by Calculated Risk on 11/24/2009 09:12:00 AM

Tuesday, November 24, 2009

Case-Shiller House Prices Increase in September

Note: I will have graphs as soon as S&P releases the data online.

S&P reports the Composite 10 index increased 0.3% in September, and the Composite 20 index increased 0.3% (both SA). Eleven cities posted increases, nine showed price declines.

From S&P:

“We have seen broad improvement in home prices for most of the past six months,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “However, the gains in the most recent month are more modest than during the seasonally strong summer months. Fewer cities saw month to month improvements in September than in August in both seasonally adjusted and unadjusted figures. Nationally, the U.S. National Composite rose by 3.1% in both the 2nd and 3rd quarters of 2009. Both the 10-City and 20-City Composites posted their fifth consecutive monthly increase with September’s report."

Q3 GDP Revised Down to 2.8%

by Calculated Risk on 11/24/2009 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.8 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "second" estimate released by the Bureau of Economic Analysis.Personal consumption expenditures (PCE) were revised down to 2.9% from 3.4%. And investment in nonresidential structures was revised down to -15.1% from -9.0%.

...

The second estimate of the third-quarter increase in real GDP is 0.7 percentage point lower, or $23.7 billion, than the advance estimate issued last month, primarily reflecting an upward revision to imports and downward revisions to personal consumption expenditures and to nonresidential fixed investment that were partly offset by an upward revision to exports.

Mortgages: 23% of Borrowers have Negative Equity

by Calculated Risk on 11/24/2009 12:43:00 AM

From the WSJ: 1 in 4 Borrowers Under Water

The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23% ...The report should be available online soon.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home's value ...

[N]egative equity "is an outstanding risk hanging over the mortgage market," said Mark Fleming, chief economist of First American Core Logic. "It lowers homeowners' mobility because they can't sell, even if they want to move to get a new job."

Monday, November 23, 2009

Forecasts: Unhappy Holidays for Restaurants and Hotels

by Calculated Risk on 11/23/2009 10:23:00 PM

Update on the Chicago Fed Index post: According to the Chicago Fed, the "CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough". Earlier I was excerpting from the entering recession section. This suggests - using this index - it is still too early to call the end of the recession.

From Jerry Hirsch at the LA Times: Restaurants brace for dreary season as consumers lose appetite for dining out

The number of people visiting restaurants has plunged for four consecutive quarters, according to NPD Group, a market research firm. ... chains such as McCormick & Schmick's, the seafood house, and Morton's, the steak purveyor, saw same-store sales, or sales at restaurants open at least a year, fall 18.8% and 16.8%, respectively ... according to Bellwether Food Group, a food industry consulting firm.And from Joe Sharkey at the NY Times: For the Hotel Industry, Recovery is a Long Way Off

Bellwether doesn't project an industry rebound to pre-recession levels until 2012.

...

Research firm NPD doesn't expect an industry turnaround any time soon. ... In 33 years of tracking restaurant traffic, NPD "has never seen this type of a weakness for this long of a period," [Bonnie Riggs, a restaurant industry analyst with NPD in Chicago] said ...

Bjorn Hanson, a clinical associate professor at the Tisch Center, said that average domestic hotel occupancy this year would be about 55 percent.The occupancy dip following the 9/11 attacks was barely below 60%, so, according to Hanson's comments, the current hotel recession is the worst since the Great Depression.

Average national occupancy has dipped below 60 percent only twice before since the 1920s, he said, during the Great Depression, and in the aftermath of the 2001 terrorist attacks.

Report: Fed asks Big Banks for TARP Repayment Plans

by Calculated Risk on 11/23/2009 08:11:00 PM

From Bloomberg: Fed Said to Ask Banks to Submit Plans to Repay TARP (ht MrM)

The central bank this month asked Bank of America Corp. and eight other banks to [submit repayment plans with a timetable]. ... Together the nine banks have received about $142 billion in TARP funds ... The banks in the stress test that have yet to repay TARP are Bank of America, PNC, Citigroup Inc., Fifth Third Bancorp, GMAC Inc., KeyCorp, Regions Financial Corp., SunTrust Banks Inc. and Wells Fargo & Co.I'd like to see the plans made public. I'd especially like to see Citi's, BofA's, and GMAC's plans.

The Fed conducted the stress tests, but didn't the Treasury loan the money? Shouldn't the Treasury be asking for the repayment plans? Just asking ...

