopped this around with no takers."CIT would be another example of the bank holding company filing for bankruptcy while the bank continues to operate. However, in the case of CIT, it was the other business lines that caused most of the problems, although the bank is operating under a Cease&Desist order.

...

"You can't have a bank out there with a bankrupt parent, especially when it appears that the finances of the bank had a lot to do with the need for the filing. [FDIC Chairman Sheila Bair] is going to have to do something about this soon, whether she wants to or not."

AmTrust Bank recently reported $11.4 billion in assets, so this is a large bank and a strong candidate for BFF.

ABI: Pesonal Bankruptcy Filings Decline in November

by Calculated Risk on 12/02/2009 11:06:00 AM

Note: The monthly data is noisy and is not adjusted for days in the month.

From the American Bankruptcy Institute: November Consumer Bankruptcy Filings Drop 18 Percent from Previous Month

The 112,152 consumer filings in November represented a decrease of 18 percent from the 135,913 filings registered in October, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Despite the drop from the previous month, the November filings represented a 12 percent increase over the 99,925 consumer filings in November 2008. ...

"While bankruptcy filings cooled in November, consumers are still feeling the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "Bankruptcies are set to top 1.4 million filings for 2009 as consumers and businesses continue to seek shelter from economic distress."

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q4 2009 is estimated using monthly data from the American Bankruptcy Institute.

The quarterly rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been over 1.3 million personal bankruptcy filings through Nov 2009, and there will probably be over 1.4 million filings in all of 2009.

Lend America Closes Down After FHA Cancels Approval

by Calculated Risk on 12/02/2009 09:31:00 AM

The FHA is expected to announce steps today to raise reserves, tighten standards and crack down on poor performing lenders. For Lend America (aka Ideal Mortgage Bankers), there were allegations of submitting false documents, but I expect further approval cancellations just for poor performance.

From Ellen Yan at Newsday.com: Mass layoff at LI home lender amid federal probe (ht Mike in Long Island)

Melville-based Lend America closed its loan-making operation Tuesday and laid off most of its 600 workers, a day after federal officials revoked its license to make loans insured by the Federal Housing Administration.According to the FHA Neighborhood Watch, Lend America (listed as Ideal Mortgage Bankers) originated 11,559 loans over the last 24 months (November 01, 2007 and October 31, 2009) and 11.47% are already in default. The national average for FHA insured loans during that period is 5.02%.

FHA-backed loans made up at least 90 percent of the company's business.

...

Last year, Lend America closed 6,986 loans, or $1.36 billion in loans, Lovallo said, and for this year it projected 12,500 loans closed, for about $2.5 billion. The company serviced about $1.8 billion in loans, he said, and it is not clear whether it will continue to provide that service.

There are 302 FHA lenders on the FHA list with default rates already over 10%, accounting for 163,590 loan originations over the last two years. The FHA could probably start with that list.

ADP: Private Employment Decreased 169,000 in November

by Calculated Risk on 12/02/2009 08:15:00 AM

ADP reports:

Nonfarm private employment decreased 169,000 from October to November 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from September to October was revised by 8,000, from a decline of 203,000 to a decline of 195,000.Note: ADP is private nonfarm employment only (no government jobs).

The BLS reported a 190,000 decrease in nonfarm private employment in October (also -190,000 total nonfarm), and ADP originally estimated October private nonfarm employment losses at 203,000; so ADP was pretty close to the BLS number last month.

On the Challenger job-cut report from Bloomberg: U.S. November Job Cuts Fall 72% From Year Ago, Challenger Says

Planned firings fell 72 percent in November to 50,349 from 181,671 during the same month last year, Chicago-based placement firm Challenger, Gray & Christmas Inc. said today. Announcements were down 9.6 percent from October. ... The level of announced job cuts was the lowest since December 2007, Challenger said.The BLS reports Friday, and the consensus is for 100,000 net jobs lost, and a 10.2% unemployment rate for November.

FHA to Ask Congress for Changes

by Calculated Risk on 12/02/2009 12:44:00 AM

From Diani Olick at CNBC: FHA to Toughen Mortgage Rules in Lenders Crackdown (ht Brad)

... the Federal Housing Administration is proposing new rules to crack down on lenders and asking Congress for the authority to raise certain borrower requirements ... Those steps will include raising minimum borrower FICO scores, requiring larger down payments, and reducing the maximum permissible seller concession from six percent currently to three percent.These proposals are similar to what Kenneth Harney outlined in the San Francisco Chronicle ten days ago: FHA looking for ways to pump up its reserves. Harney suggested the FHA was looking at four possibilities:

It could also include raising up-front and/or annual insurance premiums, which would require Congressional authority. This is according to the testimony HUD Secretary Shaun Donovan is scheduled to present to the House Financial Services Committee on Wednesday afternoon, obtained by CNBC.