Moody’s: Credit Card Delinquencies Rise

by Calculated Risk on 11/23/2009 05:32:00 PM

From Bloomberg: Late Card Payments Rose in October, Moody’s Reports

Loans at least 30 days overdue, a signal of future defaults, rose to 6.12 percent in October from 5.97 percent in September, Moody’s said ... defaults fell last month to 10.04 percent from 10.72 percent in September, reflecting lower delinquency rates earlier in the year.This is the highest delinquency rate since February. At noted in the article, credit card defaults tend to track unemployment, so the default rate will probably continue to rise.

...

Write-offs may peak at 12 percent to 13 percent in 2010, Moody’s analysts Will Black and Jeffrey Hibbs said in the report.

Existing Home Sales: Distressing Gap

by Calculated Risk on 11/23/2009 01:45:00 PM

After the expected spike in existing home sales last month, I quoted legendary basketball coach John Wooden:

"Never mistake activity for achievement."It is worth repeating this month.

First, it is important to remember that existing home sales are largely irrelevant for the economy. What matters for the economy are new home sales, housing starts and residential investment. And there has been little improvement in these key indicators.

This really shows up on the following graph:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) through October, and new home sales (right axis) through September.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

But what matters for the economy - and jobs - is new home sales, and new home sales are still very low because of huge overhang of existing home inventory and rental properties.

Second, normally a decline in inventory and the months-of-supply would be considered a positive for the existing home market, however much of the apparent recent improvement in months-of-supply is related to the artificial - and likely short lived - boost in activity.

It is not all bad news. The second graph shows the year-over-year change in existing home inventory.

It is not all bad news. The second graph shows the year-over-year change in existing home inventory. This inventory has been declining for some time, and is off almost 15% compared to last year. However the level of inventory is still high, and much of the recent inventory "improvement" has come at the expense of vacant rental units; the rental vacancy rate is now at a record 11.1%.

The key to reducing the overall inventory is new household formation, and the key to new household formation is jobs. Encouraging renters to become owners accomplishes nothing in reducing the overall housing inventory, and leads some analysts to mistake activity for achievement.

Existing Home Sales Graphs

by Calculated Risk on 11/23/2009 10:42:00 AM

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2009. For the fifth consecutive month, sales were higher in 2009 than in 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. For the fifth consecutive month, sales were higher in 2009 than in 2008.

And for the second straight month, sales in 2009 were higher than in 2007 (two years ago).

Of course many of these transactions in October were due to first-time homebuyers rushing to beat the expiration of the tax credit (that has now been extended). This has pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.  The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.57 million in October from the upwardly revised 3.71 million in September. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.57 million in October from the upwardly revised 3.71 million in September. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

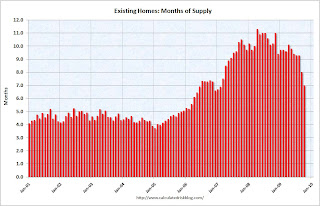

Typically inventory peaks in July or August, so some of this decline is seasonal. The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply declined to 7.0 months in October.

Sales increased sharply, and inventory decreased, so "months of supply" declined. A normal market has under 6 months of supply, so this is still high - and especially considering sales were artificially boosted by the tax credit.

Existing Home Sales increase sharply in October

by Calculated Risk on 11/23/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Record Another Big Gain, Inventories Continue to Shrink

Existing-home sales – including single-family, townhomes, condominiums and co-ops – surged 10.1 percent to a seasonally adjusted annual rate1 of 6.10 million units in October from a downwardly revised pace of 5.54 million in September, and are 23.5 percent above the 4.94 million-unit level in October 2008. Sales activity is at the highest pace since February 2007 when it hit 6.55 million.

...

Total housing inventory at the end of October fell 3.7 percent to 3.57 million existing homes available for sale, which represents a 7.0-month supply2 at the current sales pace, down from an 8.0-month supply in September. Unsold inventory totals are 14.9 percent below a year ago.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Oct 2009 (6.10 million SAAR) were 10.1% higher than last month, and were 23% higher than Oct 2008 (4.94 million SAAR).

I'll have more soon ...

Chicago Fed Index: "Economic activity leveled off in October"

by Calculated Risk on 11/23/2009 08:30:00 AM

From the Chicago Fed: Index shows economic activity leveled off in October

The Chicago Fed National Activity Index was –1.08 in October, down very slightly from –1.01 in September.

...

The index’s three-month moving average, CFNAI-MA3, decreased to –0.91 in October from –0.67 in September, declining for the first time in 2009. October’s CFNAI-MA3 suggests that growth in national economic activity remained below its historical trend.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed (update: earlier I excerpted from the entering recession section):

"When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures. The positive horizontal line in Figure 3 is at +0.2. The critical question is: how early does the CFNAI-MA3 reveal this turning point? For four of the last five recessions, this happened within five months of the business cycle trough."According to this index, it is still early to call the official recession over. The index is still fairly weak.