Currently, FHA charges an "up-front" mortgage insurance premium of 1.75 percent of the loan amount. Most borrowers roll that into their loan and finance it. FHA also charges an annual premium, paid in monthly installments, of either 0.5 percent or 0.55 percent, depending on the down payment. To rebuild reserves, FHA could ... raise the up-front premium to 2 percent or as high as the current statutory maximum of 2.25 percent. It could also raise the annual fee...

FHA is by far the most lenient and flexible player when it comes to evaluating applicants' creditworthiness.

Tuesday, December 01, 2009

Leonhardt on Long Term PEs

by Calculated Risk on 12/01/2009 10:04:00 PM

From David Leonhardt at the NY Times Economix: Stocks Start Looking Dear Again

Over the last few years, I’ve come to know and trust a version of the price-earnings ratio preferred by the economists Robert Shiller and John Campbell. It is based on an average of the past 10 years’ worth of corporate earnings, rather than just the past year (or a forecast of the next year’s earnings).And from the earlier piece:

...

What does the ratio say today? That perhaps the recent rally has gone a bit too far.

...

You can read more about the history of this ratio, including the role played by the well-known Benjamin Graham and David Dodd, in this column from 2007, back when the bull market was still raging.

Benjamin Graham and David L. Dodd ... argued that P/E ratios should not be based on only one year’s worth of earnings. It is much better, they wrote in “Security Analysis,” to look at profits for “not less than five years, preferably seven or ten years.”Just some ideas for discussion ...

The Impact of Stimulus on GDP

by Calculated Risk on 12/01/2009 07:01:00 PM

The CBO released a new report today: Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output as of September 2009. Here is their estimate of the impact on GDP:

[The] CBO estimates that in the third quarter of calendar year 2009 ... real (inflation-adjusted) gross domestic product (GDP) was 1.2 percent to 3.2 percent higher, than would have been the case in the absence of ARRA. Those ranges are intended to reflect the uncertainty of such estimates and to encompass most economists’ views on the effects of fiscal stimulus.At both extremes of the range, the economy would still be in recession without the stimulus (note: the BEA reported that GDP grew "at an annual rate of 2.8 percent in the third quarter of 2009" or about 0.7% for the quarter).

This is significant looking forward. The stimulus probably had the peak impact on GDP growth in Q3, and the positive contribution will diminish over the next few quarters. Without a pickup in end demand, the economy could slide back into recession next year.

Professor Krugman issued a Double Dip Warning today:

I’ve never been fully committed to the notion that we’re going to have a “double dip” — that the economy will slide back into recession. But it has been clear for a while that it’s a serious possibility, for two reasons. First, a large part of the growth we’ve had has been driven by the stimulus — but the stimulus has already had its maximum impact on the growth of GDP, will hit its maximum impact on the level of GDP in the middle of next year, and then will begin to fade out. Second, the rise in manufacturing production is to a large extent an inventory bounce — and this, too, will fade out in the quarters ahead.

...

I’d be more sanguine about all of this if there were any indications that private, final demand is taking off — consumers, business investment, whatever. But I haven’t seen anything suggesting that sort of thing.

The chances of a relapse into recession seem to be rising.

Light Vehicle Sales 10.9 Million SAAR in November

by Calculated Risk on 12/01/2009 03:52:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

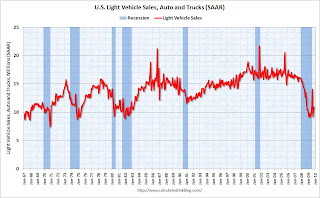

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding July and August, this was the strongest month since October 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are below the lowest point for the '90/'91 recession (even with a larger population).

ISM and Manufacturing Employment

by Calculated Risk on 12/01/2009 02:45:00 PM

From the ISM Manufacturing report on employment:

ISM's Employment Index registered 50.8 percent in November, which is 2.3 percentage points lower than the 53.1 percent reported in October. This is the second month of growth in manufacturing employment following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.The following graph shows the ISM Manufacturing Employment Index vs. the BLS reported monthly change in manufacturing employment (as a percent of manufacturing employment).

The graph includes data from 1948 through 2009. The earlier period (1948 - 1988) is in red, and the last 20 years is in green. The blue diamond is for last month (manufacturing employment fell in October even though the ISM employment Index was at 53.1 percent).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Clearly the ISM employment index is related to changes in BLS employment, however the relationship is noisy, and it appears a reading above 52 for the ISM employment index is consistent with an increase in the BLS data for manufacturing.

Although there is significant variability, the current level of 50.8 percent in November suggests further manufacturing job losses.